Russian refiners slowly building new units, upgrading refined product quality

Aging Russian refineries are slowly being upgraded and revamped with more modern processes and technologies. A significant amount of overcapacity in Russia in the 1990s delayed plans for expansions and improvements.

Increases in domestic demand are slowly catching up to the potential supply from Russian refineries. Current capacity utilization is about 60%, up from 52% in 1996.

In the next 5 years, Russian refiners will complete construction projects started in the 1990s and start new projects to produce higher quality diesel and gasoline.

Due to the lack of complexity in Russian refineries, the amounts of exports are expected to be limited during the next 5 years. Russia exports mainly to FSU states and Eastern Europe, regions whose environmental requirements are less stringent than Western Europe or the US.

The export exception is fuel oil. Russian refineries export about 55% of the fuel oil produced in country. Most of this fuel oil, however, has limited markets due to its high sulfur content.

Status

The Russian refining industry currently includes 27 refineries, two gas condensate plants, and about 40 mini-refineries, plants with less than 500,000-tonnes/year (tpy) capacity.

Most refineries are subsidiaries of vertically integrated companies (VICs). In Russia there are 10 VICs, which include oil production facilities, refineries, and product distribution.

Ownership of Russian refineries among VICs is:

- OAO Lukoil, 4.

- OAO Yukos, 5.

- Surgutneftegas, 1.

- Tyumen Oil Co. (TNK), BP PLC joint venture, 2.

- OAO Sibneft, 1.

- OAO Rosneft, 2.

- OAO Sidanko, 1.

- OAO Bashneft, 1.

- OAO Slavneft, 2.

- OAO Tatneft, 1.

Seven refineries are owned by companies other than VICs. Gas condensate plants (in Astrakhan and Surgut) are part of Gazprom.

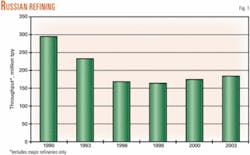

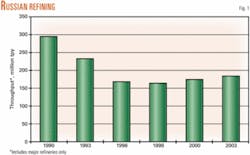

The total design capacity of Russian refineries is 309 million tpy. Russian refineries were running close to this maximum capacity in the mid-1980s. In 1985, Russian refineries processed 307 million tpy of crude. After 1992 real volume of refined crude was reduced significantly.

Fig. 1 shows the amount of crude oil that major Russian refineries (mini-refineries are not included) have processed.

Four "generations" characterize the Russian refining industry.

Twelve first-generation refineries (Khabarovsk and Komsomolsk in Eastern Russia, Moscow, Samara, Orsk, Ukhta, etc.) were built before and during World War II. Most of these refineries are relatively small, have old and idle units, and generally have unsatisfactory offsite facilities. Some of these refineries require full renovation.

Nine second-generation refineries (Angarsk, Novokujbysevsk, Novo-Ufimsk, Ufaneftekhim and Salavat in Bashkortostan, etc.) were built in 1945-65 based on "standard" units. The one standard design was used for at least three to four refineries with insignificant changes. Some of these units were relatively small and, because of this, second-generation refineries consisted of 40 or more process units. These refineries form an important segment of the Russian refining industry because they refine more than 40% of crude processed there.

Six third-generation refineries (Kirishi near St. Petersburg, Novo-Yaroslavl, and Nizhegorodsky on the Volga river, etc.) include units with high capacities, including crude units with capacities of 3-6 million tpy, catalytic reformers with capacities of 0.6-1.0 million tpy, and hydrotreaters with capacities of 1.2-2.0 million tpy. These refineries were built after 1960.

More recent refinery construction, the fourth-generation plants (Achinsk in Russia and four refineries in the Former Soviet Union), are based on the design concept of integrating the process units into one combined system.

All Russian refineries convert relatively little heavy crude fractions to more valuable products; the yield of light products is close to their content in the crude. The refineries also consume high amounts of energy, 2-3 times more than similar refineries and units in other areas of the world.

The Russian market structure, unlike the West's where profits are generated from downstream sales, is upstream biased. The production-refining balance in Russia differs fundamentally from that in developed countries and regions of the world.

Most countries buy feedstocks for refining and sell petroleum products for export, thus maintaining a high level of refinery development and saving their own crude resources for future use.

In Russia, privately owned VICs with more crude oil production prefer not to increase refining and production of fuels and lubes, but to increase crude exports. Refinery capacity remains unused, and refined product exports occur on a relatively small scale.

