FACTS: Iran to complete many delayed petchem projects

By yearend 2009, Iran plans to complete many delayed petrochemical projects currently under construction, according to FACTS Global Energy in a report entitled, “An Update on Iran’s Petrochemical Projects.”

This year, several mega petrochemical projects have started commercial production in Iran, which will significantly increase exports of petrochemical products from the Middle East. And even though some of the planned projects may not materialize, Iran’s petrochemical sector has a “huge exports potential.”

Iran, by 2015, will nearly double its petrochemical production, according to the report. Current key petchem projects will bring more than 29 million tonnes/year (tpy) of new capacity online for the production of ethylene, propylene, methanol, benzene, ammonia, urea, and other petrochemical products by 2015.

Production, exports

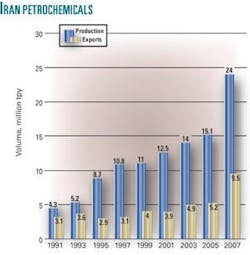

In 2007, Iran’s petrochemical production increased to nearly 24 million tpy, and it experienced an average growth rate of at least 8%/year during 1997-2007, according to the report. Exports of petrochemical products rose to almost 9.5 million tpy in 2007, a growth of about 12%/year for 1997-2007.

The figure shows this growth in production and exports from Iran.

Iran’s petrochemical exports are mainly destined for Asian markets. After the completion of new petrochemical plants in fourth-quarter 2008 and early 2009, Iran’s petrochemical exports will increase to 12-13 million tpy, according to the report.

New petrochemical projects

Currently, Iran is constructing several petrochemical plants, especially in the Pars and Bandar Iman Petrochemical Zones. Iran is also building an ethylene pipeline, currently under construction from Assaluyeh in the south of Iran to Mahabad in the northwest of the country.

Of the more than 29 million tpy of new capacity Iran plans to build, some of these projects are faced with various issues such as long delays in their completion dates due to lack of financial resources or feedstocks, according to the report.

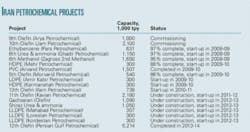

The attached table lists Iran’s petchem projects that have more definite start-up dates.

Main roadblocks

One of the main roadblocks for petrochemical projects in western and northwestern Iran is the availability of enough feedstock.

Sufficient feedstock for these petrochemical projects may become a reality after the completion of a 2,163-km ethylene pipeline (the West Ethylene Pipeline) from the south to the west and northwest of the country.

This project, which is now 50% complete, was scheduled for completion in 2007. The project’s initial costs, an estimated $2 billion, have increased to nearly $7.2 billion, according to the report.

Iran initially planned to construct five petrochemical complexes along the pipeline; currently, however, the number of petrochemical complexes has been increased to 11 projects. There may not be sufficient feedstock from the West Ethylene Pipeline for some of the new petrochemical projects.

There also may be some unsolved technical problems in delivering ethylene by pipeline over a long distance for a country that has a large temperature difference in its south as compared with its northwest, especially in the wintertime, according to the report.

Currently, there are five projects under construction across the West Ethylene Pipeline and six projects are planned to be completed by 2012. Of these projects, the 300,000-tpy polyethylene plant at Kermanshah is further along and should be completed in 2009-10.

Some projects such as those in Mahabad, Miyandoab, Mammasani, Andimeshk and Chahar Mahal, and Bakhtiary have no construction progress and are unlikely to be completed before 2014-15, the report said.

National Iranian Petrochemical Co. is planning to construct a 3,500-km ethylene pipeline to the east and northeast (East Ethylene Pipeline) and a 600-km pipeline to central Iran.

Iran is planning to build 14 petrochemical units along the East Ethylene Pipeline.

Capital expenditures for the East Ethylene Pipeline are more than $13 billion. FACTS believes that the East Ethylene Pipeline is unlikely to materialize due to many technical and commercial issues. The main commercial issues are a lack of financial resources and low profitability of the pipeline. These construction plans for petrochemical plants in eastern and northeastern Iran are therefore less likely to materialize compared with those in western and southern Iran, according to the report.

Domestic gas demand, especially for new petrochemical projects, will continue to escalate because most of Iran’s petrochemical industry is gas based. The availability of enough feedgas for the industry could become a problem if the country continues to delay its gas production projects, especially those in South Pars.