US ethylene producers poised to dominate global market

Dan Lippe

Petral Consulting Co.

Houston

Feedstock prices, coproduct values, and ethylene plant yields determine ethylene production costs. Petral Consulting maintains direct contact with the olefin industry and tracks historic trends in spot prices for ethylene and propylene. We use a variety of sources to track trends in feedstock prices. Some ethylene plants have the necessary process units to convert all coproducts to purity streams. Some ethylene plants, however, do not have the capability to upgrade mixed or crude streams of various coproducts and sell some or all their coproducts at discounted prices. We evaluate ethylene production costs in this article based on all coproducts valued at spot prices. |

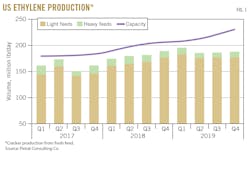

US olefins producers made major progress in 2019 transitioning to a dual focus on domestic and international ethylene markets. At yearend 2016, US nameplate capacity was 64.3 billion lb/year. The transition to international dominance began in 2017 when the first of three waves of new capacity came on stream. In the 2017 first wave, capacity increased 4.75 billion lb for a yearend capacity gain of 69 billion lb/year. In the 2018 second wave, capacity increased 6 billion lb to 75 billion lb/year by yearend. The third wave in 2019 was the largest, increasing operating capacity by 10.75 billion lb for a yearend US capacity of 86 billion lb/year. While a reasonable observer might expect US producers to take a break after such sharp gains, about 8-10 billion lb/year of additional capacity is scheduled to come on stream by 2023.

In 2014-16, the industry operating rate averaged 91.8%, and some producers operated capacity at 100% of nameplate capacity for months at a time. Operating rates were somewhat lower in 2017-19, averaging 89.3%. In the past 35 years (1984-2019), the industry’s operating rates for any 3-year period averaged less than 85% only twice (2005-07, 2008-10). One measure of the industry’s success, as defined by avoiding an extended period of weak operating rates (80-82%), is sustained growth in derivatives exports, with polyethylene exports of paramount importance.

Export terminal startup

Enterprise Products Partners LP (EPP) and Navigator Holdings Ltd. completed construction of the first merchant ethylene export terminal and loaded the first monomer export cargo in late December 2019 from their 50-50 joint venture marine terminal at Morgan’s Point, Tex., along the Houston Ship Channel (OGJ Online, Jan. 8, 2017). This terminal provides US producers with another mechanism for maintaining a balanced ethylene market in the USGC, helping producers avoid accumulation of surplus inventory and minimizing extended periods of weak prices and profit margins such as occurred in 2019. The terminal’s nameplate capacity will enable US ethylene producers to increase monomer exports to 5-7 million lb/day from 1-2 million lb/day.

Ethylene production

Petral Consulting Co. tracks US ethylene production via a monthly survey of operating rates and feed slates. In 2019, US ethylene production was nearly constant at 183-189 million lb/day during March-August. Within this 6-month period, production averaged 187 million lb/day, 7.9 million lb/day more than in the same timeframe in 2018.

During the last 4 months of 2019, producers increased output to 189-202 million lb/day for an average production of 195 million lb/day. On a year-over-year basis, production in September-December was 9.7 million lb/day more than 2018. Integrated ethylene producers increased polyethylene exports in 2019 by about 9.5 million lb/day vs. the previous year. While producers accumulated substantial ethylene inventory in 2018 in anticipation of smooth startups for all new polyethylene plants, during second-half 2019 producers liquidated inventory at rates of 8-9 million lb/day. The uptick in production in September-December is an early indication that inventory liquidation rates were about half as much as in the second and third quarters.

Regionally, however, production rates were more variable. Operating rates for Texas plants were 88% in third-quarter 2019 and 87% in the fourth quarter, with an average production of 135 million lb/day. Production from Louisiana plants increased to 48.7 million lb/day in third-quarter 2019 and 53 million lb/day in the fourth quarter. Operating rates for Louisiana plants were 80% in the third quarter before falling to 78% in the fourth quarter (Table 1).

