BHI: US rig count loses 30 in latest drilling dive

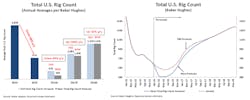

The US drilling rig count plunged 30 units to 541 during the week ended Feb. 12, continuing another interval of steep declines amid a drilling slump that stretches back to late 2014. All but two units to go offline this week were oil-directed.

The count last week dived 48 units, the largest in nearly 11 months (OGJ Online, Feb. 5, 2016).

The latest data from Baker Hughes Inc. show the count is down 817 year-over-year and at its lowest point since May 28, 1999. The nadir of the 1998-99 downturn was 488 units on Apr. 23, 1999.

With the lingering presence of $30/bbl-and-less oil, the industry has started the year further cutting average 2016 Brent and West Texas Intermediate prices, capital expenditures, and thus exploration and production activity (OGJ Online, Feb. 8, 2016).

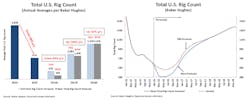

In light of the recent declines, financial services firm Raymond James & Associates Inc. further reduced its forecast US rig counts for 2016-18 in its most recent industry brief.

RJA now projects an average 2016 count of 500, down from the 620 the firm projected just last month and down nearly half compared with the 2015 average (OGJ Online, Jan. 8, 2016). The new bottom is expected occur in April at 400 units, compared with RJA’s previous projection of 550 in June.

A drilling rebound isn’t seen until late 2016, the firm says, as many E&P firms are likely to first focus on drawing down their uncompleted well inventories and improving their balance sheets, while waiting for consistently higher crude oil prices and a labor force recovery.

The count is forecast to end 2016 at 700 units, adding just 300 during the second half. “While a lower rig count will mean a much more challenging 2016 environment for oil field service companies, the lower activity this year should still lead to even more robust growth in 2017-18,” the firm said.

RJA expects the average count to jump 106% year-over-year in 2017 to 1,030, and rise 32% year-over-year to 1,358 in 2018.

“Despite the strong growth expected in 2017-18, we don’t see the rig count reaching the heights of 2014 levels again, as rig efficiencies continue to advance at a solid clip,” the firm added.

Oil, horizontal rigs freefall

Oil-directed rigs fell for the 8th consecutive week, losing 28 units to 439, down 617 year-over-year and their lowest total since Jan. 22, 2010. Since Dec. 23, the count has shed 99 units.

Gas-directed rigs lost 2 units to 102, down 198 year-over-year and their new lowest level in BHI data that dates back to July 1987.

Land-based rigs fell 29 units to 514, down 784 year-over-year. Rigs engaged in horizontal drilling lost 25 units to 433, down 592 year-over-year and their lowest point since Sept. 18, 2009. They too have fallen in 8 straight weeks, giving up 121 units over that time.

As part of its trimmed budget for the year, Permian producer Pioneer Natural Resources Co. (PNR) said this week that it’s reducing horizontal drilling activity to 12 rigs by mid-2016 from 24 rigs at yearend 2015, while still increasing 2016 production by 10% (OGJ Online, Feb. 11, 2016).

Directional drilling rigs shed 5 units to 53, down 82 year-over-year.

One rig went offline in Texas waters, bringing the overall US offshore count to 25, down by half year-over-year. Two rigs remain operating in inland waters.

Swiss offshore drilling contractor Transocean Ltd. this week reported that the Deepwater Thalassa newbuild ultradeepwater drillship started operations in February on its 10-year contract in the US Gulf of Mexico (OGJ Online, Oct. 26, 2015).

The rig, contracted to Royal Dutch Shell PLC, is designed to operate in up to 12,000 ft of water and drill wells to 40,000 ft.

In Canada, the rig count dropped 20 units to 222, down 160 year-over-year. Oil-directed rigs lost 13 units to 118, and gas-directed rigs fell 7 units to 104. Both are down 80 year-over-year.

More pain for Texas, Permian

Among the major oil- and gas-producing states, Texas took its usual largest share of declines, shedding 14 units to 248, down 350 year-over-year and the state’s lowest count since the 1990s.

The Permian dropped 8 units to 172, down 196 year-over-year; and the Eagle Ford decreased 2 units to 58, down 106 year-over-year.

PNR said all 12 of its rigs operating midyear onward will be in the northern Spraberry-Wolfcamp, where 14 were running at yearend 2015 and 1 has already been released. Its southern Wolfcamp JV area count is being reduced to 0 by the middle of the year from 4 at yearend 2015.

The firm’s Eagle Ford rig count is being reduced to 0 during the first quarter from 6 at yearend 2015, with 2 released in January.

Neighboring Oklahoma and New Mexico each declined 4 units to respective totals of 76 and 22. Oklahoma’s total, down 95 year-over-year, is the state’s lowest since Oct. 23, 2009; and New Mexico’s total, down 44 year-over-year, is the state’s lowest since the 1990s.

The Cana Woodford shed 3 units to 34, while the Ardmore Woodford lost a unit to 2.

North Dakota dropped 3 units to 39, down 84 year-over-year and its lowest point since June 26, 2009. The Williston also relinquished 3 units, bringing its count to 39, down 89 year-over-year.

Colorado, Pennsylvania, and Wyoming each lost 2 units to 20, 17, and 11, respectively. The Marcellus and DJ-Niobrara each declined 2 units as well, settling at respective totals of 29 and 18.

Colorado’s count, down 29 year-over-year, is the state’s lowest since Oct. 27, 2000; Pennsylvania’s count, down 37 year-over-year, is the state’s lowest since Dec. 7, 2007.

Kansas edged down a unit to 8.

Louisiana and California each edged up a unit to 47 and 8, respectively.

Latest crude output declines

US crude oil production declines due to decreased drilling activity have manifested since April 2015, falling 600,000 b/d to 9.1 million b/d in January, according to the US Energy Information Administration’s latest Short-Term Energy Outlook. The output drop has come entirely from the onshore Lower 48.

In its Drilling Productivity Report, also released this week, EIA projects that crude production in March from the seven major US shale plays will fall 92,000 b/d to 4.92 million b/d (OGJ Online, Feb. 8, 2016).

Output from the Eagle Ford in March is forecast to decline 50,000 b/d to 1.22 million b/d, followed by a 25,000-b/d drop in the Bakken to 1.1 million b/d and a 15,000-b/d loss in the Niobrara to 389,000 b/d. The Permian is seen rising by 1,000 b/d to 2.04 million b/d.

New-well oil production/rig across the seven plays in March is expected to increase by a rig-weighted average of 4 b/d to 504 b/d. Expected to lead the way is the Utica, up 13 b/d to 308 b/d; with the Niobrara closely behind at a 12-b/d rise to 741 b/d. The Eagle Ford is seen gaining 8 b/d to 812 b/d.

Contact Matt Zborowski at [email protected].