Cheaper labor helps reduce pipeline construction costs

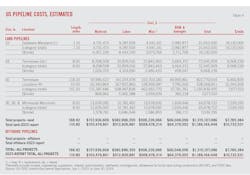

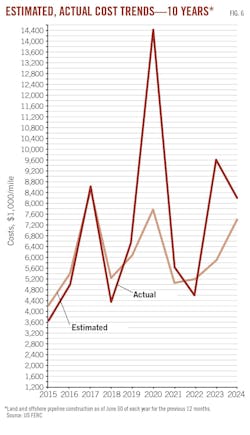

Sharply lower costs in all categories but material—which was roughly flat—decreased the price of building land pipelines by nearly $3 million/mile. The decrease in total estimated $/mile land pipeline construction costs pulled them back from a record $10.7 million/mile in 2023, to a still high $7.8 million/mile.

Estimated miscellaneous costs fell by roughly one-third, about $1.5 million/mile, and labor costs were also down by more than $1 million/mile. “Contingencies” are the most variable of the costs included as miscellaneous, with the amount set aside for such purposes typically reflecting changes in market uncertainty. Right-of-way costs were 32.7% lower this year than last.

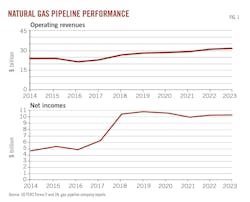

Net incomes for liquids pipelines rose by more than 12%, their second double-digit increase in a row, to reach a new all-time high of $22.8 billion. Natural gas pipeline operators’ net incomes also improved, edging 0.5% higher to mark a second straight year of gains after 2 years in a row of decline (Fig. 1). Even so, they remained below both 2020 levels and the records reached in 2019.

Gas pipeline companies’ decreased spending on additions to gas plant accelerated in 2023, however, dropping 17% as market uncertainty remained. By contrast, property change to liquids pipelines grew by 46%, a rebound from the 68% decline in 2022 as renewed demand solidified the segment’s footing.

Details

Oil pipeline earnings as a percent of revenue continued to improve—exceeding 56%—but remained below the levels reached in 2019. Natural gas pipeline operators’ net incomes as a share of revenue, however, remained near 33%, their lowest level since 2017.

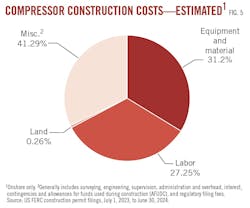

A near halving of compression construction costs ($4,369/hp) was accompanied by a more than doubling of proposed work, to just below 218,000 hp of new projects.

Actual land pipeline construction costs for projects completed in the 12 months ending June 30, 2024, were roughly $774,000/mile greater than estimated costs, with the largest difference seen in estimated vs. actual miscellaneous costs, which more than outstripped cheaper than expected labor.

US pipeline data

At the end of this article, two large tables (linked) offer a variety of data regarding US oil and gas pipeline companies: revenue, income, volumes transported, miles operated, and investments in physical plants. These data are gathered from annual reports filed with FERC by regulated oil and natural gas pipeline companies for the previous calendar year.

Data are also gathered from periodic filings with FERC by those regulated natural gas pipeline companies seeking FERC approval to expand capacity. OGJ keeps a record of these filings for each 12-month period ending June 30.

Combined, these data allow an analysis of the US regulated interstate pipeline system.

- Annual reports. Companies that FERC classifies as involved in the interstate movement of oil or natural gas for a fee are jurisdictional to FERC, must apply to FERC for approval of transportation rates, and therefore must file a FERC annual report: Form 2 or 2A, respectively, for major or nonmajor natural gas pipelines; Form 6 for oil (crude or product) pipelines.

The distinction between “major” and “nonmajor” is defined by FERC and appears as a note at the end of the table listing all FERC-regulated natural gas pipeline companies for 2023 at the end of this article.

The deadline to file these reports each year is in April. For a variety of reasons, companies often miss that deadline and apply for extensions but eventually file an annual report. That deadline and the numerous delayed filings explain why publication of this OGJ report on pipeline economics occurs later in each year. Earlier publication would exclude many companies’ information.

- Periodic reports. When a FERC-regulated natural gas pipeline company wants to modify its system, it must apply for a “certificate of public convenience and necessity.” This filing must explain in detail the planned construction, justify it, and––except in certain instances—specify what the company estimates construction will cost.

