Single-hull phaseout accelerated in IMO compromise

Ridding the world's seas of single-hull tankers took a decisive step forward early last month when the International Maritime Organization's marine environment protection committee announced agreement among shipping countries on phasing out the tankers by 2010.

The new rules take effect Apr. 5, 2005, earlier than the previous 2007 date, with the banning of all Category 1 vessels, defined as single-hull crude and product carriers without MARPOL segregated ballast tanks (SBT). (MARPOL refers to the International Convention on the Prevention of Pollution from Ships.) As such vessels come up for their anniversary dates in 2005, they will be banned from use.

In his analysis, S. Magnus Fyhr of Jeffries & Co., Houston, stated that the accelerated schedule means 13% of the world's tanker fleet—29.6 million dwt—will leave service in 2005 and by 2010, about 40% of the fleet—122 million dwt—will have been removed.

As part of the compromise, however, flag states will be allowed to operate single-hull tankers to 2015 or their 25th anniversary of construction, whichever comes first, as long as they are subject to a newly strengthened condition assessment scheme (CAS), according to lloydslist.com. Port states, however, retain the right to turn away such vessels.

Starting on the April 2005 date, vessels 15 years old or older must undergo this CAS at their next scheduled intermediate or renewal survey, said Lloyds List.

Effects

The 2005 date accelerates the removal of Category 1 tankers in comparison with the former 2007 date by rolling 18.3 million dwt into the year. Fyhr stated the accelerated phaseout of Category 1 vessels will hit hardest at VLCCs, removing 11.5 million dwt, and Aframaxes, scrapping 9.6 million dwt. The world's Suezmax, Panamax, and handysized fleets will be reduced by 4.5 million dwt, 4.5 million dwt, and 8.0 million dwt, respectively, said Fyhr.

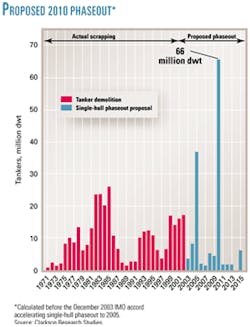

Banning all single-hull tankers from international waters by 2010, said Fyhr, will result in scrapping of an additional 66.9 million dwt of Category 2 tankers and 9.1 million dwt of Category 3 tankers. (Category 2 tankers are nondouble-hull vessels with MARPOL SBT greater than 20,000 dwt; Category 3 tankers are non-double hull vessels with MARPOL SBT less than 20,000 dwt or 30,000 dwt for clean product carriers.)

While single-hulled vessels will be banned by 2010, Fyhr said, double-sided vessels and doublebottomed vessels with MARPOL SBT and built after 1984 may trade beyond 2010 to their 25th anniversary or 2015, whichever comes first. Phaseout for double-sided and double-bottomed vessels was less affected than the single-hull vessels by the accelerated phase-out schedule for Category 2 and Category 3 vessels.

In fact, only 1.6 million dwt of double-sided and double-bottomed Category 2 vessels were accelerated into 2010 from the previous schedule, according to Fyhr's analysis, and 166,000 dwt of double-sided and double-bottomed Category 3 vessels were accelerated into 2010 from the previous schedule.

The world VLCC fleet will be hardest hit by the accelerated phase-out schedule for Category 2 single-hull tankers with more than 41 million dwt expected to be scrapped between 2006 and 2010.

The IMO agreement also banned single-hulled carriers from transporting heavy oils in international waters, a plan that will affect about 177 vessels, or 11.5 million dwt, according to Fyhr. Moving heavy crude oil and heavy fuel oil accounts for about 15% of the world's seaborne oil trade.

The Aframax fleet transports most of the heavy oils, nearly 220 million tons of the approximately 425 million tons of heavy fuel oil and heavy crude traded, said Fyhr. The Suezmax and VLCC fleets also transport about 56 million tons and 29 million tons, respectively.

While the Aframax, Suezmax, and VLCC fleets carry the largest quantities of heavy oils, he said, the Panamax and handysize fleets will be the most affected by the ban on single-hull heavy oil transport because 68% of the total oil traded by Panamaxes and 50% of the total oil traded by Handysized vessels are heavier oils.

The ban will cause a large portion of the smaller sized single-hull vessels currently carrying heavier oils will be forced to retire early, failing to find alternative employment because they are too small for the crude trade and unsuitable for clean products, said Fyhr.