Fig. 1 shows trends in ethylene production.

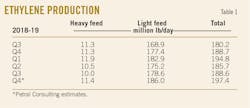

Ethylene production costs

Ethylene production costs are determined by raw material costs and coproduct credits. Based on variations in yield patterns for the various feeds, coproduct volumes vary widely between the three categories of plants (ethane-only, LPG-only, and multifeed plants). Raw material costs are determined by each feedstock’s price and its conversion to ethylene. Similarly, coproduct credits are determined by spot prices and production volumes for each coproduct but only for those plants that upgrade all coproduct streams to meet purity specifications.

A few ethylene plants can upgrade all coproducts to purity streams and sell all coproducts at market prices. Most ethylene plants produce purity coproduct propylene but produce all other coproducts as mixtures (mixed butylene-butadiene and mixed aromatics) and sell mixtures at discounted prices. Variations in realized revenue for coproducts result in large differences in coproduct credits from one plant to another. Cash production costs are determined by simple addition of raw material costs and coproduct credits (see italicized note at the beginning of the article).

Crude oil prices are generally a strong influence on prices (directly or indirectly via the value of one feedstock as a substitute for another) for most feedstocks and coproducts. In second-half 2019, however, supply-demand considerations were the dominant influences on light feed prices. While light feeds (ethane, propane, butane) historically always accounted for 80% or more of fresh feed, since 2018 these feeds have accounted for 90-95% of fresh feed. US ethylene producers will continue to take advantage of low-cost light feedstocks.

Purity ethane prices were 17.5¢/gal in third-quarter 2019 and 18.5¢/gal in the fourth quarter to average 18¢/gal in second-half 2019. Ethane pricing in second-half 2019 was 7.3¢/gal (29%) less than the first half of the year. With ethane supply chronically surplus since 2014, inventory remained plentiful.

While ethane has always been an important feedstock, it is now critical for continued growth in US ethylene capacity. Statistics from the US Energy Information Administration (EIA) show throughput rates for gas plants in the New Mexico-Texas region increased 10-12 bcfd in 2010-19. Petral Consulting estimates midstream companies increased gas processing capacity by 7-9 bcfd during 2015-19. New plants are generally designed to use state-of-the-art technology for considerably higher ethane-recovery capability than older plants. As the midstream industry increased total gas processing capacity in this New Mexico-Texas key region, Petral Consulting estimates effective ethane-recovery capability increased 15-20%.

Petral Consulting routinely updates estimates for ethane rejection. Ethane prices were persistently weak during second-half 2019, and midstream companies increased ethane rejection in New Mexico-Texas to 250,000-300,000 b/d in July-October 2019 from 180,000 b/d in first-half 2019. During third-quarter 2019, midstream companies reduced ethane recovery by only 60,000 b/d. Unrecovered ethane supply from New Mexico-Texas gas plants alone (a low-cost supply source) is sufficient to meet demand from the equivalent of three new plants that will bring on 25-30 million lb/day of additional ethylene production.

While propane supply for USGC ethylene producers has been plentiful for several years, midstream companies added enough new LPG export terminal capacity and waterborne exports increased enough to keep pace with supply growth until second and third-quarters 2019. Terminal capacity was not a constraint; instead, global demand for LPG feed and storage capacity in Europe became the limiting factors. As a result, exports did keep pace with US supply growth, and inventory in USGC storage increased 29 million bbl, or 10 million bbl more than the 3-yr average. By October 1, inventory was 20 million bbl more than in the previous 2 years. US exports to Europe also increased to a record high in the second and third quarters filling Northwest Europe’s LPG storage facilities by early August.

Propane prices in Mont Belvieu, Tex., slumped in second-half 2019, crashing to 40¢/gal in August from a first-quarter average of 67¢/gal. Spot prices in second-half 2019 were 14¢/gal (23%) less than the previous 6 months. Spot prices for normal butane were also weaker at 59¢/gal in second-half 2019 vs. 72¢/gal in first-half 2019.

