Port Corpus Christi emerges as a growing transportation and storage hub for crude oil from Eagle Ford shale

Rachael Seeley, Editor

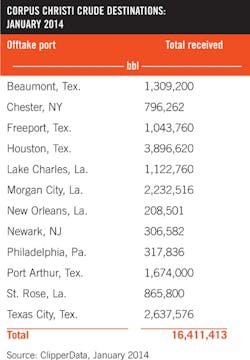

CORPUS CHRISTI, Tex.— Port Corpus Christi has emerged as a coastal gateway for crude produced in the Eagle Ford shale, with roughly 16.4 million bbl of crude moving out of the port in January primarily to refineries along the Gulf Coast, according to data compiled by ClipperData LLC.

The port, the fifth largest in the US by tonnage, is 70 miles south of the shale play and 200 miles southwest of Houston.

Crude arrives by truck, pipeline, and rail to be loaded onto US-flagged coastal barges and tankers.

John LaRue, executive director of Port Corpus Christi, said this is a reversal from 3 years ago, when the port primarily imported crude for use at three area refineries owned by Valero Energy Corp., Citgo Refining & Chemical Inc., and Flint Hills Resources LP.

"Up until 2011 we were moving almost no crude outbound," LaRue said.

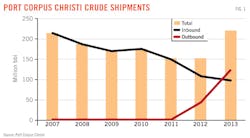

By mid-2013, LaRue said, the port was shipping out more crude than it was receiving. Port data show outbound shipments of crude jumped to 122.6 million bbl for the full year 2013 from 270,000 bbl in 2010 (See table, Fig. 1).

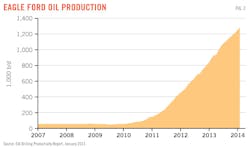

Outgoing shipments of crude rose in correlation with rising development in the Eagle Ford shale. Production rose to more than 1.2 million b/d in January 2014 from 800,000 b/d in the year-earlier period, according to data from the US Energy Information Administration (Fig. 2).

Besides the Gulf Coast, destinations for crude shipped from Port Corpus Christi include the US East Coast and Quebec. US law prevents to export of crude oil, but the Commerce Department has issued waivers allowing some exports to Canada.

Statistics compiled by ClipperData show the top destination for crude leaving Port Corpus Christi in January 2014 was Houston, which received roughly 3.9 million bbl, followed by Texas City, Tex., at 2.6 million bbl, and Morgan City, La., at 2.2 million bbl (See table).

More than 1 million bbl each arrived in the Gulf Coast ports of Beaumont, Tex., Freeport, Tex., and Lake Charles, La. Some crude—about 300,000 bbl each—made its way as far north as Philadelphia and Newark.

Eagle Ford crude moves to Port Corpus Christi by truck, pipeline, and rail. The port has dockside access for three major Class 1 railroad carriers: Burlington Northern Santa Fe, Union Pacific, and Kansas City Southern.

Oil is not the only substance moving through the port that is related to the Eagle Ford shale. Ruben Medina, director of business development for Port Corpus Christi, said last year the port handled about 1 million tons of sand used in hydraulic fracturing. The port also exports petroleum products, including gasoline, diesel, and fuel oil.

Booming economy

The growth of the Eagle Ford shale is contributing to an economic boom in the Corpus Christi metropolitan area. Roland Mower, chief executive officer of Corpus Christi Regional Economic Development Corp., said the region has added about 19,000 jobs since 2009, and the bulk of those are related to drilling, pipeline, and oil field services.

The area has a population of more than 430,000 spanning San Patricio, Nueces, and Aransas counties. Regional unemployment is 5.4%, and Mower expects 10,000-12,000 construction jobs to be added in 2015-16 for new developments—including a $1 billion seamless pipe plant planned by TPCO America Corp. and a $750 million steel production facility planned by the voestalpine Group.

"Because of that oil play, we've seen tremendous growth in our regional economy," Mower said.

LaRue said 10 crude oil, condensate, and LNG projects have been announced in recent years, including developments by Plains All American Pipeline LP, Trafigura Terminals LLC, Flint Hills Resources, NuStar Energy LP, and Martin Midstream Partners LP.

Also planned are construction or expansion of 12 docks, raising the port's existing capacity of 43 docks. Frank Brogan, managing director of Port Corpus Christi, put this number into perspective, saying: "There has been more activity announced in the last 18 months than in the last 25 years."

Construction projects

Trafigura, an international commodities trading and logistics firm, is capitalizing on opportunities emerging in the region. The company, based in Switzerland, is investing $200 million to expand its terminal and associated oil storage facilities in Port Corpus Christi. The project will expand the Texas Dock & Rail terminal to a capacity of 2.9 million bbl of storage and 200,000 b/d of sendout capacity.

Trafigura purchased Texas Dock & Rail in early 2012. Project Manager Kevin Beasley said it became apparent that customer demand for imported oil was declining as area refiners acquired more crude from the Eagle Ford shale. Port data show inbound crude shipments declined from more than 210 million bbl in 2007 to 97 million bbl in 2013.

Trafigura in December shored up more supplies for the project, signing a transportation agreement with Energy Transfer Partners LP to move about 100,000 b/d of Eagle Ford shale crude oil and condensate by pipeline to Corpus Christi from McMullen County, Tex.

Beasley said Texas Dock & Rail is Trafigura's flagship terminal in North America. Relaxation of US export restrictions would leave Trafigura well-positioned to ship crude internationally. "We have the assets in place that should allow us to participate if and when [that happens,]" Beasely said.

Voestalpine, an international steel company based in Austria, is also investing in the port. The company is building a $750 million facility with capacity to produce 2 million tons/year of hot briquetted iron.

Matthias Pastl, spokesman for voestalpine, said the company chose Port Corpus Christi because of favorable logistics—pellets can be shipped in and out easily by truck, rail, and barge; the political stability of the US; and cheap natural gas. Pastl said natural gas is about five times more expensive in the company's home country of Austria.

"I think the shale gas revolution had something to do with the location decision," Pastl said.

Construction work has also begun on a $1 billion seamless pipe plant planned by TPCO America Corp., a subsidiary of Tianjin Pipe Company of China. J.J. Johnston, director of administration for TPCO America, said the plant is the "single largest investment by a Chinese company in a greenfield manufacturing facility in the US."

The plant, expected online in 2016, will have capacity to produce 500,000 tonnes/year of seamless pipe, much of which will be used as casing for oil and gas wells in the US.

Regional growth

The economic impact of the Eagle Ford on the South Texas region is well documented. A study by the Institute for Economic Development at The University of Texas at San Antonio found, in 2012, that the shale formation generated a total economic impact of more than $61 billion across a 20-county area, which included two of the three counties surrounding Port Corpus Christi.

Mower said the region has seen "fairly significant" increases in jobs, wages, and sales tax revenues due to activity in the shale play. Sales tax revenues in Corpus Christi rose to $73 million in 2012 from $56 million in 2010. "The impact on this region has been phenomenal," Mower said.

Economic growth in the Corpus Christi region is unlikely to slow as many exploration and production companies expect their Eagle Ford shale production to continue growing in 2014.