Marine CNG opens alternate production, delivery options

Recent offshore natural gas opportunities in US waters often share the same obstacle: a lack of pipeline infrastructure to support offshore drilling and transport the gas to shore.

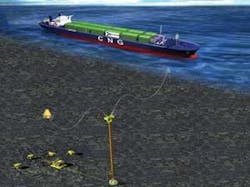

One solution is the use of compressed natural gas vessels to transport gas from production sites to market (Fig. 1). While still in its infancy and working through commercial and regulatory hurdles, the marine CNG industry may ultimately be the key to unlocking large oil and gas reserves in the US and abroad.

This article details the advantages of marine CNG, touching on current developments in the industry.

New production

The expiration of the 26-year-old moratorium on drilling on the US offshore continental shelf could open vast new areas to offshore drilling, including sites along the East and West coasts previously off limits to new exploration and production. Several potentially high-yield natural gas discoveries are also under development in the deepwater Gulf of Mexico, with dozens of other new prospects identified and under evaluation. Many of these opportunities—in both deepwater and in new geographic regions—lack pipelines to transport natural gas to shore.

Pipelines in the Gulf of Mexico often do not extend far enough to reach new deepwater fields. On the East and West coasts the longstanding ban on offshore drilling has even more sharply limited development of pipeline infrastructure. The lack of pipelines to serve new fields forces developers either to build new pipelines or seek other transportation solutions.

Stranded gas

More than one-third of the world’s gas reserves cannot currently be developed and are thus considered stranded. Gas can be “stranded” for a number of reasons, including the presence of physical or technical barriers to extraction, such as lying in areas too deep to drill, and economic reasons, such as lying beyond the reach of current pipeline networks. Political considerations, such as the moratorium on OCS drilling and state or local opposition to drilling, can also cause gas to be stranded.

Stranded gas reserves can include deepwater plays, marginal fields historically considered too small to develop, and fields in newly opened regions, such as along the East Coast. Stranded gas can also affect offshore oil production, as natural gas is frequently a by-product of oil drilling operations (associated gas). While associated gas can be reinjected into a well to increase output, the US Minerals Management Service restricts reinjection to limited short-term circumstances.

MMS similarly restricts flaring or venting unwanted gas at the wellhead during normal operations. Environmental and resource conservation concerns have also led to increased international restrictions on flaring and venting.

With reinjection, flaring, and venting generally prohibited, operators in the US must find solutions to transport both associated and nonassociated gas to market. The traditional solution is to build out existing pipeline networks, letting gas move to shore through interconnecting pipelines. This solution, however, may not be economical, particularly in remote deepwater locations potentially requiring pipelines to stretch long distances across harsh bottom geology.

In the absence of an alternative solution, extensive parts of the East and West coasts will require construction of new pipelines to accommodate new production. Experience with the siting of offshore LNG terminals suggests new production projects in regions outside the gulf will face regulatory and political hurdles stemming from environmental concerns, among other issues, resulting, at a minimum, in limiting extensive build-outs in some regions.

CNG solution

CNG vessels provide an alternative for transporting potentially stranded natural gas from production sites to market.

Marine CNG technology compresses natural gas to pressures of 1,200-3,500 psi to reduce its volume by about 200 times for transportation in dedicated vessels. While liquefying natural gas results in a higher reduction in gas volume (around 600 times), LNG liquefaction equipment, vessels, and regasification facilities involve higher capital expenditures than CNG projects and thus are primarily economical for shipping large volumes over long distances (e.g., more than 2,000 miles). CNG projects are economical over shorter distances (e.g., 500 miles) and in areas where pipeline construction is either not possible or prohibitively expensive.

CNG vessels, both self-propelled and barges, can be used to serve multiple sites, including smaller, marginal fields otherwise not economical to produce. CNG vessels can also be redeployed at the end of a field’s production life.

CNG vessel flexibility also integrates well into the operation of floating production, storage, and offloading systems (FPSOs), already used for oil recovery internationally and proposed for use in the Gulf of Mexico. One of the factors currently limiting use of FPSOs in the gulf is the difficulty of transporting associated gas ashore. CNG vessels used in conjunction with FPSOs would give operators an integrated and mobile solution, free of the costs and constraints associated with gas pipelines. CNG vessels could also be used with floating solutions for offshore natural gas development currently under development to shuttle produced gas to market.

Regulatory hurdles

Marine CNG will face regulatory hurdles in the US as federal agencies examine project proposals to issue required approvals. The lead federal agency responsible for regulating CNG vessels supporting production activities on the OCS is the Coast Guard.

A memorandum of agreement last year between the Coast Guard and MMS on regulation of floating OCS structures clarified the Coast Guard’s regulatory role over vessels transporting commodities in oil and gas operations.1 The MOA designated MMS as the lead agency for regulating all activities related to drilling and production and gave the Coast Guard authority over vessel operation, safety, and cargo transfer operations from floating production facilities to carrier or shuttle vessels.

