CO2-EOR set for growth as new CO2 supplies emerge

Vello Kuuskraa

Matt Wallace

Advanced Resources International Arlington, Va.

Development of large natural sources of CO2 in Colorado (McElmo Dome/Doe Canyon) and New Mexico (Bravo Dome) plus construction of high-volume CO2 pipelines enabled CO2 enhanced oil recovery (CO2-EOR) to achieve its first burst of growth in the Permian basin starting in the 1980s.

Subsequent development of natural CO2 supplies at Jackson Dome, Mississippi, and the capture of vented CO2 at the massive LaBarge natural gas processing plant in western Wyoming provided the foundations for the second round of CO2-EOR growth at the turn of the century in the Gulf Coast and the Rocky Mountains.

Based on these first two phases of growth, the industry now injects 3.5 bcfd (68 million tonnes/year [tpy]) of natural and industrial CO2 to produce 300,000 b/d of oil via EOR.

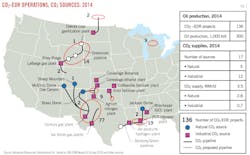

Fig. 1 provides the state-by-state locations for the 136 currently active CO2-EOR projects. Much of the activity is in West Texas with 77 projects, followed by Mississippi (19 projects), and Wyoming (14 projects).

Fig. 1 also shows the location of existing CO2 supply sources. While much of the CO2 is from natural CO2 fields, industrial sources in growing numbers also provide CO2 to the EOR industry. A robust infrastructure of CO2 pipelines, totaling more than 3,000 miles, links CO2 supply areas with oil fields.

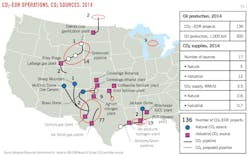

While oil production from CO2-EOR has steadily increased, its growth has slowed in the past few years (Fig. 2). This is due primarily to limits on accessible, affordable supplies of CO2. As such, large-scale capture and utilization of CO2 from industrial facilities, chemical complexes, and electric power plants will be essential if the CO2-EOR industry is to achieve its full economic potential.

We now envision a third round of growth for CO2-EOR supported by (1) development of large additional industrial sources of CO2 plus modest expansions of natural CO2 supplies, (2) the recent completion of a series of large-volume CO2 pipelines in the Rockies, Gulf Coast, and Midcontinent, and (3) a favorable outlook for oil prices.

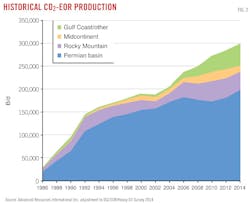

Table 1 provides a partial listing of recently announced industrial plants planning to capture CO2 emissions for sale to the EOR market. Fig. 3 shows the recent expansion in available natural CO2 supplies from the McElmo Dome and Doe Canyon CO2 fields.

Augmenting OGJ survey

Oil & Gas Journal's bienneal EOR/Heavy Oil Survey is the "gold standard" for information on EOR operations in the US. The information in the survey is collected at an EOR project level, providing detailed, highly valuable data on the nature, location, reservoir settings, and oil production from EOR for each of the major EOR technologies: CO2-EOR, chemical EOR, and thermal EOR. The survey contains data for 1986-2014. The 2014 EOR/Heavy Oil Survey appears nearby.

The objective of this article is to augment this valuable snapshot of the status of CO2-EOR with a look forward. For this, our article captures industry information on existing and future sources of CO2 as well as data on existing and announced CO2-EOR projects.

As such, our projections of future oil production from CO2-EOR are based on industry data as well as project-by-project matching of available CO2 supplies in concert with CO2 utilization. Where the announced volumes of available CO2 supplies exceed demand for CO2 by existing or announced CO2-EOR projects, we estimate the additional oil production that could result from expansion of existing CO2 floods or the initiation of yet-to-be announced CO2 floods.

