Appalachian operators counter low prices with increased efficiency

Appalachian basin producers have improved efficiencies in drilling and completions in response to lower natural gas prices, representatives of the Marcellus Shale Coalition (MSC), the Ohio Oil and Gas Association (OOGA), and the Independent Oil & Gas Association of West Virginia (IOGAWV) told Oil & Gas Journal.

“We see a flat [gas price] curve for a very long time,” said Charlie Burd, IOGAWV executive director. “Our members continue to find ways to conduct business that will keep folks working…. Our members have adapted in order to meet the demands of the markets.”

He said low commodity prices encourage technological advancements in unconventional development that drive innovation and efficiencies.

“Companies are working safely and quickly, setting records on a regular basis related to lateral length,” Burd said, while also reducing the number of drilling days per well.

“Additionally, some producers have decided to forgo new drilling and instead are working to address completions of drilled, uncompleted wells and assess future capex constraints,” Burd said.

Matt Hammond, executive vice-president for Ohio Oil and Gas Association in Columbus, Ohio, said the gas industry continues adapting “to an ever-changing” economic climate.

“We are continuing to see mergers and acquisitions in all sectors of the industry as well as competition for capital for our basin against other plays,” Hammond said. “For the Utica, production continues to rise year-over-year as more wells are put into operation; however, rig counts are going down and will likely be lower for some time.”

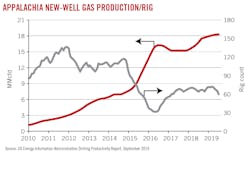

The US Energy Information Administration reports Appalachia region new-well gas production continues to increase since 2015 even as the rig count has declined (Fig. 1).

IHS Markit forecast US natural gas futures prices will fall in 2020 to levels experienced in the 1970s, citing oversupply from the Marcellus as well as the Permian basin.

Ample gas supplies could keep US gas futures prices below $2/MMbtu during 2020, said IHS Markit analysts, who expect falling gas prices despite increased demand from new gas-fired power plants and LNG exports.

IHS said US demand climbed by 14 bcfd in annual consumption since 2017, but supply has expanded by more than that since Jan. 1, 2018.

David Spigelmyer, MSC president in Pittsburgh, Penn., said, “US gas producers provide some of the most affordable energy on the planet.” He added that shale gas is a vital component in supporting “a clean energy economy.”

“Supporting a thriving natural gas industry—from production to pipeline development to its growth in electric generation—should be a core focus of any public policy discussion aimed at building on the progress our industry has realized for Pennsylvania and the nation,” Spigelmyer said.

Hydraulic fracturing concerns

Regarding suggestions by some US presidential candidates to ban or restrict hydraulic fracturing, Burd said IOGAWA is concerned those candidates do not fully understand the environmental and economic benefits that industry provides.

“A ban on fracturing would only push gas production to countries without the responsible operators and regulations that continue to find ways to reduce greenhouse gas emissions and reduce the overall environmental impact,” Burd said.

He notes the oil and gas industry has helped turn around West Virginia’s economy, where unemployment has reached an 11-year low.

“Those who espouse the rhetoric about bans endanger that growth and create uncertainty for the thousands of workers and their families who rely on the jobs created and sustained by the industry,” Burd said.

OOGA’s Hammond said, “It’s one thing to go on national TV and take a shot at the industry with an outlandish political posturing statement, but it is entirely different when you have to campaign in Ohio and look the rank and file of our labor unions square in the eye and say that those million-plus work hours you safely put into building pads and laying pipe are gone.”

MSC’s Spigelmyer noted that most consumer products are manufactured using natural gas. He said gas producers are focused on creating firm gas supply rather than on political rhetoric.

He cited a 2017 report “Forge the Future,” commissioned by Peoples Natural Gas (PNG) and Chevron Appalachia that studied gas development in Pennsylvania, including petrochemicals. The reports estimated a $60-billion-GDP increase in Pennsylvania by 2025 through increased gas-fired power for residential and commercial-industrial users and increased gas exports.

The report suggested a public-private sector advocacy effort to ensure Pennsylvania enacts policies to advance gas development. It also discussed how Pennsylvania gas was stranded due to low prices and lack of pipelines.

The report encouraged Pennsylvania, Ohio, and West Virginia lawmakers and others to create incentives to attract business investment, such as the plastics industry, to the region.

The Pennsylvania House Republican Caucus is promoting “Energize PA,” a pro-growth, pro-jobs legislative package that also calls for redeveloping infrastructure with no new fees or taxes.

On the federal level, Spigelmyer said gas producers want lawmakers to amend the Jones Act so that US vessels can deliver LNG to US ports. In January 2018, a shipment of LNG from Siberia arrived in the Boston harbor via a Russian tanker named Gaselys.

Regarding US legislative issues, Burd said IOGAWV would like to see major interstate pipeline projects obtain the necessary federal approvals. His comment came after various federal court rulings halted some construction.

Burd also called for attracting more petrochemical development more into the Appalachian region, saying it would help ensure US energy security.

