OGJ Newsletter

Alberta’s royalty framework takes effect Jan. 1

New royalty framework rates will become effective in Alberta on Jan. 1, 2009, for production from new natural gas wells and conventional oil wells.

Spurred by then-high commodity prices, Alberta Premier Ed Stelmach announced the “New Royalty Framework” in October 2007, saying it would bring an additional $1.4 billion (Can.) to government coffers in 2010, 20% more than the current royalty regime (OGJ, Nov. 5, 2007, p. 34).

The new royalty structure did not include oil sands, and the Alberta government spent 2008 negotiating with Syncrude and Suncor, large joint-venture projects that had royalty agreements in place through 2016. Syncrude partners were the last to come to terms, announcing their acquiescence on Nov. 18.

The unforeseen drop in natural gas and oil prices and credit restrictions from the global economic crisis, however, have slowed drilling activity and project development in the province.

In response, the Alberta government recently introduced optional, 5-year transitional royalty rates for new wells commenced during Nov. 19 and Dec. 31. Operators now have the option of choosing to pay royalties under the transitional scheme or the new royalty framework scheme.

Alberta Energy announced the transitional royalty rates to the media on Nov. 19, but issued a clarification on Nov. 24: “Companies with oil and gas wells between 1,000 and 3,500 m where staging, preparatory, or initial drilling work has begun during this period will be eligible to make the one-time choice to have the transitional rates applied to production beginning Jan. 1, 2009. Any wells producing oil or gas prior to Jan. 1, 2009, must transition to the new royalty framework.

“Because this clarification will only apply to a nominal number of wells and only on production after Jan. 1, this adjustment is not anticipated to affect the estimated royalty impact of the 5-year program announced on Nov. 19, 2008.”

Alberta Energy stressed that the new program is not a “royalty holiday.” Operators have a one-time option to select transitional rates or framework rates for new wells. All wells drilled in 2009-13 that pay transitional rates will be required to shift to the new royalty framework on Jan. 1, 2014.

All other existing wells and oil sands projects will move to the new royalty framework Jan. 1, 2009.

Cuba, Venezuela sign new accords on oil, gas

Venezuelan President Hugo Chavez and his Cuban counterpart, Raul Castro, have signed agreements to expand the capacity of two refineries in Cuba and to construct a third one.

Altogether, the expansion plans will see Cuba’s refining capacity increased to 350,000 b/d from the current 87,000 b/d, according to a statement from Venezuela’s state-owned Petroleos de Venezuela SA (PDVSA).

Under the agreements, the capacity of Cuba’s Cienfuegos refinery will be stepped up to 150,000 b/d from the current 65,000 b/d, while the Hermanos Diaz refinery in Santiago will rise to 50,000 b/d from 22,000 b/d.

PDVSA said the proposed refinery in the port city of Matanzas will have a capacity of 150,000 b/d, and is to be managed by Cuvenpetrol SA¿a new joint venture of PDVSA and Cuba’s state-owned Cupet.

PDVSA did not reveal the respective stakes of the two sides in the joint venture or a schedule for the expansion of the existing refineries or the construction of the new one.

However, the Venezuelan firm said that Cuvenpetrol will control all refining interests in Cuba being pursued by the two countries, including the design and construction of an LNG regasification plant, gas pipelines, and other facilities.

The agreements signed recently mirror earlier ones between the two countries.

In April 2006, PDVSA entered into an agreement with Cupet to establish a joint venture company to refurbish and expand the Soviet-built facility at Cienfuegos that had been neglected since the start of the 1990s, when Soviet assistance to Cuba ended.

Under the earlier Venezuelan-Cuban JV, the refinery’s capacity was initially raised to 65,000 b/d. The upgraded Cienfuegos refinery was inaugurated in late 2007 and started operations in January.

The Cienfuegos refinery is expected to close 2008 with production of 20 million bbl of fuel, according to deputy director, Raul Perez, who said the plan for the refinery envisaged output of 19.4 million bbl for the year.

Cuba imports 100,000 b/d from Venezuela in oil and products under special financial conditions that include bartering for Cuban goods or services such as doctors, teachers, and athletic trainers.

