Egypt advances major downstream modernization program

Egypt’s Ministry of Petroleum & Mineral Resources (MOPMR) is advancing a number of downstream projects as part of its petroleum sector modernization program (PSMP), an integrated plan developed in 2016 as part of Egypt’s strategy to reignite investment interest in its petroleum industry following sharp declines in activity in the aftermath of the country’s 2011 revolution.

While PSMP includes seven pillars covering the entirety of Egypt’s petroleum value chain—all of which support the country’s broader goal of transforming itself into a strategic hub for global oil and gas trade—the program’s downstream performance and energy efficiency pillar focuses on projects to develop, upgrade, further integrate, and maximize use of existing state-owned refining, petrochemical, gas processing, transportation, and distribution operations to cope with ever-increasing domestic demand.

Objectives of the program include increasing productivity and profitability related to production and distribution of petroleum products, lowering production costs at manufacturing sites, and reducing imports from abroad. PSMP’s downstream pillar—the core of which hinges on enhancing energy efficiency across the sector, in line with Egypt’s Vision 2030 for sustainable development—proposes to expand domestic refining capacity by 3 million tonnes/year.

This article—based on MOPMR’s latest update on PSMP’s downstream modernization program issued in early 2020, as well as information from service providers and financial institutions supporting the program—outlines major projects currently proposed, under way, and recently completed at Egypt’s state-run refining and petrochemical manufacturing sites.

PSMP downstream

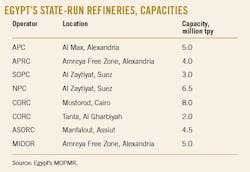

Of Egypt’s nine major refineries, eight refineries with a combined total crude processing capacity of 38 million tpy are held—directly or indirectly—by state-owned Egyptian General Petroleum Corp. (EGPC) through a series of operating subsidiaries (see accompanying table).

Devised to ensure the long-term competitiveness of Egypt’s refining and petrochemical operations in the global market, MOPMR’s PSMP downstream pillar—which applies to these eight sites—includes an aggressive program of projects involving developing and upgrading existing production units, revamping security and safety systems, and removing current bottlenecks.

Major projects involve adding new conversion units to convert low-value fuel oil into high-value petroleum products required by the local market, as well as specialized refining units to increase domestic production of products such as gasoline and LPG that comply with international quality standards.

Most importantly, however, the program envisages construction of a grassroots refinery to expand state-owned domestic crude processing capacity to 41 million tpy.

Completed projects

In November 2016, Assiut Oil Refining Co. (ASORC) commissioned a grassroots 400,000-tpy vapor recover unit (VRU) at its refinery in Assiut, about 400 km south of Cairo (Fig. 1). Designed to help meet rising demand for petroleum products in Upper Egypt and executed by Engineering Co. for Petroleum & Chemical Industries (ENPPI), the £187-million project increased the refinery’s production of LPG by about 18,000 tpy and of stabilized naphtha by about 382,000 tpy, MOPMR said. The VRU project was intended to recover 97% of butanes to produce 80,000 tpy of on-spec LPG, according to ENPPI, which served as main contractor on the project.

At its refinery in Amreya Free Zone, Alexandria, Middle East Oil Refining (MIDOR) in January 2017 commissioned a grassroots preflash tower to decrease vapor load at the crude-fired heater of the refinery’s main crude-vacuum distillation unit. Adding the tower boosted processing capacity to 115,000 b/d from the refinery’s nameplate of 100,000 b/d when processing crudes having varying API gravities (Fig. 2). The $18.5-million project has enabled the refinery to produce 21,000 tpy of LPG, 60,000 tpy of high-octane gasoline, 205,000 tpy of jet fuel, and 250,000 tpy of gas oil, according to MOPMR, MIDOR, and ENPPI, served as project contractor.

In April 2017, Amreya Petroleum Refining Co. (APRC) completed a revamp of the phenol extraction unit at the lube oil complex of its Amreya refinery, converting it to using a more environmentally friendly solvent as a substitute for phenol when treating aromatics and increasing the unit’s extraction and production efficiencies. The £600-million project increased feed capacity of the unit to 283,840 tpy from 250,000 tpy, and increased production of lube oils by 21,800 tpy and waxes by 15,400 tpy, MOMPR and APRC said.

