Special Report:Global refining capacity advances; US industry faces uncertain future

Global crude distillation capacity in 2009 shot ahead of capacity for 2008, according to the latest OGJ survey of the world's refineries, extending in a big way the growth evident in recent years. Worldwide refining capacity set a record for the eighth year in a row.

For 2009, OGJ's survey shows a total capacity of 87.2 million b/cd for 661 refineries, an increase of more than 1.6 million b/cd over 2008. Last year's refinery survey, as of Jan. 1, 2009, listed a global capacity of 85.6 million b/cd in 655 refineries.

The 2009 capacity growth far surpasses the total growth for the previous 3 years: 2008 (300,000 b/cd), 2007 (130,000 b/cd), and 2006 (52,000 b/cd). And the number of refineries reversed what had been a steady contraction, adding a net of six new plants during 2009 and reversing a 10-year contraction that saw more than 100 refineries closed, mostly smaller, less-efficient ones.

Fig. 1 shows the trend in operable refineries and worldwide capacity.

Five new refineries started up in 2009, all in the burgeoning oil-product markets of the Middle East and Asia. Net Asian refining capacity in fact leaped more than 1 million b/cd for 2009, followed by North America with more than 393,000 b/cd, and the Middle East with more than 200,000 b/cd.

Other regions experienced little or no net gain or loss in stated capacity.

New crude capacity

This year's survey lists five new refineries, adding more than 1 million b/cd of crude capacity.

In the Middle East, the Kar Group opened the 40,000-b/cd plant in Abril in Iraq's Kurdistan region (OGJ, July 27, 2009, p. 10), while Laffan Refinery Co. Ltd. at midyear opened a 138,700-b/cd refinery at Ras Laffan City, Qatar.

Qatargas Operating Co. Ltd. is operating the plant for a consortium of Qatar Petroleum (51%), ExxonMobil (10%), Total (10%), Cosmo Oil Co. (10%), Mitsui (4.5%), and Marubeni (4.5%; OGJ, Apr. 20, 2009, p. 9).

In Asia, Reliance Industries Ltd. started up a 580,000-b/cd plant in the state of Gujarat; PetroVietnam started up the first refinery in Vietnam, at Dung Quat, 148,000 b/cd; and China National Petroleum Corp. started up a new refinery at Dushanzi in far western Xinjiang region, 200,000 b/cd.

All other increases in refining capacity occurred in existing facilities:

• For North America, OGJ's survey for US refineries reveals a total capacity increase of 383,837 b/cd. Much of that results from new data received for Valero Energy's Norco, La., refinery that now peg its crude capacity at 310,000 b/cd.

The other large increase is for Marathon Oil's 436,000-b/cd Garyville, La., refinery that in late 2009 has started up a 180,000-b/cd expansion.

Laffan Refinery Co. Ltd. this year started up a new refinery at Ras Laffan City operated by Qatargas Operating Co. Ltd. (photograph from Qatargas).

More capacity is on the horizon for South America. Last month, Petroleo Brazileiro SA (Petrobras) and the Rio Grande do Norte state government agreed on details for expanding the Refiniaria Potiguar Clara Camarao to boost its installed capacity and deploy a gasoline production unit (OGJ Online, Nov. 19, 2009).

OGJ subscribers can now download, free of charge, the text version of the OGJ Worldwide Refining Report 2009 tables from www.ogjonline.com. Scroll down to "Additional Information," click "OGJ Subscriber Surveys," then "Worldwide Refining." This link also features the previous editions of this report as well as a collection of other OGJ surveys from previous years. Subscribers and nonsubscribers may purchase Excel spreadsheets of the survey data by sending an email to [email protected] or calling (800) 752-9764. For further information, please email [email protected], or call Leena Koottungal, OGJ Survey Editor/News Writer (713) 963-6239.

The 30,000-b/d refinery, which already produces LPG, diesel fuel, and aviation kerosine, will also produce petrochemical naphtha and other products, along with enough gasoline to make Rio Grande do Norte self-sufficient.

The upgrade will allow the refinery to produce 21,000 cu m/month of gasoline, 45,000 cu m/month of diesel, 7,500 cu m/month of aviation kerosine, 11,700 cu m/month of LPG, and 3,000 cu m/month of chemical naphtha.

• In the Middle East, Kuwait reported an increase in capacity at its three refineries, to 936,000 b/cd for 2009, up by 46,800 b/cd over 2008. That increase also represents the total net increase for the Middle East.

• In Asia, new data for two refineries in South Korea—Yeosu and Onsan—and Taiwan, at Mailiao, added a net increase for the region of 115,000 b/cd.

And more Asian capacity is in the works.

Last month, Pakistan Minister for Petroleum and Natural Resources Naveed Qamar told the country's National Assembly that three refineries with a total capacity of 465,000 b/d "are in the pipeline" (OGJ, Nov. 16, 2009, p. 12).