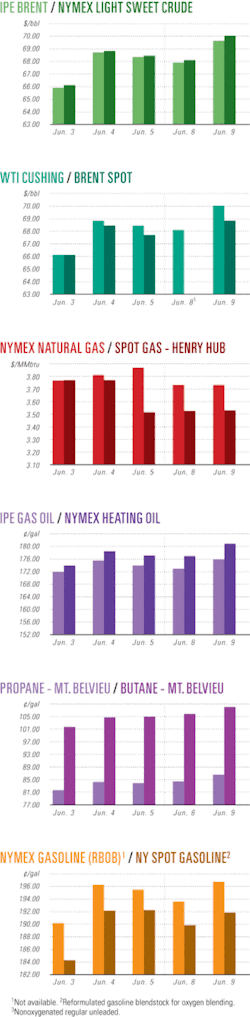

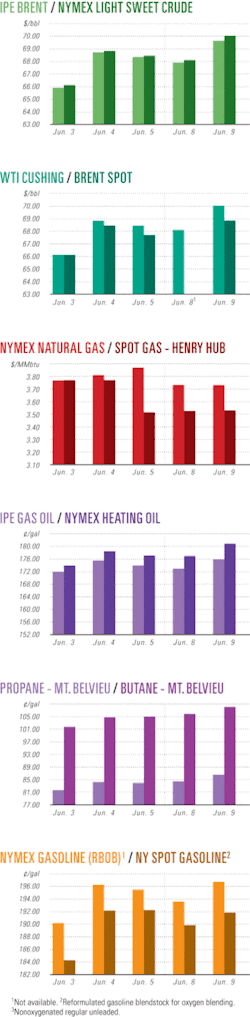

Industry Scoreboardnull

null

null

Exploration & Development Quick TakesHess discovers oil in Libya Sirte offshore

Hess Corp. said an exploratory well has encountered a 500-ft gross hydrocarbon section at various intervals in the offshore extension of Libya’s mainstay Sirte basin.

A deepwater exploration well off Egypt found hydrocarbons, while another wildcat off Ghana was unsuccessful while another is planned, the company said.

Hess holds 100% interest in Area 54 of Libya, where the A1-54/01 wildcat 38 miles offshore went to total depth of 11,077 ft in 2,807 ft of water in the Mediterranean Gulf of Sirte.

The Dekhila-1x well in deepwater West Mediterranean (Block 1) 45 miles offshore in Egypt’s Nile Delta went to TD 8,881 ft in 3,883 ft of water and found a gross hydrocarbon section of 148 ft at multiple intervals. Results will be incorporated into engineering studies for the wider West Med development.

Hess didn’t elaborate on the magnitude of the find, but the Sirte offshore is not as yet a producing province.

Interest are Hess 55%, RWE Dea 35%, and Kuwait Foreign Petroleum Exploration Co. 10%. The 586,000-acre West Med block contained the Abu Sir, El King, El Max, and Al Bahig gas discoveries when Hess acquired its interest in late 2005 on trading its US Permian Basin properties to Apache Corp.

Hess’s Ankobra-1 wildcat, on the Deepwater Tano Cape Three Points license and 70 km southeast of the Jubilee oil discovery, went to 13,000 ft in 5,682 ft of water without encountering commercial hydrocarbons. Hess is shooting 625 sq miles of 3D seismic in anticipation of a well to be drilled in the unexplored western half of the license.

China reports northern Xinjiang region gas find

China’s National Mineral Resource Committee has reported PetroChina’s discovery of a major gas field, claiming proved reserves of 100 billion cu m, in the Xinjiang Uygur Autonomous Region.

Klameli field, in northern Xinjiang’s Junggar basin, is said to be PetroChina’s largest gas find in the area. The field was discovered in 2006, and more test wells were drilled in 2007 to confirm the size of the reserves.

Chen Xinfa, general manager of PetroChina subsidiary Xinjiang Oil Field Co., said exploitation of Klameli field will alleviate gas shortages in northern Xinjiang.

According to Kuang Lichun, XOFC vice-general manager, Klameli field will produce 3.38 billion cu m of gas this year, about 20% of it to be sold to the cities of Urumqi and Sihezi, with the remainder reserved for the company’s own use.

PetroChina expects the field to produce at least 1 billion cu m/year of gas for 50 years or more, Kuang said. Neither official said when the company expects to start production from the field.

No explanation was given for the delay in reporting the discovery.

Saratoga developing Vermilion 16 area

Saratoga Resources Inc., Houston, chasing untapped potential in Vermilion 16 field in state waters off Louisiana, acquired four tracts adjacent to the field and has commissioned a full-field study.