Cash production costs for purity ethane were 8.9¢/lb in third-quarter 2019 and 10.5¢/lb in the fourth quarter to average 9.7¢/lb for second-half 2019, or 3¢/lb (24%) less than first-half 2019. Cash production costs for propane were 6¢/lb in the third quarter and 7¢/lb in the fourth quarter for a second-half 2019 average of 6.5¢/lb, 8.6¢/lb (57%) less than the first half of the year. All light feeds maintained substantial cost advantages vs. light naphtha throughout second-half 2019.

Table 2 shows production costs for major ethylene feedstock.

Ethylene pricing, profit margins

Pricing data published by OPIS PetroChem Wire showed spot ethylene prices recovered in second-half 2019. Prices at Nova Chemical Corp.’s hub in Mont Belvieu fell to 13-14¢/lb in the second quarter before rebounding to 14-24¢/lb in the third quarter and 17-25¢/lb in the fourth quarter. Spot prices averaged 19¢/lb in third-quarter 2019 and 21¢/lb in the fourth quarter.

After eight consecutive quarters (second-quarter 2017 through first-quarter 2019) of surplus inventory, producers, buyers, and traders were accustomed to transacting spot deals in a persistently weak price environment. During second and third-quarters 2019, however, ethylene producers and buyers liquidated about 1.5 billion lb of inventory. As inventory declined and the threat of a surge in ethylene exports loomed, traders with substantial short interest encountered difficulty covering large short positions. During September-November, spot prices at Nova Hub were 21-25¢/lb, 60-86% higher than the second-quarter average. Monthly reports from OPIS PetroChem Wire showed the volume of spot market transactions (fixed price trades only) in second-half 2019 accounted for about 2% of USGC production. In 2015-17, trading volumes equaled about 4-5% of production.

Net transaction prices (NTP), the basis for ethylene supply contracts and internal transfer price agreements, are more important than spot prices. In second-half 2019, negotiated settlements for NTP increased for 4 consecutive months (July-October) but slipped to 27¢/lb in December. NTP averaged 26.4¢/lb in the third quarter and 28.75¢/lb in the fourth quarter, and carried a 7-9¢/lb premium to spot prices in second-half 2019, except during the short-covering surge in spot prices in September-October when premiums dipped to 5.0-5.5¢/lb.

During second-half 2019, profit margins based on cash costs for ethane, propane, and normal butane were consistently positive but varied with a range of 6-20¢/lb. Margins for purity ethane were less variable than for propane and normal butane, averaging 10¢/lb in the third quarter and 10.5¢/lb in the fourth quarter. Margins for propane reached 16-17¢/lb in September-October but fell to 8¢/lb in November and 5¢/lb in December. Propane margins averaged 12.3¢/lb in the third quarter and declined to 9.8¢/lb in the fourth quarter. Margins for normal butane (based on TET normal butane prices) were 15-21¢/lb in the third quarter to average 18.8¢/lb before falling to 4¢/lb in December to average 10¢/lb for the fourth quarter. (“TET” is short for “Texas Eastern” and refers to petroleum products in Texas Eastern storage at Mont Belvieu, now owned and operated by Lone Star Partners, an operating unit of Energy Transfer Partners. “Non-TET” refers to product at Mont Belvieu but in other owners’ systems.)

Fig. 2 shows historical trends in ethylene spot prices and NTPs.

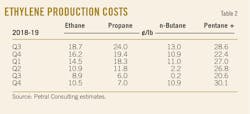

Olefin-plant feed slate trends

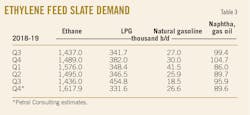

Petral Consulting’s monthly survey of plant operating rates and feed slates showed industry demand for light feedstocks (ethane, propane, and normal butane) increased in third and fourth-quarters 2019. Light feed demand was 1.89 million b/d in the third quarter and 1.95 million b/d the following quarter to average 1.92 million b/d in second-half 2019, which was 36,200 b/d (1.9%) more than first-half 2019.

