EIA: Leasing ANWR's 1002 area spells less oil imports

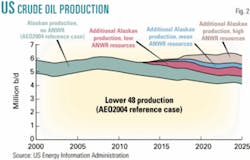

The US Energy Information Administration told a key US House lawmaker that opening the 1002 area of the Arctic National Wildlife Refuge to oil exploration and development could mean that the US imports 8% less crude in 2025.

Supporters of ANWR leasing said the EIA report justifies having the US Congress authorize oil and gas leasing in the coastal plain, while ANWR drilling opponents said the EIA report validates their position.

EIA is an independent statistical agency under the US Department of Energy that does not take positions on policy questions.

Opening part of ANWR's coastal plain to development could reduce 2025 US oil import dependence from the currently projected 70% level to 64-67%, depending on how much oil is actually found, EIA said.

Study details

The report forecasts that, "energy development in [ANWR] would increase domestic production by nearly 20% by 2025. Given America's energy crunch, ANWR production is a must," said US House Resources Chairman Richard Pombo (R-Calif.), the lawmaker who on Feb. 23 asked EIA for the ANWR analysis.

Pombo asked EIA to compare the impact of authorizing oil and gas leasing in the agency's annual energy outlook.

He also asked EIA to assess whether there were any "significant synergies" between ANWR coastal plain leasing and the potential construction of an Alaskan North Slope natural gas export line to the Lower 48.

EIA's analysis assumed ANWR coastal plain production starts in 2013 with development costs similar to those for Prudhoe Bay. But the agency stressed that potential ultimate oil recovery and yearly production figures are as yet uncertain.

An earlier House version of the pending energy bill authorized limited oil and gas leasing in the 1002 area.

But if energy legislation does pass Congress this year, ANWR is not expected to be included because too many senators, both Democrat and Republican, oppose leasing and could stall the legislation indefinitely through a filibuster.

Supporting the Senate's majority view, for example, is a Republican-based environmental group called REP America, which said the EIA report "strengthens the case for an accelerated transition away from conventional fossil fuel technologies to meet the nation's energy needs."

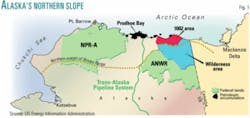

Under current EIA projections, total US crude oil production increases to 6.1 million b/d in 2008 from 5.8 million b/d in 2002.

After 2008, domestic oil production declines, reaching 4.6 million b/d in 2025.

In Alaska, oil production continues at about 900,000 b/d through 2016 (assuming no ANWR leasing is granted), with production from existing North Slope fields declines offset by production from National Petroleum Reserve-Alaska (NPR-A).

But after 2016, total Alaska oil production declines to 500,000 b/d in 2025, with declines in production occurring in all regions.

Using existing US Geological Survey data, EIA said about 900,000 b/d of oil could be in production in 2025 under the USGS mean oil resource case, and 600,000 b/d and 1.6 million b/d under the low and high resource cases, respectively.

These cases include the impact of production in the 1002 area plus native lands and Alaska's offshore area within a 3 mile limit, EIA said.

USGS surveys suggest that 5.7-16 billion bbl of technically recoverable oil is in the coastal plain, with a mean estimate of 10.4 billion bbl, divided into many fields.

Other findings

EIA said the opening of the coastal plain of ANWR to oil and gas development is expected to have little impact on when or if an Alaskan gas export line gets built.

"Although the opening of ANWR might reduce the gas resource risk of building an Alaska gas pipeline, there is expected to be a much larger gas resource in [NPR-A]," EIA said.

The agency noted that NPR-A currently is being leased and explored and has an expected gas resource base six times larger than expected for ANWR's coastal plain.

"The NPR-A is expected to have a greater impact on reducing the gas resource risk associated with an Alaska gas pipeline than ANWR, EIA said.

But leasing ANWR would be a big plus for the operators of the Trans-Alaska Pipeline System (TAPS).

ANWR development could extend the life of that pipeline well beyond 2025, EIA said.

Oil companies say TAPS won't make economic sense to operate once oil throughput falls to 200,000-400,000 b/d, depending on prevailing oil prices.

"The retention of this oil pipeline infrastructure could prove crucial in the future, if and when other regions of North Alaska are leased and developed, such as the offshore Beaufort and Chukchi seas," EIA said.