In related fuel-production projects under PSMP, EGPC’s indirectly held Alexandria National Refining & Petrochemical Co. (ANRPC)—which operates an integrated manufacturing site in Alexandria that includes naphtha hydrotreating, splitting, isomerization, platforming, reforming, and recovery units for production of high-octane gasoline to serve the local market—completed a project in September 2018 that added a second Honeywell UOP LLC proprietary continuous catalyst regeneration (CCR) platforming unit, including a modular CCR section, increasing gasoline production (Fig. 3).

The project was designed to enable processing of 605,000 tpy of heavy naphtha previously exported and produce 560,000 tpy of high-octane reformate feedstock, according to ANRPC and contractor ENPPI. Undertaken at a cost of about $219 million, the project has equipped the site to produce an additional 700,000 tpy of high-octane gasoline, 10,000 tpy of LPG, and 33,000 tpy of hydrogen, MOMPR said.

Though a nonstate entity, Egyptian Refining Co. (ERC) in late 2019 commissioned its long-delayed grassroots hydrocracking unit built within state-held Cairo Oil Refining Co.’s (CORC) existing Mostorod refining, 20 km northeast of Cairo (OGJ Online, Nov. 11, 2019). All the units at ERC’s refinery are now operating and scheduled to ramp up to full production before the end of first-quarter 2020, said Qatar Petroleum, owner of 38.1% of Arabian Refinery Co., which in turn owns 66.6% of ERC.

While not a direct PSMP project, the $4.4-billion unit—which will process about 4.7 million tpy of mainly atmospheric residue feed from the adjacent CORC refinery to produce Euro 5-quality products, such as diesel and jet fuel, for consumption primarily in Cairo and surrounding areas—directly supports Egypt’s plans to increase the resilience of its domestic hydrocarbon supply chain and reduce dependence on imports, Qatar Petroleum said. According to MOMPR, the new complex will produce about 2.3 million tpy of diesel, 522,000 tpy of reformate, 79,000 tpy of LPG, 599,000 tpy of jet fuel, 315,000 tpy of fuel oil, 366,000 tpy of light naphtha, 96,000 tpy of sulfur, and 453,000 tpy of coke.

Ongoing, planned projects

To help meet Upper Egypt’s demand for petroleum products, ASORC is executing a $450-million project at its Assiut refinery to increase high-octane gasoline production by 800,000 tpy. Scheduled for completion in April 2020, the project will also boost production of LPG by 23,000 tpy and hydrogen-rich gases by 34,000 tpy, according to MOMPR.

ASORC also recently let a contract to a consortium of ENPPI, Petroleum Projects & Technical Consultation Co. (Petrojet), and TechnipFMC PLC for construction of a grassroots hydrocracking complex at Assiut (OGJ Online, Feb. 20, 2020). ENPPI will deliver detailed engineering, procurement, construction (EPC), precommissioning, commissioning, and start-up tests for the complex’s vacuum distillation unit, distillate hydrotreating unit, sulfur recovery unit, and sulfur solidification unit. Once completed, the $2.5-billion hydrocracking complex will process 2.5 million tpy of heavy fuel oil (mazut) from ASORC’s nearby refinery to produce about 2.8 million tpy of Euro 5-quality diesel and other high-value products to help meet regional product demand and reduce the country’s reliance on imports. Alongside Euro 5-quality diesel, ENPPI and MOPMR said the new hydrocracking complex—scheduled for startup in 2022—also will produce 360,000-400,000 tpy of naphtha, 91,000-101,000 tpy of LPG, 331,000 tpy of coke, and 57,000-66,400 tpy of sulfur.

At its Al Max refinery in Alexandria, EGPC’s Alexandria Petroleum Co. (APC) is finalizing work on converting the refinery’s furfural phenol extraction unit to a more environmentally friendly solvent. The £365.5-million project, which is currently in precommissioning and scheduled for full completion by the end of first-quarter 2020, will increase production of lube oil by 10,000-16,000 tpy and waxes by 1,000-2,000 tpy, MOMPR said.

