US refinery investments align with oil sands supplies to 2015

Supply of Canadian oil sands products will increase by 2 million b/d between 2007 and 2015; half of this growth will be in Canadian heavy crude blends. A recent study shows that the export pipeline infrastructure and US refinery capacity will be able to handle forecast additional supplies of Canadian crude during 2007-15. Planned export pipeline infrastructure should keep pace with forecast additional supply of oil sands products to 2015; export pipeline capacity will increase by 2.1 million b/d. Current capacity tightness should be resolved once expected new pipelines start up in 2008 and 2009. By the end of 2015, spare capacity will reduce, suggesting the need for additional export capacity shortly after 2015.

Refinery projects targeting Canadian heavy blends that we expect to proceed are aligned with our forecast of additional supply: Canadian heavy blends supply will increase by 1 million b/d by 2015, and projects that are planning on processing heavy blends will increase by 1.1 million b/d.

Flexibility in Canadian heavy blends supply vs. refinery capacity will be available only after commissioning of the proposed Texas Access pipeline to the US Gulf Coast (post 2012). At that point, heavy-oil capacity in the region could be used to process Western Canadian blends if projects do not progress as planned in US Petroleum Administration for Defense District (PADD) 2.

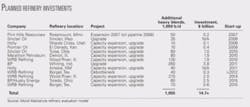

Currently disclosed project costs reveal that pipeline companies and US refiners plan to invest more than $31 billion by 2015 to export and distribute oil sands products as well as process them in the US refining system. This figure excludes any investments in internal pipelines in Alberta, the Canadian refining and upgrading system, and undisclosed refining investments.

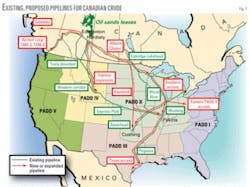

Our study shows that pipeline availability will largely determine the actual allocation of crude supplies by 2015:

- Canadian heavy blends. Most additional Canadian heavy blends will be refined in PADD 2 by 2015, with remaining supplies processed in new markets of the US Gulf Coast or supplied from Cushing, Okla.

- Synthetic crude oil. Most additional SCO will be shipped to the US Pacific Coast by 2015; pipeline constraints will limit transfers to PADDs 2 and 3. SCO that will make its way to the Midcontinent will be run in PADD 2 and US Gulf Coast refineries.

This study uses Wood Mackenzie’s refinery evaluation model, which provides independent appraisal of global refinery competitive position.

Canadian crude

Canada ranks as having one of the world’s largest oil reserves, after only Saudi Arabia and potentially Venezuela. The Albertan oils sands deposit has in-place resources of about 1.75 trillion bbl, of which about 10% are recoverable with current technologies.

Projected growth of Alberta’s oil sands output is triggering investments in US midstream and downstream sectors in anticipation of the new production. In Canada, oil producers have announced production projects as well as upgraders that will supply growing volumes of bitumen and SCO.

This has encouraged Canadian and US pipeline companies to propose new midstream infrastructure to deliver the production to market. US refiners have announced projects in preparation for the incoming flows from Western Canada.

This article analyzes the effect of pipeline and refinery investments during 2008-15, focusing on:

- Who is expected to invest and where?

- How will the projects fit together?

- How will the medium term look?

Upstream outlook

Strong growth in oil sands production during the past few years has been an important contributor to global supply and provided the US with the prospect of a secure source of supply from Canada. Bitumen production from Alberta’s oil sands during 2007-15 will increase to 3.1 million b/d from 1.2 million b/d.

This outlook is based on an assessment of individual projects that are currently in production or likely to come on stream. It also anticipates delays to projected start-up dates and less than full utilization rates due to anticipated technical problems.

A significant portion of bitumen production will be upgraded to SCO. Currently there are four upgraders in Alberta and Saskatchewan, operated by Suncor, Syncrude, Husky Energy, and the Athabasca Oil Sand Project. Canadian Natural Resources Ltd. and OPTI-Nexen have invested in new upgraders, scheduled for start-up in 2008. In addition, another 11 upgraders and one refinery conversion have been announced, projected to begin operating before 2015.

In reality, several of these projects including proposed expansions of existing upgraders are likely to be delayed, rescaled, or canceled due to increased cost, complexity of regulatory requirements, engineering and construction material shortages, as well as revisions to forecasts for bitumen output.

Nonupgraded bitumen is blended with diluents, synthetic oils, and conventional crude to reduce its viscosity before being pumped to the refineries. Resulting Canadian heavy blends and SCO supply will grow to 3.7 million b/d by 2015 from 1.7 million b/d in 2007.

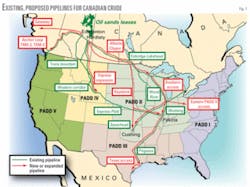

Existing pipelines

The existing pipeline infrastructure to deliver oil sands crude to foreign markets consists of export pipelines and the internal distribution network in the US (Fig. 1). Most of the Canadian crude is exported to US markets through four major trunk-line systems:

- Enbridge-Lakehead system is the main route for Western Canadian crude exports to the US. It links Alberta with PADD 2 and also with Ontario. This system connects to downstream pipelines in Illinois, which extend to Cushing and the US Gulf Coast.

