DRILLING MARKET FOCUS: Industry invests record sums in rigs, drilling campaigns

The market for offshore oil and gas drilling services continues to expand and newbuilds swell the fleets. As of May 9, more than 90% of the world’s mobile offshore drilling units were under contract, according to ODS-Petrodata.

In addition to exploration wells, operators have committed large amounts of capital to drill and develop major projects around the world (see article, p. 55).

Drilling expenditures are reaching record highs, but high oil prices still make it profitable to explore and to redevelop old fields, generating heavy activity for light workover rigs and coiled tubing systems.

Oil price driver

Demand drives prices, and prices drive drilling activity.

The benchmark futures price of US light, sweet crudes rose above $126/bbl for the first time in intraday trading May 9 (for June contracts) on the New York Mercantile Exchange (OGJ, May 12, 2008, p. 6). North Sea Brent crude was not far behind, with the June IPE contract closing at $125.40/bbl.

In mid-May, Goldman Sachs said that oil prices could rise to $150 or $200/bbl within 2 years.

Drilling expenditures

Last month, the American Petroleum Institute released its 2006 joint association survey on drilling costs. The survey estimates total spent to drill and equip wells in the US.

The industry spent $109.8 billion in 2006, up 44% from $76.2 billion in 2005, according to API.1 This included:

- $14.7 billion on exploration wells, up 19% from 2005.

- $93.8 billion on development wells, up 47% from 2005.

- $33.6 billion on development oil wells, up 58%.

- $53.7 billion on development gas wells, up 72%.

For the 19th consecutive year, companies spent more drilling for natural gas (54%) than for oil (34%), with 12% of the total drilling spend resulting in dry holes.

The number of wells and total footage drilled increased from 2005, pushing the average cost per well and per foot to the highest levels ever.

North American drilling

Based on Baker Hughes Inc. rig counts, total US rig activity has increased by about 130 rigs during the past year. Most of the increase (80 rigs) is due to an increase in oil drilling in response to higher oil prices, which have risen steadily since January 2007.

BHI’s US rig count showed 1,754 land rigs, 23 inland water rigs, and 69 offshore rigs operating as of May 9.

In the 5 quarters beginning January 2007, rig activity increased notably in Texas, Oklahoma, and Colorado, which added 120, 40, and 30 rigs, respectively. But rig counts dropped in Louisiana (40 rigs) and Wyoming (20 rigs) over the same period.

Rig activity in the Gulf of Mexico has declined since 2001, dropping to about 60 rigs in first-quarter 2008 from a high of 176 rigs in 2001. ODS-Petrodata’s weekly rig count showed 124 MODUs in the Gulf of Mexico fleet in mid-May, down from 135 rigs a year earlier.

The number of US rigs drilling horizontal wells began increasing about 5 years ago, from about 50 in second-quarter 2003, to about 500 rigs in first-quarter 2008.

The number of US rigs drilling vertical wells has decreased to about 1,300 from about 1,450 in early 2006.

Directional drilling has remained essentially flat in the US over the last 2 years.

Overall drilling activity in Canada has declined over the past 3 years, driven predominantly by a 30%/year reduction in Alberta gas drilling in the 2007-08 winter season. The drop has been attributed to adverse changes in currency exchange rates, lower natural gas prices, and changes in Alberta’s royalty regime.2

Offshore forecast

In mid-April, Douglas Westwood Ltd. announced its forecast of shallow and deepwater drilling budgets. The report notes that offshore drilling accounted for 45% of all offshore capital expenses in 2007, when nearly 4,000 wells were drilled offshore. Operators spent nearly $50 billion on shallow water drilling in 2007, and about $18 billion on deepwater drilling, according to Douglas Westwood estimates.3

The company says that drilling will continue to increase over the next 5 years, with deepwater drilling increasing to 31% of total offshore spending, compared with 26% in 2007.

By 2012, the industry will spend about $26 billion on deepwater drilling and $57 billion on shallow water drilling, worldwide.

Newbuilds

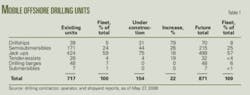

With 154 mobile offshore drilling units under construction, the MODU fleet is set to increase 22%, to 871 units from 717 units (Table 1).

Drillships show the largest increase, 79%, with 39 ships in the current fleet and 31 more under construction. They now comprise 5% of the MODU fleet but will increase to 8% of the total. Houston-based Transocean Inc. is building 8 of the 31 ships; all but 1 already have contracts.

The semisubmersible fleet is poised to increase 26%, with 44 floaters under construction, adding to the 17 already working. Semisubs will increase to 25% of the future MODU fleet, up from 24% of the current fleet.