EGPC’s MIDOR also is proceeding with a project to further expand the crude processing capacity of its 115,000-b/d Amreya refinery to 160,000 b/d (OGJ Online, Mar. 5, 2019). As main contractor on the project, TechnipFMC’s scope of work includes debottlenecking existing units and delivering new units, including a crude distillation unit (CDU), vacuum distillation unit (VDU), and a hydrogen production plant based on proprietary steam reforming technology, as well as various process units, interconnecting off-sites, and utilities. Scheduled to be completed in first-quarter 2022, the $2.3-billion project will boost the refinery’s production of high-octane gasoline by 600,000 tpy, diesel by 1.3 million tpy, LPG by 145,000 tpy, coke by 226,000 tpy, and sulfur by 65,000 tpy, according to MOMPR.

EGPC subsidiary Suez Oil Processing Co. (SOPC) is executing a multitiered energy efficiency and upgrade program to modernize the existing delayed coking complex, replace the existing VDU, add a new distillate hydrotreating unit to replace two existing units, add a grassroots VRU, and build a new asphalt production plant based on a VDU system at its refinery about 3 km west of Suez, at the entrance of the Suez Canal, according to MOMPR and the European Bank for Reconstruction and Development (EBRD). EBRD is providing loan support for the projects (Fig. 4).

As currently planned, the coker complex refurbishment project will involve installation of a new delayed coking unit with all supporting units to replace existing units at the complex, ERBD said. Alongside ensuring more stable production, cutting plant outage periods, and reducing energy demand, the revamp would return the complex to its initial design capacity of 5,000 tonnes/day, ERBD said. The project—which will involve replacing the complex’s old six-drum coker design with a modern two-drum unit with key improvements in coke processing, off-gas utilization, and final coke storage—would allow the refinery to maximize production of Euro 5-quality diesel, gasoline, and LPG to meet growing domestic demand. An associated VRU also would be built as part of the project to help reduce hydrocarbon emissions from flaring and improve production yields. At an estimated cost of $589 million, the coker revamp project is scheduled for start of construction in November 2021, according to MOMPR.

Also scheduled to break ground in fourth-quarter 2021 is SOPC’s $68.5-million project to add a 726,000-tpy VDU asphalt plant, removing lighter fractions from residues of the refinery’s existing CDU, and enabling improved processing of heavy-end feedstock fractions from both SOPC’s CDU and that of state-owned Nasr Petorleum Co.’s (NPC) nearby Suez refinery. Once completed, SOPC’s VDU asphalt plant will produce 396,000 tpy of asphalt and 323,000 tpy of vacuum gas oil, MOMPR said.

While EBRD referenced the addition of a new main VDU and distillate hydrotreater to be included as part of SOPC’s planned coker revamp and VDU asphalt plant projects in a Jan. 29, 2020, prequalification invitation to potential service companies for work on the projects, further details regarding the scope of these units have yet to be made available. The financier, however, did confirm the combined projects would reduce SOPC’s greenhouse gas emissions and water demand by 289,000 tpy and 385,000 cu m/year, respectively.

In a related project to take advantage of surplus and undeveloped production of fuel oil by NPC and SOPC refineries by processing it into high-quality petroleum products, MOMPR said state-run Red Sea National Co. for Refining and Petrochemicals (RSNCRP)—established in 2019—is developing a $2.75-billion, 2.5 million-tpy hydrocracking and gasoline production complex in Suez. While further details regarding RSNCRP and its activities remain unavailable, MOMPR said the complex is scheduled to be completed in January 2022.

