GLOBAL OIL RESERVES-1: Recovery factors leave vast target for EOR technologies

Since 2003 prompt and long-term oil prices have been constantly climbing to levels ($70-90/bbl) that have caught many people by surprise. The erosion of large spare capacity in the oil chain and the perception that surging demand1 2 will eventually outpace supplies are the two key commonly cited fundamental reasons for the escalation in prices.

At the heart of the argument is that global oil resources are scarce and stretched, hence the industry will struggle to deliver incremental supplies. This consensus view is underpinned by several themes: limited access to some hydrocarbon rich regions, two decades of a sluggish worldwide exploration record, poor expectation of finding new oil provinces, increasing number of mature basins that are on production, among others.

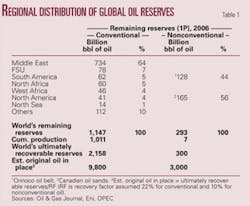

Resources and supplies are obviously finite, but to conclude that global oil resources are stretched or that the industry is or will be unable to replace production is a myth. Consider the fact that we have consumed less than 8% (1 trillion bbl) of the vast volumes of oil that have been discovered so far-a resource base of 9.6 trillion bbl of conventional and 3 trillion bbl of nonconventional crude oil.

Resource base is here defined as the original oil in place (OOIP) associated with proved reserves. Assuming a conservative average overall recovery factor of 22% for the conventional proved reserves of crude oil discovered to date of 2,158 billion bbl would establish a global resource base of 9.8 trillion bbl (Table 1).

Regarding the nonconventional resources, the combined OOIP for the Canadian and Venezuelan oil sands, the two largest accumulations of their kind in the world, has been reliably established at 3 trillion bbl; proved reserves of 300 billion bbl correspond to a 10% recovery factor obtained from current and future known field projects.

More resources of this type and oil shales have been quantified elsewhere. At best they are considered contingent resources-they have not yet been proven economically recoverable.

It is physically impossible to recover and produce all of the oil in the ground, but the industry is leaving behind as much as 78% of the oil discovered in fields that have been abandoned for whatever reason or in the late stages of depletion.

Looking at the future, a tenable, long-term goal would be to produce 70% of the resource base of conventional oils and 30% of the nonconventional extraheavy oils. And for this, enhanced oil recovery (EOR) techniques are the only alternative.

What is at stake is that each percentage point improvement would unlock vast amounts of oil reserves (and production) from known reservoirs and thus reduce the need to rely so heavily on new discoveries.

From a supply point of view, it is a fact that many of the known basins are mature (either stable or declining) while fewer are growing, immature, or remain to be explored. There is no doubt that the incremental sources of supply will depend on the continued development of known resources, onshore Middle East and North Africa, unconventional oils, new offshore fields,3 and oil from new difficult basins.

EOR production accounts for only 3% of world oil production, but in the near term its potential could be significant in extending the current plateau of world onshore and mature offshore production.4

The objective of this two-part article is to estimate global oil resources based on a heuristic analysis of the recovery efficiency of the existing proved reserves, with a view to determine how much these reserves can be expanded by boosting their recovery factor through technology proven EOR.

The reserves are sorted by oil gravity and depth, which are key parameters used in the screening of oil reservoirs to establish the most viable EOR techniques. The impact of EOR on future supplies is also discussed.

EOR’s competitiveness

It is a simple fact that the economics of finding new oil in most regions of the world has been much more attractive than squeezing the oil from aging fields.

Global F&D5 costs were $14.42/bbl in 2006, up a whopping 29% from the previous year. Development capex for high-end deepwater fields6 with built-in pressure maintenance (gas and water injection) projects run between $4 and $6/bbl of added reserves, with production costs in the $3-4/bbl range.

For nonconventional oils, development costs for recent projects in the Canadian and Venezuelan oil sands range from $4.30 to $6.25/bbl of added reserves. Production costs are $6 for cold production or $17 with steam generation.

In contrast, capex for development of EOR projects is nearly $2 per added barrel, varying somewhat with field location, well depth, number of existing wells that can be converted for injection, source of carbon dioxide, etc.

EOR production costs-those above conventional operating costs-however, can be high depending on the cost of chemicals, of steam generation that uses natural gas ($10 per added barrel), and the cost of CO2, roughly $10 per added barrel in the US. Incentives for CO2 capture/sequestration could further lower the infrastructure costs associated with CO2 delivery to the oil field, particularly those offshore.

The bottom line is that EOR capex is now very competitive with F&D costs and also with reserves acquisitions,7 which averaged $12.86/bbl worldwide in 2006.

Global oil recovery factor

Oil recovery factor is the percentage of the in-place discovered oil that is technically recoverable.

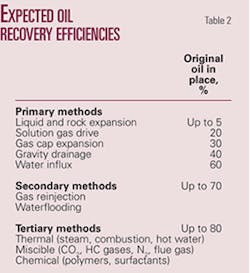

The primary phase of oil production from a reservoir depends on its existing natural energy source which may be one of several (Table 2).

Solution gas drive is the most widespread natural drive mechanism in the majority of the world’s reservoirs and can provide a recovery of up to 20% of OOIP. This primary process is normally supplemented early in the life of the reservoir by secondary recovery or improved oil recovery (IOR) processes consisting of stranded gas reinjection and waterflooding. Roughly one-third of the world’s reservoirs have natural water drives.

When secondary recovery processes are implemented from the start of production-as is now standard practice with new oil fields-or later on during the primary phase, the process is referred to as “pressure maintenance.” Although recovery rates of up to 70% are theoretically possible, values above 60% are very rare; they are more in the range of 45-50%.