Table 1 shows the balance between crude production, refining, and exports.

The key problems of Russian petroleum refining are historically:

- Low processing depth vs. Western refineries. The share of light oil products in 2003 was 61% of total production.

- Inferior output quality. Products do not conform to current European and worldwide standards.

- High capital consumption.

- The lack of production of light, high-octane components from alkylation and isomerization. Cumulative alkylation and isomerization processes in Russian petroleum refining are less than 0.2% of total processing capacity.

- Less-than-perfect plant locations. There is an unreasonably high concentration in Middle Volga and Bashkortostan.

Product specifications

Motor gasolines produced in Russia are low quality compared to world standards. Many motor fuels are low-octane gasolines with MONs of 76-80. Other areas of the world rarely produce gasoline with this low an octane. Catalytically reformed gasoline is still the major constituent of motor gasolines; therefore, the total aromatic content of high-octane gasolines is 50-55% and greater.

Gasoline quality is, however, improving. The production of low-octane gasolines decreased to 45% in 2003 from 67.9% in 1997.

Before 2001, Russian refineries produced leaded gasolines. Currently, however, these are not produced in the big refineries. Low-grade gasolines with antiknock additives are still produced at mini-refineries.

Diesel fuel quality is also lower quality than what is produced in other areas of the world.

Developed countries started producing diesel fuels with limited aromatic hydrocarbons and a sulfur content of no more than 0.035% as early as 2000; only 10 of 26 Russian refineries have started producing at least some diesel fuels with a sulfur content less than 0.05%.

The share of low-sulfur (0.05%) grades in the overall production of diesel fuels does not exceed 12%.

The product mix and grade structure of Russian diesel fuels is also unsatisfactory.

It is a paradoxical fact that Russia, with its severe climatic conditions and hard winters, has a ratio of winter to summer grades that is much lower than in Canada and Scandinavian countries (12% and 20-25%, respectively).

null

Capital consumption, refinery configuration

Russian refineries consume high amounts of capital because many of the units are old and inefficient. More than 60% of crude units are older than 40 years and more than 60% of catalytic reforming and hydrotreating units are older than 30 years.

The problems with Russian petroleum refining are well known. The required solutions have been copied from one government document to another for the past 15-20 years.

The most recent document is the Energy Strategy of Russia for the period leading up to 2020 (ES-2020) approved by the Russian government on Sept. 5, 2003. This program provides for the construction of deeper oil-conversion complexes, the introduction of product-quality improvement processes, and the replacement of outdated plants.

Russian refinery configuration has not changed radically in the past 5 years, but there are some positive trends.

Changes have occurred in the infrastructure of Russian refineries in the last 5-7 years (OGJ, Aug. 18, 1997, p. 31; Sept. 7, 1998, p. 95).

All refineries attempt to maintain capacity utilization at 40-90%. Despite the low utilization of existing refineries, however, construction of mini-refineries have continued since 1997.

More than 20 new mini-refineries were built near areas of oil production (Strezhevoy, Uray, Kogalym, Varyegan, Urengoy in Siberia, Sakhalin Island) and in the regions without traditional refineries (Mari Republic, Yakutia-Sakha, Vanino).

Mini-refinery capacities are 20,000-500,000 tpy. Most of them have only a crude unit and, due to the absence of secondary processes, they produce only low-quality products: straight-run gasoline and high-sulfur diesel fuel.

Lukoil

Lukoil is the largest Russian oil company. Its Perm refinery has successfully upgraded the catalytic reforming plants with high-performance catalysts produced by UOP LLC and built a light-paraffins isomerization plant from unused equipment in the liquid-paraffin-recovery plant.

Lukoil refurbished its delayed coking unit, which increased capacity by 80% and allowed the production of high-grade electrode coke for the aluminum industry.

The Volgograd refinery has commissioned a 1.4-million-tpy diesel hydrotreating unit, which enables the enterprise to convert to production of clean diesel fuels.

One of the oldest refineries in Russia, the Ukhta refinery situated in the far north and built by Gulag prisoners in mid-1930s, started a fundamental reconstruction.

The first steps in this renovation were the installation of a new technology designed by Sandvik AB for bitumen cooling, and the erection of a diesel hydrofining and hydrodewaxing plant with sulfur production. The 850,000-tpy plant was designed by the German firm SKL Engineering & Contracting GMBH. The refinery can now produce a high-grade diesel.

