Worldwide refining capacity growth rises again in 2008

In 2008, growth in crude distillation capacity continued to build on momentum of past years; refiners added more capacity than the past 2 years, according to the latest OGJ Refinery Survey. For the seventh year running, worldwide capacity is at a record level.

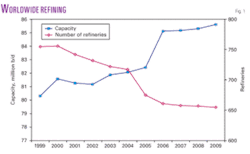

Last year’s refinery survey listed a global capacity of 85.309 million b/cd in 657 refineries as of Jan. 1, 2008. This year’s OGJ survey shows a total capacity of 85.603 million b/cd in 655 refineries, an increase of nearly 300,000 b/cd.

This year’s capacity growth is greater than the growth in 2007 and 2006 of 130,000 b/cd and 52,000 b/cd, respectively. The number of refineries, on the other hand, has been on a steady decrease. In the past 10 years, the global refining industry has shut down more than 100 refineries, mostly smaller, less-efficient plants.

Fig. 1 shows the trend in operable refineries and worldwide capacity.

A new refinery start-up in China, expansions in other refineries, and capacity creep that offset losses were the main reasons for the capacity increases in the latest survey.

Asia experienced the largest increase in the amount of refining capacity, up about 269,000 b/cd, or 1.2%. Western Europe added about 34,000 b/cd, or 0.2%.

North America showed a slight net decrease of 7,500 b/cd.

Other regions experienced no net gain or loss in stated capacity.

New crude capacity

This year’s survey lists one new refinery. All other increases in refining capacity occurred in existing facilities.

In mid June, China Petroleum & Chemical Corp. (Sinopec) started up a $1.8-billion refinery in Qingdao, China. The company reported that the 200,000-b/cd refinery will produce transportation fuels that will meet Euro III emission standards as well as petrochemical products.

The largest single-facility increase occurred in Valero Energy Corp.’s Jean Gaulin refinery in Quebec. The company reported a capacity of 260,000 b/cd, up from 215,000 b/cd, which was the capacity listed in last year’s survey.

Two refineries in Asia experienced 30,000-b/cd increases. LG-Caltex reported an increase to 680,000 b/cd, up from 650,000 b/cd in its Yosu, South Korea, refinery. In addition, Nippon Oil Co. Ltd. reported an increase to 160,000 b/cd from 130,000 b/cd in its Oita, Japan, refinery that it acquired from Kyushu Oil Co. Ltd. this year.

OGJ subscribers can now download, free of charge, the text version of the OGJ Worldwide Refining Report 2008 tables from www.ogjonline.com. Click on the Resource Center tab, then the Surveys and OGJ Subscriber Surveys links. This link also features the previous editions of this report as well as a collection of other OGJ Surveys from previous years. Subscribers and nonsubscribers may purchase Excel spreadsheets of the survey data by sending an email to [email protected] or calling (800) 752-9764. For further information, please email [email protected], or call Leena Koottungal, OGJ Survey Editor (713) 963-6239.

In the US, the largest reported capacity increase occurred in Frontier Oil Corp.’s El Dorado, Kan., refinery. Frontier reported a 16,000-b/cd increase, growing to 126,000 b/cd in this year’s survey from 110,000 b/cd reported in last year’s survey.

Another major increase in reported capacity occurred in LyondellBasell’s Berre l’Etang, France, refinery, which it acquired from Royal Dutch Shell Group in 2008. The refinery increased capacity to 105,000 b/cd from 78,000 b/cd reported in last year’s survey.

Refinery closures, delistings

As in 2007, no refineries shut down in 2008, mainly due to high refining margins early in the year that made the vast majority of refineries profitable.

The removals of refineries from this year’s survey include MOL Hungarian Oil & Gas Co.’s Tiszaujvaros, Hungary, and Koramo Kolin’s Czech Republic refineries. The plants were removed from the survey because they process no raw crude.

In addition, the Suncor Energy Inc., Denver, refinery was removed from the survey. The company reported that the Denver and Commerce City refineries are operating as a single, integrated plant.

Other refineries lost capacity as owners restated and updated the survey numbers.

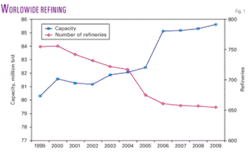

Largest refining companies

Table 1 lists the top 25 refining companies that own most worldwide capacity. Table 2 lists companies with more than 200,000 b/cd of capacity in Asia, the US, and Western Europe. Capacities from Tables 1 and 2 include partial interests in refineries that the companies do not wholly own.

Significant changes from last year involve Total SA, Chevron Corp., Nippon Oil, Marathon Oil Corp., Valero, BP PLC, and Alon USA.

On Aug. 30, 2007, Murco Petroleum Ltd., a UK subsidiary of Murphy Oil Corp., agreed to purchase Total’s 70% interest in the Milford Haven, Wales, UK, refinery for $250 million. This year’s survey reflects the ownership change for the 108,000-b/cd refinery. Murco previously held a 30% interest and now owns the entire plant.