From a bird’s eye view, the industry’s feed slate in first and second-half 2019 was similar, with light feeds (ethane, propane, and butane) accounting for 94% during the first 6 months and 94.4% in the remaining months. The mixture of light feeds, however, changed considerably, in the fourth quarter vs. the third quarter. Ethane accounted for 71.6% of total feed during third-quarter 2019 before increasing to 78.3% in the subsequent quarter. At the same time, LPG feeds made up 15.7% of total fresh feed in the third quarter before decreasing to 12.7% in the final quarter (Table 3).

The shift between ethane and LPG feeds was consistent with production cost advantages during the summer months when propane and normal butane prices fell to unusually weak levels while spot prices for major coproducts were steady or increased to peak seasonal levels. When propane and normal butane prices rebounded in the last 4 months of 2019, coproducts prices and LPG production costs lost their advantage, leaving ethylene producers once again using feedstock flexibility to maintain total cash costs as low as possible.

Monomer exports

Ethylene and propylene are used as raw material feeds for production of derivative products, with polyethylene and polypropylene the most important derivatives. US chemical companies focus primarily on selling surplus supplies of polyethylene, ethylene glycol, PVC, polypropylene, and acrylonitrile into international markets. Since EPP completed its merchant ethylene export terminal in December 2019, US ethylene monomer exports are no longer limited by terminal capacity.

US International Trade Commission (ITC) data showed monomer exports on a quarterly average basis ranged from zero to 1.6 million lb/day during 2015-18. Ethylene monomer exports averaged 1.99 million lb/day in first-half 2019 but fell to 1.77 million lb/day in second-half 2019. Before 2019, ethylene producers recorded a single-month record high (2.8 million lb/day) in March 2011. In June 2019, ethylene monomer exports spiked to a new single-month record of 3.8 million lb/day.

On an annualized basis, ethylene monomer exports were 689 million lb in 2019 (January-November). With EPP’s new terminal now in service, USGC ethylene producers can export about 8-10 million lb/day from new plants.

Polyethylene exports

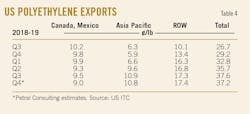

According to US ITC statistics for second-half 2019 (July-November) US producers extended the quarterly growth streak in exports of polyethylene—including HDPE, low-density polyethylene (LDPE), and linear low-density polyethylene (LLDPE)—to eight consecutive quarters. Exports to all destinations were 28.1 million lb/day in third-quarter 2019 and 28.2 million lb/day in the fourth quarter. For the first seven quarters (first-quarter 2018 through third-quarter 2019), quarterly growth rates averaged 2.72 million lb/day. In fourth-quarter 2019, however, exports increased only 47,000 lb/day.

Exports to Canada and Mexico in third-quarter 2019 were 9.5 mm lb/day but slipped to 9 million lb/day in the fourth quarter. Exports to Mexico during the fourth quarter were 0.43 million lb/day less than the previous quarter, accounting for 100% of the quarterly decline. Exports to all other destinations (ROW) were 28.1 million lb/day in third-quarter 2019 and 28.2 mm lb/day in the following quarter (Fig. 3).

According to OPIS PetroChem Wire, spot prices for HDPE (free on board, FOB Houston) slipped into a bearish trend during second-half 2019. HDPE prices in third-quarter 2019 averaged 34.2¢/lb, or 5.4¢/lb (13.7%) lower than the previous quarter. Prices continued falling in the fourth quarter to average 30.2¢/lb, 4¢/lb (11.8%) lower than the third quarter. For second-half 2019, HDPE prices averaged 32.2¢/lb, or 7.6¢/lb (19.1%) less than first-half 2019.

Most US polyethylene producers are ethylene-supply integrated. The best basis for analysis of trends in HDPE margins is the cash cost for ethylene production based on purity ethane. Margins on this basis were 25.4¢/lb in third-quarter 2019 and 19.7¢/lb in the fourth quarter, averaging 4.6¢/lb (16.7%) less than first-half 2019 (Fig. 4).