Not all applications are approved. Not all that are approved are built. But assuming a company receives its certificate and builds its infrastructure, it must—again, with some exceptions—report back to FERC how its original cost estimates compared with what it spent.

OGJ monitors these filings from July 1 to June 30 each year, collecting them, and analyzing their numbers.

Reporting changes

The number of companies required to file annual reports with FERC may change from year-to-year, with some companies becoming jurisdictional, others nonjurisdictional, and still others merging or being consolidated out of existence. Such changes require care be taken in comparing annual US petroleum and natural gas pipeline statistics.

Only major gas pipelines are required to file miles operated in a given year. The other companies may indicate miles operated but are not specifically required to do so.

Reports for 2023 show a decrease in FERC-defined major gas pipeline companies: 99 companies of 177 filing, from 101 of 178 for 2022.

FERC-regulated major natural gas pipeline mileage shrank in 2023 (Table 1), final data showing an decrease of 2,079 miles, or 1.1%. Oil mileage also fell, losing 2,806 miles (1.6%).

Rankings; activity

Natural gas pipeline companies in 2023 grew revenues by roughly $125 million (0.4%), marking a seventh-straight year of growth. Net income, however, rose by just $51 million (0.5%), a second-consecutive annual increase.

Oil pipeline earnings, meanwhile, continued the return to growth started in 2021, climbing roughly $2.5 billion (12%). Revenues rose roughly $2.8 billion or 7.5% (Table 2).

Improved liquids pipeline earnings came on the back of a 6.3% increase in product deliveries, crude shipments rising almost 3% year-on-year.

OGJ uses the FERC annual report data to rank the Top 10 pipeline companies in three categories (miles operated, trunkline traffic, and operating income) for oil pipeline companies and three categories (miles operated, gas transported for others, and net income) for natural gas pipeline companies.

Positions in these rankings shift year to year, reflecting normal fluctuations in companies’ activities and fortunes. But also, because these companies comprise such a large portion of their respective groups, the listings provide snapshots of overall industry trends and events.

For instance, earnings for the Top 10 oil pipeline companies rose 15% compared with the 12% overall increase for the segment, suggesting that the larger operators have been better able to capitalize on market opportunities. The Top 10 companies’ share of the segment’s total earnings grew accordingly, to 38.6% vs. the 37.6% share of earnings held in 2022.

Earnings by the Top 10 most-profitable gas pipeline companies grew by 3.8%, supported by a 4.75% increase in volumes moved for a fee.

As noted earlier, net income as a portion of natural gas pipeline operating revenues remained near 33% in 2023, stabilizing above the 27% posted in 2017 after years of decline. The percentage of income as operating revenues for oil pipelines rose to more than 56%, the third consecutive increase but still below the all-time high of 60% in 2019 and the levels reached in other years going back through 2017.

Net income for major natural gas pipelines as a portion of gas-plant investment eased slightly to 4.5%. Net income as a portion of investment in oil pipeline carrier property grew to 14.2%, just below 2019’s recent high of 14.3%.

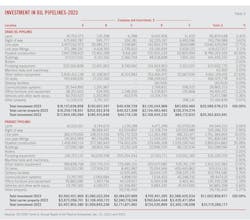

Major and nonmajor natural gas pipelines in 2022 reported total gas-plant investment of roughly $230 billion, the highest level ever, up from $226 billion in 2022, $219.5 billion in 2021, $213 billion in 2020, $206 billion in 2019, $197 billion in 2018, $171 billion in 2017, $158.5 billion in 2016, $158 billon in 2015, and $152 billion in 2014.

Investment in oil pipeline carrier property also continued to grow in 2023, reaching more than $161 billion. Carrier property in 2022 was $157 billion, up from 2021’s total of $156.5 billion, 2020’s total of $149 billion, $138 billion in 2019, $122 billion in 2018, $112 billion in 2017 and $99.5 billion in 2016, after reaching $93 billion in 2015, and nearly $85 billion in 2014.

OGJ for many years has tracked carrier-property investment by five crude oil pipeline and five products pipeline companies chosen as representative in terms of physical systems and expenditures (Table 3). In 2003, we added the base carrier-property investment to allow for comparisons among the anonymous companies.

The five crude oil pipeline companies in 2023 increased their overall investment in carrier property by more than $225.6 million (1.1%).

The five products pipeline companies saw their overall investment in carrier property increase 2.7% in 2022, or nearly $284.6 million.

Comparisons of data in Table 3 with previous years must be done with caution as reorganizations, mergers, acquisitions, and sales can make comparisons with previous years’ data difficult.