This transaction was sufficient to move Total down two spots in Table 1. Last year’s survey lists the company with 2.719 million b/cd of capacity. This year’s survey shows that the company owns 2.655 million b/cd of capacity.

Similar to 2007, Petroplus acquired two European refineries. The company purchased the Petit Couronne and Reichstett Vendenheim refineries in France from Shell.

The Petit Couronne refinery has a capacity of 154,000 b/cd and the Reichstett Vendenheim refinery has a capacity of 85,000 b/cd.

The acquisition, completed on Apr. 1, 2008, was first announced on Aug. 2, 2007, and had to go through the European Commission’s approval process. The net purchase price, including estimated inventory and other adjustments, was about $785 million.

Petroplus now has 792,000 b/cd of refining capacity, up from 552,000 b/cd at yearend 2007 and 300,000 b/cd in 2006.

On Oct. 1, 2008, Nippon Oil acquired Kyushu Oil, which increased its refining capacity to 1.3 million b/cd from 1.16 million b/cd as listed in last year’s survey. In addition, Nippon reported that the refinery has a capacity of 160,000 b/cd.

The acquisition moved Nippon Oil from 17 to 15 in Table 1. Nippon also moved up to fourth in Table 2, up from fifth last year.

In the largest US transaction, Alon USA purchased the Krotz Springs, La., refinery from Valero on July 7, 2008. The purchase price for the 83,000-b/cd refinery was $333 million in cash plus about $140 million for working capital, including inventories.

Alon now appears in Table 2 as the 18th-largest refiner in the US.

Also new to the US section of Table 2 is Husky Energy Inc. The company entered into an oil sands joint venture with BP in December 2007 in which Husky acquired 50% of BP’s 152,000-b/cd Toledo refinery (OGJ, Dec. 10, 2007, p. 32).

Husky now operates 237,500 b/cd of refining capacity, which also includes the Lima, Ohio, refinery it purchased from Valero in 2007.

As reported in last year’s article (OGJ, Dec. 24, 2007, p. 50), Basell announced it was merging with Lyondell Chemical Co. for about $12 billion, which includes the 268,000-b/cd Houston refinery. The new company, LyondellBasell Industries, is now the 14th-largest refiner in the US.

On Apr. 1, 2008, LyondellBasell announced that it had purchased the Shell refinery and associated infrastructure at the Berre l’Etang petrochemical complex in France. The refinery, with production capacity of 105,000 b/cd, is adjacent to a LyondellBasell polyolefins complex.

In Table 2, Shell fell from second to third due to the loss of three refineries in Western Europe.

Other changes in capacity that appear in Tables 1 and 2 are due to adjustments in declared capacity. In Table 2, LG-Caltex moved to 10 from 12 in Asia, Marathon moved to 5 from 6 in the US.

Largest refineries

Table 3 lists the world’s largest refineries with a minimum capacity of 400,000 b/cd.

As previously mentioned, LG-Caltex increased capacity at its Yosu refinery, which was sufficient to move it up to third largest refinery in the world. It surpassed the Jamnagar refinery, which should move up to largest refinery in the world in next year’s report when its massive 580,000-b/cd expansion officially starts up in early 2009.

The ExxonMobil Corp. Baytown, Tex., refinery increased capacity to 572,500 b/cd from 567,000 b/cd, but the increase was not sufficient to move it up a spot in Table 3. Likewise, BP’s Texas City refinery restated its capacity a bit lower, but not enough to move it down in the list.

BP’s Whiting, Ind., refinery, however, fell off the list when the company restated its capacity as 384,750 b/cd, down from 405,000 b/cd as listed in last year’s survey.

Regional crude capacities

Table 4 lists regional process capabilities as of Jan. 1, 2009. As previously mentioned, the largest increase in crude capacity occurred in Asia due to the new Sinopec refinery and expansions in other refineries there.

Western Europe increased crude distillation capacity and North America lost capacity.

Table 4 also shows that Asia significantly increased conversion capacity in 2008. Catalytic reforming rose to 2.15 million b/cd from 2.0 million b/cd, an increase of 7%. Catalytic hydrocracking increased to 1.0 million b/cd from 806,628 b/cd, an increase of 26%.

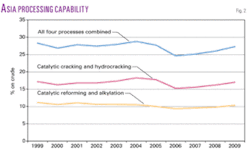

Processing capabilities

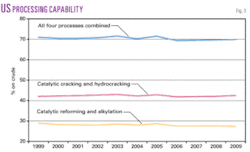

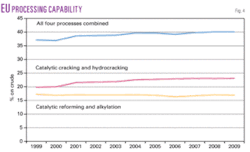

Figs. 2-4 show the processing capabilities of Asia, the European Union (EU), and the US for the past 10 years. Processing capabilities are defined as conversion capacity (catalytic cracking and hydrocracking) and fuels-producing processes (catalytic reforming and alkylation) divided by crude distillation capacity (% on crude).

Countries in the EU include Belgium, Denmark, France, Germany, Greece, Ireland, Italy, the Netherlands, Portugal, Spain, and the UK.

null