In 2002, Lukoil acquired the Nizhegorodsky (Novo-Gorkovsky) refinery located in Middle Volga. The refinery was previously practically independent, had no steady oil supply source, and in 1998-2002 operated at 25-35% of design capacity. In 2003, the refinery utilization was more than 50%.

The refinery has recently built a new crude unit, revamped the vacuum units with Zultser packing and plates, which helped improve substantially the quality of motor lubes, and constructed a 20,900-tpy wax production unit.

Yukos

During the past 5 years, Yukos has also conducted upgrades and renovations in its plants. The company operates refineries in Kuibyshev, Novokuibyshev, Syzran, and Achinsk, and a petrochemical complex in Angarsk.

The Kuibyshev (Samara) refinery started up a new primary oil processing facility with a capacity of 3.5 million tpy. The Syzran refinery commissioned a new 6-million-tpy crude distillation unit. Both units allowed Yukos to shut down several small crude units built during World War II.

Yukos management, however, is not placing a high priority on refinery development and modernization. Management is now focused on increasing crude oil production for export sale.

In 2003, only 30.6 million tonnes of the total 80.7 million tonnes produced were sent for processing at Yukos refineries in Russia. Refinery utilization was less than 50% in 2003.

The Novokuibyshev refinery is a good case study of this strategy. When the refinery was economically independent (1990-97), it launched a fundamental modernization program. The refinery purchased equipment for a high-octane gasoline production facility consisting of a continuous catalytic regeneration (CCR) reformer with Penex isomerization based on the UOP process.

After Yukos acquired the refinery, it suspended construction of the new complex and the equipment, worth more than $80 million, is still unused.

Another example is the Achinsk refinery in Eastern Siberia; final construction of an integrated vacuum gas oil and delayed coking unit is not in sight.

null

Surgutneftegaz

The Kirishi refinery is the only downstream facility of Surgutneftegaz. The refinery processes more crude than other refineries in Russia.

In 2003, the refinery processed 15 million tonnes of crude. The existing processing units, however, make it impossible to refine oil efficiently; more than 40% of the crude is processed into fuel oil for internal consumption and for export sale.

The Kirishi refinery is the largest exporter of fuel oil in Russia. Recently, the refinery replaced furnaces at the atmospheric distillation plants and began to produce jet fuel on a Western commercial scale.

TNK-BP

The TNK-BP joint venture incorporates the Ryazan and Orsk refineries. The Ryazan refinery has launched a large-scale modernization program.

The first stage includes a renovation of the catalytic cracking unit that uses western technologies and doubles its capacity.

Slavneft

The Novo-Yaroslavl refinery expanded its FCC unit to 1.5 million tpy using a Stone & Webster design. The refinery can now produce European-grade gasolines with octane ratings of 95-98 due to the expansion and modernization of the FCC and alkylation plants, construction of an MTBE unit, and use of isomerates from the high-temperature isomerization plant.

Sibneft

The Omsk refinery, which until recently was the largest refinery in Russia with the most sophisticated and developed technological structure, was one of the first plants in the Russia that achieved a processing rate of 85%. This was accomplished, however, when the refinery was independent.

After Sibneft acquired the refinery, it experienced lower production rates. The refinery's feed rate does not exceed 50% of rated capacity and lube oil production capacities decreased to 200,000 tpy from 600,000 tpy.

It took 10 years to build an alkylation plant and construction of a continuous regenerator for the catalytic reforming unit has been under way for more than 9 years.

Bashneft

Changes have occurred at the Bashkortostan refineries in the past 5 years.

A renovated reforming unit was commissioned at the Novo-Ufimsky refinery, which is the first in Russia to use the "dualforming" system of catalytic reforming developed by Institut Français du Pétrole. The revamped complex also includes a gasoline isomerization plant, which enables the refinery to produce low-benzene gasolines.

Another Bashkortostan refinery, Ufaneftekhim, has refurbished a hydrocracking plant based on an IFP design, the only one in Russia, which improved its productivity. The refinery also built a unit to regenerate hydrocracking and other catalysts.

Rosneft

The state-owned oil company, Rosneft, owns two first-generation refineries: Komsomolsky in Eastern Russia and Tuapsinsky on the Black Sea coast of the Caucasus.

In the past 5 years, the Komsomolsk refinery began its fundamental modernization. In 2001, the plant commissioned a 450,000-tpy catalytic reforming plant based on a design by Lengiproneftekhim, a Russian institute. The refinery can now produce high-octane gasolines, a previously unattainable goal.

