Price rollercoaster for natural gas to get under way in earnest now

The real rollercoaster for natural gas prices starts now. Unseasonably warm weather took the wind out of the sails of high gas prices the last couple of weeks, but that trend was abruptly reversed this week.

Last week, temperatures again rose across the US to higher than normal levels. With the heating season getting off to a relatively weak start and the onset of some nuclear power capacity coming back on line in recent weeks, spot prices fell about 50-70¢ below October's levels (see table below). A spurt of cold weather this week pushed gas prices back up to the mid-$5s again.

But the outlook is for a return to normal winter weather, and forecasts point to cooler temperatures for about the next 2 weeks. That helped NYMEX futures prices rebound from their recent decline, with the 12-month strip recently trading about 50¢ higher this week than it did a week ago.

Bear in mind that this seasonal shift represents volatility at a level near $5/Mcf. This points to the continuing strength of the underlying market fundamentals for natural gas in North America. The lackluster onset of the heating season merely means the industry has another chance to bring natural gas inventories up to a level of about 2.7-2.8 tcfstill well below the level desirable for ending the heating season with a comfortable remaining cushion next March ahead of the next cooling season.

The warmer weather notwithstanding, there was a slowdown in injection rates last week, as only 36 bcf was injected vs. 70 bcf the prior week. But with the heating season imminent last week, the fact that even 36 bcf was injected during a comparatively warm stretch was itself anomalous. It apparently reflects continuing concerns by operators about whether inventories will be adequate in light of expected strong weather-related demand this winter. The year to year storage deficit thus shrank a bit, to 259 bcf from 283 bcf. But with the onset of colder weather this week and next, expect that deficit to widen once again, slowing the buildup of inventories to even the 2.8 tcf level.

As for continuing concerns over supplies, particularly the level of wellhead deliverability, it is important to note that this is a time of year that typically Canadian rig activity takes a hit because of sloppy weather conditions hindering rig movement. Nevertheless, the Canadian rig count rose to 404 last week, 8 rigs higher than the week before and 30 rigs more than a year ago at this time. US rig activity slipped a bit, but the US tally remains well above 1,000. For both areas, the bulk of this increased activity is still focused on natural gas. But bear in mind that the gas wells getting drilled in both countries get deplete much sooner and more rapidly than in the past, so it is going to take a lot more wells to provide a cushion for wellhead deliverability than had been the case even a decade ago. The good news is that there seems the likelihood of a robust price environment to sustain that kind of drilling impetus for perhaps several more years-maybe to the end of the decade, the optimists say.

The bad news is that even strong prices aren't going to do much to alleviate critical shortages of equipment and manpower in the near term. That in itself will be a limiting factor that will rein production growth and thus keep a prop under prices. LNG pipeline imports will be a partial solution, but as soon as they start having much of a supply impact, the price of gas will begin to decline enough to where they start to drop out of the picture again. Mexican pipeline imports might make more of a contribution in the midterm, but don't count on that source as a long-term solution to US gas supply woes. The new administration in Mexico is likely to expedite the privatization of the country's power sector and continue efforts to open the natural gas midstream and downstream sectors. Given the strength of Mexico's economy and the desperate need for power capacity additions (and the very real environmental concerns that will bolster demand for natural gas by all these new power plants), Mexico is more likely to be competing with the US for gas supplies in the years to come-especially if constitutional strictures against foreign investment in Mexican E&D remain in place, as expected.

Where does that leave us now? With expectations of normal winter temperatures, the US is likely to end the heating season at well below the desired level of 1 tcf-perhaps even half that level. Even another warm winter won't bring storage levels to much more than 1 tcf, which is where we ended last winter. That sets the stage for gas prices remaining strong throughout 2001, probably $4-5/Mcf. But real sustained blast of cold weather persisting for several weeks will probably see spot prices rocket into the double digits-perhaps briefly as high as $20-30/Mcf, some analysts are warning.

If Gore ends up in the White House and with the new Congress virtually at stalemate-especially with a lot of antagonism already aimed at the industry over gasoline and heating oil price spikes this year-that kind of price spiral could end up hurting the oil and gas industry much more in the long run than would benefit it in the short term.

null

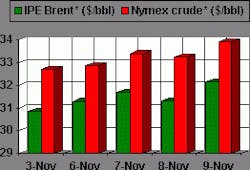

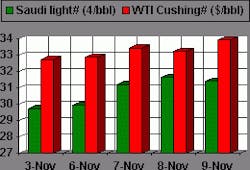

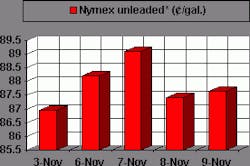

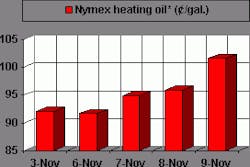

OGJ Hotline Market Pulse

Latest Prices as of November 10, 2000

null

null

Nymex unleaded

null

Nymex heating oil

null

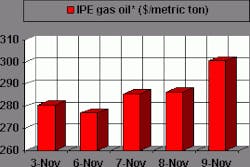

IPE gas oil

null

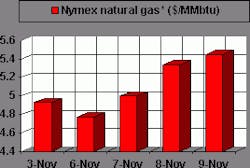

Nymex natural gas

null