CO2-EOR outlook

Oil production from CO2-EOR in onshore, Lower 48 oil reservoirs provided 300,000 b/d of incremental oil supply at the start of year 2014. This rate of oil production has grown steadily for the past 30 years.

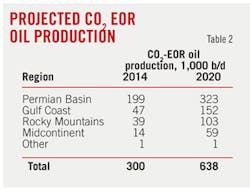

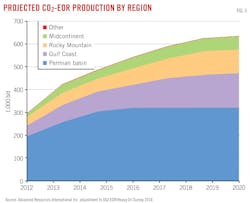

Given the new volumes of CO2 supplies and the numerous announced CO2-EOR projects, we envision strong growth in near-term oil production and CO2 utilization from CO2-EOR. Our analysis shows that incremental oil production from CO2-EOR operations is likely to double to 638,000 b/d by 2020 (Fig. 4; Table 2).

Our outlook for CO2-EOR incorporates growth (or decline) in oil production from previously initiated CO2-EOR projects as well as expected oil production from recently announced new CO2-EOR projects expected to come online by 2020.

For example:

• The recently initiated CO2-EOR projects at Bell Creek, Burbank, Goldsmith, Hastings, Katz, and Oyster Bayou (among others) have yet to reach peak production.

• A series of large-scale CO2-EOR projects, such as at Conroe, Thompson, and Webster, together holding nearly 250 million bbl of CO2-EOR oil potential, are scheduled to achieve first production by 2020.

CO2 supply outlook

Currently, the majority of CO2 used by EOR is from natural sources, notably from the McElmo Dome, Bravo Dome, and Doe Canyon natural CO2 fields, which supply the Permian basin and portions of the Midcontinent, and from Jackson Dome, which supplies CO2 for EOR in East Texas and along the Gulf Coast.

Natural CO2 resources are limited, however. As such, future development of CO2-EOR will need to rely on new sources of industrial CO2. Importantly, the capture and sale of industrial CO2 emissions would provide revenues to industrial plants, gas processing plants, and power generation operators. Without a CO2-EOR market for captured CO2 emissions, however, these plants may vent their CO2 emissions rather than be able to sell their captured CO2 for productive use by EOR.

Our outlook for growth in industrial sources of CO2 includes the following announced projects:

• Large expansions in CO2 captured from gas processing plants, such as at Lost Cabin, LaBarge, and Riley Ridge in the Rockies and the Century Phase 2 plant in West Texas.

• Capture of CO2 from a host of nitrogen, hydrogen, fertilizer, and other industrial plants in the Midcontinent and along the Gulf Coast.

• Potential for captured CO2 emissions from Summit Energy's TCEP integrated gasification/combined cycle (IGCC) plant in West Texas, Sasol's gas-to-liquids (GTL) plant in Louisiana, Leucadia's coal gasification plant in Mississippi, and DKRW's Phase 1 coal-to-liquids plant in the Rockies, among others.

No doubt some of these industrial projects expecting to capture CO2 may be delayed or even canceled. As such, we have used probabilities on the likelihood of each plant becoming operational by 2020.

Here is a region-by-region assessment of future CO2 supplies.

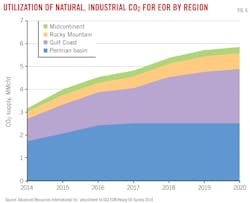

• Permian basin. The current sources of CO2 supply for the Permian basin include McElmo Dome, Doe Canyon, and Sheep Mountain/La Veta in Colorado, Bravo Dome in New Mexico, and the Century and Val Verde gas plants in Texas. With recently completed expansions, these sources are projected to provide 1.9 bcfd of CO2 in 2014 for use by CO2-EOR.

A new source of natural CO2 (300 MMcfd of capacity) from St. John's Dome in New Mexico is expected online by 2016. Captured CO2 from expansion of the Century gas processing plant and from the Texas Clean Energy Project (TCEP) also will become available for the Permian basin by 2016. With successful completion of these projects, overall CO2 supply for Permian basin EOR will reach to 2.8 bcfd by 2017 and stay at this level through 2020.