Komsomolsk also recently started up an isomerization plant.

Tatneft

The 6-million-tpy atmospheric crude unit that spun off from the Nizhnekamskneftekhim petrochemical plant in 1998 became a foundation for the Nizhnekamsk refinery, the first petroleum-refining enterprise within Tatneft.

In 2002, the new refinery finished construction of a large complex, including a diesel fuel and kerosine hydrotreating plant (front-end engineering design by ABB Lummus), and sulfur production line (front-end engineering design by Parsons E&C).

Heavy blends of crude refined at Nizhnekamsk produce low amounts of light and medium distillates and high amounts of tar. The tar residue, however, is widely used in road construction.

The Nizhnekamsk refinery decided to process the rest of the heavy crude using a 350,000-tpy unoxidized bitumen production facility. A new visbreaker was also built at Nizhnekamsk.

The Nizhnekamsk refinery experienced the most dynamic changes in Russia in the last 5 years.

5-year outlook

In 2004-09, implementation of the program to renovate and modernize Russian refineries will continue. Even though Russian crude production continues to grow and the revenues of oil companies increase without precedent, there is no expected surge in investment in the downstream.

Before additional investment occurs, Russian refiners must complete the construction of those facilities that began in the 1990s. The refining industry will significantly improve when the many deep-oil conversion facilities finish construction.

The first plants in the deep-oil conversion complex, revolving around a Texaco-licensed T-Star hydrocracking plant, at the Perm refinery are scheduled for completion in 2005.

A contract for the front-end engineering design of the complex was signed in 1994, and the detailed engineering began in 1997.

The hydrocracking reactor, equipped with an activity-maintaining system and rated at a pressure of 105 bar, was manufactured at a Russian enterprise, Izhorsky Zavod, which formerly specialized in nuclear-power equipment. Manufacture of the reactor in Russia and its delivery to the erection site cost the refinery less than if purchased abroad.

The forecast for the construction of another deep-oil conversion complex at the Kirishi refinery is less optimistic. The process technology is based on licenses from ChevronTexaco Corp. and ABB Lummus Global. ABB, assisted by Russian design institutes, developed the basic engineering and detailed design.

The complex consists of a 4.9-million-tpy vacuum distillation unit, a 2.9-million-tpy vacuum gas oil hydrocracking unit, a 1.9-million-tpy heavy residue visbreaker, hydrogen production and concentration, and sulfur production plants.

The new complex would enable Kirishi to substantially improve product quality, and raise crude conversion to 75%.

An objective assessment of construction progress, considering equipment problems and the absence of a general constructor, shows that commissioning will not occur before 2008-09.

The Nizhnekamsk refinery is also planning to build a deep-conversion complex. In January 2004, the board of directors approved a feasibility study completed by Foster Wheeler Corp. Total investments in this complex are more than $1.1 billion. Crude conversion will increase to 70-75%.

Construction of a deep-oil conversion complex is also planned at the Nizhegorodsky refinery.

The first unit in the complex should be an FCC, followed by a vacuum gas oil hydrotreater, a visbreaking plant, expansion of sulfur production, MTBE production, and alkylation plants.

The construction plan for this complex dates from 1995, and its feasibility in the next 5 years will depend on the Lukoil investment policy.

The Novo-Yaroslavsky refinery can achieve a substantial (to 85% from 63%) increase in crude conversion if the refinery completes construction of a vacuum gas oil hydrocracking plant and visbreaker, which commenced many years ago.

One of the first projects to terminate is another "drag-on construction" project, a CCR reforming unit at the Nizhegorodsky refinery. This was to be the first CCR plant for the production of high-octane gasolines in Russia; CCR plants built in Ufa and Omsk were designed to produce aromatic hydrocarbons.

A contract for the plant construction at the Nizhegorodsky refinery was signed in 1993 and equipment delivery was completed in 1997. Due to a lack of funds, construction in 2000-02 was virtually frozen and resumed after Lukoil acquired the refinery.

After starting up the reformer, Lukoil plans to renovate one of the existing reforming units with cyclic catalyst regeneration for the isomerization process.

Another CCR reformer based on the UOP technology is planned for the Novo-Yaroslavsky refinery. Construction of the CCR section in the semi-regenerative catalytic reforming unit in the Omsk refinery will continue.

