FACTS: India's crude demand, product exports on the rise

India has experienced a sharp upward trend in 2004 both in its refined products consumption and in refinery runs, leading to a consequent surge in products exports, reports FACTS Inc. analyst Hassaan Vahidy in the Honolulu-based company's fall 2004 preliminary forecast of India's demand, supply, and trade in refined products and crude oil markets.

"After 3 years of virtually zero growth, oil products consumption is projected to increase by some 140,000 b/d in 2004," Vahidy reported. FACTS Inc. estimates that India will refine 160,000 b/d more crude oil in 2004 than the 2.47 million b/d refined in 2003, and it will export a total of 400,000 b/d of refined products, compared with 300,000 b/d in 2003.

Although the country's crude production also has increased—to 684,000 b/d in 2004 from 654,000 b/d in 2003—production remains insufficient to fill the increased throughput of the refineries, Vahidy said, and therefore crude oil imports are poised to grow to 1.95 million b/d in 2004 from 1.8 million b/d in 2003.

Products consumption

The most notable products growth has been in diesel consumption, Vahidy said. Incremental growth for 2003-04 is expected to be as high as 50,000 b/d, spurred by overall higher economic activity, especially in agriculture. During the 2003-04 fiscal year—Apr. 1, 2003 to Mar. 31, 2004—"India's economy expanded by 8.3%, with agriculture leading the growth at 12.6%." During 2002-03 the economy had expanded by only 4.3%, and agricultural output actually shrank by 3.2%, he added.

Another factor in products growth was a late 2003 government ban on private imports of kerosine. Privately imported kerosine was being adulterated into diesel, resulting in lower reported sales for the fuel. The FACTS report factors in these figures in its refined product consumption figures.

Election activity through the first quarter of this year also contributed to the consumption increase by keeping domestic petroleum products prices fixed—even as international prices rose throughout fourth quarter 2003 and the first quarter of 2004—shielding Indian consumers from high prices elsewhere and avoiding any dampening impact on consumption.

This led to a 10% increase in diesel use, a 13% growth in jet fuel use, and a 7% gasoline consumption increase throughout first quarter 2004 over first half 2003.

Through 2001-03, CNG use replaced significant volumes of diesel, but "under the current scenario CNG conversion has peaked," FACTS said, "unless increased volumes of gas enter the market. Furthermore, for 2004 we are measuring growth in diesel consumption from a low base."

LPG growth

Other products also are experiencing growth (Fig. 1). LPG continued to grow at double-digit rates, and naphtha consumption increased—a reversal from previous years stemming from decline in the power sector. "We believe that India's petrochemical capacity has been running at higher utilization rates, driving naphtha consumption through 2004," Vahidy said.

For the first half of 2004 India's oil product consumption grew 8% over the first half of 2003, with signs of a slowdown in the second half of this year because oil companies are now allowed to revise prices, "which in the event of high international prices would impact Indian oil consumption." Economic growth for 2004-05 is forecast at a "relatively modest, though impressive, 6.3%" with agricultural output subdued at less than 3%.

Forecasts

For the year as a whole, FACTS expects India's oil products consumption to grow at 5-6%—"a stellar performance" compared with 0% for 2001-03.

For 2005, growth is forecast at 70,000-80,000 b/d, with continued growth in LPG, gasoline, diesel, and naphtha and with the high petrochemical utilization trend expected to continue.

"We project a slowdown in the growth of diesel for a few years beyond 2005," Vahidy said, citing some substitution of CNG, especially around Mumbai because of increased volumes of LNG imports.

Beyond 2005, India's oil product consumption is expected to be 3.0-3.5%/year.

Refinery expansions

Debottlenecking and optimization exercises by Indian refineries this year enabled crude run averages to exceed 2.6 million b/d, even though current refining capacity was rated at 2.5 million b/d. The increased crude runs were driven both by increased domestic consumption and the improvement in regional refining profitability, Vahidy said.

Significant increases came from Indian Oil Corp. (IOC) Ltd.'s Koyali, Haldia, and Panipat refineries, and Mumbai-based Reliance Industries Ltd., which finished a debottlenecking project early this year at its Jamnagar refinery, managed runs of almost 700,000 b/d through this year. ONGC subsidiary Mangalore Refinery & Petrochemicals Ltd. also increased crude throughput substantially.

More increases are projected for the near future. These include IOC's 120,000 b/d expansion at Panipat, and expansions at Mumbai of some 110,000 b/d by state-owned Hindustan Petroleum Corp. Ltd. and Bharat Petroleum Corp. Ltd.

On the whole there will be an additional 230,000 b/d of refining capacity by yearend 2006, and FACTS expects that the 240,000 b/d grassroots project by Essar Oil Ltd. will materialize by mid-2007.

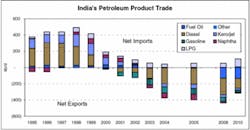

Product trade

In this demand-supply balance, diesel exports this year are expected to be 175,000-200,000 b/d, followed by gasoline exports of 70,000-80,000 b/d, and naphtha exports of 60,000-65,000 b/d.

On a net basis, exports this year can exceed 300,000 b/d compared with 193,000 b/d in 2003. And Vahidy noted that the increase in crude throughput capacity has already surpassed the increase in domestic demand for 2004.

The FACTS longer-term outlook for India's product trade is presented in Fig. 2. Net exports from India will exceed 400,000 b/d by 2008, based on a domestic demand growth projection of 3-3.5%/year, according to the report, with an increasing emphasis on middle and light distillates and driven primarily by automotive fuels and fuel oil.

Crude balance

With increases in domestic refining throughput and a relatively flat production profile, India's import of crude oil continues to rise. FACTS analysts expect India's crude imports to be almost 2 million b/d this year, compared with 1.8 million b/d in 2003.

During 2003, the Middle East provided more than 68% of the crude oil imported by India. And more than 17% of the imports were sourced from the Atlantic Basin (West Africa and Europe), making India the largest user of West African grades in Asia. About 5.6% of India's imported crude comes from other African sources, 4.8% from Asia, and 3.8% from the Americas.

In 2003, FACTS estimates that some 1 million b/d of Atlantic Basin (West African and European) crudes moved to Asia, with India taking 32%, China 30%, Taiwan 17%, Japan 10%, Indonesia 7%, and South Korea 3%."

"[India's] reliance on West African grades is driven largely by a gap in the stringent product specifications and the capacity of the refineries to manufacture these grades," Vahidy said. "This we believe is a short-run phenomenon, as most of the existing refiners have plans to upgrade treating capacity. Furthermore, all of the new expansions are designed to process heavy-medium and sour grades," he said. Therefore, in the longer run India's reliance on Middle Eastern crude is likely to grow.

Future direction

India, then, is poised to become an increasingly important player in the Asian and global oil markets because of increased domestic oil consumption , its increased refined products exports, and growing crude oil imports.

With a reasonably advanced refining configuration, the quality of exported products will be relatively high, the FACTS report said, and it is expected that Indian exports will continue to compete with traditional—mainly Middle Eastern suppliers—for markets in Asia and beyond.