The decline in margins vs. cash costs based on purity ethane feed was consistent with the continued transition from a focus on domestic markets to a focus on global markets. In 2014-17, PE exports to Canada and Mexico accounted for 45% of US exports, 38% of exports in 2018, and 25-26% of exports in second and third-quarters 2019 (Table 4).

Propylene supply

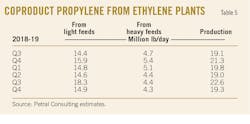

Olefin-plant coproduct supply. Coproduct propylene supply depends primarily on the use of propane, normal butane, naphtha, and other heavy feeds. In second-half 2019, monthly survey results showed demand for LPG feeds (propane and normal butane) jumped to 455,000 b/d, or 100,000 more than first-half 2019. Propane and butane prices rebounded in the fourth quarter, however, and ethane regained its position as the low-cost feed. As a result, LPG feed demand fell by 125,000 b/d from the third quarter to 330,000 b/d in fourth-quarter 2019.

As profit margins for incremental ethylene production on all feeds declined in second-half 2019, ethylene producers became more sensitive to wide cost differentials between light and heavy feeds. Demand for heavy feeds during the period was 110,000-120,000 b/d to average 115,000 b/d, while demand for LPG and heavy feeds was about 30,000 b/d more than first-half 2019. Demand for LPG and heavy feeds in the third quarter, however, was 60,000 b/d more than the first half of the year, while demand in the fourth quarter was 5,000 b/d less than the previous quarter. The surge in demand for LPG feeds was the primary driver for the 19% jump in coproduct propylene supply in the third quarter. Similarly, the seasonal slump in feedstock demand for propane and normal butane was the primary driver for the 18% decline in coproduct propylene supply in the fourth quarter.

Coproduct supply from all feeds was 20.7 million lb/day in second-half 2019, or 1.24 million lb/day (6.4%) more than first-half 2019. Coproduct supply from LPG and heavy feeds was 16.9 million lb/day in second-half 2019, which was 1.29 million lb/day (8.2%) more than first-half 2019. But coproduct supply from ethane was 3.74 million lb/day in second-half 2019, unchanged from the first half of the year (Table 5).

PDH plant supply. Based on OPIS PetroChem Wire daily reports and other industry sources, Petral Consulting estimates propylene production from propane dehydrogenation (PDH) plants at the USGC. Three PDH plants with a combined capacity of 13 million lb/day were operational in second-half 2019. Based on reports of plant downtime, Petral Consulting estimates PDH plant supply was 10-12 million lb/day in second-half 2019.

Refinery supply. Refinery propylene sales into the merchant market are a function of:

- FCCU feed rates (most important variable).

- FCCU operating severity (important but not directly measurable).

- Economic incentive to sell propylene rather than use it as alkylate feed.

Variations in FCCU feed rates generally are the most important parameter determining refinery-grade propylene supply. Economic factors that may result in changes in operating severity are generally of secondary importance, but prices for refinery-grade propylene in second-half 2019 were persistently weak, leading some refiners to curtail merchant sales.

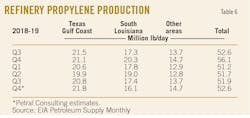

The seasonal swing in refinery crude runs is the primary driver for quarter-over-quarter variations in FCCU feed rates, with runs usually at their seasonal peak in the third quarter. Based on EIA statistics, fresh feed to FCC units at USGC and Midcontinent refineries increased to 3.44 million b/d in third-quarter 2019 (165,700 b/d and 5.1% more than second-quarter 2019). Based on EIA monthly statistics for October 2019 and weekly statistics for November and December, Petral Consulting estimates FCCU feed rates declined 155,000-160,000 b/d in the fourth quarter to average 3.28 million b/d.

Even though feed to FCC units increased 5% in third-quarter 2019, refinery-grade propylene supply from USGC and Midcontinent refineries dipped to 48.4 million lb/day during the quarter. Based on the seasonal decline in FCCU feed rates and persistently weak prices, Petral Consulting estimates merchant refinery-grade propylene supply was 46.8-47.3 million lb/day in the fourth quarter. Merchant supply in second-half 2019 was 0.6-0.7 million lb/day (1.4%) less than first-half 2019 (Table 6).

