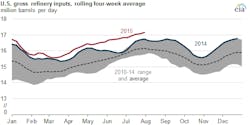

Gross inputs to US refineries exceeded 17 million b/d in each of the past 4 weeks, according to the US Energy Information Administration. That's a level not previously reached since EIA began publishing weekly data in 1990.

The rolling 4-week average of US gross refinery inputs has been above the previous 5-year range during 2010-14 every week so far this year, reflecting both higher refinery capacity and higher utilization rates.

Lower crude oil prices and strong demand for petroleum products, primarily gasoline, both in the US and globally, have led to favorable margins that encourage refinery investment and high refinery runs. Refinery margins are currently supported by high gasoline crack spreads that reached a peak of 66¢/gal on July 8, a level not reached since September 2008.

“For the past several years, distillate crack spreads have consistently exceeded those for gasoline, but since May, this trend has reversed,” EIA said. From 2011 to 2014, distillate crack spreads—calculated using Gulf Coast spot prices for light Louisiana sweet crude, conventional gasoline, and ultra-low sulfur distillate—averaged a 24¢/gal premium over gasoline crack spreads. Since May 20, Gulf Coast gasoline crack spreads have averaged 17¢/gal higher than for distillate crack spreads.

Higher demand for gasoline is supporting these margins. Total US motor gasoline product supplied is up 2.9% through the first 5 months of 2015, and trade press reports indicate that demand is also higher in major world markets such as Europe and India so far this year compared with 2014. Total US petroleum product supplied, a proxy for demand, is up 2.5% through the first 5 months of the year compared with 2014. Much of the refinery output is reaching global markets, as net exports are 19% higher this year through May.

“Favorable margins leading to high refinery runs are not limited to the Gulf Coast region,” EIA said.

Since early April, US refinery utilization, gross inputs divided by operable calendar day capacity, has consistently been above 90%, driven largely by elevated runs at Gulf Coast and Midwest refineries. During that time, East Coast and Rocky Mountain utilization has also been high, only dipping below 90% in 5 weeks and 2 weeks, respectively.

Despite the ongoing unplanned outage at ExxonMobil Corp.'s refinery in Torrance, Calif., utilization on the West Coast exceeded 90% for the past 3 weeks, marking the second, third, and fourth times that all five regions have recorded refinery utilization rates above 90% within the same week since EIA began publishing weekly utilization data in 2010. These high utilization rates, combined with increased US refinery capacity—18.0 million b/d as of Jan. 1—have led to record high gross inputs. Monthly data on utilization rates go back further, and the last time all regions exceeded 90% in the same month was in September 2006.

US refinery runs tend to peak in the second and third quarters of the year when demand for gasoline is greater because of increased driving in the summer. In its July Short-Term Energy Outlook (STEO), EIA estimates that refinery runs will average 16.7 million b/d from April through September and then decline slightly in the fourth quarter to 16.2 million b/d before falling further to 15.8 million b/d in the first quarter of 2016. Following the winter period of lower demand and refinery maintenance, EIA's STEO expects US refinery runs will reach new highs next summer, averaging 16.9 million b/d in third quarter of 2016.