India: Oil growth prospects changing tanker patterns

Prospects for increased crude oil demand in India bode well for ship owners looking for charters in the region, according to an analysis released last month by New York-based shipping consultant Poten & Partners Inc.

"While China is taking center stage in the media for economic growth, India is moving to displace its diva counterpart," said the analysis.

Growth; a bump

In fourth-quarter 2003, India's gross domestic product rose by more than 10%; GDP growth of 7.2% is expected for 2004, it said.

In April, the world's second most populous nation reduced its $15 billion trade deficit (2003) by $3.2 billion. The country exports light manufacturing products such as textiles and some agricultural products, with software moving into the export category.

India "benefits from foreign companies outsourcing information technology and financial analysis to Bangalore in the south and Bombay in the west," said Poten & Partners.

A potential bump in the economic road occurred in last month's election when voters threw out of power the ruling Bharatiya Janata Party (BJP). It had been primarily responsible for the past decade of economic growth by encouraging privatization of many key industries, said the analysis.

Concern of financial analysts translated into a steep decline in the Indian stock market as the initial view was that the winning Congress Party might slow the movement toward further privatization, which could slow economic growth.

But Poten & Partners told OGJ it is unlikely that this change in parties will do much to slow growth.

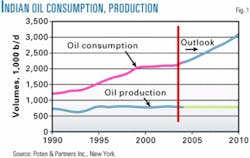

And, specifically, where tanker owners "see green is in India's increasing demand for energy." Although more than half of India's energy consumption is coal, nearly all of which is domestically produced, the country's demand for oil will rise to 3.2 million b/d by 2010 from the current 2.0 million b/d (Fig. 1). India's current domestic crude production is around 800,000 b/d and will remain flat, at best.

The country, then, will have to rely on imports to meet the increased demand for oil that a growing economy will need.

Fixtures up

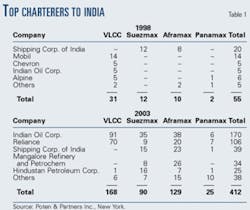

In 1998, crude oil fixtures (vessels under charter) to India were minimal, said the consultant, and most of the companies "fixing" ships to India were foreign. By 2003, however, crude oil cargoes to India, primarily from the Persian Gulf, were fixed eight times as much (Table 1), mostly by Indian refiners and the Shipping Corp. of India (SCI) to meet contract requirements for the Indian Oil Corp. (IOC).

Reliance Petroleum built and owns Jamnagar, the largest refinery in India. The refinery, completed in 1998 and started in 1999, has a nameplate capacity of 540,000 b/d (27 million tonnes/year) and is currently running at 625,000 b/d.

Since Jamnagar is equipped with sophisticated refinery equipment, said the analysis, imports of heavy Venezuelan and Mexican crude, transported on very large crude carriers (VLCCs), make up a significant portion of the crude slate.

West Africa also plays a critical role for IOC and Reliance.

Tankers movements

Poten & Partners noted the decline in "clean" fixtures to India after the country significantly increased refinery capacity in 1999 (Table 2). Such vessels typically carry petroleum products, ranging from methyl tertiary butyl ether (MTBE), naphthas, and so-called "clean condensates" to cycle oils and fuel oils, according to a schematic maintained by Clarkson Research Studies and published in its semiannual world "Shipping Review & Outlook" (OGJ, June 14, 2004, p. 62).

The increase in crude oil imports to India, said Poten & Partners, has caused an increase in tanker ownership by several large Indian companies such as Great Eastern, Essar Shipping Ltd., Mercator Shipping, and the government-owned SCI.

"Each of these companies has added appreciably to its fleet via acquisition. Several have spent considerable sums upgrading their existing fleets including newbuildings," said the analysis. SCI will take delivery of two newbuild VLCCs in 2005, and Essar recently added a double-hull VLCC. Great Eastern already has a large inventory of double-hull tonnage.

"Look for this trend toward fleet upgrading to continue," said Poten & Partners.

India's geographic location is advantageous: Being close to the Persian Gulf makes it close to a major energy supply that requires little tanker capacity. But Indian oil imports "will increase by 50% during the next 6 years," said the analysis, and will continue to be sourced from more distant locations.

"With sport utility vehicles becoming popular on the crowded downtown roads of the major Indian cities, oil demand will continue to grow. Tanker owners will be adding India to their list of stops on these lucrative trade routes," said Poten & Partners.