The tender-assist fleet will grow 19%, with 4 new units soon to be added to the 28 working. They now represent about 4% of the fleet, and that will decrease slightly.

Jack ups represent 59% of the current MODU fleet; after adding 75 units now under construction, that portion of the fleet will decrease slightly, to 57%.

Drilling barges and submersibles represent 7% and 1% of the current MODU fleet, respectively. With no new units under construction at this time, those units will represent 6% and less than 1% of the future MODU fleet.

The push into deep water will require additional vessels capable of drilling in water depths exceeding 10,000 ft. These rigs will also be in demand for interventions unless a new fleet of deepwater intervention vessels is built (OGJ, May 26, 2008, p. 37).

We expect shipyards to continue to book orders for new drilling units, particularly drillships and semisubs. Operators will also continue to book long-term contracts for newbuilds, particularly those capable of working in deep and ultradeep water.

In mid-April, two Indian industrial conglomerates announced plans to begin manufacturing deepwater drilling rigs (OGJ Online, Apr. 14, 2008)Reliance Industries Ltd. and Larsen & Toubro Ltd. Reliance had to put drilling on hold for 3 years due to its inability to secure rigs to explore nine deepwater blocks.

L&T plans to double revenues from its offshore business by getting into rig construction. In 2007, it built a port at Sohar, Oman, to serve a shipyard where it plans to build rigs and other offshore equipment. L&T also plans to construct two new ports at Dhamra in Orissa and Kakinada in Andhra Pradesh.

Tom Kellock, a Houston-based analyst at ODS-Petrodata Consulting & Research, told OGJ that the market will absorb still more floaters, but the supply of jack ups is probably adequate at this time.

Billion-dollar drillship

Last month, Stena Drilling, a wholly owned subsidiary of Stena AB, announced it’s building a new Arctic-class drillship at Samsung Heavy Industries shipyard in South Korea. The estimated total delivery price for the dynamically positioned Stena DrillMAX IV is $1.15 billion. It will be delivered in December 2011.4

The ship is designed with a thickened hull for drilling in harsh, high-latitude environments, and will be capable of drilling in ultradeep water. It will have six propellers and a total displacement of 97,000 tons.

Stena’s existing drilling fleet includes four semisubmersibles, active off Norway, Great Britain, Angola, and Australia, and three drillships. The Stena DrillMAX I operates off Brazil under a 4-year contract with options for Repsol-YPF; two other drillships, Stena DrillMAX III and Stena Carron, are under construction at Samsung in Korea.

The two unfinished drillships have contractual commitments when delivered. The Stena Carron, named for a Scottish river, will be completed mid-2008 and begin a 3-year contract with Chevron, drilling off northern Europe. The Stena DrillMAX III will be delivered in mid-2009 and begin a 5-year contract with Hess Corp.

Realignments

In late May, Pride International announced that it sold its fleet of platform rigs to Blake International LLC for $66 million. Pride intends to focus its offshore drilling operations in deep water.

In April-May, private Norwegian investor Dry Ships Inc. acquired a majority of shares of independent offshore drilling contractor Ocean Rig ASA. On May 27, Ocean Rig announced that Dry Ships held an aggregate of 75.15% and intended to delist Ocean Rig from the Oslo Stock Exchange. Founded in 1996, Ocean Rig owns and operates two of the world’s largest harsh environment semisubmersibles, the Leiv Eriksson and the Eirik Raude currently operating in the North Sea and the US Gulf of Mexico.

Dry Ships also announced in late April that it was exercising options to build two new drillships at Samsung Heavy Industries Co. Ltd. The ships will each cost about $800 million and will be delivered third-quarter 2011.

Calgary’s Saxon Energy Services Inc. announced discussions in late April about a potential sale of the company to Schlumberger Ltd. and First Reserve Corp. On May 5, Saxon announced an arrangement agreement with Sword Canada Aquisition Corp., a company indirectly owned by Schlumberger; a special shareholders will be held mid-July.

Saxon estimated that about 16% of its 2008 revenue will derive from its drilling joint ventures in Mexico and Colombia with Schlumberger.

References

- 2006 Joint Association Survey on Drilling Costs (JAS), American Petroleum Institute, May 7, 2008.

- Dearman, Britt, “Topic Report: North American Drilling Trends,” Apache Corp., May 5, 2008.

- “The World Offshore Drilling Spend Forecast 2008-2012,” Douglas Westwood Ltd., April 2008.

- Wallis, Keith, “Shipbuilding & RepairStena places $942m order for fourth drillship,” Lloyds List, May 1, 2008, www.lloydslist.com.