Special Report: Worldwide ethylene capacity increases 2 million tpy in 2007

Ethylene producers added a net 2 million tonnes/year (tpy) of capacity in 2007, according to the latest ethylene survey. This is a significant increase from the 2006 addition rate of 245,000 tpy.

Capacity as of Jan. 1, 2008, was 119.6 million tpy, an increase from 117.6 million tpy of capacity reported in last year’s survey (OGJ, July 16, 2007, p. 46). The 2-million-tpy addition is a rise of 1.7%.

The latest survey showed that one new train with a capacity of 1.2 million tpy in an existing plant started up in 2007. None of the ethylene producers surveyed reported any shutdown capacity. The net additional 800,000-tpy of capacity resulted from expansions and debottlenecking at existing sites.

Fig. 1 shows that the capacity additions recovered from last year’s low addition rate, which was the lowest in at least 20 years. In 2007, capacity additions should be at their highest level in more than 20 years.

According to the latest OGJ Construction Survey, more than 17 million tpy of capacity is slated for start-up in 2008, mostly in the Middle East. Most of the projects, which have been delayed numerous times, are in Iran and are scheduled to start up in 2008.

Fig. 2 shows that global operating rose slightly in 2007, but are still lower than the peak of about 93% in 2004. Due to large amounts of capacity coming online in 2008-12, operating rates will decrease to the low levels seen in 2001-03.

Fig. 2 also shows that demand for ethylene will not keep pace with rapidly expanding capacity.

New units

One new ethylene unit appears in this year’s survey. Formosa Petrochemical Corp. started up a new 1.2-million-tpy cracker in May 2007. The ethylene plant at Formosa’s Mailiao, Taiwan, plant is the largest in Asia.

Formosa’s Mialiao complex now has three trains with a total plant production capacity of 2.5 million tpy. It is now the largest ethylene production complex in Asia and second largest worldwide.

All the additional capacity is due to expansions at existing plants.

Regional review

Table 1 shows rankings of the 10 largest ethylene production complexes in the world. Nova Chemical Corp.’s 2.8-million-tpy Joffre plant retains the top spot on the list.

Formosa is a new listing in Table 1 due to the new unit at its Mailiao plant. The Mailiao complex was previously 14th largest in the world. It is now the second largest ethylene production complex in the world.

All the other listings in Table 1 fell a spot from last year’s report. Shell Chemical’s 1.5-million-tpy Norco, La., plant fell off the list.

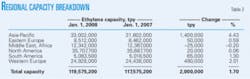

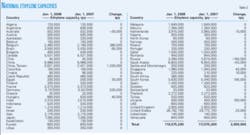

Table 2 ranks ethylene production capacity by region. The biggest gainers were Asia-Pacific, which added 1.4 million tpy of capacity, and Western Europe, which added 490,000 tpy. Other regions showed incremental gains, except for the Middle East, which showed a slight decrease.

In addition to Formosa’s Mailiao plant start-up, two other plants in Asia-Pacific showed significant expansions of ethylene production capacity. Samsung-Total Petrochemicals increased the capacity of its Daesan, South Korea, naphtha cracker to 820,000 tpy from 600,000 tpy.

The company is a 50/50 joint venture of Samsung and Total Petrochemicals. Total announced that the expansion construction was completed in May 2007 and the unit was brought online in early June.

On Mar. 23, 2007, ExxonMobil Chemical announced the successful completion of an expansion in its Singapore steam cracker. The plant can now produce 900,000 tpy of ethylene, up from a previous capacity of 860,000 tpy as listed in last year’s survey.

In Western Europe, two major expansions occurred. BASF increased the capacity of its Antwerp, Belgium, plant to 1.08 million tpy from 800,000 tpy. BASF reported in its annual report that the expansion was completed in late 2007.

OMV AG completed an expansion of its Burghausen, Bavaria, Germany, petrochemical plant (OGJ, Nov. 13, 2006, p. 10). The ethylene production capacity increased to 450,000 tpy from 340,000 tpy.

Table 3 ranks ethylene production capacity by country. Taiwan showed the largest increase, followed by Belgium, Germany, and South Korea, for the reasons previously mentioned.

Russia showed a loss of 180,000 tpy of capacity and Ukraine showed a 180,000-tpy gain because the ethylene survey corrected the location of the Oriana ethylene plant.

Smaller increases occurred in Brazil, Egypt, Hungary, Netherlands, Slovakia, and the US.