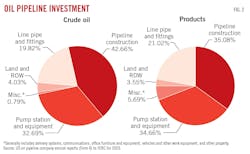

Fig. 2 illustrates how investments in the crude oil and products pipeline companies were divided.

Construction mixed

Applications to FERC by regulated interstate natural gas pipeline companies to modify certain systems must, except in certain instances, provide estimated costs of these modifications in varying degrees of detail.

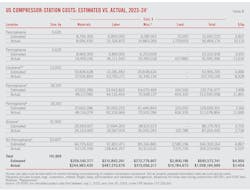

Tracking the mileage and compression horsepower applied for and the estimated costs can indicate levels of construction activity over 2-4 years. Tables 4 and 5 show companies’ estimates during the period July 1, 2023, to June 30, 2024, for what it will cost to construct a pipeline or install new or additional compression.

These tables cover a variety of locations, pipeline sizes, and compressor-horsepower ratings.

Not all projects proposed are approved. And not all projects approved are eventually built.

- Roughly 169 miles of pipeline were formally proposed to FERC for land construction in the 12 months ended June 30, 2024, with no offshore work submitted. The land level was up from the 110 miles submitted in 2023 and even with the 169 miles submitted in 2022, all of which were greater than the 77 miles submitted in 2021. Roughly 367 miles were proposed in 2020. The 246 miles proposed for land construction in 2019, were well below the roughly 545 miles proposed in 2018.

- New or additional compression proposed by the end of June 2024 totaled nearly 218,000 hp, more than the 98,000 hp filed for in 2023, but still less than half of the 502,000 hp applied for in 2022. Nearly 200,000 hp were proposed in 2021 and 680,000 hp proposed in 2020. Compression proposals in 2019 totaled 292,000 hp, with 287,000 hp proposed the year before.

Putting US gas pipeline construction in perspective, Table 4 lists 4 land-pipeline “spreads,” or mileage segments, and 0 marine projects, compared with:

- 5 land and 0 marine projects (OGJ, Oct. 2, 2023, p. 24)

- 19 land and 0 marine projects (OGJ, Oct. 3, 2022, p. 35).

- 9 land and 0 marine projects (OGJ, Oct. 4, 2021, p. 52).

- 18 land and 0 marine projects (OGJ, Oct. 3, 2020, p. 42).

- 18 land and 0 marine projects (OGJ, Oct. 7, 2019, p. 46).

- 11 land and 0 marine projects (OGJ, Oct. 1, 2018, p. 60).

- 27 land and 1 marine projects (OGJ, Oct. 2, 2017, p. 71).

- 33 land and 0 marine projects (OGJ, Sept. 5, 2016, p. 89).

- 46 land and 0 marine projects (OGJ, Sept. 7, 2015, p. 114).

Only one spread in 2024 measured 100 miles or more, a 30-in. OD transmission line running 118.2 miles through Tennessee.

For the 12 months ending June 30, 2024, the 4 land projects filed would cost an estimated $1.3 billion, compared with the 5 land projects filed for $1.2 billion a year earlier. Estimated construction costs fell by roughly $3 million/mile.

These statistics cover only FERC-regulated pipelines. Many other pipeline construction projects were announced in the 12 months ending June 30, 2024, but were outside FERC’s jurisdiction.

Estimated 2023-24 $/mile costs for new onshore projects as filed by operators with FERC were $7.8 million/mile, down from the record $10.7 million/mile in 2022-23. In 2021-22 the average cost was $8.7 million/mile. In 2020-21 the average cost was $8.3 million/mile.

Cost components

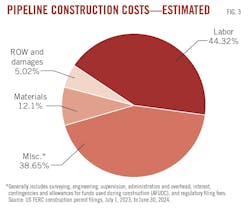

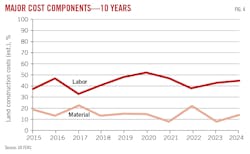

Variations over time in the four major categories of pipeline construction costs—material, labor, miscellaneous, and right-of-way (ROW)—can also suggest trends within each group.

Materials can include line pipe, pipe coating, and cathodic protection.

“Miscellaneous” costs generally cover surveying, engineering, supervision, contingencies, telecommunications equipment, freight, taxes, allowances for funds used during construction (AFUDC), administration and overheads, and regulatory filing fees.

ROW costs include obtaining rights-of-way and allowing for damages.