• Gulf Coast-East Texas. The current 1.1 bcfd of CO2 available for EOR in the Gulf Coast-East Texas is primarily natural CO2 from Jackson Dome in Mississippi. This CO2 supply also includes two new industrial sources of CO2: the Air Products hydrogen and PCS nitrogen plants in Louisiana that came online in 2013.

Aside from a modest increase in supply from Jackson Dome, most of the incremental CO2 supply for EOR in the Gulf Coast will likely be from industrial sources. Many chemical plants in Louisiana are scheduled to capture and supply CO2 to the region, including the Lake Charles gasification plant, Leucadia's Mississippi gasification plant, a planned Sasol gas-to-liquids operation in Louisiana, plus other plants in Louisiana yet to be announced.

Two new power plants, one by Mississippi Power and the other by NRG, will capture and supply CO2 for EOR in 2014 and 2016, respectively. Total CO2 supply for EOR in the Gulf Coast-East Texas region will increase to 2.6 bcfd by 2020.

• Rocky Mountains. The majority of CO2 supply in the Rockies comes from the Shute Creek/LaBarge gas processing plant. A small volume of natural CO2 supply from McElmo Dome is supplied to the CO2 flood at Greater Aneth oil field. Total supply of CO2 for EOR in the Rockies is projected at 370 MMcfd for 2014.

In addition to expansion of CO2 capture at the Shute Creek/LaBarge and Lost Cabin gas processing plants, four sources of industrial CO2 are to come online, including the Riley Ridge gas processing plant, the DKRW Medicine Bow fuel plant, the Linc Energy gasification plant, and the Quintana South Heart IGCC plant.

Under a probability-based estimate, these expansions and new projects would add nearly 400 MMcfd of CO2 supply for Rockies EOR by 2020.

• Midcontinent. The great bulk of the CO2 supply in the Midcontinent comes from industrial sources, including the Koch nitrogen plant, the Agrium fertilizer plant, the CVR Coffeyville chemical plant, and the Conestoga Arkalon and Bonanza nitrogen plants.

A modest amount of natural CO2, 35 MMcfd, is currently supplied to the Postle oil field in Oklahoma from Bravo Dome. Projected total CO2 supply for Midcontinent EOR is 150 MMcfd in 2014.

Several new sources of CO2 are likely for the Midcontinent. The Lilly Lateral pipeline will extend Bravo Dome CO2 supply to the N.E. Hardesty EOR project, and increased supplies of CO2 from other industrial plants will support expansion of CO2-EOR at Burbank and surrounding oil fields. Projected total CO2 supply for EOR in the Midcontinent will reach reach 300 MMcfd by 2020.

CO2-EOR production

Our outlook is for CO2-EOR-based oil production to increase to 638,000 b/d in 2020 from 300,000 b/d in 2014 (Fig. 5). This estimate of future CO2-EOR oil production derives from several sources:

• Existing CO2 floods. The starting point for estimating future oil production is the set of 136 currently operating CO2-EOR projects. We projected future CO2-EOR oil production for each of these existing CO2 floods taking into account available information. Operator projections for future oil production were available for most of the CO2-EOR projects in the Gulf Coast, Midcontinent, and the Rockies. For the Permian basin, the study used a combination of operator projections and project-by-project historical trend data to estimate future oil production for each existing CO2 flood.

• Planned CO2-EOR floods. Operators often provide data on start date, peak production year, and expected ultimate recovery for new CO2-EOR. We used this information to estimate oil production for the 11 new CO2-EOR projects included in the study.

• Potential CO2-EOR floods. Where the available CO2 supply exceeded CO2 demand from existing and planned CO2-EOR floods, we estimated future oil production using regional CO2 utilization factors (Mcf of CO2/bbl of oil production) for potential (yet-to-be announced) CO2 floods.