US supply. EIA statistics for refinery-grade propylene and Petral Consulting estimates for coproduct supply and PDH plant production show total USGC propylene supply was 81 million lb/day in third-quarter 2019 before falling to 78 million lb/day in the fourth quarter. Supply from all sources in second-half 2019 was 79 million lb/day, up 1.3 million lb/day (3.0%) from first-half 2019.

Fig. 5 shows trends in coproduct supply, PDH plant production, and refinery merchant sales of propylene.

Propylene economics, pricing

In the face of persistent supply surpluses, as determined by unusually high inventory levels in reportable USGC storage, refinery and polymer-grade propylene prices were steady in second-half 2019 until November and December. Analysis of pricing, supply, and exports led to one surprising conclusion: producers or buyers (or both) shifted 500-600 million lb of propylene inventory from private (unreported storage facilities) to reportable storage.

Propylene inventory in reportable USGC storage on Jan. 1, 2019, was 1.23 billion lb, 536 million lb (77%) above the 3-year average (712 million lb). Inventory varied with a range of 1.1-1.4 billion lb in first-half 2019, dipped below 1 billion lb on Aug. 1, 2019, and rebounded to 1.3 billion lb on Nov. 1, 2019. During 2010-17, inventory had never exceeded 1 billion lb and reached 700 million lb or more only one-third of the time.

With a persistent inventory surplus and sluggish propylene monomer exports, spot prices for refinery-grade propylene in the USGC were discounted vs. unleaded regular gasoline every month in second-half 2019. Based on OPIS PetroChem Wire’s daily reports, prices for refinery-grade propylene were 22.8¢/lb in third-quarter 2019 but slumped to 16¢/lb in December to average 19.4¢/lb in the fourth quarter. Discounts vs. unleaded regular gasoline were 5.1¢/lb and 4.6¢/lb in third and fourth-quarters 2019, respectively. Spot prices in December were 7.6¢/lb (31.6%) lower than July.

Two economic factors are the primary drivers for polymer-grade propylene prices. The cost of upgrading refinery propylene via propane-propylene fractionation units (commonly known as PP splitters) is a well-established driver. A few companies control merchant fractionation capacity for upgrading refinery propylene to polymer-grade quality and many refining companies sell refinery propylene to the companies who control upgrading capacity. Companies operating PP splitters play the classic trading game of buy low, sell high. PP splitter operating costs are only 15-20% of typical differentials between polymer-grade and refinery propylene prices, and PP splitter economics are of secondary importance as a price driver. Since 2010, the conversion cost of propane to propylene via a dehydrogenation unit is the new price driver. Petral Consulting monitors and forecasts prices for both grades.

From a June 2019 average of 32.8¢/lb, spot prices for polymer-grade propylene recovered to 35-37¢/lb in July through September before slumping to 30-32¢/lb in December, according to OPIS PetroChem Wire reports. Polymer-grade propylene premiums vs. refinery-grade propylene were 13.3¢/lb in third-quarter 2019 and 12.7¢/lb in the fourth quarter. Surprisingly, premiums in second-half 2019 were 1.1¢/lb more than first-half 2019. PDH plant operators had the good fortune of weak propane prices in the third quarter, with gross margins improving to 23.3¢/lb. In the fourth quarter, however, propylene prices fell, feedstock costs increased, and gross margins were 18.0¢/lb, 5.3¢/lb (22.7%) less than the previous quarter.

Monomer, polypropylene exports

Propylene inventory surpluses (inventory in reportable storage) persisted for 14 consecutive months (November 2018-December 2019). Petral Consulting defines the inventory surplus for the USGC propylene market as any volume in reportable storage that is 20% more than the 3-year average. By this definition, USGC propylene market inventory is at surplus levels when it exceeds 840 million lb. Will propylene inventory return to its historic mid-range in 2020? Trends in exports of propylene monomer and polypropylene in second-half 2019 suggested not.