State taxes, water

Spigelmyer said Pennsylvania state officials want to impose a severance tax on top of the existing natural gas impact tax, which provides revenues to help counties and municipalities improve roads, bridges, parks, and first-responder services.

“For the last 6 years, we have pushed back on a government severance tax,” Spigelmyer said.

Burd said IOGAWV, “believes a concerted focus by our state policy makers in the areas of tax reform, power generation from natural gas, and incentives for new infrastructure investment--particularly in the areas of fractionation, storage, and transport of NGLs--will be vital.”

IOGAWA also wants pooling legislation that strikes a balance between the need to efficiently produce the state’s oil and gas resources and protect surface and landowner rights.

Pooling allows an operator to combine or pool tracts of land and interests to form drilling and production units. West Virginia has pooling rules for deep coalbed methane wells. But the state lacks pooling rules for shallow gas wells, such as those in the Marcellus.

“A fair pooling law allows for each owner in a production unit to receive their just share of production from the designated drilling unit,” Burd said. “Pooling laws are usually under the jurisdiction of a state commission, for example, the West Virginia Oil and Gas Conservation Commission.”

Pooling enables operators to drill longer laterals. Pooling laws exist in some form in all oil and gas producing states and represent statutory modifications to the rule of capture, Burd said.

In 2018, West Virginia passed a law allowing for majority owners to decide whether a tract of land can be developed. The older common law required 100% consent from all owners. Mineral ownership, however, is highly fractionalized and after many generations, some owners simply cannot be located.

“Pooling allows for all interests to be produced, protects operators from trespass claims from distant owners, and allocates production fairly to each owner in a designated and approved drilling-production unit,” Burd said.

Hammond said OOGA is pushing to plug orphan wells, which are improperly abandoned oil and gas wells.

“Ohio is one of a few states in a position to eradicate orphan wells and prevent future orphan wells,” Hammond said. “Additionally, we continue to be hopeful that producers in Ohio will be allowed to lease state acreage. The lack of leasing state acreage puts Ohio at a disadvantage with other states competing for drilling capital.”

Some oil and gas producers are partnering with water companies to ensure water-delivery infrastructure. For example, Southwestern Energy said it eliminated 1.3 million truckloads of water from Appalachian roads and saved millions of dollars by installing waterlines to well sites.

“This investment in infrastructure allows Southwestern Energy to not only transport water to its well sites, but also provides it with an opportunity to partner with other local operators to provide fresh and produced water to their well sites,” Burd said.

Several IOGAWV members, including Southwestern Energy, have invested in water infrastructure to handle both fresh and produced water to manage costs.

“Produced water is a nationwide issue,” Burd said. “It’s very expensive to move, clean, and reuse or dispose of produced water so we will see efforts to reduce the water-management footprint across the industry.”

Spigelmyer said producers are forced to be extremely efficient and to reduce or eliminate costs.“[Water] recycling is a big part of fracturing,” Spigelmyer said, adding recycling means less need for as many disposal wells.

Technology

Faced with commodity price constraints, Marcellus and Utica operators have realized efficiencies through technology advances in drilling and completion work.

“Batch or development drilling on pads allow companies to optimize drilling and completion capex by reducing rig and frac crew moves and by reducing drilling days,” said Burd. “Producers have decreased drilling time by half in most cases while drilling much longer laterals.”

Hammond said operators analyze real-time data to manage costs.

“While it depends on the operator, we are seeing more completion stages, longer laterals, and more wells per pad, which are reducing both overall costs and surface impact,” Hammond said. “Producers will continue to find ways to lower costs in a low-commodity price environment and internally compete for capital in the states where they are operating.”

Spigelmyer said companies took an average of 60 days to drill a 3,000-ft lateral 5 years ago compared with today when it takes 20 days or less to drill a 10,000-ft lateral.

Once oil and gas prices improve, other regional shales also will be explored, Spigelmyer said, using the Upper Devonian as an example.

About the Author

Paula Dittrick

Senior Staff Writer

Paula Dittrick has covered oil and gas from Houston for more than 20 years. Starting in May 2007, she developed a health, safety, and environment beat for Oil & Gas Journal. Dittrick is familiar with the industry’s financial aspects. She also monitors issues associated with carbon sequestration and renewable energy.

Dittrick joined OGJ in February 2001. Previously, she worked for Dow Jones and United Press International. She began writing about oil and gas as UPI’s West Texas bureau chief during the 1980s. She earned a Bachelor’s of Science degree in journalism from the University of Nebraska in 1974.

![“We see a flat [gas price] curve for a very long time. Our members continue to find ways to conduct business that will keep folks working.” — Charlie Burd, IOGAWV executive director. “We see a flat [gas price] curve for a very long time. Our members continue to find ways to conduct business that will keep folks working.” — Charlie Burd, IOGAWV executive director.](https://img.ogj.com/files/base/ebm/ogj/image/2019/11/191104OGJddi_p01_1_.5dc1dd349b6c4.png?auto=format,compress&fit=max&q=45?w=250&width=250)