Tertiary or EOR methods are applied at the end of the secondary phase. They can be thermal, miscible, or chemical processes that attempt to sweep out as much as possible of the remaining oil. The most ubiquitous of these techniques is CO2 flooding for medium and light oils.

The 30-year history of this technology in the US and other countries indicates that it is possible to recover an additional 7-15% after waterflooding. Lake et al.8 has an excellent review of the three major EOR processes and their limits in regard to oil viscosity, permeability, and depth of the reservoirs.

Large scale injection of standard fluids like natural gas and water to supplement the natural energy of the reservoir was not the norm in the international arena until the 1960s. Even today, the large reservoirs are the ones generally selected.

Moreover, not all IOR/EOR techniques are applicable to all reservoirs and oil types. As a result considerable numbers of reservoirs, especially in medium and small fields that account for 50% of world production, have been left without the application of secondary recovery processes.

As a general rule, a recovery factor of 15-20%, corresponding to the solution gas drive mechanism, is usually the first estimate for a new discovery until other production mechanisms have been observed in the field. Case in point is the recent certification of the China Nanpu9 offshore oil find; PetroChina had originally assigned a recovery factor of 40% and subsequently downgraded it to 20%.

Recovery estimates for heavy oils (<22.3°) range at 10-15% for primary, 20-25% with secondary, and an additional 2-6% with EOR, for a total of 30%. Extraheavy oils (≤10°) are unique. The very viscous ones may be unproducible by primary means and are subjected to steam injection from the onset as is the case of the Canadian oil sands. Their recovery factor is 10%. For Venezuela’s Orinoco, primary recovery by solution gas drive (referred to as cold production) is also 10%; an additional 10-15% is estimated with EOR processes still to be tested.

How can we get an estimate of the overall recovery factor associated with the existing world reserves of more than 40,000 oil fields each with multiple reservoirs? A baseline estimate is necessary so as to determine how much room there is for IOR and EOR growth.

Several statistical estimates ranging from 27% to 35% have been mentioned in the literature. In a recent study of 11,242 fields, Laherrere obtained a worldwide average of 27%. Harper studied 9,000 fields and came up with a mean of 30%. The US Geological Survey10 estimated a worldwide recovery factor of 40%.

An overall recovery factor for the US was reported at 22% in 1979. It had increased to 35% by 1999 and would be about 39% today if the trend continued.

The overall recovery efficiency for the North Sea province is 46%, the highest in the world thanks to sound IOR management applied throughout the life of the fields. Examples of top oil fields include Statfjord field with a record 66% recovery efficiency without EOR. Prudhoe Bay is expected to reach 47% due to early gas and water injection, followed later by miscible hydrocarbon gas flooding.

A heuristic approach to estimating an overall worldwide recovery factor based on proved reserves might be useful. Proved reserves by definition encompass everything geologic and engineering that has been applied to every oil field ever discovered.

Let’s examine two cases, the US and Saudi Arabia. The US has a resource base11 of 582 billion bbl, and Saudi Arabia12 has 700 billion bbl. Decline curve analysis,13 which is based on production from proved reserves, establishes URRs of 225 billion bbl and 165 billion bbl for the US and Saudi Arabia, respectively. The corresponding recovery factors are 39% and 23%.

It is worth noting that Saudi Arabia’s recovery efficiency of 23% is at the level of the US average in 1979. Most Saudi reservoirs have been produced by primary and secondary methods; other IOR technologies are also being applied to reservoirs that are among the largest in the world.

Most Saudi pressure maintenance programs, however, went into effect after substantial volumes of oil had been produced from the reservoirs. In the case of supergiant Ghawar field, gas and water injection began more than 10 years after production start-up (1951).

Experience in the North Sea indicates that reservoirs with delayed pressure maintenance programs have recoveries of up to 10 percentage points less than their counterparts that start from day one.

Of the OPEC countries that together hold almost two thirds of the world’s reserves, Saudi Arabia’s average recovery factor of 23% is in the upper echelon. Venezuela, the OPEC member with the most experience (since the 1950s) with both secondary and tertiary recovery projects, also has an overall recovery factor of 23%. Consequently, by analogy the overall recovery factor for the bulk of the world’s conventional oil reserves would at best be about 20%.

A simple weighted average among the major oil provinces gives an average recovery factor of 22%. This is well within the range of solution gas drive reservoirs (15-25%) with some added IOR technology effects, which are the most widespread in the world.

This is the recovery value used in this article to estimate the world’s conventional oil resource base of 9.8 trillion bbl. The total global oil resource base would be 12.8 trillion bbl, including the 3 trillion bbl of nonconventional oil. Schlumberger’s estimate14 of global oil resources is 9-13 trillion bbl, while the American Association of Petroleum Geologists15 estimate is 9-11 trillion bbl.

Next: Classifying the resource base and EOR’s production potential.

The authors

Ivan Sandrea ([email protected]) is head of international E&P strategy with StatoilHydro. He was previously principal supply analyst for the Organization of Petroleum Exporting Countries. Before that he was a global E&P analyst for Merrill Lynch in London and earlier was an exploration geologist for BP International. He has a BS in geology from Baylor University, an MS in petroleum geology, and an MBA from Edinburgh University.

Rafael Sandrea ([email protected]) is president of IPC, a Tulsa international petroleum consulting firm. He was formerly president and chief executive of ITS Servicios Tecnicos, a Caracas engineering company he founded in 1974. He has a PhD in petroleum engineering from Penn State University.