Closed, idled plants

Table 3 also shows that only two countries showed a net decrease in capacity: Australia and Saudi Arabia. The total decrease in these two countries was 85,000 tpy.

No plant announced a complete shutdown; therefore, the capacity decreases were due to partial shutdowns or companies restating ethylene capacity.

The most significant decline occurred in Saudi Arabia. Saudi Petrochemical Co. reported to OGJ that the production capacity of its Jubail plant is 1.045 million tpy. Last year’s survey lists the capacity at 1.1 million tpy.

Ownership, name changes

There were two significant ownership changes in 2007.

LyondellBasell Industries (then Basell) purchased the ethylene plant in Munchsmuntser, Germany, from Ruhr Oel GMBH, a joint venture of BP PLC and Petroleos de Venezuela SA. The plant has a listed production capacity of 320,000 tpy of ethylene.

On Dec. 20, 2007, Basell and Lyondell Chemical Co. completed a merger that created LyondellBasell Industries. The $20 billion deal included the Lyondell subsidiary Equistar Chemicals LP, which has six ethylene production plants in the US.

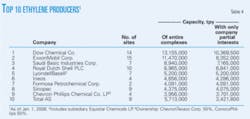

Table 4 lists the top 10 owners of ethylene capacity worldwide. There were two changes in the company order. The LyondellBasell acquisition moved it up to fifth on the list. Formosa’s new unit allowed the company to move up to seventh. The company was not included in Table 4 in last year’s report.

Construction

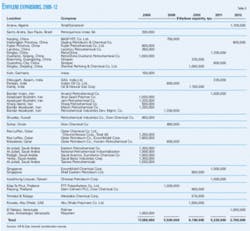

Last year, OGJ forecast that 3.0 million tpy of new capacity would come online in 2007, based on responses to construction surveys. The 2 million tpy of capacity that started up in 2007 did not include two plants in Iran that were listed in Table 5 last year.

The plants in Iran again experienced project delays. At least two of these will start up in 2008, including the Arya Sasol Polymer Co. and Jam Petrochemical Co. plants in Assaluyeh Bushehr.

According to the latest OGJ construction data, an unprecedented 17.4 million tpy of new capacity is slated to come on stream in 2008 (Table 5).

The vast majority of this capacity is in the Middle East. Twelve of the projects list capacities of more than 1 million tpy each. All are in the Middle East except for one in China and one in Venezuela.

Global market

Ethylene markets experienced strong supply-demand conditions again in 2007, a trend that started in late 2004. Fig. 2 shows that worldwide operating rates were nearly 92%, a slight increase from 2006. Operating rates were high in 2004 when incremental demand surpassed capacity increases.

According to Mark Eramo, executive vice-president for CMAI, Houston, “the regional markets are experiencing some moderation in the supply-demand balance as the US economy beings to slow. By the end of 2008, the industry will begin to feel the impact of the next wave of Middle East new steam cracker start-ups.”

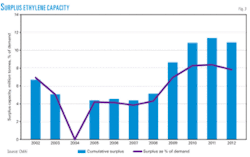

Fig. 3 shows surplus ethylene capacity. Eramo told OGJ, “by 2009-10, the acceleration in capacity additions compared to the forecast for annual demand growth will prove to be too much in a short period of time and surplus capacity is expected to rise once again.”

CMAI predicts that surplus capacity will peak at nearly 11 million tpy, or 8% of total demand. This level of surplus capacity could sustain through 2012; therefore, the next market downturn could be prolonged.

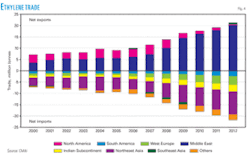

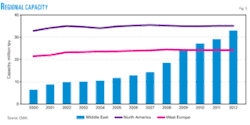

Fig. 4 shows that Middle East producers will dominate the net equivalent ethylene trade (net trade flows of ethylene derivatives).

“The Middle East low-cost position will ensure that their product will be supplied to those areas that offer the most profitable net backs; this will be Asia, Europe, India, South America, and North America in that order,” Eramo said. “This period will prove to be a significant challenge as the Middle East producers are sure to take market share, leaving a very competitive environment for the other producers.”

CMAI forecasts that Middle East ethylene capacity will increase to more than 30 million tpy by 2012 (Fig. 5). By 2010, Middle East capacity will surpass that of Western Europe, and by 2012, it will nearly match capacity in North America.