The Iraqi oil dispute: Who holds the power?

The new Iraqi National Constitution left as many petroleum questions unanswered as it answered. It not only separated branches of government but also established federalism as its lodestar. Due to unresolved legal issues covering regional and national control over petroleum resources, oil companies continue to function in a hazy legal environment.

The legal context

The Iraqi constitution, negotiated in 2005 and approved by a nationwide referendum on Oct. 15, 2005, assumed the force of law in 2006.

To move from Iraq’s Baathist past, the framers of the new constitution established among its fundamental principles that Iraq is a “single, federal, independent, and fully sovereign state.”1 And within that federation, the Northern Kurdistan Region has special recognition.2 The rush to approve a national constitution left widespread uncertainty as to the division of power between the regions and the federal government on matters related to energy policy.

The Kurdish Regional Government (KRG) argues that Article 112 of the Iraqi constitution grants the central government a conditional right to “undertake management of oil and gas extracted from existing oil and gas fields.” In homage to federalism, this right is shared with the producing governorates and regional governments.

Article 112 does not, however, grant the central government the power to manage nonproducing, underproducing, or future fields. These fields are under the control of the regional governments, which must, somehow, respect overall federal policy in oil development.

Further, the KRG argues that Article 110 of the Iraqi constitution enshrines the KRG’s legal right to oil self-determination and limits the federal government’s powers to such activities as providing national security and mail service and printing currency.

While these conflicting, if not mutually exclusive, constitutional provisions optimally embody compromise and the wish to expedite a constitution palatable to all stakeholders, they may set the stage for wholesale political conflict or even violence in an already shattered country.

After simmering for years, tension boiled over in late November 2007 when the Iraqi Oil Ministry proclaimed that it will unilaterally cancel KRG contracts with oil companies signed after February 2007. The threat of cancellation shows that the central government treats regional contracts seriously.

Facts of the dispute

In fourth-quarter 2007, the KRG increased the tempo of its oil deals and signed four contracts that will attract an estimated $500 million in investment.3 The agreements, announced on Nov. 7, 2007, show that the KRG is interested in weighty contracts with large oil and gas companies. A subsidiary of MOL Hungarian Oil & Gas PLC signed two production-sharing contracts, while India’s largest private oil company Reliance Energy and Austria’s OMV signed two additional production-sharing contracts.3

In addition, the KRG awarded four “strategic” blocks to Kurdistan Exploration & Production Co. and granted the undeveloped Khurmala oil field to Kurdistan National Oil Co.

These deals followed five oil and gas production-sharing contracts signed in early 2007.3 In total, the KRG has either opened or has pending 28 production contracts and production-sharing agreements (PSAs).3

Most of the KRG contracts are with smaller, more risk-taking firms because larger international oil companies fear censure from the central government if they participate with the KRG’s contract initiatives. Holders of the PSAs will take 15% of the profit, with the remaining 85% to be divided between Baghdad and the KRG.

However, even these small oil and gas deals drew the ire of the country’s oil ministry, which in September stated that the deals are illegal and do not have the proper legal force to go forward.4

The KRG rejects this claim and stated that it not only has the legal authority but also will continue its current talks with a number of local and international oil and gas companies.4

The KRG signed a PSA with a subsidiary of Toronto’s Heritage Oil for drilling in the Miran block and authorized another with the French oil and gas company Perenco for the Sindi-Amedi block. Frustrated by the Iraqi parliament’s slow passage of the nationwide draft oil and gas law, the KRG sought to increase its own production from several hundred thousand barrels per day to 1 million b/d in about 5 years.4

The KRG oil and gas council also has set its sights on enhancing the region’s refining capacity. In 2007, the KRG approved construction of two 20,000 b/d refineries valued at a total of $300 million. Heritage Oil will construct one in the vicinity of the Miran block area, while Addax Petroleum and Turkish partner Genel Enerji will build another in the Taq Taq oil field area.

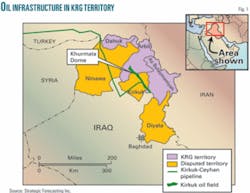

The issue of Kirkuk is central in the eyes of the KRG and is a point of contention between the federal authorities and the KRG. The Kirkuk region, which sets atop a field holding 15 billion bbl of Iraq’s estimated 115 billion bbl, falls outside of the Kurdish-administered area. A referendum will determine whether Kirkuk, and its surrounding provinces of Diyala and Ninawa, will become part of the Kurdistan region.4

Article 140 of the constitution initially recognized that the Kirkuk referendum would be held by Dec. 31, 2007. However, persistent delays and allegations of ethnic cleansing have held it back for a further 6 months.5 Control of this oil-rich governorate is a major source of friction between the KRG and Baghdad.

