Green hydrogen poses opportunities, problems for Indian refineries

Sidhartha Harichandan

Institute of Management Technology

Nagpur, India

Om Prakash

M S Balathanigaimani

Sanjay Kumar Kar

Rajiv Gandhi Institute of Petroleum Technology

Jais, India

As climate policies both domestically and abroad continue to tighten, refiners in India—home to one of the largest global refining hubs—are rapidly advancing decarbonization efforts, with adoption of green hydrogen poised to play a vital role in achieving the nation’s 2070 net-zero target.

Responsible for about 4% of total global greenhouse gas (GHG) emissions, decarbonizing the international refining industry forms a key part of global climate policy initiatives.1 While the sector’s implementation of green hydrogen will help reduce dependence on fossil fuels and scale up the use of renewable energy—if properly executed—it also presents Indian refineries with long-term economic and strategic opportunities, including unlocking new markets and attracting future outside investments.

Ensuring refiners’ transition to green hydrogen is successful, however, requires developing a supportive framework of sound policy, financial incentives, production mandates, reliable pricing systems, infrastructure development, further research and development on emerging technologies, and public-private partnerships.

In addition to providing an overview of India’s refining industry and its use of hydrogen, this article introduces opportunities for and roadblocks to expedited integration of green hydrogen by domestic refineries.

Part 2 of this article (Mar/Apr 2025) will more fully explore obstacles stifling refiners’ implementation of green hydrogen, and present policy measures suggested by industry experts to overcome them.

India’s refineries

Vital to national energy security for the reliable supply of transportation fuels and petrochemical feedstocks to meet the demand of both domestic and export markets, India’s refining sector represents the world’s fourth-largest hub, its 22 operable refineries featuring a combined crude processing capacity of about 256.8 million tonnes/year (tpy; Table 1).

While state-owned Indian Oil Corp. Ltd. (IOCL), Bharat Petroleum Corp. Ltd. (BPCL), and Hindustan Petroleum Corp. Ltd. (HPCL) control more than 60% of India’s total refining capacity—with 31.4% belonging solely to IOCL—private operators Nayara Energy Ltd. and Reliance Industries Ltd. (RIL) have incrementally expanded their capacities. RIL operates two refineries in Jamnagar, Gujarat, that, together, form the world’s largest single-location refining complex (Table 2).

While the country’s refineries predominantly cater to domestic consumption driven by rising energy demand from the regional transportation and industrial sectors, an individual refinery’s processing and production capacities depend on the level of complexity of processing units included at the site. A varied production mix and flexible configuration equip individual refineries to more easily adjust operations to meet ever-shifting product demand for maximized revenue.

For example, RIL’s Jamnagar refining complex—with a high-complexity rating of 21.1—incorporates FCC and hydrocracking capabilities that enable it to process relatively low-quality, heavier crudes into high-value, light products (e.g., gasoline, aviation fuel). Less complex refineries largely feature only atmospheric and vacuum distillation capabilities that require processing lighter, lower-sulfur crude feedstocks for production of standard fuel products.

Table 2 shows key characteristics of notable Indian refineries.

To comply with India’s Bharat Stage VI (BS VI, equivalent to Euro 6-quality) specifications, many domestic refiners have invested in adding processing units aimed at reducing the sulfur content of fuel production. Despite these additions, however, the refining sector remains a major source of GHG emissions, with its carbon footprint still affected by process inefficiencies and continued dependence on fossil fuels.

Hydrogen consumption

Refineries rely on hydrogen to enable hydrocracking and desulfurization processes for producing cleaner fuels.3 Most volumes are consumed by secondary processing units, including:

- Naphtha, diesel, and vacuum gas oil (VGO) hydrotreaters.

- Hydrocrackers (full conversion and once-through conversion crackers).

- Prime G units.

- Catalytic dewaxing units.

- Isomerization units.

Used by hydrotreaters to remove impurities from naphtha, kerosine, and diesel, hydrogen is employed by dewaxing and isomerization processes for product-value upgradation (e.g. ultralow sulfur diesel), as well as for cracking heavier hydrocarbons (e.g., VGO) into lighter hydrocarbon products (naphtha, distillates).

Most hydrogen consumed by Indian refineries is produced using carbon-intensive steam methane reforming (SMR), a natural gas-dependent process that emits an average of 9–12 tonnes of carbon dioxide (CO2) for every 1 tonne of hydrogen produced.4 With its 6-million tpy demand, India is currently one of the largest global hydrogen markets.

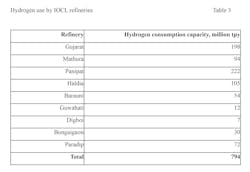

According to data from industry sources, IOCL’s refineries, combined, consume about 794,000 tpy of hydrogen (Table 3).

Most hydrogen consumed by Indian refineries is grey hydrogen, which is produced from natural gas without using carbon-abatement technologies.

Green hydrogen

India’s refineries afford varied opportunities for production and consumption of green hydrogen, which is produced via electrolysis using water and electricity generated by renewable or nuclear energy. In addition to drastically cutting individual-site emissions, a switch to green hydrogen by domestic refineries would enable India to expedite attaining its net-zero ambitions.

Adoption by the sector, however, continues to lag. Green hydrogen costs are very high ($4–6/kg) relative to grey hydrogen ($1.50/kg). India also still lacks a well-established domestic infrastructure and stable supply of renewable energy to accommodate green-hydrogen transportation and production.

While Indian refiners will require more-competitive pricing before committing to adopting green hydrogen at scale, some domestic refineries are testing green-hydrogen integration in pilot projects, including IOCL, which is one among several operators working to develop solar-based electrolyzers to produce green hydrogen across its refining system. IOCL has launched plans to set up a 10,000-tpy green-hydrogen plant at its Panipat refinery in Haryana. RIL has similarly revealed a shift in emphasis toward green hydrogen for its Jamnagar refinery as part of the operator’s renewable-energy investments.

The authors interactions with multiple refiners confirm that Indian refiners are willing to consider green-hydrogen adoption in the long-run subject to sufficient green-hydrogen availability at competitive prices. For India’s coastal refineries, availability of fresh water also poses a challenge, with desalination being very costly.

References

- Griffiths, S., Sovacool, B. K., Kim, J., Bazilian, M., and Uratani, J. M., “Decarbonizing the oil refining industry: A systematic review of sociotechnical systems, technological innovations, and policy options,” Energy Research and Social Science, Vol. 89, July 2022, p. 102542.

- Government of India, Ministry of Statistics and Programme Implementation, “Energy Statistics India 2024,” Mar. 14, 2024, pp. 12-24.

- Nurdiawati, A. and Urban, F., “Decarbonising the refinery sector: A socio-technical analysis of advanced biofuels, green hydrogen and carbon capture and storage developments in Sweden,” Energy Research & Social Science, Vol. 84, February 2022, p. 102358.

- Krishna, D., Steinmann, J., and Tuff, G., “High-Emitting Sectors: Challenges and Opportunities for Low-Carbon Suppliers,” World Economic Forum, Sept. 3, 2024.