Energy transition initiatives will require naphtha, petcoke

Paul Bjacek

Worley Ltd.

Houston

Rituraj Jha

Worley Ltd.

Mumbai

As downstream operators continue reducing conventional crude oil refining capacities to meet

net-zero targets in line with the global transition to a low-carbon future, these plans frequently overlook strategies to address corresponding supply shortfalls for two key refinery-sourced products critical to achieving a sustainable energy transition: naphtha and petroleum

coke (petcoke).

Recovered early along the refining distillation process, naphtha is a key feedstock for production of olefins that serve as building blocks for other high-value petrochemicals used in many applications. While used in general to produce plastics and rubber, naphtha-dependent petrochemicals are necessary in manufacturing energy transition-essential products such as lightweight parts for automobiles, tires for electric vehicles (EVs), and foam for insulation.

Produced at the tail-end of a refinery’s downstream coking process, petcoke plays a vital role in EV battery anodes, aluminum, steel (via electric furnace) manufacturing anodes, and other end-use markets on which the energy transition depends.

In addition to providing an overview of problems currently facing global refiners in meeting product demand as part of a reduced-carbon future, this article presents an in-depth look at the markets for naphtha and petcoke, as well as options refiners should consider for ensuring

ongoing supplies in a manner aligned with longterm, net-zero targets.

Refining disruption

While there is growing demand for alternative transportation fuels, current technological limitations and other factors have slowed their uptake. At the same time, the International Energy Agency (IEA) is projecting global oil demand to peak towards the end of this decade.

In its Oil 2024 annual medium-term market report, IEA projected global oil refining capacity will grow to 107.4 million b/d by 2030 from 104.2 million b/d in 2023. Despite overall growth, there will be some regional disparities. While nameplate capacity in the US and Europe is forecasted to decrease by about 500,000 b/d each during this timeframe, China and India are each projected to add 1 million b/d in fresh capacity.

Under the IEA’s Stated Policies Scenario (STEPS)—the least-aggressive carbon-reduction scenario of the agency’s annual World Energy Outlook—global EV sales (excluding two and three-wheelers) are estimated to reach about 45 million units in 2030 compared with 14 million units in 2023, increasing the market share for EVs to about 40% in 2030 from 15% in 2023.

Progress towards these targets, however, is faltering.

During first-half 2024, 48% of new vehicle registrations in Europe—which is anticipated to have the greatest regional EV penetration—were still for vehicles equipped with internal combustion engines, according the European Automobile Manufacturers’ Association.

In 2023, the US government under the Biden administration set a 2030 goal for EVs to make up 50% of all new vehicle sales, but that effort faces headwinds. According to Kelley’s Blue Book, US domestic EV sales during first-half 2024 were up just 7% year-over-year to about 600,000

units, prompting several automakers to scale back EV plans. Additional downward pressure on an expedited US transition to EVs could also come from President Trump’s Jan. 20 declaration during his second inaugural address of a Day 1 executive order ending EV-friendly policies instituted under the outgoing Biden-Harris administration.

With the transition to EV uptake uncertain at best, traditional fossil fuels will necessarily remain part of operating portfolios. While gasoline-powered automobiles may be straightforward to decarbonize, the heavy vehicle sector is not. The aviation sector also will remain harder to decarbonize because of limits to sustainable aviation fuel (SAF) production, with current SAF production worldwide meeting less than 0.5% of global jet-fuel demand, according to the International Air Transport Association (IATA).

As government policies and consumer demand continue to evolve, refiners are faced with maintaining necessary fuel supplies in ways that best-position operations to remain competitive for a progressive transition to net-zero goals.

Naphtha, petrochemicals demand

Rising demand for petrochemical feedstocks—the highest- growth refined product—remains a reliable force in shaping future refining operations.

Via different routes and grades, naphtha is a cornerstone for production of olefins and aromatics.

Refinery-grade naphtha has historically been the dominant feedstock for ethylene production, accounting for 53% of all feedstock in 2023, according to Worley Ltd.’s Worley Insights database. Using liquid feedstock allows ethylene plants (via crackers) to produce a range of base organic chemicals, including other high-demand olefins and aromatics.

Olefins can also be produced via natural gas (e.g., ethane) cracking.

Ethane can provide less mid to long-term risk than refinerysourced naphtha, but the ethane option is not without some difficulties.

While the US has abundant natural gas resources, these volumes are increasingly exported.

With US ethane exports also steadily growing in recent years, gasbased ethylene may reach capacity limits before costs increase enough to incentivize further ethane recovery.

And while there are still other routes to producing olefins (e.g., coal), naphtha production via refineries will remain a critical feedstock for ethylene producers.

Alongside naphtha, aromatics base chemicals such as benzene, toluene, and xylene (BTX)— which play a dominant role in synthetic textiles and packaging (e.g., polyethylene terephthalate, or PET)—are also almost inextricably linked to refinery production as a source

of reliable feedstock.

BTX is typically manufactured by extraction from naphtha (via reformate) and as a coproduct from naphtha cracking. There are also various technologies for the conversion of one base aromatic to another. As such, overall demand growth tends to be driven by paraxylene—the highest-growth component—which serves as the base material for PET bottles and polyester fiber.

Worley projects ethylene demand will grow at an average rate of at least 2.5%/year to 2040, with BTX demand to grow about 3.6%/year during the same period. These outlooks account for the impact of recycled plastics.

After 2030—amid a continuous rise in demand for petrochemicals feedstocks and a fall in refinery throughputs—Worley analysis shows there will be a deficit in naphtha availability for petrochemicals, increasing pressure on operators to decarbonize petrochemical production (Fig. 1).

Petcoke demand, dynamics

Historically viewed as the last increment of processing and final byproduct to be disposed of at whatever price moved it out of the refinery, bottom-of-the-barrel petcoke is also experiencing rising demand from a variety of energy transition-focused industries. More than 30% of petcoke production is now sold into these higher-value-added markets.

Fuel-grade petcoke is consumed by industries such as cement, power generation, lime, and petcoke gasification.

Anode-grade petcoke is consumed by the calcining industry to produce calcined petroleum coke (CPC), which, in turn, is used to make carbon anodes for aluminum smelting. CPC is also used in steel manufacturing (e.g., for carbon electrodes in electric arc furnaces), the titanium dioxide industry as a pigment, and both the iron and steel industries as a recarburizer for adjusting carbon levels.

Future growth in petcoke demand will stem from its ongoing use in production of anodes for EV batteries, vital to the energy transition. Petcoke originates from vacuum tower bottoms (VTB) that can be used to make asphalt, residual fuel oil (RFO), or as feedstock for a petroleum

coker or other bottoms-upgrading process. Refiners employ VTBupgrading technologies to produce higher-value light products and eliminate the need to produce RFO.

Coking remains the dominant bottoms-upgrading technology, with the coker’s primary purpose to reduce a refinery’s production of RFO by converting heavy VTBs into higher-quality, revenue-generating transportation fuels, leaving petcoke as a by-product.

A refinery’s VTB-production volume depends on its selection of crude feedstocks and throughputs, with petcoke production increasing with heavier crude runs. Refineries configured to process heavy crude slates are much more likely to have coking capacity—or other VTB upgrading technology—than refineries configured for processing lighter crude grades.

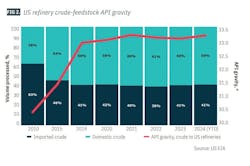

US petcoke production experienced its largest growth between 1995 and 2018, according to data from Worley Insights and the US Energy Information Administration (EIA). This growth resulted primarily from global demand for light transportation petroleum products outpacing RFO demand worldwide and an overall increase in API gravity of crude production that left refiners processing heavier crude slates.

In addition to moves by some refiners to configure operations for oil-to-chemicals production, petcoke production growth has also more recently slowed due to increased availability of lighter crude feedstocks.

Rising US tight light oil (TLO) production amid OPEC+ production cuts has led to rising US LTO exports to mostly European refiners, lightening European and other regional crude slates.

Since most refineries are equipped to run a blend of different crudes, the choice of feedstock naturally impacts the quantity and quality of petcoke produced. Crude selection depends on factors such as the capacities and capabilities of processing units, the operating conditions

of units, availability and pricing of crude feedstock, and fluctuating demand for various refined products.

