Woodside enters 40% Louisiana LNG farm-out deal, moves closer to 50% equity sell-down

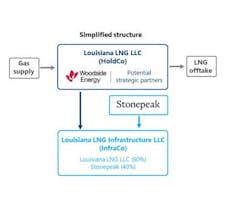

Woodside Energy Group Ltd. has entered into a binding agreement with investment firm Stonepeak to farm out 40% interest in Louisiana LNG Infrastructure LLC, its LNG production and export terminal under construction in Calcasieu Parish, La.

Louisiana LNG has a total permitted capacity of 27.6 million tonnes/year (tpy) and is nearing final investment decision (FID) for the three train, 16.5 million tpy foundation development.

The agreement calls for Stonepeak to provide $5.7 billion towards the expected capital expenditure for development of the project’s initial development from the effective date of Jan. 1, 2025. Woodside said the agreement calls for investment on an accelerated basis, with Stonepeak contributing 75% of project capital expenditure in both 2025 and 2026. The remainder of Stonepeak’s committed capital will be funded in subsequent years, the operator continued.

The estimated forward cost for the foundation development remains $900-960/tonne, which includes EPC costs, contractor completion incentive payments, owner’s costs, allowances, and contingency. It excludes costs and contingency of Louisiana LNG LLC—the holding company operated by Woodside—and pipeline costs.

Woodside said the agreement provides validation of project quality and increases the attractiveness of the project to other potential equity partners. Chief executive officer Meg O’Neill said the company will continue advancing discussions with additional potential partners targeting an equity sell-down of around 50%.

The deal is expected to close in this year’s second quarter subject to conditions including a positive FID for the Louisiana LNG foundation development, as well as requisite regulatory, legal, and other customary approvals.