Permian gas processors advance projects, complete capacity expansion programs

Operators in the Permian basin are proceeding with plans to expand cryogenic natural gas processing capacity in the region despite the downturn in market demand and pricing of global oil prices resulting from the coronavirus (COVID-19) pandemic.

While operators have indicated they will continue to monitor spending amid unsettled market economics during the ongoing health crisis, none have yet to confirm either cancellation or delays of announced gas plant capacity expansion projects in the Permian. Many operators with major holdings in the region already have completed, or are nearing completion of, planned capacity additions.

This article examines proposed major Permian gas processing capacity projects already under way and provides a brief update on recent additions to operable processing capacity in the region.

Major projects on deck

In its May 8 first-quarter 2020 earnings call with investors, EnLink Midstream LLC said it is continuing construction without interruption on Delaware G&P LLC’s (Delaware Basin JV) 200-MMcfd Tiger natural gas processing plant in Culberson County, Tex., in the Delaware basin, which remains on track to become operational second-half 2020 (OGJ Online, Feb. 26, 2020). Delaware Basin JV is a joint venture of EnLink (50.1%) and NGP Natural Resources XI LP (49.9%).

While EnLink plans to experience notably lower well-connect activity in both Delaware and Midland basins for a number of months as producers adjust production levels, the company said Tiger plant’s operations are underpinned by ExxonMobil Corp.’s active four-rig drilling program at its Corral Canyon development, plans which ExxonMobil has reaffirmed will not change despite the current market environment.

As part of its response to the COVID-19 health crisis, EnLink also informed investors it was reducing total capital expenditures for the remainder of 2020 to $190–250 million from a previous guidance of $315-425 million. The operator, however, will dedicate 62% of the revised budget to ongoing Permian projects, including completion of the Tiger plant, on which it will spend $60 million this year. While EnLink did not specify other Permian projects included in the updated 2020 spending plans, a series of expansion and debottlenecking projects to add 70 MMcfd of gas processing to its Midland basin operations are presumably advancing.

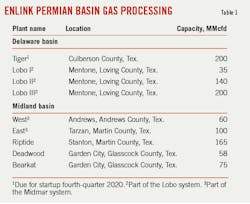

Upon completion of the Tiger plant, expected fourth-quarter 2020, EnLink’s Permian natural gas processing capacity—including a 55-MMcfd first-quarter 2020 expansion to its Riptide plant in Stanton, Martin County, Tex.—will be about 1.1 bcfd, the operator said.

EnLink’s existing Permian gas processing capacity includes the Delaware Basin JV-owned Lobo system in Delaware basin and the multiplant Midland Energy Gathering Area (MEGA) system in Midland, Martin, and Glasscock Counties, Tex., among others, in Midland basin (Table 1).

Targa Resources Corp. confirmed in early May 2020 that it is proceeding with construction of its new gas processing plant in Midland basin. Located in Reagan County, Tex., the 250-MMcfd Gateway plant remains on schedule for commissioning in second-half 2020. The operator, however, revised its projected capital spending for the remainder of 2020 to $700-800 million—40% lower than its initial 2020 guidance—as part of measures to weather expectations of lower growth and business activity resulting from COVID-19’s impacts to market prices and demand.

Targa completed construction of two new 250-MMcfd gas processing plants in Delaware basin—the Falcon and Peregrine plants, both in Culberson County, Tex.—in third-quarter 2019 and second-quarter 2020, respectively. By the end of fourth-quarter 2020, following startup of the Gateway plant, Targa expects its total gross Permian gas processing capacity to rise to 3.7 bcfd, the company said in a May 20 presentation.

Table 2 shows an overview of capacities at existing and planned Targa-operated Permian gas plants.

Recent capacity additions

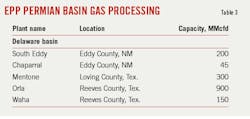

Enterprise Products Partners LP (EPP) completed its 300-MMcfd Mentone cryogenic natural gas processing plant in Loving County, Tex., in Delaware basin during first-quarter 2020 (OGJ Online, Jan. 21, 2020). Commissioning of Mentone plant marks the seventh Delaware basin gas plant in which the operator holds interest, bringing the company’s total capacity in the Permian basin to more than 1.6 bcfd of natural gas processing (Table 3).

Startup of the Mentone plant followed 2016 commissioning of the EPP-operated 200-MMcfd South Eddy plant in Eddy County, NM, as well as the 150-MMcfd Waha gas plant, owned by the EPP-Occidental Petroleum Corp. joint venture Delaware Basin Gas Processing LLC (OGJ Online, May 20, 2016). In 2019, EPP also commissioned the full buildout of its three-train Orla gas processing plant in Reeves County, Tex., which has a total processing capacity of 900 MMcfd (OGJ Online, July 9, 2019).

EPP on Apr. 29 slashed its guidance for total 2020 growth capital investments by about $1 billion to $2.5-3.0 billion and guidance for 2020 sustaining capital expenditures by about $100 million to $300-400 million from its original 2020 budget and has not announced plans to add further gas processing capacity in the Permian to date.

MPLX LP subsidiary MarkWest Tornado GP LLC commissioned its 200-MMcfd Tornado plant in Loving County, Tex., in fourth-quarter 2019, MPLX said in its 2019 annual report to investors released in 2020. The Tornado plant was part of definitive agreements with Kaiser Francis Oil Co. to provide gathering and processing services in the Delaware basin (OGJ Online, July 27, 2018) and is joined to MPLX’s existing 200-MMcfd Hidalgo and 200-MMcfd Argo plants in Culberson County, Tex., by a high-pressure gathering system.

MPLX also told investors in early 2020 that its 200-MMcfd Preakness plant in the Delaware basin remained under construction and was scheduled to enter service during second-quarter 2020. The company told investors it also plans to build the 200-MMcfd Apollo gas processing plant in the Delaware basin. While further details regarding Apollo’s future have yet to be disclosed, the plant was scheduled for commissioning sometime in 2021, as of a June 2019 MPLX presentation.

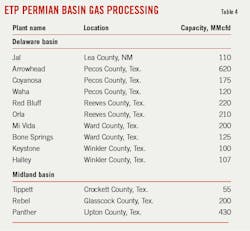

Energy Transfer Partners LP (ETP) completed its buildout of Permian gas processing capacity in January 2020 with startup of its 200-MMcfd Panther II plant in the Midland basin, the operator said in a March 2020 investor presentation. The plant’s commissioning brings ETP’s total Permian gas processing capacity to 2.7 bcfd, including its 50% interest in Mi Vida JV LLC’s 200-MMcfd gas plant in Ward County, Tex., and 50% ownership in Ranch Westex JV LLC’s 125-MMcfd Bone Springs gas plant, also in Ward County (Table 4).

Elsewhere in the region, Altus Midstream Co.—which owns substantially all gas gathering, processing, and transportation assets servicing Apache Corp.’s production in Delaware basin’s Alpine High play—completed startup of all three cryogenic natural gas processing trains at its 600-MMcfd Diamond Cryo Complex (DCC) in Alpine High, in southern Reeves County, Tex. (OGJ Online, Jan. 31, 2020).

Commissioned over phases beginning in May 2019, each of the DCC’s 200-MMcfd processing trains—which are equipped with Honeywell UOP LLC’s proprietary Ortloff supplemental rectification with reflux (SRX) technology—are in operation. In the new technology’s first application Ortloff SRX recovered more than 99% of ethane and 100% of propane in ethane recovery mode, and more than 99% propane in ethane rejection mode at design capacity.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.