Russian LNG exports to grow through 2040

Eugene M. Khartukov

Moscow State University for International Relations

Moscow

Russian LNG exports are poised to grow dramatically in the next 22 years. This article details the factors shaping that growth.

On Dec. 9, 2017, the first vessel loaded with LNG from Yamal LNG left Russia for Europe. Yamal is the first Russian LNG project in which Russian shareholders have had a controlling interest from the outset and is the northernmost liquefaction project in Russia.

Yamal LNG is sited in Sabetta at the northeast edge of the Yamal Peninsula. In addition to the LNG plant, the project includes production at the Yuzhno-Tambeyskoye (South Tambey) gas field, and transport infrastructure including the Sabetta seaport and airport.

China expects to take more than 4 million tonnes/year (tpy) once the plant hits its full 16.5-million tpy capacity in 2019, China National Petroleum Co. (CNPC) said in a statement posted on its website. CNPC holds a 20% stake in the OAO Novatek-operated project.

The first Yamal cargo was carried by Sovcomflot’s Arc7 172,845-cu m ice-class LNG vessel Christophe de Margerie. The ship is the first of 15 ice-class vessels being built to serve Yamal LNG.

Yamal LNG and Belgium’s Fluxys LNG signed a 20-year contract for transshipment of up to 8 million tpy at the port of Zeebrugge, with Yamal Trade (a 100% subsidiary of Yamal LNG) to support year-round LNG deliveries from the Yamal Peninsula to Asia Pacific markets. During the summer navigation period, Arctic-class LNG tankers will deliver LNG directly to Asian customers. In the winter, cargoes will be delivered to Zeebrugge Terminal where Fluxys will provide services to transship LNG on conventional vessels to customers in Asia via the Suez Canal.

According to Yamal LNG it will take half as much time to ship LNG to Asian countries using the eastward route as the westward one. This benefit, however, will be fully realized only after Atomflot commissions three nuclear-powered 60 Mw ice breakers—Arktika, Sibir, and Ural—in 2019, 2020, and 2021. Ice-breaking gas carriers are needed as Yamal LNG lies above the Arctic Circle in the estuary of the Ob River, frozen for 7-9 months/year and where winter temperatures can drop to as low as -50° C. (-58° F.).

Russia shipped its first cargo via the eastern, Arctic route in July. Two 172,000-cu m vessels—Eduard Toll and Vladimir Rusanov—delivered LNG to Jiangsu Rudong port, China.

South Tambey field has 2P reserves of 927 billion cu m (bcm), according to Petroleum Resources Management System (PRMS) classification. More than 200 wells have been drilled and three 5.5-million tpy liquefaction trains built. All LNG production is sold under 15- to 20-year contracts.

With the launch of the Yamal LNG, Russian LNG exports have grown by more than 100% in the first three months of 2018. By July 23, 2018, Yamal LNG had exported 3 million tonnes from Train 1 and shipped 41 cargoes.

Yamal LNG’s shareholders are Novatek (50.1%), