Petrobras reveals new details on refining investments

Petróleo Brasileiro SA (Petrobras) recently unveiled new plans for two of its Brazilian refineries as part of the company’s 2024-28+ strategic plan to modernize refining assets for long-term competitiveness and sustainability in a global market transitioning to a low-carbon future.

To be implemented at the operator’s 434,000-b/d Refinaria de Paulínia (REPLAN) refinery—Brazil’s largest—in Paulínia, São Paulo, and the 208,000-b/d Presidente Getúlio Vargas refinery (REPAR) in Araucária, Paraná, the projects involve a mix of upgrades and new additions that, together, will expand the company’s systemwide capacity to process crude oil and increase its supply of lower-carbon fuels to the Brazilian market.

In addition to presenting a detailed overview of Petrobras’s latest 5-year capital investment plans and proposed projects in the refining segment of its refining, transportation, and marketing (RTM) business division during the 2024-28+ period, this article discusses the company’s latest updates on current and new projects under development at the REPLAN and REPAR refineries.

Strategic plan 2024-28+

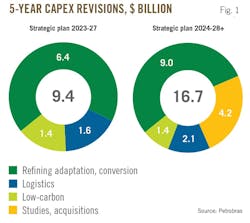

Released in late-November 2023, Petrobras’s Strategic Plan 2024-28+ increased capital expenditures (capex) dedicated to its RTM segment by more than $7 billion from the 2023-27 program as part of the operator’s ongoing objective to achieve a balanced energy mix by meeting ongoing demand for fossil-based energy while expanding its offering of low-carbon products.

Under the 2024-28+ budget, Petrobras will spend $16.7 billion across the RTM segment (vs. $9.4 billion under the previous plan), of which refining expenditures are budgeted $6.4 billion higher from 2023-27 at $9 billion (Fig. 1). The overall RTM budget also includes a $1.4 billion allocation for low-carbon initiatives in line with Petrobras’s plan to achieve zero emissions across its operations under what the operator calls its “fair energy transition” pathway to net zero.

Aligned with the original $102-billion 2024-28+ capex program’s objective of strengthening Petrobras’s position in the Brazilian market by integrating the company’s entire value chain—from domestic upstream production through finished-product distribution to end users—RTM spending under the current plan specifically allocates $2.1 billion on works to remove logistical bottlenecks, including expanding, adapting, and optimizing existing terminals and transportation infrastructure.

As part of the 2024-28+ program, Petrobas also dedicated $4.2 billion of previously unincluded capex for undertaking studies on petrochemical and fertilizer projects.

While Petrobras has yet to reveal details of petrochemical projects under study, the company said in May that these will focus integration opportunities to maximize synergies with the operator’s existing assets in refining and oil and gas production, as well as involve potential asset acquisitions.

With regard to fertilizers, Petrobras confirmed on Sept. 6 that it will spend 6 billion reals ($1.1 billion) under the 2024-28+ program on a return to the fertilizers segment—including projects under study—870 million reals ($155.7 million) of which is earmarked for resuming operations at Araucária Nitrogenados SA’s (ANSA) plant near REPAR in Araucária, Paraná (Fig. 2). Shuttered in 2020 and slated for restart in May 2025, ANSA can produce 720,000 tonnes/year (tpy) of urea, 475,000 tpy of ammonia, and 450,000 cu m/year of automotive liquid reducing agent (ARLA 32), Petrobras said.

The operator said in May the 2024-28+ plan will also cover completion of Unidade de Fertilizantes Nitrogenados (UFN-III), a nitrogen fertilizer plant in Três Lagoas, Mato Grosso do Sul, that—started for construction in 2011 but mothballed in 2014—will be equipped to produce 3,600 tonnes/day and 2,200 tonnes/day of urea and ammonia, respectively.

