IEA sees diminished seasonality in oil market

The traditional second-quarter slump in global oil consumption isn't what it used to be.

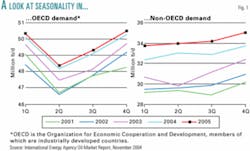

In the industrialized world, represented by members of the Organization for Economic Cooperation and Development (OECD), average quarterly demand drops to its lowest level each year in the period between the Northern Hemisphere's heating and driving seasons.

From oil companies to the Organization of Petroleum Exporting Countries, therefore, anticipation of a second-quarter market lull has always been fundamental to planning.

In the non-OECD world, however, demand usually doesn't drop in the second quarter. And it's there that consumption is growing most rapidly (Fig. 1).

The result, notes the International Energy Agency, is changing seasonality of the oil market.

In its Oil Market Report for November, IEA says non-OECD demand, usually at its highest in the fourth quarter, appears to have risen to a "secondary peak" in this year's second quarter.

While it's unusual for non-OECD demand in the second quarter to exceed its level of the preceding period, it seldom drops, IEA said.

Second-quarter 2003 violated that pattern because of demand weakness associated with the outbreak of Severe Acute Respiratory Syndrome (SARS) in Asia.

The consequently low basis for comparison amplified the increase in global oil demand between the second quarters of 2003 and 2004.

IEA said second-quarter demand this year was up nearly 4 million b/d from its level of the corresponding period a year earlier and down only 1.3 million b/d from first-quarter consumption.

A quarter-to-quarter decline that is less than half its size of the preceding year surprised traders. And the shrinkage can't all be explained by the SARS toll on consumption in second-quarter 2003.

"While many market participants, assuming a steep cyclical downturn in global oil consumption, had thought prices would fall with the end of peak winter heating demand, second-quarter demand was in fact unseasonably robust" in absolute as well as relative terms, IEA said.

Analysts need to account for "lasting structural shifts arising from the takeoff—and fast-rising energy needs—of China and other emerging economies."

IEA points out that demand data are less precise for non-OECD countries than for OECD members. But seasonal trends between the regions diverge for obvious reasons.

"In parts of China—notably in the booming coastal provinces—and in the Middle East, household consumption peaks with summer cooling rather than winter heating," IEA says.

"In both regions, soaring income gains have fueled a construction boom and associated surge in air-conditioning and transportation demand."

In Latin America, where demand is rebounding, and elsewhere in the Southern Hemisphere, IEA pointed out, "heating demand hits during the Northern Hemisphere's summer months."