Supply constraints limit global LNG market growth

Despite lower prices, the growing global LNG market remains tight amid supply constraints, according to the 2024 International Gas Union (IGU) World LNG Report. The report finds that global LNG trade grew by 2.1% in 2023, surpassing 401 million tonnes. The global market now connects 20 exporting with 51 importing markets, with supply the primary growth-limiting factor. After 2 years of severe turbulence, the LNG market has a newfound but fragile equilibrium, given the lack of spare supply in the near-term.

LNG has become a critical component of the global energy mix, the report says, with its role as a flexible, highly efficient, and reliable resource continuing to grow, and as such, decarbonizing the LNG value chain is a priority for many in the industry. Several proposed projects are undertaking innovative emissions-reducing measures to meet this need by integrating renewable electricity, carbon capture and storage (CCS), partnering to develop e-methane, and grow bio-LNG, or liquefied biomethane, which is produced from capturing and upgrading biogas that would have otherwise been emitted from landfills, agricultural waste, or other feedstock.

LNG receiving capacity growth has been shaping market development over the past 24 months, as it reached 1,029.9-million tonnes/year (tpy) across 47 markets at the end of February 2024, adding almost 70 million tpy in 2023 and making it the highest year of new additions since 2010. Europe saw the greatest additions (30 million tpy), followed by Asia (26.9 million tpy) and Asia Pacific (13 million tpy). The Philippines and Vietnam joined LNG importers in 2023 for the first time.

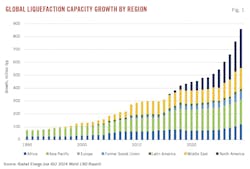

Supply remained constrained, with just 0.8% year-on-year growth from Indonesia’s 3.8-million tpy addition at Tangguh LNG. However, global liquefaction capacity is likely to grow to more than 700 million tpy by 2030, driven by new final investment decisions and the startup of projects currently under construction, particularly in the growing Asian markets, where coal-to-gas switching is being pursued as a decarbonization and air-quality improvement strategy.

LNG export was dominated by the US, which became the largest producer and exporter (84.53 million tonnes in 2023 vs. 75.63 million tonnes in 2022), followed by Australia (79.56 million tonnes), Qatar (78.22 million tonnes), and Russia (31.36 million tonnes).

2023 spot LNG prices declined to levels palatable for recovery of import growth in Asia, as Platts Japan-Korea Marker (JKM) averaged $13.86/MMbtu during the year, while average annual price volatility fell from 2022 levels. China came back as the largest LNG importer at 71.19 million tonnes, Japan and Korea remained second and third despite annual declines, and India came back to the fourth position, with more demand due to the lower spot price. Europe also cemented its role as an LNG importing heavyweight, maintaining the second-largest importing region spot at 121.29 million tonnes in 2023. With LNG supplying almost half of Europe’s gas, the competition between Asian and European markets remains as key market dynamic.

The global LNG market continues to rapidly evolve as it responds to growing gas demand in emerging markets, the increasing number and diversification of market participants, and the acceleration of technology development and innovation. The LNG industry is no longer a game only for big markets or big companies, with portfolio players playing an increasingly important role. In 2023, about 180 companies were involved in LNG deliveries under term contracts, while about 35% of transactions were spot-priced.

However, according to the report, several major uncertainties confront the supply-constrained market, contributing to the fragility of its current equillibrium. Key sources of this uncertainty include: the Biden administration’s US non-free trade agreement (FTA) exports approval pause, which could delay more than 70 million typ of new capacity; sanctions on Russian LNG, which impact almost 20 million tpy of expected capacity; the possibility that Ukraine may not extend the Russian gas transit deal at the end of 2024; shipyard bottlenecks; the ongoing security risk in the Middle East; and declines in gas field supply. More than 120 million tpy of currently operational liquefaction capacity is 20+ years old, and some of these plants are being mothballed due to insuf-ficient upstream gas production, which calls for attention to the supply side risk, according to IGU.