Included are the 250,000-b/d Khalifa Coastal refinery and the 115,000-b/d Bosicor Oil Pakistan Ltd. plant, both in Hub, Balochistan Province; and the 100,000-b/d Trans-Asia Refinery Ltd. plant at Port Qasim in Karachi.

Refinery closures, delistings

As the global recession took hold during 2009, oil demand fell and crude inventories expanded. With the year winding to its end, refinery curtailments and shutdowns became more and more likely.

The only shutdown OGJ's survey reflects this year was in March by Nihonkai Oil Co. Ltd. at its 57,000-b/cd Toyama, Japan, refinery. The company plans to convert the plant to an oil terminal. It was the smallest refinery owned by the Nippon Oil group (OGJ, Aug. 3, 2009, p. 44).

Several refiners, mainly among hard-hit US operators, have announced reduced utilization, periodic idling of units, planned temporary shutdowns, and one permanent closing.

In March of this year, Motiva Enterprises LLC announced it was delaying for more than 2 years the completion target for addition of a single-train crude distillation unit that will add 325,000 b/cd of capacity to its Port Arthur, Tex., refinery. Added to its current capacity of 285,000 b/d, the project will make the refinery the largest in the US.

A joint venture of Shell Oil Co. and Saudi Refining Inc., Motiva originally planned to complete the $7 billion expansion late next year.

In June, Valero Energy Corp. announced suspension of plans to add hydrocrackers at its 250,000-b/d Port Arthur refinery and its 310,000-b/d St. Charles, La., refinery. At Port Arthur, plans were to add a 50,000-b/d hydrocracker for an estimated $1.7 billion. At St. Charles, Valero planned a new 50,000-b/d hydrocracker to cost $1.25 billion (OGJ Online, June 4, 2009).

In September, the company also announced it was shutting down the coker and gasifier complex at the 210,000-b/cd refinery at Delaware City, Del., operated by its Premcor Refining Group Inc. subsidiary. This step followed an earlier shut down of the coker and fluid catalytic cracking unit at its 315,000-b/d Corpus Christi, Tex., refinery (OGJ Online, Sept. 9, 2009).

But the moves at the Delaware City refinery proved insufficient, and last month Valero Energy permanently closed the plant, citing financial losses caused by "very poor economic conditions, significant capital spending requirements, and high operating costs" (OGJ Online, Nov. 20, 2009). The closure will be reflected in OGJ's 2010 survey results.

In fourth-quarter 2009, the company said, it will report a pretax charge of $1.7-1.8 billion, related primarily to "asset impairment," employee severance, and other shutdown costs.

Valero estimates the shutdown will reduce pretax operating expenses by about $450 million in 2010, including $125 million of noncash costs, and will reduce capital spending and turnaround costs by about $200 million through 2010.

Shutting down the refinery's gasifier and coking operations to improve reliability and financial performance did not sufficiently improve profitability, said Valero Chairman and CEO Bill Klesse last month.

In October, Sunoco Inc., Philadelphia, announced it was idling its 150,000-b/d Eagle Point refinery at Westville, NJ. The refinery is interconnected with Sunoco's refineries at Philadelphia and Marcus Hook, Pa., which form a complex capable of processing 655,000 b/d of crude oil (OGJ Online, Oct. 6, 2009).

Last month, Western Refining Inc., El Paso, announced plans to consolidate two small refineries in New Mexico to reduce operating costs. At Gallup, Western will consolidate the 23,000-b/d refinery there and the 17,000-b/d facility at Bloomfield, which will be idled.

Elsewhere, earlier this year, Kuwait canceled plans to build a 630,000-b/d fourth refinery at Al Jour on the Persian Gulf coast near the Saudi Arabia border. The refinery, earlier expected to cost $10 billion but later raised to $15 billion and rebid, had been scheduled to start in 2013 (OGJ, Nov. 12, 2007, p. 32; OGJ Online, Mar. 23, 2009).

And last month, in Germany, ConocoPhillips confirmed plans to delay an upgrade at its 260,000-b/d Wilhelmshaven refinery. The company had planned to add a coker, hydrocracker, and hydrogen units to the refinery, which it acquired in 2006 from Louis Dreyfus Refining & Marketing Ltd. (OGJ Online, Nov. 18, 2009).

Largest refining companies

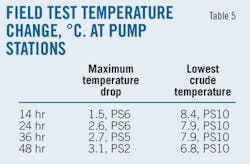

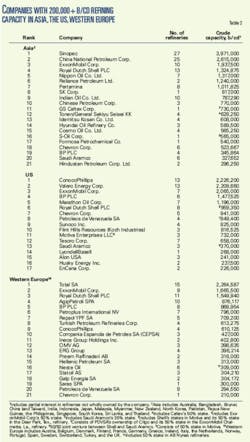

Table 1 lists the top 25 refining companies that own most worldwide capacity. Table 2 lists companies whose plants total more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Major changes of positions in Table 1 since Jan. 1, 2009, involve Valero, Chevron, Total, and Marathon. Other refiners moving up or down the list by only one rank are Petroleos de Venezuela SA, China National Petroleum Corp., Petroleo Brasileiro SA, Kuwait National Petroleum Co., SK Corp., and Flint Hills Resources.

