Energy Transfer takes FID on newly renamed Permian natural gas pipeline

Energy Transfer LP will construct a pipeline to provide transportation capacity out of the Permian basin to serve growing natural gas demand. Of note, the company said the project is also expected to “further establish Energy Transfer as the premier option to support power plant and data center growth in the state of Texas.”

Hugh Brinson natural gas pipeline

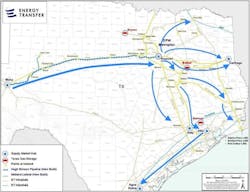

Energy Transfer reached a positive final investment decision (FID) to construct the large-diameter intrastate Hugh Brinson pipeline, previously named Warrior pipeline, to connect Permian basin production to multiple markets.

Energy Transfer said the Hugh Brinson pipeline will connect shippers to Energy Transfer’s existing intrastate natural gas pipeline network and other downstream pipelines and will provide shippers with “optionality to access prolific markets and trading hubs throughout Texas and beyond, including Carthage and Katy.”

Construction of the natural gas pipeline will be implemented in two phases. The first phase—expected to be in service by end-2026—will include construction of about 400 miles of 42-in. OD pipeline with a capacity of 1.5 bcfd. The line will extend from Waha to Maypearl, Tex., south of the Dallas-Fort Worth Metroplex for continued transport to the Gulf Coast.

As part of Phase I, Energy Transfer also will construct the Midland Lateral, which is expected to be a 42-mile, 36-in. OD lateral to connect Energy Transfer and third-party processing plants in Martin and Midland Counties to the Hugh Brinson pipeline.

The second phase of the project will include the addition of compression to increase the capacity of the new pipeline to about 2.2 bcfd. This second phase could be constructed concurrently with the first phase depending on shipper demand, the company said.

Overall costs of both phases are expected to be $2.7 billion.

The project is backed by long-term, fee-based commitments with strong investment grade counterparties, the company said, without providing additional detail.

About the Author

Mikaila Adams

Managing Editor, Content Strategist

Mikaila Adams has 20 years of experience as an editor, most of which has been centered on the oil and gas industry. She enjoyed 12 years focused on the business/finance side of the industry as an editor for Oil & Gas Journal's sister publication, Oil & Gas Financial Journal (OGFJ). After OGFJ ceased publication in 2017, she joined Oil & Gas Journal and was later named Managing Editor - News. Her role has expanded into content strategy. She holds a degree from Texas Tech University.