It is likely that additional yet-unknown natural gas processing and chemical plants will be installed in the US during the next 6 years and sell their captured CO2 to the EOR industry. This would lead our projections of CO2-EOR-based oil production to be conservative.

CO2-EOR; ROZs

The pursuit of residual-oil-zone (ROZ) resources offers the promise of greatly increasing CO2 demand and oil production in the Permian basin. Early ROZ projects were undertaken by Shell in the Denver Unit of giant Wasson oil field. Occidental acquired these projects from Shell and has continued to operate these ROZ assets as well as expand ROZ development to other units in Wasson field.

Since then, several additional ROZ projects are reported to be under way in the oil fields of the Permian basin. Recent information on development of ROZ resources has come from Hess and Kinder Morgan.

• Hess. A series of ROZ projects has been undertaken by Hess in Seminole (San Andres) oil field. The company started in 1996 with the 500-acre (Phase 1) ROZ pilot project and followed in 2004 with a 480-acre ROZ pilot (Phase 2).

Subsequently, Hess launched the 2,320-acre Stage 1 ROZ project in 2007 which has recently been expanded.

The above ROZ projects reported oil production of 3,500 b/d in OGJ's 2012 EOR/Heavy Oil survey, with 7,800 b/d reported in the 2014 survey.

• Kinder Morgan. Following successful drilling of ROZ appraisal wells, Kinder Morgan announced in early 2014 plans for drilling 29 new wells, constructing production facilities, and investing $78 million in a major ROZ project in the Permian basin.

The Kinder Morgan Phase I ROZ project would involve nine 20-acre, inverted five-spot patterns expected to provide 4.7 million bbl of recoverable reserves, with oil production from the Phase I ROZ project peaking at about 2,400 b/d. Additional phases of ROZ development are likely. Under an expected oil recovery rate of 18% of original oil in place, the Phase I ROZ project would provide a 30% internal rate of return.

Longer-term, Kinder Morgan sees a potential CO2 market of 750 MMcfd for ROZ in the Permian basin, including 450 MMcfd in currently leased ROZ areas plus 300 MMcfd for additional ROZ development, according to a presentation for investment analysts in January. Kinder Morgan's Phase I ROZ project and its future ROZ expectations are not included in the OGJ's 2014 survey.

International CO2-EOR

With some exceptions, use of CO2 injection for oil recovery has been slow to catch on outside of the US. One notable exception is Weyburn oil field, where EnCana and Apache have field-wide CO2-EOR projects. Additional exceptions include the injection of CO2 into Bati Raman heavy oil field in Turkey and the use of CO2 in a series of heavy oil fields in Trinidad.

Recently, interest has emerged for productively using otherwise vented CO2 for EOR in oil fields in Abu Dhabi, Brazil, China, Malaysia, the North Sea, and other areas.

For additional information, see the International Energy Agency's Greenhouse Gas R&D Programme report "CO2 Storage in Depleted Oilfields: Global Application Criteria for Carbon Dioxide Enhanced Oil Recovery" (Technical Report Number: 2009-12, December, by Michael Godec, Advanced Resources International Inc.).

The future

Based on the analysis presented here, we offer these observations:

• We anticipate significant growth in CO2 supplies available to the EOR industry. Overall CO2 utilization by CO2-EOR (including both industrial and natural CO2) will nearly double by 2020—to 6.5 bcfd by 2020 from 3.5 bcfd in 2014 (Fig. 6).

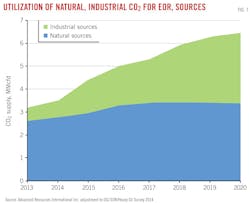

• Much of the growth in CO2 supplies for EOR will be from capture and utilization of CO2 from industrial sources, chemical facilities, and power plants.

Current (2014) utilization of industrial CO2 by EOR is 0.7 bcfd (14 million tpy). This rate will reach 3.1 bcfd (60 million tpy) by 2020 (Fig. 7). Much of the increased capture of industrial CO2, between today and 2020, will be from the numerous announced industrial plants along the Gulf Coast that would otherwise vent their high-purity CO2 emissions.