Netting an annual gain of only slightly more than 100,000 b/d in capacity, Valero nonetheless managed to move past Total and PDVSA in this year's rankings, after new data for Total redefined its holdings.

And, as has already been noted, Marathon added 180,000 b/d at Garyville, La., moving it up the ranking to eighteenth from twentieth.

In Asia, India's Reliance Industries Ltd. moved up to sixth position from twelfth following start-up in late 2008 at its 580,000-b/d refinery at Jamnagar in western India, as also noted previously. Combined with Reliance's neighboring 660,000-b/d refinery, total refining capacity at the site is 1.24 million b/d.

Chevron's position for Asia fell to eighteenth from eleventh after a downward adjustment of 145,000 b/d of capacity at Thailand's Ma Ta Phut, in whose operator, Alliance Refining Co. Ltd., Chevron has an interest.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity. In Table 2, several companies moved one position up or one position down.

These include, for Asia, nearly all companies between the fourth and seventeenth positions. Gone from the list this year is Showa Yokkaichi Sekiyu Co., whose refinery capacity dropped to less than 200,000 b/d.

For the US, ConocoPhillips and Valero switched positions, Royal Dutch Shell moved up two spots to fourth, and Total dropped off the list when adjusted capacity for its Port Arthur refinery dropped to less than 200,000 b/cd.

For Western Europe, single-position changes are evident for Royal Dutch Shell, ExxonMobil, AgipPetroli, and BP PLC.

Largest refineries

Table 3 lists the world's largest refineries with a minimum capacity of 400,000 b/cd.

Two new refineries joined the list this year, both previously mentioned:

• Reliance Industries' new 580,000-b/d refinery adjacent its older 660,000-b/d refinery at Jamnagar, India.

• Marathon Oil's Garyville, La., plant that boosted its capacity to 436,000 b/d from 256,000 b/d.

Several plants added capacity and, in a few cases, changed positions as a result. Among those are GS Caltex, which reported an additional 50,000 b/d at its Yeosu, South Korea, refinery; S-Oil added 45,000 b/d at Onsan, South Korea; Kuwait National Petroleum, 23,300 b/d at in Mina Al-Ahmadi plant; Formosa Petrochemical Co., 20,000 b/d at Mailiao, Taiwan; and Shell Eastern Petroleum, 13,000 b/d at Pulau Bukom, Singapore.

Other plants changed positions as they added or reduced smaller capacities.

Regional crude capacities

Table 4 lists regional process capabilities as of Jan. 1, 2010. As previously mentioned, the largest increase in crude capacity occurred in Asia, thanks to the start-up of more than 900,000 b/d at three new refineries in India, Vietnam, and China.

China's apparent petroleum demand in October jumped 10.2% from a year earlier, according to a report last month from Platts, as the world's second largest oil consumer ramped up crude processing rates.

For October, Chinese oil demand reached an estimated 33.886 million tonnes (about 248 million bbl) compared with 30.75 million tonnes in October 2008, analysis of official data showed.

October was the second consecutive month Chinese oil demand had posted double-digit growth year over year. The country's oil demand climbed by 12.6% in September from a year earlier. October demand, however, was only slightly higher than September's 33.8 million tonnes, said Platts.

Chinese refineries processed 33.29 million tonnes (7.87 million b/d) of crude in October, surpassing the previous all-time high of 33.11 million tonnes set in July of this year.

Citing official Chinese data, the analysis went on to say that Chinese industrial production and retail sales had risen by more than 16%/year in October, but Chinese growth "continues to be driven by domestic demand rather than a recovery in the country's export markets."

It said higher crude throughput at refineries in October coincided with a 12.3% spike in crude imports during the month, compared with September, and an 11.6% slide in refined-products imports.

October crude imports of 19.33 million tonnes represented a 19.6% increase from a year earlier and were the second highest monthly purchase by China historically, said Platts's analysis.

Elsewhere, the Middle East added 178,700 b/d of new capacity at new refineries in Iraq and Qatar.

North America and Western Europe also increased crude distillation capacity.

Processing capabilities

Figs. 2-4 show the processing capabilities of Asia, the European Union, and the US for the past 10 years. Processing capabilities are defined as conversion capacity (catalytic cracking and hydrocracking) and fuels-producing processes (catalytic reforming and alkylation) divided by crude distillation capacity (% on crude).

Countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK.

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com