In order to gain regulatory approval, one of the main issues that will need to be addressed is the safety of CNG vessels. To address this issue, the Coast Guard may require studies demonstrating the extent of hazards associated with CNG due to accidental or intentional hull breaches approve its use both in production operations and in transiting near shore and into crowded US ports. Other potential regulatory issues will likely include environmental effects associated with the vessels, such as air and water emissions, and the effect multiple transiting vessels could have on marine mammals.

Political hurdles

The longstanding US prohibition on oil and gas leasing off the Atlantic and Pacific coasts has been lifted for the time being. These regions, however, have not traditionally been receptive to offshore production. While some states, such as Virginia, have signaled interest in pursuing offshore drilling, environmental concerns will be a leading factor determining the extent of future drilling operations in new regions.

A key issue is the build-out of pipelines thought necessary to support production, which could cause environmental harm to marine habitats through dredging, directional drilling, and other construction techniques, will likely key such concerns.

Opposition from local communities and disputes among neighboring states also pose potential hindrances to offshore development. States opposed to offshore production may attempt to block projects by preventing development of pipeline infrastructure. An example of this recently occurred in California, when a state agency blocked an offshore LNG project by denying a land lease for a pipeline crossing state waters.2 CNG vessels used in lieu of pipeline development could mollify or potentially circumvent local opposition.

Moving forward

Interest in marine CNG is rising, but no projects have moved into the construction or production phases. Developers actively pursing projects include Overseas Shipholding Group, TransCanada, the Artumas Group, Sea NG, and Enersea.

Artumas Group has progressed towards commercializing what may be the world’s first marine CNG project off the east coast of Africa. The project would transport gas produced from fields in Mnazi Bay 380 miles to Mombasa, Kenya. Artumas recently received approval from Tanzania to pursue the project, which could serve as a model both from a commercial and regulatory perspective on the international development of marine CNG.

Deepwater option

Depending on distance to market, between four and six CNG vessels may be required in rotation to transport gas from a site such as Mnazi Bay. To reduce transit distances and the number of ships needed, deepwater ports could be used to unload gas and transport it to market by subsea pipeline.

Current turret-buoy deepwater port designs, such as Excelerate Energy’s Gulf Gateway Energy Bridge terminal offshore Louisiana, have so far only unloaded and transferred LNG (Fig. 2). The submerged buoy unloading mechanism could not only be used by CNG vessels to unload gas into a deepwater port, but also could potentially load gas into vessels at production sites (Figs. 3-4).

Uploading LNG into a terminal like Gulf Gateway, located 116 miles from shore, could sharply reduce transit distances.

While current deepwater ports have only been used to unload LNG and oil, the Deepwater Port Act—the federal law governing licensing of offshore terminals—applies to all forms of natural gas and would apply to the licensing of an offshore CNG terminal. A CNG deepwater port could also reduce safety and security concerns, as vessels would not transit near shore.

Other applications

Marine CNG vessels have potential applications beyond supporting oil and gas production. CNG vessels could also engage in regional shipping, such as within the Caribbean islands, delivering gas supplies over shorter shipping distances where it may be uneconomical to use LNG carriers. Marine CNG could also be used to transship regasified LNG from a central hub such as a regasification terminal, to multiple local markets either not served or underserved by pipelines.

References

- Memorandum of Agreement Between the Minerals Management Service-US Department of the Interior and the US Coast Guard-US Department of Homeland Security, MMS/USCG MOA: OCS-04, Feb. 28, 2008.

- “Lands Commission rejects LNG terminal,” Ventura County Star, Apr. 10, 2007.

The authors

Steven Sparling ([email protected]) is a partner in the Washington office of Sutherland Asbill & Brennan LLP. Sparling chairs Sutherland’s global LNG group and focuses his practice on LNG, offshore projects, oil spills, and emergency preparedness. Over the past 8 years, he has counseled LNG project developers, negotiated terminal access and supply agreements, and optimized shipping and terminal operations in North America and Europe. He holds a BA (1990) from the University of Pennsylvania and a JD (magna cum laude; 2000) from George Mason University School of Law.

Daron Threet ([email protected]) is counsel in the Washington office of Sutherland, Asbill & Brennan LLP and a member of the firm’s LNG group. Threet focuses his practice on offshore energy project development and government affairs. Before joining the firm, he served as counsel for the deepwater ports program at the US Department of Transportation, Maritime Administration (MARAD) and was secretary of the agency. He holds a BS (cum laude; 1997) from the University of Colorado at Boulder, College of Business and a JD from Notre Dame Law School (2000).

Nate Teti ([email protected]) is an attorney in the Washington office of Sutherland Asbill & Brennan LLP. Teti focuses his practice on government affairs and regulatory matters regarding natural gas, oil, LNG, and renewable energy. He holds a BA (1996) in policy studies from Dickinson College, an MPA (2000) from George Washington University, and a JD (magna cum laude; 2005) from the Catholic University of America, Columbus School of Law.