Baghdad reacts

Baghdad is obviously unhappy with the contracts signed between the KRG and the oil companies. In October 2007, Iraqi Oil Minister Hussain al-Shahristani stated, “[There] are many measures the federal government is thinking of taking against these companies, and one of them is to blacklist them and prevent them from working in Iraq in the future.”6 He ratcheted up the pressure on Nov. 24, 2007, by proclaiming the deals “null and void.”6

In order to counter the KRG law, and in the absence of a national oil law, he threatened to utilize Saddam-era legislation to block these deals.7 “[The] federal government’s position toward these new deals is that any contract signed without its approval isn’t considered a contract,” he said.7

The KRG responded to the oil minister’s threatened use of Saddam-era laws by stating that most of Saddam’s laws are null and void because they conflict with the new constitution.8

To add teeth to its pronouncements, federal officials declared that any contracts signed without the approval of the central authorities would be considered “smuggling.”8 Al-Shahristani contended that, under Hussein-era hydrocarbon law and the current Iraqi draft law, the state oil marketing body is the only organization authorized to export Iraqi oil. Hence exportation by any other means is “smuggling.”9

The central authorities set out the parameters by forbidding oil companies from purchasing Iraqi oil or bidding on upcoming projects in Iraq’s oil and gas sector if they’ve signed any deals with the KRG since February 2007. This date is significant as the benchmark when Baghdad and the KRG reached a temporary compromise; however, it fell apart a few months later.10

Predictably, the oil ministry sent letters to companies that have signed exploration and production agreements with the KRG, canceling any prior agreements with Baghdad.

Cancellation letters were sent to SK Energy of South Korea, OMV, and Reliance Energy, and the central authorities also cut crude exports to SK Energy.11 International Oil Daily reported that South Korea is attempting both to fulfill its need for Iraqi oil and concurrently retain the KRG contract.12 South Korea imports about 125,000 b/d and likely will make up its shortfall from neighboring countries.12

South Korea has been trying to resolve this dispute through diplomatic and political measures. KRG Prime Minister Nichervan Barzani visited South Korea to meet with its president-elect Lee Myung-Bak to reassure that all the energy deals signed were legal as per the Iraqi oil and gas regime. Further, during the meeting, Myung-Bak requested more cooperation with the KRG for expansion of oil and gas development by South Korean companies in the Kurdish region.

One of the more controversial PSAs is with US-based Hunt Oil. The territory under exploration falls outside of the Kurdistan region, in the Ninawah Governorate. This region was historically populated by Kurds, who the KRG hopes will join the region along with Kirkuk after the referendum.13 If the central government’s suspicions are true, the KRG has broader political ambitions in the control of oil and gas in disputed areas adjacent to its territory (see map).

Potential export impact

For all the rhetoric, the Kurds depend on Baghdad for the export of oil. The KRG may legally be able to sign contracts to the dismay of the central authorities, but it also needs a secure and reliable oil export route. The Kurdish region in the north is essentially landlocked in its ability to export oil.

With the central authorities in control of the southern Basra port, Umm Qasr, the Kurds must look to often hostile neighbors. An existing overland oil pipeline extends from northern Iraq to the Turkish port of Ceyhan, but Turkey has an existing contractual arrangement with Baghdadwhich also secured an agreement with neighboring countries Iran and Syriato prevent the KRG from circumventing Baghdad’s restrictive embargo on KRG oil.14

Although the Kurds could opt to smuggle the oil overland through routes in Syria or Iran in contravention of the embargo, this option would be quite risky and expensive if undertaken.15 Northern Iraq, which is thought to sit upon substantial oil reserves, must currently resort to importing or “smuggling” refined fuel from neighboring countries. This region lacks refineries, and none of the region’s oil installations is connected to Iraqi refineries for smooth export.

Moreover, Syria and Iran, which have little incentive to see a prosperous Kurdish-dominated region, have pledged their assistance to Baghdad in any potential blockade.

Many firms also would be reluctant to sign any further contracts if a legal and safe export route were not available. For example, DNO, the Norwegian oil firm, has repeatedly asked that Baghdad grant an export permit as an inducement for increased production.16

Any overland smuggling route through Turkey would most likely be blocked by Ankara as it also fears the development of a vibrant and autonomous Kurdish region, which could stir Turkey’s own restive Kurdish population.

However, the political impasse may be the ultimate force to spur compromise between the various stakeholders.17 Pressure is mounting against the KRG’s position. On Jan. 15, 2008, a majority of Iraq’s parliamentarians signed a public statement denouncing the KRG’s “unilateral” actions to sign contracts. Osama Najafi, of former Prime Minister Ayad Allawi’s secular National List party, stated at a news conference, “[There] must be a formula for maintaining the unity of Iraq and the distribution of its wealth.”

After the KRG and Hunt Oil signed a production-sharing contract in 2007, the US State Department cautioned that this collaboration hurt Baghdad’s efforts to “reconcile and rule the country.”18

Rightful jurisdiction

Which governmental level has rightful jurisdiction? Article 111 of the Iraqi constitution states that oil and gas are the property of all Iraqi people; however, Article 112 vests Baghdad with authority to manage existing fields.

