BHI: Global rig count activity mixed in May

A winding down of seasonal drilling downtime in Canada combined with the continuing US drilling rebound ensured the worldwide rig count was back on an upward trajectory last month. Outside North America, gains in Latin America, Europe, and the Middle East were almost completely offset by losses in Asia Pacific and Africa.

Baker Hughes Inc.’s global tally of active drilling rigs increased by 18 month-over-month in May to average 1,935, up 530 year-over-year. May 2016 was the final month of a 1½-year-long drilling dive in the US.

The US rig count for May was 893, up 40 from the April average and up 485 from the May 2016 average (OGJ Online, June 2, 2017). The Canadian rig count for May was 85, down 23 month-over-month and up 43 year-over-year.

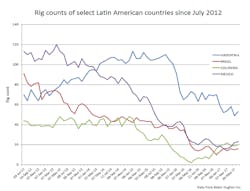

Latin America in May climbed 8 units month-over-month and 2 units year-over-year to average 190. It marked the region’s first year-over-year increase since August 2014. Half of the monthly climb came from Argentina, which averaged 53, down 18 year-over-year.

Mexico, Colombia, and Brazil each rose 1 unit to 23, 20, and 16, respectively. In Mexico, where Talos Energy LLC in May spudded the first exploration well to be drilled on acreage awarded in the country’s first international licensing round in 2015, the rig count has increased 7 units from its January average (OGJ Online, May 22, 2017).

Drilling has ramped up in particular in Colombia, where Ecopetrol SA has boosted activity and outsiders such as Anadarko Petroleum Corp. and GeoPark Ltd. are active. Its count was up fourfold from its year-ago average. Brazil was up 1 rig year-over-year.

Europe increased 4 units month-over-month in May to 95, even with its average a year ago. Turkey added 2 units to average 23, down 6 year-over-year. Offshore UK also gained 2 and averaged 10, up 1 year-over-year.

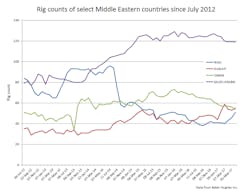

The Middle East was up 2 units month-over-month in May to 391, even with its year-ago average but up 15 since December when members of the Organization of Petroleum Exporting Countries and several non-OPEC countries agreed to collectively curb production in an effort to balance the global oil market. The drilling increases since December have primarily come from Iraq and Kuwait.

Iraq jumped 5 units to 51, up 8 year-over-year. Kuwait rose 2 units to 55, up 12 year-over-year. Pakistan increased 2 units to 25, down 2 year-over-year. Israel’s only 2 active units started work.

Oman, the Middle East’s largest non-OPEC producer, dropped 2 units to 54, down 15 year-over-year. Qatar lost 2 to 10, up 3 year-over-year. Egypt decreased 4 units to 23, down 5 year-over-year. Saudi Arabia’s count remained at 119, down 8 since November.

Africa declined 5 units month-over-month in May to 84, down 7 year-over-year. Algeria led the way with a 4-unit monthly loss to 53, down 2 year-over-year. Kenya dropped 2 units to 9, down 2 year-over-year. Nigeria decreased 2 units to 8, up 2 year-over-year. Congo (Brazzaville) added 2 units to average 3, also up 2 year-over-year.

Asia Pacific fell 8 units month-over-month in May to 197, still up 7 year-over-year. Indonesia dropped 3 units to 20, up 1 year-over-year. Malaysia lost 2 units to 3, half its year-ago average. Myanmar decreased 2 units to 1.

Contact Matt Zborowski at [email protected].