BP: Global energy demand to jump 37% by 2035

Global demand for energy is expected to rise by 37% from 2013 to 2035, or by an average of 1.4%/year, due in large part to ongoing economic expansion in Asia, particularly in China and India, according to the latest BP Energy Outlook 2035.

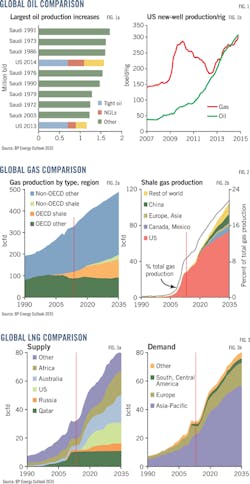

Demand for oil is projected to increase 0.8%/year to 2035, coming entirely from countries outside of the Organization for Economic Cooperation and Development. Oil consumption within OECD peaked in 2005 and by 2035 is expected to have fallen to levels not seen since 1986. China by 2035 is likely to have overtaken the US as the world's largest single consumer of oil.

The recent worldwide rise in oil supply stemming in large part from strong growth in tight-oil production in the US, meanwhile, is likely to take several years to work through, BP indicates in its outlook.

Tight-oil production in 2014 drove overall US oil output higher by 1.5 million b/d-the largest single-year rise in US history. But further out, BP notes, the growth in tight oil is likely to slow and Middle East production will gain ground once more.

By the 2030s the US is likely to have become self-sufficient in oil, after having imported 60% of its total demand as recently as 2005.

The outlook also projects worldwide carbon dioxide emissions to increase 1%/year to 2035-or 25% over the period-on a trajectory significantly above the path recommended by scientists as illustrated, for example, by the IEA's "450 Scenario" (OGJ Online, Dec. 7, 2009).

Natural gas demand rising

Demand for natural gas will increase fastest of the fossil fuels over the period to 2035, rising 1.9%/year, led by demand from Asia, the outlook indicates.

Half the increased demand will be met by rising conventional gas production, primarily in Russia and the Middle East, while the other half will come from shale gas.

By 2035 North America, which currently accounts for almost all global shale gas supply, will still produce 75% of the total.

As demand for gas grows, there will be increasing trade across regions and by the early 2020s, Asia-Pacific will overtake Europe as the largest net gas importing region.

The continuing growth of shale gas also will mean that in the next few years, North America will switch from being a net importer to net exporter of gas, BP says.

The overwhelming majority of the increase in traded gas will be met through increasing LNG supplies. LNG production will show dramatic growth over the rest of this decade, with supply growing almost 8%/year through the period to 2020. This also means that by 2035 LNG will have overtaken pipelines as the dominant form of traded gas, BP says.

Increasing LNG trade will also have other effects on markets. Over time it can be expected to lead to more connected and integrated gas markets and prices across the world.

And it is also likely to provide significantly greater diversity in gas supplies to consuming regions such as Europe and China.