- Express-Platte system links Alberta with PADD 4 and, in a limited way, to PADD 2.

- Western Corridor connects the Rangeland and Cenex pipelines in Western Canada with PADD 4.

- Trans Mountain pipeline is the only system that links Alberta with the Pacific Coast (Vancouver in Canada and Anacortes in the US).

These trunk lines transported about 1.7 million b/d of Canadian crude, including both conventional crude and oil-sands products, to the US in 2007. They are unable, however, to accommodate the projected increase in heavy oil supply from Western Canada.

New pipeline investments

There are many proposals to expand and extend the pipeline infrastructure to meet growing supplies from Western Canada in the short and medium term. In many cases, the decision to invest will be subject to support from pipeline users and regulatory approval, leaving considerable potentials for delay.

Fig. 1 shows the existing and proposed pipelines to export and distribute Canadian crude.

Enbridge is investing the most in pipeline infrastructure. Its projects with disclosed cost information total more than $8.5 billion. Other companies including Kinder Morgan and ConocoPhillips-TransCanada have announced investments totaling more than $7.3 billion, and there are three substantial projects proposed for after 2010 with undisclosed costs.

New and incremental export pipeline projects will provide an additional 2.1 million b/d of capacity between 2008 and 2015. The downstream distribution pipelines most likely to proceed will add 250,000 b/d of additional capacity to Eastern PADD 2, 65,000 b/d to Cushing, Okla., and 450,000 b/d to the US Gulf Coast during 2008-15.

Expansion of the pipeline infrastructure will focus on PADD 2 in the short term. Expansions will not allow significant oil sands products to reach the US Gulf and Pacific Coasts until after 2012.

Downstream

Fig. 2 shows an indicative allocation of additional oil sands products by 2015.

It also shows that, assuming Canadian heavy blends’ intake into PADD 2 reach maximum capacity by 2015, only small volumes of oil sands products would reach the US Gulf Coast (PADD 3) by yearend 2015.

This raises a question regarding the future supply of additional heavy crude in PADD 3, given the significant number of projects that are planning to upgrade heavy oils in this region, and may lead to some strong price competition for Canadian heavy blends that could affect the various flows in Fig. 2.

Canadian heavy blends

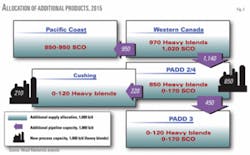

The growth of heavy oil sands production and the attractive price differential vs. conventional light crudes has encouraged proposed refinery investments in the US targeted at processing heavy blends.

Refiners that lead the investment in refinery expansions and upgrading to run Canadian heavy blends are BP PLC (including its partnership with Husky Energy), ConocoPhillips (by means of its WRB Refining joint venture with EnCana), and Marathon Petroleum Corp. These three companies and their partners currently plan to invest $13 billion to add about 850,000 b/d of heavy blends processing capacity by 2015.

Other refiners have announced refinery projects that will require investments exceeding $1.7 billion to process an additional 205,000 b/d of oil sands blends by 2015.

The investment climate is changing quickly; increasing project costs, availability of raw materials and labor, as well as reductions in refinery margins are delaying and could lead to cancellation of several proposed projects.

Most of the announced capacity will be built in PADD 2 areas already supplied by Western Canadian crude and only 250,000 b/d in southern markets. In addition to the investments listed in the accompanying table, there are several expansion and upgrading projects that will increase heavy oil processing, most of them on the US Gulf Coast but not necessarily planned exclusively for Canadian heavy blends feedstocks.

Synthetic crude oil

There have been no announcements of new capacity in the US specifically for processing SCO. SCO can replace light sweet conventional crude in most refineries. The sensitivity of each refinery to the weak point of SCO—poor quality of the distillates—determines how much each refinery can process. In most cases, dilution in the crude slate is sufficient to overcome this.

Wood Mackenzie assumes that SCO will compete with both domestic and foreign light crude oil in the US. Canadian SCO penetration will redistribute domestic light crude flows within the US. This will likely result in less domestic crude from the US Gulf Coast and Texas transferring to PADD 2. PADD 3 refineries will instead process this crude.

The net effect of increased SCO intake by US refineries will be the replacement of foreign crude in the US market.

The author

Lindsay Sword ([email protected]) is product manager, global refinery view for Wood Mackenzie, Edinburg. She has worked for Wood Mackenzie since 1996 in both research and consulting, focusing on the downstream industry with a particular emphasis on refining. Sword has been involved in detailed analysis of refinery supply, product quality, oil product pricing, and refinery economics, as well as product trade. She has worked on a range of downstream consulting assignments including market analyses and pricing studies in Europe, the US, and Asia Pacific. Sword moved from consulting to research in 2006 to develop the global refinery view research offering.