Dedicated refining capex

In its latest presentation on revised spending plans, Petrobras confirmed a series of projects involving a mix of upgrades and new installations are currently under development for its refining business, each of which aims to help meet one or more of the following RTM objectives under the 2024-28+ capex plan:

- Increase systemwide crude processing capacity by 225,000 b/d. The operator’s primary vehicle for growing its conventional processing capability will occur via optimization and expansion works at the 88,000-b/d Refinaria Abreu e Lima (RNEST) refinery in Ipojuca, Pernambuco, in northeast Brazil (Fig. 3). Launched in April 2023, the first leg of the project involves works to improve operations of existing RNEST Train 1’s atmospheric distillation unit, delayed coker, and other auxiliary units that, together, will return Train 1 to its 130,000-b/d nameplate capacity and improve quality of its production. Scheduled for completion during fourth-quarter 2024, Train 1’s modernization also will enable Petrobras to increase its supply of 100% low-sulfur S-10 diesel for the Brazilian market beginning in 2025. In addition to reducing emissions of particulate matter, S-10 diesel—which has a higher cetane number than S-500 diesel (500 ppm sulfur)—promotes improved fuel performance of vehicle engines in line with Brazil’s stricter air pollution control program for on-road heavy-duty and utility vehicles.Fig. 4 shows upgrades now under way at RNEST Train 1.

Approved in late-June 2023 following reassessment and confirmation of its economic attractiveness, the more-substantial project at RNEST involves resuming implementation of the previously stalled Train 2, work on which was interrupted in 2015. Petrobras said revival of the RNEST Train 2 project—which is scheduled to begin operating in 2027 and reach its full 130,000-b/d design capacity in first-quarter 2028—will contribute to increased production of finished petroleum products to meet market demand, especially for S-10 diesel.

- Increase S-10 diesel production capacity by more than 290,000 b/d. To meet rising demand for lower-carbon fuels, the capex plan includes projects—80% of which will involve new capacity additions, with the remaining 20% to come from revamps—that will boost systemwide S-10 diesel production, which accounted for 64%, or nearly 459,000 b/d, of Petrobras’s total 717,000-b/d diesel sales in second-quarter 2024. Alongside implementation of RNEST Train 2, fresh capacity is slated to come online via installation of a new diesel hydrotreater at REPLAN, which remains on schedule for startup in 2025, the company said in September. The new unit will have a production capacity of 63,000 b/d and include an associated 150,000-cu m/d hydrogen recovery unit. Petrobras previously said the new hydrotreater also would increase REPLAN’s production of jet fuel by 12,500 b/d to help meet more stringent specifications and rising demand for economically and sustainably produced aviation fuels.

At its 252,000-b/d Refinaria Henrique Lage (REVAP) refinery in São José dos Campos, São Paulo, Petrobras said it expects to complete the conversion of an existing hydrotreater in 2026 to exclusively produce S-10 diesel. The company also is also evaluating installation of a new hydrotreater and hydrocracker for S-10 diesel production at the Polo GasLub Itaboraí hub in Itaborai, Rio de Janeiro as part of a plan to integrate some of the hub’s units to receive intermediate products delivered via pipeline from the 239,000-b/d Duque de Caxias (REDUC) refinery in the Baixada Fluminense area of Brazil’s Rio de Janeiro state for use as feedstock. Combined, the REPLAN, REVAP, and GasLub projects would increase overall S-10 diesel production by about 180,000 b/d, the operator said.

- Expand biorefining capacity for production of 100% renewable diesel (R100) by 34,000 b/d. As part of its BioRefino program, which aims to expand the operator’s production of SAF and renewable diesel at new and existing plants, Petrobras has undertaken technical and economic feasibility studies for construction of a grassroots, dedicated biorefining plant at its 170,000-b/d Refinaria Presidente Bernardes (RPBC) refinery in Cubatão, São Paulo that would be equipped to flexibly process 790,000 tpy of various renewable feedstocks to produce 6,000 b/d each of SAF and R100, as well as 3,000 b/d of other unidentified renewable products. If approved, the proposed 15,000-b/d biorefining plant would come online in 2027 and reach full-production capacity during first-half 2028, Petrobras said. A similar dedicated plant targeted for startup in 2028 is also under study for implementation at the newly renamed Boaventura energy complex (BEC)—formerly GasLub—that, if approved, would have an SAF production capacity of 19,000 b/d. The planned RPBC and GasLub biorefining projects come alongside Petrobras’s goal of expanding its production of renewable fuels via co-processing of organic feedstock with conventional crude. As of yearend 2023, the operator was producing a combined 59,000 b/d of diesel with 5% renewable content through co-processing at the REPAR, REPLAN, REDUC, and RPBC refineries.

- Increase API Group II lubricants production by 12,000 b/d. This capacity increase will come exclusively from installation of a Chevron Lummus Global LLC-licensed 12,580-b/d hydroisodewaxing (HIDW) unit that—once completed—will produce a wide-viscosity range of premium API Group II/II+ lubricating base oil grades. Petrobras most recently said the unit is scheduled for startup sometime in 2028.

REPLAN, REPAR updates

As part of the revised spending program’s focus on the company’s “just energy transition” strategy, Petrobras in August-September 2024 confirmed a series of projects either under way or proposed for its REPLAN and REPAR refineries.

In early September, the operator revealed plans to expand nameplate crude processing capacity of its REPLAN refinery by 26,000 b/d (about 5%) to 460,000 b/d (Fig. 5). While Petrobras did not reveal how the capacity boost would occur, the company said it anticipates undertaking the expansion sometime in 2026, the same year in which it expects to commission a new solar photovoltaic plant at the manufacturing site as part of the refinery’s decarbonization journey.

In mid-August, Magda Chambriard, Petrobras’s chief executive officer, confirmed that of the 2024-28+ capex plan’s seemingly adjusted 60 billion reals ($10.96 billion) of total investments in the operator’s Brazilian refining system, 3.2 billion reals ($584.23 million) will be dedicated to works at REPAR (Fig. 6). Alongside installation of the new hydrotreater to expand the refinery’s production of S-10 diesel, Petrobras said it will also execute additional projects to improve energy efficiency at REPAR. Without disclosing further details, the operator said these projects will target reducing the carbon footprint of existing refining operations, improving current distillation capability and crude throughput, as well as increasing the refinery’s production of high-value derivatives that can serve as feedstock for Brazil’s petrochemical industry.

Petrobras has yet to reveal either costs or specific timelines for REPLAN’s new hydrotreating and other upgrading projects planned under the current capex plan.

RefTOP program spending

Many of Petrobras’s recent investments in its refineries come amid the backdrop of the company's RefTOP strategy, a multiyear modernization program consisting of initiatives designed to improve efficiency and operational performance of the sites. Launched in May 2021 at a proposed budget of about $300 million to help position operations more competitively within Brazil’s plan to open its national refining sector to outside investors, the RefTOP program includes works to optimize processing capabilities and quality of production at the refineries, as well as projects in line with the operator’s commitment to decarbonize corporate-wide operations by 2050.

In addition to promoting intensive use of digital technologies, automation, and robotization throughout the refining complex, the RefTOP program also includes works to help the refineries leverage processing of Brazil’s own low-sulfur presalt crudes, allowing the sites to achieve competitive advantages and opportunities for increasing margins by favoring production of low-sulfur S-10 diesel and bunker fuel.

Under the revised spending plan, Petrobras said new investments in the RefTop program will total $1.1 billion up to 2030—up from $813 million in the previous capex plan—with $776 million specifically allocated to projects between 2024-28.

Last year, Petrobras said investments under the 2023-27 spending plan for RefTOP included 148 works aligned with its objectives of increasing operational availability, lowering energy intensity, reducing emissions, and increasing presalt crude processing capacity at REPLAN, as well as at REVAP, REDUC, RPBC, and the 57,000-b/d Refinaria de Capuava (RECAP) in Mauá, São Paulo (Fig. 7).

Specific goals by 2025 are to involve:

- Achieving operational availability of more than 97%.

- Reaching an emissions intensity of less than 36 kg CO2e/CWT.

- Attaining an energy intensity index (by producing more and consuming less) of less than 89.

- Achieving 100% processing capacity of presalt crude produced from offshore Brazilian fields.

The kg CO2e/CWT indicator uses the Complexity Weighted Tonne (CWT) methodology developed by Solomon Associates and the Association of European Oil and Gas Refining and Distribution Companies specifically for the European oil refining industry, and adopted by the European Union Emissions Trading System, to set the sector’s greenhouse gas (GHG) reduction targets. The CWT of a refinery considers a load equivalent to distillation in terms of potential GHG emissions, given the different process units and respective loads processed in a refinery, making it possible to compare emissions from refineries of various sizes and complexities.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.