Vermilion 16, discovered in 1961, has produced from 30 stacked sands at 10,500-16,200 ft. Saratoga has identified five existing proved developed nonproducing opportunities in three wellbores and four proved undeveloped opportunities. Only two wells are drilled deeper than 17,000 ft.

Surrounding Vermilion 16 are several fields that each produced more than 3 tcf of gas. The newly acquired tracts either contain extensions to proved reserves or provide access to surface locations for proposed directional development wells.

NuTech Energy Alliance is using 25 sq miles of licensed 3D seismic from Fairfield Industries Inc. to identify unswept areas for infill drilling, identify and confirm directional development drilling opportunities, identify shallower bypassed gas pay, and identify low resistivity bypassed gas pay.

The recompleted S.L. 3762-1 well flowed 1.2 MMcfd of gas and 45 b/d of condensate on a 13/64-in. choke with 3,050 psi flowing tubing pressure from Rob 54-F sand perforations at 13,004-014 ft, adding 34,000 bbl and 1.1 bcf of net reserves.

This plugback was identified by a pulsed neutron log that was run in the well in June 2007. Enough proved developed nonproducing reserves are recognized on that log to justify an acceleration well, Saratoga said. The data will be used to help accelerate the drilling of over 37 bcf and 400,000 bbl of proved undeveloped reserves.

The state recently approved a voluntary unit covering 600 acres on S.L. 3762 and 3763, which will insure that the lease area covered by these reservoirs is protected.

Saratoga’s subsidiary The Harvest Group LLC also acquired 66 acres in Main Pass Block 53 with 100% working interest.

Petromin buys into Papua New Guinea fields

Papua New Guinea’s state company Petromin has bought a 20.5% direct interest in onshore Elk-Antelope gas field discovered by InterOil in the country’s Gulf province.

Petromin has made an initial cash payment to partially fund its share of field development costs.

InterOil Vice-Pres. Christian Vinson said his company has high hopes for the field based on recent testing. “We believe the discovery has the potential to make a major contribution to the future economic development of the nation,” he said.

InterOil says recent testing at Elk-4 appraisal has recorded gas flow rates of 105 MMcfd of gas. Condensate rate is estimated to be 1,890 b/d. The company currently is drilling Antelope-1, about 2.8 km from Elk-4.

Development plans include supply to the proposed $5-7 billion Liquid Niugini LNG project, which is a rival of the ExxonMobil PNG LNG project to produce gas from the Kutubu-Hides group of fields in the country’s central highlands region.

The initial phase of the Liquid Niugini gas project includes a pipeline to be built from the Gulf province to Port Moresby, where a gas processing plant will be constructed near InterOil’s existing oil refinery. The plan includes a two-train LNG plant producing as much as 9 million tonnes/year of LNG with an on stream date of late 2013 or early 2014.

Liquid Niugini is owned equally by InterOil, Merrill Lynch, and Clarion Finanz.

Drilling & Production Quick TakesSakhalin Energy starts oil exports from Aniva Bay

Sakhalin Energy Investment Co. has started exporting oil from Molikpaq platform to the terminal in Aniva Bay in the south of Sakhalin, which will be dedicated to year-round oil deliveries.

The company has commissioned the 800-km TransSakhalin oil and gas pipeline system, which connects the offshore Molikpaq, Piltun-Astokhskoye-B, and Lunskoye platforms in the northeast to the new terminal and Prigorodnoye port in Aniva Bay. Oil was exported through a tanker loading unit 4.5 km offshore in Aniva Bay and connected to the terminal by a subsea pipeline.

The Governor Farkhutdinov giant tanker carrying 100,000 tonnes of oil left the island and set sail for South Korea’s Yosu port, according to Russian news reports. At peak, Prigorodnoye will annually serve 160 LNG carriers and 100 Aframax oil tankers.

The milestone represents a major step in commissioning the facilities. The operator also will start LNG processing in the next few weeks. LNG supplies to customers in Japan will start begin in February (OGJ Online, Nov. 28, 2008). The Piltun-Astokhskoye-B platform also will send oil later this month.

The $20 billion Sakhalin-2 project has been unable to export year-round as its offshore facility could work for only 6 months of the ice-free season. “Year-round production and export of the Sakhalin-2 oil will significantly enhance energy security in the Asia Pacific and strengthen Russia’s position in the world markets,” Sakhalin Energy said.

Sakhalin-2 involves oil and gas production from Piltun-Astokhskoye field, which includes Piltun and Astokh oil and gas areas, and Lunskoye field.

