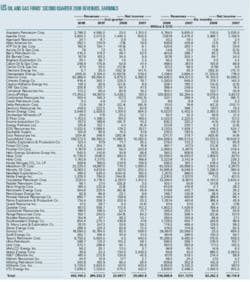

Oil, gas prices boost producers’ 2Q earnings

US-based oil and gas producers and refiners reported higher second-quarter 2008 earnings as a group, but individual company results were highly varied. The combined earnings of a sample of these firms were up 10% from a year earlier.

Meanwhile, a sample of producers and pipeline companies headquartered in Canada posted a collective 13% increase in net income for the second quarter, and a group of service and supply companies reported a combined earnings increase of nearly 5% from a strong year-earlier period.

High oil prices buoyed the combined second-quarter results of the operators, but downstream earnings were crushed by the high cost of inputs. Natural gas prices were up from the second quarter of last year, too, but many producers reported lower earnings as a result of hedging losses. Companies also incurred higher operating expenses, while higher feedstock costs pinched chemicals earnings.

Prices, margins

Commodity prices rallied in the first half of this year, suppressing demand for some petroleum products, especially motor gasoline in the US.

During the quarter ended June 30, 2008, the front-month futures price of crude on the New York Mercantile Exchange averaged $123.80/bbl, up from $65.02/bbl in the second quarter of 2007.

Weak gasoline demand and high input costs heavily weighed on refining margins in the recent quarter. US East Coast cash refining margins sank 70% from the second quarter of last year to average $3.63/bbl, according to Muse, Stancil & Co.

Also in the second quarter of 2008, such margins declined 56% in the Midwest, 48% on the Gulf Coast, and 40% on the West Coast vs. the 2007 second quarter, according to Muse, Stancil & Co.

Natural gas futures on the NYMEX averaged $11.468/MMbtu in the recent second quarter compared with $7.655/MMbtu a year earlier.

Integrated companies

The large, integrated oil companies in the sample of US-based operators reported stronger earnings as a result of higher oil and gas price realizations compared with those a year earlier, but all of them recorded meager downstream results.

The largest company in the group, ExxonMobil, reported record earnings of $11.68 billion for the second quarter, a 14% increase from a year earlier, as revenues gained 40% to top $138 billion. Downstream and chemicals earnings slumped, but record oil and gas realizations increased earnings by $6.1 billion.

ExxonMobil said that lower sales volumes, higher operating costs, and increased taxes reduced the company’s earnings somewhat, as its total production decreased 8% from second-quarter 2007.

With net income of $6 billion, Chevron Corp. posted an 11% earnings increase from the second quarter of last year. The company’s revenues climbed 48%, but downstream margins weighed on earnings.

Chevron chairman and CEO Dave O’Reilly said, “The higher cost of crude oil used in the refining process was not fully recovered in the price of gasoline and other refined products.” As a result, Chevron’s downstream operations incurred a $734 million loss in the recent quarter, with most of the loss taking place in the US.

O’Reilly said the effects of planned refinery downtime in Pascagoula, Miss. also contributed to the US loss in the period. Refined-product sales volumes declined 8% from second-quarter 2007 to 1.38 million b/d, primarily the result of lower gasoline and gasoil sales.

Independent operators

Some of the independent producers reported lower results in the second quarter due to hedging losses, as oil and gas prices climbed in the second quarter of this year.

Among these producers are Chesapeake Energy Corp. and Petrohawk Energy Corp.

Chesapeake recorded a $1.6 billion loss for the recent quarter, compared with $518 million in net income in the 2007 second quarter, although the company’s oil and gas production and sales volumes were up.

The Oklahoma City-based producer announced an unrealized noncash, after-tax mark-to-market loss of $2.085 billion from future-period natural gas, oil, and interest rate hedges, mostly as a result of higher oil and gas prices as of June 30, 2008, compared with Mar. 31, 2008.

For the recent second quarter, Petrohawk reported revenues of $305 million, a 31% increase over second-quarter 2007 revenues, but the company incurred a $92.8 million loss for the 3 months ended June 30.

The Houston-based producer’s average realized natural gas price for the quarter was $9.48/Mcf, which included a realized loss from natural gas derivatives of $1.51/Mcf. The company’s average realized oil price for the quarter was $79.84/bbl, which included a $38.01/bbl realized loss from oil derivatives.

Petrohawk’s total loss on derivatives contracts was $277.6 million for the second quarter and $420.3 million for the first half of this year.

Refiners

Independent refiners, including Holly Corp., Valero, and Tesoro, posted weak results due to low refining margins.

Independent refiners’ profitability could be further reduced in coming quarters, according to Friedman, Billings, Ramsey & Co. analyst Eitan Bernstein, as a slowdown or contraction of the US and global economies dampens the growth in demand for refined products, lowering sales prices for gasoline, heating oil, diesel fuel, and other products.

Holly Corp. reported that its second-quarter net income declined to $11.5 million from $158.6 million in the same period of 2007. For the first 6 months of this year, net income was $20.1 million compared with $226.2 million for the first half of 2007.

The refiner’s revenues were up for the recent quarter and for the first half due to higher refined product sales prices, but earnings were hit on a couple of fronts. Holly’s Navajo refinery in Artesia, NM in May experienced unplanned downtime for repairs to its fluid catalytic cracking unit following an instrument control malfunction, and the company’s Woods Cross, Utah refinery operated at reduced rates during the quarter primarily due to multiple power interruptions.

Holly also said that its earnings in the first half decreased due to reduced refined-product margins combined with production declines, lower yields, and higher operating expenses.

Meanwhile, Valero reported a 67% decline in second-quarter earnings to $734 million, and Tesoro’s earnings declined 99% from a year earlier to $4 million.

Canadian operators

A sample of oil and gas producers and pipeline operators based in Canada recorded a combined increase in earnings for the second quarter, but four of the 14 companies posted a net loss for the period.

With net income up 345%, Enbridge Inc. announced the largest percentage gain in earnings from the second quarter of 2007. Net income was $659 million (Can.) on revenues of $3.87 billion (Can.).

Enbridge said the increase reflects a $556.1 million after-tax gain on the sale of its interest in Compania Logistica de Hidrocarburos CLH SA, a Spanish pipeline company, and favorable operating performance, partially offset by unrealized fair value losses on derivatives.

Canadian Natural Resources Ltd. posted a $347 million (Can.) loss for the second quarter, which the company attributed primarily to risk management losses. Higher product prices would have otherwise resulted in earnings of $960 million (Can.) for the quarter, despite a nearly 7% production decline from the second quarter of last year.

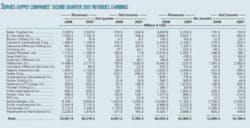

Service, supply firms

Strong demand for oilfield equipment and services boosted the earnings of a sample of service and supply companies during the second quarter and first half of this year.

The 24 companies in this sample posted a combined 5% increase in earnings for the recent quarter, as their revenues climbed 26%.

Although none of these firms reported a loss for the 3 months, eight of them announced a decline in earnings from the second quarter of last year. Only two of these firms reported a reduction in second-quarter revenues from a year earlier.

Transocean Inc. merged with GlobalSantaFe Corp. in November 2007 and reported that its earnings and revenues for the second quarter and the first half of 2008 were more than double its results from a year earlier.

Halliburton Co. announced its net income in second-quarter 2008 was $507 million, down from $1.5 billion in the second quarter of 2007. Halliburton had completed its separation of KBR Inc. in second quarter 2007 and recorded to discontinued operations a gain of $933 million, accounting for the strong second-quarter 2007 results.