TNK-BP will continue its Ryazan refinery modernization program. It will complete the construction of a diesel hydrofining plant. There are plans for construction of a sulfuric-acid alkylation plant in the near future.

Other investment plans for construction at different plants include:

- A deep-oil conversion complex at the Tuapse refinery of Rosneft. According to Rosneft President Sergei Bogdanchikov, this complex will cost $700 million.

- An isomerization unit and diesel fuel hydrofining plant at the Khabarovsk refinery, owned by Alliance Co. in Eastern Russia.

- Isomerization and visbreaking plants at Sidanco's Saratov refinery.

The prospects for construction and start-up of these complexes remain vague and, in many ways, depend on the investment policy of the refinery owners.

Product supply, demand

Russia imports little gasoline. The 2003 gasoline production in Russia was 29.1 million tonnes. In terms of gasoline yield and consumption, which is 170 kg/capita, Russia is lower than the US and Canada, whose indicator is 6-7 times higher, and European countries whose indicators are 2-2.5 times higher.

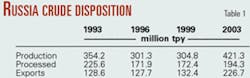

As with gasolines, Russia is well off in terms of diesel fuel. Diesel production in 2003 was 53.8 million tonnes; the per-capita production and consumption in Russia is 1.5-2 times and 3-4 times, respectively, less than the level in developed countries on average.

The most significant changes in the last 15 years in Russia have occurred in jet fuel production.

Due to drastic cuts in national defense expenditures, the production of jet fuel has been reduced by 50%, and per-capita consumption has been reduced 65%. Due to less passenger and air-freight service, the per-capita consumption of jet fuel in Russia is 1/7 that of the US.

In the early 1990s, the FSU possessed advanced technology for high-grade jet fuel production and was among the world leaders in the quality of that product; however, for the last 10-15 years the technology has had no changes. Simultaneously, because of privatization of civil aviation facilities, and the emergence of more than 50 small and economically weak airlines, the demand for grades of inferior jet fuel increased sharply.

Fuel oils are the only exportable output from Russian refineries. On a per-capita basis, Russia produces more fuel oil than all other countries of the world, including the US.

The yield of fuel oil is more than 30% of the fresh feed in Russia, which is much greater than the level in any other country.

The consumption of fuel oil as heating fuel is high in Russia despite the fact that the country has the world's largest deposits of natural gas. Russia lacks clear legislative environmental standards and natural gas producers have excessive political leverage. Natural gas, therefore, is exported and sour fuel oil is consumed in Russian thermal power plants that, as a rule, are not equipped with sulfur oxide pollution-abatement systems.

Exports, imports

As previously mentioned, Russian refineries supply virtually all the petroleum products for domestic consumption. Because only 60-70% of the Russian refining capacities are utilized and production can be increased at any time, opportunities for product imports to Russia are limited.

Some motor gasoline imports into Russia occurred in 1995-98 (1.0-2.4 million tpy). That growth, however, was incidental and could be attributed to appearance of western oil companies in the Russian market.

They were unaware of the capabilities of Russian refineries and actual requirements of Russian fuel consumers and preferred to receive gasoline, particularly high-octane, from abroad. At that time, high-octane gasoline production from Russian refineries was relatively low.

Motor gasoline exports are limited. In 1998, 2000, and 2003, they were 2.5, 4.2, and 5 million tonnes, respectively. Gasoline is generally exported to FSU states; virtually no supplies go to Western Europe and other developed countries.

Russian gasoline exports are limited due to their low quality. Russia-produced high-octane gasolines usually contain 45% or more of aromatic hydrocarbons and up to 5% benzene. Reformulated gasolines are not available from Russian refineries; only Sibneft's Omsk refinery and Slavneft's Novo-Yaroslavl refinery have alkylation and MTBE plants.

Russian refiners have built some light gasoline isomerization plants in the past 3-5 years. Some refineries converted idle semi-regenerative reformers into isomerization plants. Nevertheless, the prospects for gasoline exports are still limited in the future.

Russia imports virtually no diesel, jet fuel, or heavy fuel oils. The demand for these fuels is satisfied from domestic production.

Table 2 shows diesel fuel production and exports.

Diesel exports from Russia have been fairly stable for years. Russia currently exports a little less than half of the produced diesel fuel.

The primary consumers of Russian diesel fuel are the FSU and Eastern European countries.

Increasing export availability and meeting Western European market specifications require a breakthrough in diesel fuel quality.