SEIC has produced more than 100 million bbl of the Vityaz crude since 1999. The company is a joint venture of OAO Gazprom 50% plus 1 share, Royal Dutch Shell PLC 27.5%, Mitsui & Co. Ltd. 12.5%, and Mitsubishi Corp. 10%.

Tui field partners consider FPSO expansion

Partners in the development of Tui oil field off New Zealand, led by Sydney-based Australian Worldwide Exploration (AWE), are considering an expansion of the fluid handling capacity of the Umuroa floating production, storage, and offloading vessel to 180,000 b/d. The group has also deferred indefinitely the drilling of a third horizontal well in the field in favor of further exploration within the larger mining licence PMP 38158.

The upgrade of the FPSO will enable more oil to be recovered at a faster rate from the currently producing reservoirs and also provide the flexibility to tie-in any future nearby discoveries.

As expected from the outset, the field is gradually increasing its water cut and this is now limiting the maximum oil recovery rate to about 32,000 b/d.

The field has an estimated proven and probable reserve of around 50 million bbl. At the end of November, total production had reached 19 million bbl.

The Tui group is now confident it can extract the remaining reserves without the extra development well. There are five attractive prospects near the three producing reservoirs which in total could contain another 50 million bbl of oil.

Semisubmersible Kan Tan IV will be used for the 2009 exploration program but no decision has been made about which prospects will be targeted.

The Tui partners are AWE 42.5%, Mitsui Exploration & Production NZ 35%, New Zealand Oil & Gas 12.5%, and Pan Pacific Petroleum 10%.

Processing Quick TakesFate of North Pole refinery pondered

Alaska’s state government and Flint Hill Resources will begin a joint effort to position the company’s refinery at North Pole for long-term success, Gov. Sarah H. Palin announced on Dec. 10.

“The Flint Hills Resources Alaska refinery in North Pole has a significantly positive economic impact throughout our state,” Palin said. “The refining operation is a major employer in Alaska and is vital to the operations of Anchorage International Airport, the Port of Anchorage, and the Alaska Railroad,” she added.

The move came after Flint Hills’ announcement in May that it was reviewing alternatives for the refinery due to financial challenges.

The plant is Alaska’s largest refinery with a 240,000 b/d processing capacity. About 60% of its products are destined for the aviation market.

Palin said both the state and Flint Hills would evaluate options aimed at improving the plant’s ability to respond to volatile energy costs, varying product demands and volatile refining margins as well as facilitating upgrades to position the installation for long-term success.

The governor said Flint Hills has agreed to provide data to the state’s Department of Natural Resources, which has assured that it will remain confidential. The data will let the state agency analyze refinery economics over 3-6 months, Palin said.

The Alaska Railroad and Flint Hills also will review potential opportunities to structure refinery ownership and operations as part of a corporation similar to, or part of, the Alaska Railroad, Palin indicated.

The state will consider impacts on other Alaska refineries in all case, she emphasized.

Dominican Republic buys Shell’s refinery share

The Dominican Republic has become the sole owner of the 31,000 b/d Refidomsa refinery at Haina after Shell Petroleum NV completed transferring its 50% stake.

The government paid $110 million for the interest, which Shell said it sold because it was no longer of strategic importance to the company.

The parties agreed to the share purchase on Aug. 5.

The refinery, commissioned in January 1973, is the primary refinery in the Dominican Republic. Along with its import terminal, it supplies most of the fuel requirements in the country. It has a hydroskimming configuration, and in 1992 the refinery commissioned its own power generation plant, which improved the plant’s reliability.

Shell said it would remain in the retail, lubricants, and commercial marketing businesses in the Dominican Republic.

Transportation Quick TakesEquatorial Guinea to set up gas processing hub

Equatorial Guinea plans to establish a gas-gathering company to collect gas in the Gulf of Guinea and direct it to key projects in the nation, according to a senior official from the state owned gas company Sonagas.

Serapio Sima Ntutumu, deputy director general at Sonagas, said at the CWC LNG summit in Barcelona that Equatorial Guinea wants to position itself as a gas processing hub in the region gathering gas from Nigeria, Cameroon, and other sources in Equatorial Guinea that could be fed into its LNG expansion, petrochemicals, LPG plants, and methanol systems.

Sonagas will perform a feasibility study to evaluate its gas options, an initiative crucial to eliminate gas flaring. It hopes to collect at least 800 MMcfd from Nigeria and 200 MMcfd from Cameroon, Ntutumu told OGJ.