Grassroots integrated complex

As part of MOMPR’s plan to boost Egypt’s state-owned crude processing capacity, Egyptian Petrochemicals Holding Co. (ECHEM) signed a heads of agreement (HOA) in February 2020 with Bechtel Corp. for execution of EPC on a proposed integrated refining and petrochemicals complex to be built in the Suez Canal Economic Zone (SCZone). As part of the HOA, Bechtel also will assist in facilitating financing for the project from financial institutions, a Bechtel spokesperson told OGJ (OGJ Online, Feb. 14, 2020). While Egyptian media reported an overall cost of the proposed project of $6.7 billion, project documents from MOMPR indicate a cost of $6.2 billion.

Designed to help meet increased demand for transportation fuels and petrochemical products on Egypt’s domestic market as well as create opportunity for possible exports abroad, the integrated refining complex—if realized—would be equipped to process 2.7-3.2 million tpy of crude oil to produce 900,000 tpy of petroleum products and 1.2-1.9 million tpy of petrochemical products, according to MOPMR. Details regarding precise location of the complex or a time for its development have yet to be released.

Petrochemical plans

MOPMR has emphasized petrochemicals as one of the most important strategic industries to meet Egypt’s growing need for derivative products in different segments of the economy. State-owned companies are developing several new projects aimed at maximizing petrochemical production.

In February, Egyptian Natural Gas Co. (GASCO) let a contract to a consortium of ENPPI and Petrojet under which the partners will deliver EPC services for the expansion of GASCO’s Western Desert Gas Complex (WDGC) in Amreya, Alexandria (OGJ Online, Feb. 20, 2020). The project includes construction of WDGC’s proposed Train D, the complex’s fourth production train. Train D will have a capacity of 600 MMcfd, lifting WDGC’s overall throughput to 1.5 bcfd from 950 MMcfd.

Alongside increasing output of ethane-propane mixture as feedstock to supply Egyptian petrochemical producers—including Egyptian Ethylene & Derivatives Co.’s (Ethydco) 460,000-tonnes/year and Sidi Kerir Petrochemicals Co.’s (Sidpec) 300,000-tpy ethylene and derivatives complexes in Alexandria—the expansion also will increase WDGC’s production of LPG and condensates for local consumption. The project additionally will increase WDGC’s production of commercial propane to be used as feedstock for the first phase of Sidpec’s $1.6-billion, 450,000-tpy polypropylene plant currently under construction and scheduled to be completed by second-quarter 2022 (OGJ Online, Sept. 25, 2018).

Commissioned in 2000, WDGC—which receives and treats Western Desert gases from Badr El-Din Petroleum Co.’s Al-Obayed and Khalda Petroleum Co.’s Salam, Tarek, and El-Qaser fields—is Egypt’s first NGL plant to produce ethane-propane mixture as feedstock for Egypt’s petrochemicals industry, as well as commercial propane (OGJ Online, Jan. 28, 2008). In August 2016, Ethydco officially commissioned its $1.9-billion Alexandria complex, which uses an ethane-propane mixture it receives from WDGC as feedstock to produce 460,000 tpy of ethylene, high-density and low-density polyethylene, butadiene, and other derivatives to meet domestic demand (Fig. 5).

Ethydco also is executing a $180-million project to produce 36,000 tpy of polybutadiene based on a feedstock of 20,000 tpy of butadiene sourced from its own and Sidpec’s operations. The project is scheduled for startup in fourth-quarter 2021, according to MOMPR.

Finally, MOMPR is evaluating a project to construct a new integrated refining and petrochemical complex at New Al-Alamein City on Egypt’s northwestern coast, near Marsa Matrouh governorate. The complex would have crude and condensate processing capacity of 2.5 million tpy for production of a variety of high-quality fuels and petrochemical products to meet local demand, with any surplus exported. via the Al Hamra terminal near the Mediterranean Sea, according to the ministry. The $8.5-billion project, if realized, would be completed by yearend 2024, MOMPR said, and supplied by Western Desert crude.

About the Author

Robert Brelsford

Downstream Editor

Robert Brelsford joined Oil & Gas Journal in October 2013 as downstream technology editor after 8 years as a crude oil price and news reporter on spot crude transactions at the US Gulf Coast, West Coast, Canadian, and Latin American markets. He holds a BA (2000) in English from Rice University and an MS (2003) in education and social policy from Northwestern University.