For the 4 spreads filed for in 2023-24, project cost-per-mile fell in all categories except material, which was generally flat after falling by more than 50% in 2022-23. Miscellaneous costs fell by roughly one-third, or more than $1.5 million/mile, making up about half of the overall drop.

Miscellaneous charges in 2011 passed material to become the second most expensive cost category and in 2017 they passed labor costs to become the most expensive category of all. For the past 6 years, however, labor has reclaimed its throne. A breakdown of 2023-24 costs shows:

- Material—$934,979/mile, roughly flat from $933,933/mile for 2022-23.

- Labor—$3.45-million/mile, an almost $1.2 million/mile decrease from $4.63-million for 2022-23.

- Miscellaneous—$3-million/mile, down about $1.6-million/mile from the roughly $4.6-million/mile estimated cost for 2022-23.

- ROW and damages—$391,002/mile, down from $581,043/mile in 2022-23 and the $449,490/mile cost for 2021-22.

Table 4 lists proposed pipelines in order of increasing size (OD) and decreasing lengths within each size.

The average cost-per-mile for the projects rarely shows clear-cut trends related to either length or geographic region. In general, however, the cost-per-mile within a given diameter decreases as the number of miles rises. Lines built nearer populated areas also tend to have higher unit costs.

Additionally, road, highway, river, or channel crossings and marshy or rocky terrain each strongly affect pipeline construction costs.

Fig. 3, derived from Table 4, shows the cost-component splits for pipeline construction.

Labor is the most expensive category and the most volatile. Labor’s 2024 portion of estimated costs rebounded from last year but remained below the recent high of 52.4% reached in 2020, increasing to 44.3% from 43.1% in 2023. It made up a 44.9% portion of the total in 2022 and 46.8% a year earlier. Labor’s portion of costs was 48.7% in 2019, 40.6% in 2018, 35.8% in 2017, 47% in 2016, and 37.8% in 2015.

Material costs’ portion of land pipeline costs also increased (in line with its unchanged $/mile cost), reaching 12%. This was up from a low of 8.7% in 2023 but still down sharply from its 22.5% portion in 2022. Material’s share of total costs was 9.9% in 2021, 14.9% in 2020, 15% in 2019, 13.1% in 2018, 22.4% in 2017, 13% in 2016, and 19.3% in 2015.

Fig. 4 plots a 10-year comparison of land-construction unit costs for material and labor.

Fig. 5 shows the cost split for land compressor stations based on data in Table 5.

Table 6 lists 10 years of unit land-construction costs for natural gas pipeline with OD ranging from 8 to 36 in. The table’s data consist of estimated costs filed under CP dockets with FERC, the same data shown in Tables 4 and 5.

Table 6 shows that the average cost per mile for any given diameter may fluctuate year-to-year as projects’ costs are affected by geographic location, terrain, population density, and other factors.

Completed project costs

In most instances, a natural gas pipeline company must file with FERC what it ended up spending on an approved and built project. This filing must occur within 6 months after a pipeline’s successful hydrostatic testing or a compressor’s being put in service.

Fig. 6 shows 10 years of estimated vs. actual costs on cost-per-mile bases for project totals.

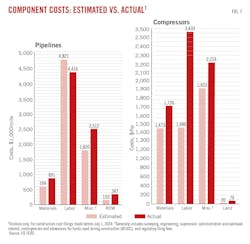

Tables 7 and 8 show actual costs for pipeline and compressor projects reported completed to FERC during the 12 months ending June 30, 2024. Fig. 7, for the same period, depicts how total actual costs ($/mile) for each category compare with estimated costs.

Actual costs for pipeline construction were roughly $800,000/mile more than estimated costs for the same project, significantly narrowing the $3.7-million/mile gap from the year before. Labor costs were actually about $400,000/mile less than estimated, but every other category was more expensive than anticipated.

The three final cost filings for the 12 months continues to reflect the relatively limited number of projects applied for over the past few years.

If a project was reported in construction spreads in its initial filing, that’s how projects are broken out in Table 7. Completed projects’ cost data, however, are typically reported to FERC for an entire filing, usually but not always separating pipeline from compressor-station (or metering site) costs and lumping various diameters together.

The 12 months ending June 30, 2024, saw almost 142,000 hp completed, more than double the year before. Actual compression costs of $7,454/hp were similar to the year before and 52% higher than estimates, with costs in every category higher than what initially had been filed but the biggest difference (~2,000/hp) present in labor costs (Table 8).

OGJ US pipeline economics data tables

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.