China seeks oil security through fleet expansion

China’s push for energy security has prompted a program for building 70 additional very large crude carrier (VLCC) tankers.

The recent drop in oil price reduces the financial burden placed by oil imports on Chinese industry, but ensuring adequate supplies remains a concern for the country. China is the world’s most populous country and second largest oil consumer and importer, just behind the US. The Chinese economy relies heavily on consuming natural resources, including oil.

This article examines China’s efforts to increase its energy security by taking more direct control of its supply.

Background

China imported 90.53 million tonnes of crude oil in first-half 2008, an increase of 11.04% from the same period last year.1

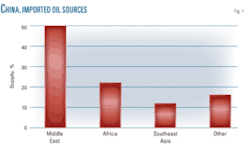

Regional imports totaled 50% from the Middle East, 22% from Africa, and 12% from Southeast Asia, accounting for 84% of total imported oil (Fig. 1). All of these regions are far from China and oil from them can only be transported to China by sea.

More than 90% of China’s imported oil, however, is transported by foreign oil tankers, a situation the government views as both economically and strategically unsound. Leading global marine transportation companies from Europe, North America, and Asia—Maersk of Denmark, NYK Group, Kawasaki Kisen Kaisha Ltd., and Mitsui O.S.K. Lines Ltd. of Japan, as well as companies from South Korea and Singapore—supply the bulk of this shipping.

This dependence on foreign carriers makes oil supply vulnerable to both increases in transportation costs and uncertainties such as war. Shipping rates have increased dramatically in recent years, and the lack of its own crude transportation alternatives places China in a negative position when negotiating rates.

The current situation also poses a potential strategic threat to oil security. Wars, terrorist attacks, diplomatic conflicts, and political factors can all threaten oil transportation by sea. China is hard-pressed to send its military to locations like the Strait of Hormuz and the Malacca Strait to guard oil being shipped on foreign vessels.

Domestic limits

China’s tanker fleet has a capacity of about 10 million tonnes/year, or 5-6% of current oil imports. China’s tankers average 20 years old, and the fleet has few large tankers, placing it at a disadvantage in terms of economies-of-scale. China should possess at least 90 million tonnes/year of shipping capacity for even half its imported oil to be transported by its own fleets and needs at least 70 more VLCC to reach this target.

Pipelines are under construction to bring oil imports from Russia, Kazakhstan, and other neighboring countries, but the bulk of China’s supplies will still have to travel by water. Zhiming Zhao, executive president of China Petroleum and Petrochemical Industry Association, estimates China will increase its imports of oil and gas from Africa by 35-40% in the next 5-10 years, with the oil shipped entirely by marine transport.

Expansion

By expanding domestic transportation capacity for imported oil China hopes to improve its supply security. This strategy, dubbed “nation’s oil, nation’s fleet,”2 has strong support in both the Chinese government and industry.

Some Chinese shipyards can build VLCC and other oil carriers, with the new strategy also serving to support and promote China’s shipbuilding industry (Fig. 2). The Chinese government is encouraging domestic shipping companies to order VLCCs from domestic shipbuilding companies and has promised financial support to ship yards building VLCCs.

Almost all of China’s major shipping companies have carried out plans to increase their oil transportation capacities. China Shipping Development Co. Ltd., for example, signed a contract with China’s largest shipbuilder, Dalian Shipbuilding Industry Co. Ltd. (DSIC) in September 2008 for four oil carriers with a total value of $228 million. DSIC was China’s first shipyard to build a 300,000-dwt VLCC, delivered to the National Iranian Tank Co. in August 2002.

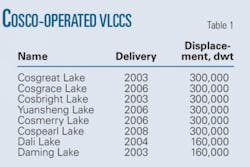

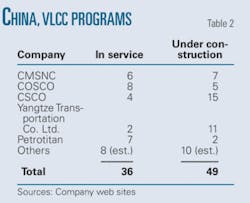

At the end of 2002 the only Chinese company operating VLCCs was China Merchants Steam Navigation Co. Ltd. (CMSNC), which used four of them. By October 2008 this list had expanded to include China Ocean Shipping (Group) Co. (COSCO; Table 1), China Shipping (Group) Co. (CSCO), Titan Petrochemicals Group Ltd. (Petrotitan), a Hong Kong-listed company, and others, operating a total of about 36 VLCCs. COSCO also operates 11 Panamax tankers.

About 49 more VLCCs are already under construction and will be in service in the near future (Table 2); five joining CMSNC’s fleet in 2009.

The strategy of building tankers for domestic oil transportation will also stimulate the nation’s steel industry, suffering low demand due to the recent weakening of the global economy.

Strategic steps

The Chinese government is implementing the new strategy. Early in 2002, China’s Ministry of Transportation promulgated “Strategy of Reviving the Nation through Enlarged Marine Transportation Capacity,” calling for the establishment of strong domestic fleets. The Ministry of Finance grants subsidized loans to shipyards building supertankers.

The government is also encouraging domestic oil companies to use domestic shippers. In the past, the bulk of even the small domestic shipping capacity served foreign oil companies. In 2002 CMSNC, holding half of China’s tanker capacity and its only VLCCs, delivered only 7.3% of its cargoes to China. Only 3.78% of crude China imported from the Middle East was carried by domestic fleets. Domestic shippers carried more than half of China’s crude imports from Southeast Asia in 2002, but none of its imports from Africa.

The government now encourages domestic shipping companies and domestic oil companies to enter long-term transportation contracts with one another in an effort to reverse this trend. The four major oil transporters, CMSNC, COSCO, CSCO, and Yangtze Transportation Co. Ltd., have all contracted with China Petroleum & Chemical Corp. (SINOPEC) for crude oil transportation, while Petrotitan has signed a long-term transportation contract with Zhuhai Zhenrong Co. Ltd., a crude oil importer in Guangdong province.

References

- All trade statistics are from the official Chinese customs web site, http://www.customs.gov.cn/publish/portal0/.

- Luo, P., “Nation’s oil, nation’s fleet,” a necessary way for China’s energy security, China Maritime, Vol. 2, pp. 38-40, 2005.

The authors

Meng-di Gu ([email protected]) is a professor of economics at Shanghai Jiao Tong University, Shanghai. He was an assistant engineer for Guiyang Hydraulic Power Design Institute in China, 1982-85. He holds a BS (1982) and MS (1988) from Hohai University in Nanjing and a PhD (1992) from Shanghai Jiao Tong University.

Shou-de Li ([email protected]) is an associate professor of economics at Shanghai Jiao Tong University. Before joining the university, he was a lecturer at Xi’an Jiao Tong University, Xi’an. He holds a BS (1988), MS (1996), and a PhD (2000) from Xi’an Jiao Tong University.