Refinery sources will fill the future 'propylene gap'

Propylene demand for chemical production is growing by 4.7%/year globally. Chemical uses of propylene include polypropylene, cumene, oxo-alcohols, acrylonitrile, propylene oxide, acrylic acid, and other products.

Based on volume and cost, refineries will be one of the preferred propylene sources, especially in North America. An often-underestimated trend is the growth of refinery propylene production and its potential as a chemical feedstock.

SRI Consulting (SRIC) does not believe there will be a shortage of propylene during the next 10 years. Sources other than naphtha crackers are available to fill the gap and include refineries, metathesis plants, and propane dehydrogenation units.

Propane dehydrogenation units must be supplied with low-cost propane; therefore, the Middle East, North Africa, and Russia are potential areas for new units. Companies have announced plans to build metathesis plants in Port Arthur, Tex.; Osaka, Japan; and Antwerp, Belgium.

Propylene production

During the past 5 years, world refinery propylene production increased to 33 million tonnes/year (tpy) from 25 million tpy (Fig. 1), an increase of 6%/year.

Of the total propylene produced worldwide, the amount designated for chemical uses increased to 20 million tpy from 12 million tpy during the past 5 years. This increase of 10.6%/year is far greater than the overall propylene production growth.

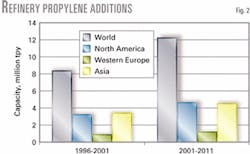

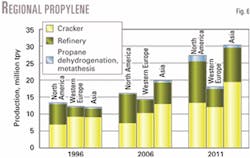

Primary production increases during 1996-2001 were in North America and Asia, with 3 million tpy more refinery propylene output in each region.

The refinery propylene production increase in Western Europe was only 800,000 tpy; in the Middle East it was 250,000 tpy (Fig. 2).

SRIC forecasts that 12 million tpy of additional worldwide refinery propylene will be available during the next 10 years. This contradicts some fears in the industry of widespread propylene shortages, based on ethane cracker (which produce relatively less coproduct propylene) construction in low feedstock-cost regions and the higher growth of polypropylene vs. polyethylene.

Refinery propylene production will increase to 45.25 million tpy in 2011 from 33.05 million tpy in 2001. This additional volume equals the output of approximately 30-40 world-scale steam crackers.

About 97% of refinery propylene comes from catalytic cracking. The remaining 3% is produced in delayed cokers.

Refineries in North America and Asia will produce about 75% of the additional 12 million tpy of refinery propylene.

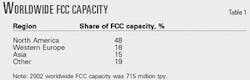

Nearly half of worldwide catalytic cracking capacity (340 million tpy out of 715 million tpy) is in North America (Table 1). The Middle East has 18 million tpy of installed FCC capacity, which represents only 2.5% of worldwide capacity.

Refiners will increase propylene output mainly by using new catalysts or deep catalytic cracking.

Asia refiners will add about 35 million tpy of new FCC capacity in addition to using new catalysts and deep catalytic cracking.

Asia is the only region that will experience significant FCC capacity increases. North America and Asia each will increase refinery propylene output by 4.5 million tpy during the next 10 years.

FCC units, the main source of refinery propylene, are built to produce lighter refined products and gasoline. It is not economic to build an FCC for propylene production alone—propylene is only 4-5% of the FCC yield—but it is economical to extract propylene from an FCC for chemical uses.

Chemical production is the most economic use for refinery propylene unless the refiner does not have enough other components to improve the gasoline pool octane number. New FCC capacity, therefore, will be built mainly in Asia, where gasoline demand is still growing. Western Europe and North America gasoline demand is declining or stagnating.

Recent catalyst developments have helped increase the propylene yield of FCC streams from 4.5% to 10% or greater. These developments have given North American refiners an advantage over other regions of the world. The US MTBE ban will increase the need for high-octane gasoline components. FCC products have high octane numbers. FCC units therefore can also fill the gap for high-octane gasoline components.

SRIC's forecast regarding new FCCs related to the MTBE ban is conservative. The forecast may be more optimistic in the future, depending upon further developments.

Propylene consumption

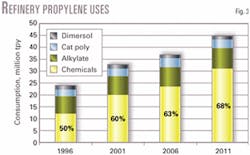

In 2001, about 60% of refinery propylene was used in chemical production. This share will increase during the next 10 years to 68%, or 31 million tpy (Fig. 3).

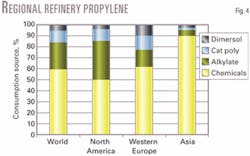

Fig. 4 shows significant variations in regional refinery propylene consumption patterns. Asia uses approximately 90% of its propylene for chemical production, North America about 50%, and Western Europe about 62%. The Middle East uses about 56% of its propylene for chemicals.

During 1996-2001, use of refinery propylene for chemicals increased to 60% from 50% of the total refinery propylene consumed. SRIC predicts that this trend will continue.

Other uses of refinery propylene include alkylation, catalytic polymerization, and dimerization.

These processes are all used to produce high-octane products in the gasoline boiling range.

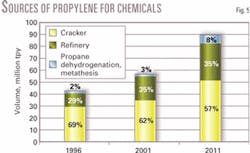

On the chemical consumption side, refineries supplied 35% of total propylene in 2001 (Fig. 5). In 1996, the propylene production from refineries was only 29% of total world chemical demand.

For 2011, SRIC forecasts that 35% of world refinery propylene will be consumed to produce chemicals.

This rising trend exists in all three major regions. In 2001, North American refinery propylene production for chemical consumption was greater than the amount of propylene produced by steam cracking (Fig. 6).

The percentage of total propylene production from North American refineries increased to 53% in 2001 from 45% in 1996. A similar trend occurred in Western Europe and Asia.

The main propylene sources in Asia and Western Europe are steam crackers, but the percentage of total propylene supplied from steam crackers is declining while refinery sources are increasing.

The author

Michael W. Walther ([email protected]) is a senior consultant at SRI Consulting, Houston. He has also served as manager of market research in the purchasing division of BASF AG, Ludwigshafen, Germany. Walther also worked for Buna Sow Leuna (BSL) Olefinverbund GMBH, Boehlen, Germany, a subsidiary of Dow Chemical Co. He holds an MS in chemical engineering from the Moscow Institute of Chemical Engineers.