“If they have even more, all the better. Noble Energy has discovered gas on Block O & I; ExxonMobil has gas activities. We want to work with them.”

The new company would effectively become a hub for gas activity, coordinating work in Equatorial Guinea and offering licenses for gas development.

Equatorial Guinea also is working on a master gas plan to find ways of monetizing its resources. The government will announce further details later, Ntutumu said.

The nation’s importance in the oil and gas arena was recognized by Gazprom Neft in October after it signed memorandum of understanding with the nation’s energy ministry committing to carry out upstream, downstream, and financial studies. The partnership will strengthen the cooperation between Russia and Equatorial Guinea.

Pakistan plans $1 billion TAPI, IPI gas storage

Pakistan says it will require $1 billion to build underground storage for gas to be imported from Iran and Turkmenistan, according to the country’s petroleum ministry and the Asian Development Bank in a joint study with Sui Northern Gas Pipeline Ltd. (SNGPL) and Sui Southern Gas Co. Ltd. (SSGCL).

SNGPL, SSGCL, and Inter-State Gas Systems, which is responsible for building the Turkmenistan-Afghanistan-Pakistan-India (TAPI) and Iran-Pakistan-India (IPI) gas pipelines, would build three to four underground gas storage tanks.

Pakistan plans to import 2.2 bcfd of gas from Iran, of which Pakistani share would be 1.05 bcfd. If India does not participate, Pakistan would take the entire volumes.

From Turkmenistan, Pakistan will import 3.2 bcfd of gas, to be shared equally with India. Pakistan would also need underground storage for gas supplied to different areas of the country.

Pakistan and Iran currently are in a dispute over the gas price, an obstacle to further progress on the IPI gas pipeline project. Pakistani and Iranian officials were expected to meet soon in Tehran to resume negotiations on the price issue.

The steering committee on the TAPI gas pipeline project was scheduled to meet in New Delhi this month, but the meeting was postponed after the recent Mumbai massacre.

Turkmenistan, which has failed to provide the gas reserves certification required by both Pakistan and India, is expected to present the certification when the meeting is rescheduled.

Gazprom to plan gas transport, storage in Europe

Gazprom Vice-Pres. Alexander Medvedev indicated in Paris Dec. 12 that the company is interested in acquiring gas transport and distribution assets in France and other areas of Europe to bolster the company’s gas storage capacities. He said Gazprom Marketing & Trading France already has joint gas storage projects.

“We want to ensure distribution in all the countries where we deliver our gas under long-term contracts,” he said.

Gazprom signed an agreement in December 2006 extending Gaz de France’s long-term contracts to 2030 and, at the same time, the partners agreed that Gazprom could sell as much as 1.5 billion cu m/year in France as direct sales.

Medvedev said he is aiming for these volumes within 2-3 years, up from the current 500 million cu m, which accounts for 1% of the French market for large industries. Gazprom is now aiming for medium-size clients.

Youri Virobian, who heads the new French affiliate, said broadening Gazprom’s market share would depend on “the future of regulated prices,” which have kept the industrial gas market restricted to 19% for new entrants since the industrial market opened to industry in 2004. Householders, who could access the market since July 2007, only account for 1.9%, he noted.

Medvedev indicated that, due to the financial and economic crises, Russian investments will be prioritized, but he did say the Nordstream and Southstream gas pipelines and the Shtokman gas field projects would proceed.

Gran Tierra defers Colombian pipeline project

Gran Tierra Energy Inc., Calgary, deferred a 100-km pipeline project in Colombia connecting Costayaco field to the Orito gathering facilities. Recent pressure-testing of the existing pipeline system and testing of friction reducers injected into the oil stream show the existing pipeline system can move about 15,000 b/d from Costayaco with new pumps.

Gran Tierra will move an additional 10,000 b/d by truck, allowing it to meet estimated second-half 2009 production of 25,000 b/d. The company reduced expected peak plateau production from 35,000 b/d, but extended the peak’s duration to 3 years.

The company estimates a $140 million savings for 2009 from deferring the pipeline project. The company said a WTI price of $61/bbl was needed to keep pipeline construction economical.

Gran Tierra, which discovered Costayaco field in 2007, holds five exploration licenses and a working interest in two technical evaluation areas in Putumayo basin.

Production in Costayaco field is suspended while the existing pipeline remains shut in. Output from other Putumayo assets, the Llanos basin, and the Lower Magdalena basin continues (OGJ Online, Dec. 4, 2008).