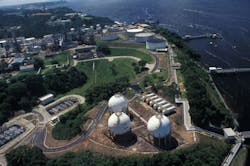

Petróleo Brasileiro SA (Petrobras) has completed divestment of its 46,000-b/d Isaac Sabbá refinery (REMAN)—including a storage terminal—in Manaus, Amazonas, to Atem's Distribuidora de Petróleo SA (Atem) subsidiary Ream Participações SA (OGJ Online, Aug. 26, 2021).

Ream Participações finalized its acquisition of the refinery and related logistics assets on Nov. 30 with a payment to Petrobras of $ 228.8 million, which is in addition to $28.4 million the new owner previously paid as a security deposit upon signing of the purchase and sale agreement in August 2021, Petrobras said.

While a final adjustment to the overall $257.2-million transaction price remains to be determined in the coming months, with the sale now officially concluded, Petrobras confirmed it has started work under a previously negotiated service agreement to offer ongoing support to Ream Participações for a period of up to 15 months to help avoid any operational interruptions at the refinery.

Closing of the sale follows Petrobras’s warning earlier this year the original timeline for the proposed transaction could be delayed amid a March order from Brazilian regulator Administrative Council for Economic Defense (CADE) requiring execution of additional diligence activities involving further analyses of REMAN’s operations, including the refinery’s effects and possibly competitive impacts on the downstream refining market (OGJ Online, May 16, 2022; Mar. 10, 2022).

The REMAN divestment follows Petrobras’ early November sale of its 5,800-tonne/day Unidade de Industrialização do Xisto (SIX) unit—including a mine in one of the world’s largest oil shale reserves and a shale processing plant—in São Mateus do Sul, Paraná, to Forbes Resources Brazil Holding SA (F&M Brazil), a subsidiary of privately-held Forbes & Manhattan Resources Inc. (F&M), Toronto, Ont. (OGJ Online, Nov. 7, 2022).

Sales of SIX and REMAN—alongside a still-pending transaction for the 10,400-b/d Lubrificantes e Derivados de Petróleo do Nordeste (LUBNOR) refinery in Fortaleza, Ceará, and a completed sale of the 333,000-b/d Refinaria Landulpho Alves (now renamed Refinaria de Mataripe) refinery in São Francisco do Conde in the Recôncavo Baiano region of Bahia—come as part of Petrobras’ broader downstream divestment program initiated under a June 2019 agreement between Petrobras and CADE governing the operator’s ongoing plan to divest most of its Brazilian refining and related logistics assets, as well as the opening of Brazil’s refining sector to promote increased competitiveness and transparency (OGJ Online, June 17, 2019).

The downstream divestments additionally support the operator’s portfolio management strategy and improved allocation of its capital, the company said.

Ongoing divestments

In August, Petrobras started the nonbinding phase in its program to sell three of its Brazilian refineries and associated logistics assets, the sales of which were previously delayed to accommodate revisions to divestment plans for each of the sites, which include the 130,000-b/d Refinaria Abreu e Lima (RNEST) refinery; 208,000-b/d Refinaria Presidente Getulio Vargas (REPAR) refinery; and 208,000-b/d Refinaria Alberto Pasqualini (REFAP) refinery (OGJ Online, Aug. 22, 2022).

Restart of sale processes for the refineries follows a series of delays to the divestment cycle in 2021 resulting from a mix of issues involving unqualified buyers expressing interest in the assets, qualified buyers failing to submit binding bids for the sites, and initial binding proposals falling short of Petrobras' economic-financial evaluation for the assets (OGJ Online, Oct. 1, 2021).

Located in Ipojuca, Pernambuco, in northeast Brazil and representing 5% of the country’s total refining capacity, the RNEST refinery —which has the potential to double its capacity to 260,000 b/d with startup of a second 130,000-b/d processing train—includes a terminal with crude and product storage capacities of 4.706 million bbl and 5.496 bbl, respectively, as well a 101-km set of short pipelines.

Located in Araucária, Paraná, in southern Brazil and representing 9% of the country’s total refining capacity, the REPAR refinery—which caters mainly to the local markets of Paraná, Santa Catarina, São Paulo, and Mato Grosso do Sul—includes five terminals equipped to store 3.472 bbl of crude and 6.034 bbl of finished products. Logistics infrastructure assets involved in the sale also will include a 476-km pipeline network.

Located in Canoas, Rio Grande do Sul, in southern Brazil and representing 9% of the country’s total refining capacity, the REFAP refinery—which caters mainly to the local markets of Rio Grande do Sul, Santa Catarina, and Paraná—includes two terminals with crude and product storage capacities of 3.652 million bbl and 5.820 million bbl, respectively, as well as a set of pipelines totaling 260 km.

A definitive timeframe for the nonbinding phases for the proposed sales, however, has yet to be revealed.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.