Propylene monomer exports were 5.2 million lb/day in first-half 2019, 247 million lb more than 2018 (43% more in the first quarter, 35% more in the second quarter). Propylene exports to Europe, however, surged in first-half 2019 and were 1.4 million lb/day vs. 0.23 million lb/day in first-half 2018. Exports to other destinations were 3.78 million lb/day in first-half 2019, just 0.18 million lb/day more than in 2018.

Propylene monomer exports fell to 4.5 million lb/day in second-half 2019 for a year-over-year growth of only 154 million lb during the period, or 62% of year-over-year growth in first-half 2019. Colombia and Mexico remained the primary destinations for USGC propylene monomer exports, and exports were constant. Exports to these two countries also accounted for 76% of total exports for 2019 (January-November) and for 75% of exports in second-half 2019. These trends confirmed the view that propylene monomer exports are not likely to increase enough in 2020 to reduce inventory to historic mid-range volumes.

US ITC statistics showed a strong rebound in US polypropylene exports in first-half 2019, with year-over-year growth stalling in second-half 2019 to average 6.46 million lb/day. Mexico and Europe imported the most, accounting for two thirds of all US polypropylene exports in second-half 2019.

More troublesome, monomer exports in 2019 were about 400 million lb more than 2018, and primary supply from all sources was 520 million lb less than 2018. The combined impact of a decline in propylene supply and an increase in monomer exports support the view that producers or buyers (or both) shifted propylene inventory from private storage facilities to reportable storage.

Until USGC producers can expand the geographic scope of international monomer and polymer trade, propylene supply is likely to remain surplus and persistent surpluses will limit the upside for polymer-grade prices.

2020-22 outlook

Domestic ethylene producers successfully expanded the geographic scope of US polyethylene exports. Gross margins for HDPE (FOB Houston pricing) based on ethylene production costs from purity ethane were weaker in second-half 2019 but remained strong enough to support operating rates for monomer and polymer plants in first-half 2020 at fourth-quarter rates.

Ethylene producers were also able to reduce ethylene inventory by 50% or more during 2019. If ethylene monomer exports continue to increase as international buyers take advantage of low-cost US supply, chemical companies are likely to boost US production rates 6-8 million lb/day in 2020 just to prevent an inventory crash.

Economic growth in the Asia Pacific remains an imperative for continued growth in US exports of ethylene derivatives. The first phase of a comprehensive trade agreement between China and the US was an important first step in creating long-term support for continued growth in exports. According to recent news articles, China exempts imports of US polyethylene from tariffs imposed during the trade war.

The US-Mexico-Canada (USMCA) trade agreement will also support sustained economic growth in North America. Growth in demand for ethylene derivatives within North America remains an important consideration in maintaining a balanced US market. All things considered, development and trends in the next 2 years will be important precursors to continued growth in industry capacity and production during 2023-28, as they were during 2014-17 for 2018-19.

Until propylene exporters develop strategies for expanding their geographic scope, propylene supply surpluses are likely to persist in 2020-22. Furthermore, if Dow Chemical Co.’s proprietary fluidized catalytic dehydrogenation (FCDH) technology becomes the standard for new PDH units and sparks a surge in North American PDH capacity, propylene surpluses would be increasingly likely to persist indefinitely. Eventually, the USGC will become a major source of supply for markets in the Asia Pacific, Europe, and South America.

The author

Daniel L. Lippe ([email protected]) is president of Petral Consulting Co., which he founded in 1988. He has expertise in economic analysis of a broad spectrum of petroleum products including crude oil and refined products, natural gas, natural gas liquids, other ethylene feedstocks, and primary petrochemicals.

Lippe began his professional career in 1974 with Diamond Shamrock Chemical Co., moved into professional consulting in 1979, and has served petroleum, midstream, and petrochemical industry clients since. He holds a BS (1974) in chemical engineering from Texas A&M University and an MBA (1981) from Houston Baptist University. He is an active member of the Gas Processors Suppliers Association.