OPEC+ producers tend to preferentially cut heavy oil production when cuts are needed to prevent oversupply, to maximize their revenue by supplying higher-priced, lighter crudes to market. This preferential cutting of heavy crude production causes corresponding shortages in heavier feedstock supplies, prompting increased pricing for refiners seeking heavier crude slates. Since higher-priced heavy crude reduces a refiner’s profitability from its coking operations, coking-equipped refineries migrate to processing lighter crude slates, yielding less petcoke. One positive side effect of this dynamic is that lighter crude oils, in many cases, are also lower in sulfur, which results in production of a lower-sulfur petcoke product.

US crude oil refinery throughputs in 2019 averaged about 16.6 million b/d and fell in the wake of COVID to 16 million b/d in 2023 (Fig. 2). While crude runs through US refineries were anticipated to remain stable through yearend 2024, throughput rates are projected to decrease to 15.7 million b/d in 2025. As US domestic LTO production continues to climb and foreign

oil imports decrease, US refineries’ growing diet of lighter crude feedstocks will affect both the quality and quantity of petcoke produced.

With efforts to hasten the energy transition still strong outside of the US, the need for aluminum and EV batteries will remain on the uptick, requiring high volumes of decarbonized,

or blue, petcoke for their production.

Turning blue

As the global energy transition continues, refining and petrochemical operators will need to

stay ahead of shifting feedstock dynamics and work closely with process technology engineers to remain competitive.

Strategic thinking is needed to decarbonize. Some options available for operators to consider in the short term include:

- Participating in carbon capture, utilization, and storage to capture carbon dioxide emissions. This can include implementing carboncapture strategies ranging from pre-combustion, post-combustion, and oxy-fuel combustion, to directair capture and other emerging technologies.

- Installing small modular nuclear reactors (SMR) to reduce use of hydrocarbons as fuel in refining and cracking operations and improve a site’s carbon profile. SMR power could particularly help lower the carbon intensity of advanced recycling operations. Solar and wind power options could also play a role in lowering carbon profiles at certain sites.

- Evaluating implementation of crude oil-to-chemicals (COTC) technologies. This may only make sense for a subset of refineries based on their configurations and locations. Sites equipped for processing heavy crudes can perhaps include petcoke in this scheme.

- Naphtha-extracted BTX. Not all refineries currently extract BTX from naphtha. There is an opportunity to tap these resources, especially in high-aromatics growth regions like Southeast Asia.

- Advanced recycling. Up to 40% of plastics—or 400 million tonnes/year by 2040—are targeted for recycling. While there are complications with logistics and contaminants, these issues should be solvable. Microwave technology may be promising, for instance. Partnering with waste-handling companies will be required as well, and advanced recycling would not be subject to the supply and price volatility of hydrocarbons.

- Alternative processes using other available hydrocarbons (e.g., gases, C6-C8 molecules, etc.) for conversion to aromatics. This could include technologies such as Honeywell UOP LLC’s Cyclar or Chevron Phillips Chemical Co. LLC’s Aromax.

- Other modifications or reconfigurations to existing refining operations to focus on improving a site’s petrochemical and petcoke yields.

The authors

Paul Bjacek ([email protected]) is the global head of Worley Insights at Worley Ltd. in Houston, where he writes, presents, and consults on strategic industry issues. He previously served as Accenture’s North American director of thought leadership and global director of resources, as well as world petrochemical director at SRI Consulting. He has also led business analysis for Chevron Chemical Co. LLC. With more than 30 years’ experience in chemicals, energy, minerals, and metals, he has conducted in-person presentations and projects in more than 30 countries. He holds a BS in chemistry and business from the University of Scranton, Pa., and an MS from the London School of Economics and Political Science.

Rituraj Jha ([email protected]) is senior management consultant for Worley Ltd.’s Worley Insights team in India, where he also manages company operations in Mumbai. He is lead author of Worley Consulting’s Market Perspective Report and is a contributing author for Worley Consulting’s Pace Petroleum Coke Quarterly and its Calcined Petroleum Coke Report. He is also involved in numerous petroleum coke market studies, serving as the team’s regional expert on India’s petroleum coke market and refining segment. He holds a B.Tech (2012) in chemical engineering with a specialization in petroleum refining from Rajiv Gandhi Institute of Petroleum Technology, Jais, India.