Growth in LNG demand could outpace new supply capacity, projects

Mikaila Adams

Editor-News

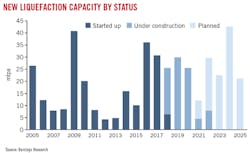

A glut of liquefaction capacity earlier anticipated by LNG project developers is unlikely to materialize, and stronger-than-expected demand could result in a market constrained by supply as early as 2020.

Increasing worldwide energy consumption and a transition away from coal in key economies is driving a rapid growth in LNG demand, and the wave of new supply capacity may be unable to keep up, according to research from Barclays.

By its count, there will be 25 million tonnes of liquefaction capacity coming on stream in 2018, Barclays said in its May report. Five liquefaction projects have started up so far in 2018: Cameroon FLNG Train 1, Cove Point Train 1, Ichthys Train 1, Wheatstone Train 2, and Yamal Train 2. It sees the market rebalancing over the next 2 years despite large volumes of supply expected to come on stream, aided by strong demand in Asia and the delay of project start-ups in recent years.

“Post 2020 we expect the LNG market to rapidly tighten with few projects under construction now ready to start up in the first half of the next decade. We see a clear need for liquefaction projects to be sanctioned now to prevent a supply shortfall,” Barclays said. At the time of the report, about 90% of the projects it expects to come on stream post-2020 still needed project sanction.

Given its forecast of incremental demand of more than 60 million tonnes in 2021 and 2022, the LNG market returns to being supply-constrained rather than demand-constrained. “There is likely to be significant new capacity in 2024-25 if the companies make the sanction decision imminently, but this (as with the last wave of capacity expansions) is still likely to struggle to meet unconstrained demand growth,” Barclays said.

Investments in the oil and gas industry are picking up as the outlook for oil prices steady, but a material increase in final investment decisions (FID) of LNG projects will be slower given difficulty in securing financing and long-term buyers. In the accompanying table, Barclays detailed projects it deemed most likely to achieve FIDs in the short term.

New capacity in 2018

In January, Dominion Energy commissioned equipment at its Cove Point natural gas liquefaction plant at Lusby, Md., and started processing gas. The facility, integrated with Dominion’s LNG import terminal on Chesapeake Bay, is designed to handle an average 750 MMcfd of inlet gas, mostly from the Marcellus and Utica shale plays.

Also in January, Energy World Corp. said Phase 1 of the Sengkang LNG terminal in Indonesia was 80% complete and start-up would proceed once an offtake agreement with Perusahaan Listrik Negara, the state electricity distribution company, was finalized. Current construction includes a 500,000 tonne/year liquefaction train, with the possibility of three additional 500,000-tpy trains subject to further sales contracts.

Early this year, Perenco started production at Cameroon LNG via Golar LNG Ltd.’s Hilli Episeyo floating LNG (FLNG) production unit (OGJ Online, Mar. 18, 2018). The Hilli Episeyo FLNG unit arrived in Cameroon in late November 2017. A ship-to-ship transfer of cooldown LNG with the Golar Bear took place in mid-December 2017, followed by the introduction of feed gas from the onshore processing plant. Commissioning of the FLNG’s refrigerant trains continued into February.

Chevron Australia has brought on stream the second LNG train in its $34-billion Wheatstone project in the Pilbara region of Western Australia (OGJ Online, June 15, 2018). The plant lies 12 km from the coastal town of Onslow. The final part of the Wheatstone infrastructure—the domestic gas plant—is on schedule to be brought on stream at yearend.

The first shipment of LNG from Yamal LNG’s Train 2 in northern Russia was loaded for shipment in August (OGJ Online, Aug. 9, 2018). Train 2 adds 5.5 million tpy, doubling the plant’s capacity. A third 5.5 million-tpy train is expected to start operations in early 2019. Train 2 was commissioned 6 months ahead of schedule, according to majority owner PAO Novatek.

The Inpex Corp.-led joint venture’s first cargo of LNG from the Ichthys project has been shipped from the onshore gas liquefaction plant in Darwin, Northern Territory (OGJ Online, Oct. 23, 2018). Inpex said the Pacific Breeze LNG carrier sailed from the terminal late on Oct. 22 bound for the Inpex-operated Naoetsu LNG receiving terminal in the Niigata Prefecture in Japan. The project will gradually increase its production to about 8.9 million tpy of LNG when it reaches the production plateau—a figure equivalent to more than 10% of Japan’s annual LNG import volume.

As part of a September investor presentation, Kinder Morgan said it expects the first liquefaction unit at Elba Island LNG near Savannah, Ga., will enter service in the fourth quarter with the remaining nine units expected to enter service staggered over time by third-quarter 2019. Export capacity of 350 MMcfd of LNG is expected when complete. The project will have the ability to liquefy about 2.5 million tpy of LNG, equivalent to 350 MMcfd of gas. Shell has committed to entire capacity of facility, as well as Elba Express expansion, Kinder Morgan said.

Stock beneficiaries

Royal Dutch Shell PLC and Total SA are the biggest direct winners from the next phase of the LNG cycle, Barclays said.

Shell reached record LNG profitability in this year’s first quarter, Barclays said, with more to come with higher volumes from Gorgon and Pearl and the expected start-up of the Prelude project later this year. In early October, Shell Canada Energy made FID on its 14 million tpy liquefaction JV, LNG Canada, in Kitimat, BC, allowing work to begin immediately (OGJ Online, Oct. 2, 2018). Further options may follow, Barclays said, including Lake Charles in the US and Sakhalin Train 3 in Russia.

Total is in the investment phase for LNG after setting ambitious targets to increase its integrated gas business, Barclays said. In July, the company closed a deal to acquire LNG assets from Engie SA for an overall enterprise value of $1.5 billion with possible further payments of $550 million. Total is acquiring 2.5 million tpy of liquefaction capacity with 16.6% interest in the Cameron LNG liquefaction plant in Louisiana—where three trains are currently under construction and expected to enter service in 2019 and two more can be added—as well as 5% stake in the first train of the Idku LNG project in Egypt.

The deal gives Total a liquefaction portfolio of 23 million tpy by 2020 with interests in the Middle East, Australia, Russia, and the US. It will also have a worldwide LNG trading portfolio of 28 million tpy, and European regasification capacity of 18 million tpy. Total’s 2020 fleet will include 16 LNG carriers and two floating storage and regasification units, one to be stationed off Ivory Coast and the other off Myanmar.

Combining its overall interests in liquefaction plants and portfolio of third-party supply contracts, Total will manage 40 million tpy of LNG volume globally by 2020, making it the second-largest international oil company in global liquefaction behind Shell.