The phrase, “existing field,” is not an industry-specific term; therefore, it leaves room for considerable ambiguity. Proceeds from these “existing fields” are to be shared on a per capita basis, with certain benefits given to regions that bore the brunt of Saddam’s brutality and economic exclusion.

By the simplest logic, new fields are to be managed by the regions as they see fit. The duty to allocate proceeds is also ambiguous because only Article 112 deals with proceeds and only in conjunction with existing fields, not new fields.

It appears that the KRG has a stronger legal argument because Baghdad has no jurisdiction over general exploration or production. Yet the KRG is constrained by Article 112, which declares that the central authority and the resource-rich regions will exercise joint authority to set national oil and gas policy.

At the very least it will seem that the regions must consult with central authorities in Baghdad to set a national oil policy.

Further, the KRG is limited by the practical, ground-level reality that Baghdad has the capacity to establish an embargo on oil exports from the KRG and effectively block the flow of Kurdish oil.

As this article goes to press, the parties have engaged in neither a public reconciliation nor meaningful debate. Oil and gas companies contemplating oil deals in Iraq likely will have to deal with the central authorities one way or another in order to effectively plan business strategy for exploration and production with the KRG. However, one undeniable truth remains: If this shattered land is to heal and develop its economic potential, the stakeholders will have to soon come together to resolve their differences.

References

- Iraqi constitution, Sect. 1, Article 1.

- Ibid, Sect. 1, Article 4.

- “Iraq’s Kurdish Region approves four new oil deals,” Reuters’ UK, Oct. 3, 2007, (http://uk.reuters.com/article/oilRpt/idUKL0373334120071003).

- “The KRG’s bold moves on oil,” Strategic Forecasting Inc., Nov. 30, 2007.

- Sumedha Senanayake, “Iraq: Kirkuk referendum likely to be delayed,” RFE/RL, Sept. 13, 2007.

- “Baghdad-KRG oil rift deepening,” The New Anatolian, Oct. 15, 2007. (http://www.thenewanatolian.com/tna-29281.html).

- Sumedha Senanayake, “Iraq: Baghdad, Kurds at odds of oil deals,” RFE/RL News Analysis, Nov. 30, 2007.

- “Iraqi oil minister authorized to ban Kurdistan oil exports,” KurdNet, Nov. 24, 2007.

- Kathleen Ridolfo, “Iraq: Kurds push ahead with oil contract,” RFE/RL, Nov. 12, 2007.

- Senanayake, Supra Note 14, “Iraq: Baghdad, Kurds at odds of oil deals.”

- “Iraq makes good on Kurd oil blacklist,” United Press International, Jan. 21, 2008.

- International Oil Daily, Mar. 5, 2008, and “KRG minister says new South Korean energy deal constitutional,” Kurdish Regional Government Website, Feb. 15, 2008. (http://www.krg.org/articles/detail.asp?lngnr=12&smap=02010200&rnr=73&anr=22781).

- Interview with Issam Chalabi on KRG and Hunt Oil, Middle East Economic Survey, Oct. 15, 2007.

- Senanayake, Supra Note 20, “Iraq makes good on Kurd oil blacklist.”

- “Kurdish struggle for Iraq’s oil,” BBC News, Jan. 3, 2007, (http://news.bbc.co.uk/2/hi/business/6211853.stm).

- “DNO: Iraqi Kurd oil needs export route,” United Press International, Feb. 21, 2008.

- “Iraq factions join against Kurd oil deals,” United Press International, Jan. 15, 2008.

- “Analysis: Hunt, State talked on Iraq oil,” United Press International, Oct. 12, 2007.

The author

Justin Dargin ([email protected]) specializes in the study of international law and energy law and is a prolific author on energy affairs. He trained at Owens Corning global headquarters in the international legal department for adherence to the Energy Policy Act of 2005 and for compliance with the Patriot Act provisions. He also completed training in the legal department at the Organization of Petroleum Exporting Countries (OPEC), where he advised senior staff as to the implications of European Union and American law in multilateral relations. He served as a researcher at the Oxford Institute for Energy Studies, where he studied Middle Eastern gas issues, and pioneered the first major work on transnational gas trade in the form of the Dolphin Project. His most recent major publication is “The Dolphin Project: The Development of a Gulf Gas Initiative” Oxford Institute for Energy Studies Working Paper No. 22 (Jan. 2008). Dargin holds a BBA in management and information systems from the University of Michigan and a JD from Michigan State University. He also studied international petroleum law at the American University in Cairo. He is a member of the Association of International Petroleum Negotiators and a founder and director of the International Institute of Ideas (Interintel), a not-for-profit organization dedicated to facilitating informational exchange between academia and the business sector. Fluent in Spanish, English, and Arabic, he is a frequent presenter on the lecture circuit in matters relating to oil and energy.