Russian refiners should push to eliminate the lag in the fuel quality. In the past 5 years, definite steps had been taken in that direction; the Ukhta, Nizhnekamsk, and Volgograd refineries started up new diesel-fuel hydrotreaters, a process that was previously unavailable. The Ryazan and Komsomolsk refineries are constructing a hydrotreaters currently.

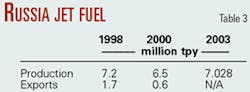

Table 3 shows jet fuel production and export data. The main grades of jet fuel produced at Russian refineries are TS-1 and RT.

RT fuel is produced by hydrofining straight-run kerosines and adding essential additives to bring it up to international quality standards. This fuel can be sold in world markets for subsonic air-breathing engines.

The RT fuel conforms to major standard characteristics (except for the flash-point) of the Jet A-1 aircraft fuel. Some Russian refineries have started producing Jet A-1 aircraft fuel on the basis of the RT fuel.

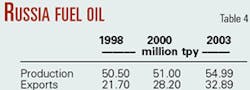

Table 4 shows the fuel oil production and exports.

A lack of processing complexity, catalytic cracking, and hydrocracking capacity is forcing many Russian refineries to produce fuel oil in quantities that are not required for Russian consumers. More than 55% of the produced furnace fuel oil is exported.

The quality of fuel oils produced in Russia is relatively low. Only four refineries produce low-sulfur fuel oils with a sulfur content not exceeding 1%; gross production of this fuel oil is less than 5% of the overall production balance.

Another eight refineries produce fuel oil containing up to 2% sulfur. Ten refineries produce practically 100% high-sulfur fuel oil with a sulfur content of 3.5% and higher.

Others produce both low-sulfur and high-sulfur grades.

Russian fuel oils also feature high viscosities and ash (metal) content. To meet the viscosity requirements, Russian refiners can blend with diesel fractions and add new processes such as visbreaking.

Currently, the processes needed to control fuel oil sulfur levels are not available at Russian refineries. The sulfur content depends on feedstock quality.

Of the total fuel oil exports, Russia sent about 15% to the FSU countries and Eastern Europe, 65-70% to Western Europe, and 15-20% to Asia and Africa.

To meet the existing quality standards for exported fuel oil, up to 30% distillate fractions are added. Some of the international buyers run off the distillate fractions and use them as a market diesel fuel or feed for diesel hydrotreaters.

Russia has a program for deep-oil conversion that plans for the construction of catalytic cracking and hydrocracking complexes at refineries that export large amounts of fuel oil, such as the Kirishi, Ryazan, Nizhnekamsk, and Perm refineries. Implementation of this program that commenced in the late 1980s, however, is progressing slowly; it is unlikely that the next 5 years will see a drastic decrease in fuel oil exports.

Feedstock changes

Most Russian refineries now process sulfurous feedstocks (Urals crude) that contain 1.4-1.8% sulfur and 42-55% light fractions up to 350° C. This feedstock is produced in Western and Eastern Siberia.

The high-sulfur content is intrinsic in the Tartar oil delivered to the Nizhnekamsk refinery and in the Bashkir oil processed at Salavat petrochemical plant.

The refineries supplied with high-sulfur crude constitute about 70% of the total capacity.

Some refineries receive sweet oil with a sulfur content less than 1%. This feedstock is produced in the Komi Republic, on the Sakhalin Island, Northern Caucasus, and at some deposits in Western Siberia.

Whereas worldwide feedstocks are trending towards heavier and higher sulfur crudes, Russian refineries will experience lighter, sweeter feedstocks.

Future Russian crudes will consist of lighter sweet oil from Eastern Siberia, Sakhalin, and the Arkhangelsk region (Timan-Pechora Province). More light oil products that distill off below 350° C. characterize this oil.

To a certain extent, these feedstock trends will help refiners increase production, reduce sulfur content in commercial products, and raise the export potential of Russian plants.

The author

Mikhail Rudin is an approvals manager with Parsons E&C, a position he has held since 2001. Before joining Parsons, he worked for Lengipronftekhim, a St. Petersburg engineering company (1960-94) as a process manager and vice-president, Litwin Engineers & Constructors Inc., Raytheon Co., and Mustang Engineering Inc. Rudin has been involved in the design of downstream and upstream projects and is the author of more than 18 textbooks and reference books. He holds an MS in chemical engineering and PhD in organic chemistry from St. Petersburg Technology University.