Liquefactions projects

As of end-February 2024, 216.85 million tpy of liquefaction capacity is either under construc-tion or approved for development, according to the IGU, 48% of it in North America. This continued North American lead in new liquefaction plans follows 2023 approval of nearly 41 million tpy of capacity: Venture Global LNG Inc.’s Plaquemines LNG Phase 2 (10 million tpy), Sempra Infrastructure’s Port Arthur LNG (13 million tpy), and Global Infrastructure Partners Rio Grande LNG (17.6 million tpy).

International LNG production growth plans are led by QatarEnergy which plans to increase its capacity to 142 million tpy from 77 million tpy by 2030 (see accompanying article). Russian growth plans, by contrast, have been hampered by ongoing international sanctions related to its invasion of Ukraine. Commissioning of PAO Novatek’s 6.6-million tpy Arctic LNG 2 Train 1 has been delayed by sanctions and IGU doesn’t expect the plant’s second and third trains to start up until after 2026.

There was 1,046 million tpy of potential liquefaction capacity awaiting final investment decision (FID) as of end-February 2024, according to IGU, driven by a desire to replace Russian volumes lost as a result of its ongoing war with Ukraine.

Pre-FID plans from US producers include Venture Global’s 20-million tpy CP2 plant in Camer-on Parish, La., and Tellurian Inc.’s 27.6-million tpy Driftwood LNG plant Calcasieu Parish, La. Earlier this year, the US Federal Energy Regulatory Commission (FERC) approved CP2 and its accompanying pipeline (OGJ Online, June 27, 2024). The project, however, still needs Depart-ment of Energy (DOE) authorization to export to non-FTA countries.

FERC also this year granted Tellurian a 3-year extension to complete Driftwood (OGJ Online, Feb. 15, 2024). The company subsequently sold its upstream natural gas assets in Hayneville and Bossier shales to Aethon Energy Management LLC.

In Canada, Pembina Pipeline Corp. and the Haisla Nation earlier this year took FID on Cedar LNG (3.3 million tpy) in Kitimat, BC (OGJ Online, June 25, 2024). The project will use a floating LNG (FLNG) plant and source its gas from Montney shale production. In-service is expected in late 2028. The 14-million tpy Shell Canada Energy-led LNG Canada plant, also near Kitimat, is expected to start operations mid-2025. LNG Canada Development Inc. is considering Phase 2 of the project, which would double the plant’s capacity.

Russia continues to pursue alternatives for getting its gas to market in light of the sharp curtail-ment of its pipeline shipments to Europe. According to state news agency Interfax, the country cur-rently produces 33 million tpy and plans to expand this to 100 million tpy by 2035. Hitting this goal will be difficult due to both the capital and technological deficiencies of Russian operators under sanction.

IGU expects approval of Novatek’s 5-million tpy Ob LNG plant in the Arctic Yamal-Nenets re-gion by end-2024. Interfax in February 2024 quoted Deputy Prime Minister Alexander Novak as describing plans for PAO Gazprom’s 6.2-million tpy Sakhalin-1 LNG plant on Russia’s Pacific coast as active.

Sakhalin-2’s 5.4-million tonne/year Train 3 expansion is pre-FID and, according to IGU, “may face difficulties with sourcing feed gas since it plans to purchase this from the abandoned Sakhalin-1 gas fields with developed gas reserves in the Sakhalin-2 region not yet sufficient.” Sakhalin-2 involves brownfield development of the mature Lunskoye gas field, 20 km offshore in the Okhotsk Sea. IGU estimates that at least some portion of the planned 17.7-million tpy Yakutsk LNG, also in Russia’s Far East, will start operations supplying Asian customers in 2031.

IGU pegs Africa’s proposed liquefaction capacity at 101.3 million tpy, 32.2 million tpy of which is in Mozambique. ExxonMobil Corp. expects to take final investment decision on its 15-million tpy Rovuma LNG plant by end-2025, security issues in Cabo Delgado province having for a time stabilized somewhat. Abu Dhabi National Oil Co. bought Galp Energia SGPS SA’s 10% stake in the Area 4 concession of Rovuma basin, including the Rovuma LNG project, in May 2024 (OGJ Online, May 22, 2024).

TotalEnergies SE’s 13-million tpy Mozambique LNG project on the Afungi peninsula has been under force majeure since April 2021 due to similar security concerns. The company is in the pro-cess of reengaging project financers in an effort to restart it.