• We anticipate that CO2-EOR production will grow significantly, reaching 638,000 b/d by 2020. While CO2-EOR oil production grows in all four regions examined by this study, the Permian basin and the Gulf Coast will lead the way, each with more than 100,000 b/d of increased CO2-EOR oil production.

The outlook by region:

Permian basin. Continued oil production from current CO2-EOR projects and their expansion to field-wide would increase oil production to 323,000 b/d in 2020 from 199,000 b/d in 2014.

Gulf Coast. Increased oil production from the 20 current Gulf Coast CO2 floods combined with start-up of new CO2 floods in East Texas (Webster, Conroe, and Thompson counties) will increase oil production to 152,000 b/d in 2020 from 47,000 b/d in 2014.

Rocky Mountains. The addition of the Bell Creek and Grieve CO2 floods (plus other, yet-to-be announced projects) will increase CO2-EOR production in the Rockies to 103,000 b/d in 2020 from 39,000 b/d in 2014.

Midcontinent. The addition of the Northeast Hardesty CO2 flood and significant expansion of the Burbank project will increase CO2-EOR in the Midcontinent to 59,000 b/d by 2020 from 14,000 b/d in 2014.

• Based on already announced and likely CO2–EOR projects, we project oil production from CO2-EOR to continue to grow after 2020. In addition to the numerous CO2-EOR projects coming online between now and 2020, numerous other CO2 floods, such as at Cedar Creek anticline and in the San Joaquin basin, are to start after 2020.

These major projects provide the basis for our anticipation of continued growth of CO2-EOR oil production after 2020.

• Along with increased US oil production, the CO2-EOR industry is on pace to store 1-2 billion tonnes of industrial CO2 that would otherwise be vented during the next 20 years. We estimate that 14 million tonnes of industrial CO2 was stored in underground formations in 2014 through CO2-EOR. This will increase to nearly 60 million tonnes in 2020.

Assuming a constant industrial CO2 storage rate of 60 million tpy after 2020, more than 1 billion tonnes of industrial CO2 will be stored with CO2-EOR in the next 20 years (Fig. 8, baseline industrial CO2 case). If the growth in industrial CO2 utilization and storage rate were to continue increasing by about 10 million tpy, nearly 2 billion tonnes of industrial CO2 would be stored with CO2-EOR in the next 20 years (Fig. 8, upside industrial CO2 storage Case 8).

Acknowledgment

This article has been extracted and updated from the US DOE/National Energy Technology Laboratory draft analytical paper entitled "Near-Term Projections of CO2 Utilization by Enhanced Oil Recovery Production" prepared for US/NETL in 2014 by Advanced Resources International Inc. The authors received valuable assistance with research for this article from Steve Melzer, Melzer Consulting, Midland, Tex.

The authors

Vello A. Kuuskraa ([email protected]) is president of Advanced Resources International Inc. with more than 40 years' experience with enhanced oil recovery and unconventional gas. He was the 2007-08 SPE Distinguished Lecturer on integrating enhanced oil recovery and carbon dioxide sequestration following his original lecturer season of 1986-87, and he has worked with numerous firms and countries examining how to coordinate the productive use and storage of CO2 with EOR. He holds an MBA (highest distinction) from the Wharton School of the University of Pennsylvania and a BS in applied mathematics-economics from North Carolina State University.

Matthew Wallace ([email protected]), a consultant with Advanced Resources International, specializes in analysis of CO2 capture and utilization for CO2-enhanced oil recovery, as well as reservoir modeling and analysis of CO2-enhanced oil recovery operations. Most recently, he has contributed studies for the US Department of Energy on the development and implementation of next-generation CO2-enhanced oil recovery technology. Wallace holds a degree in environmental studies from Washington & Lee University, Lexington, Va.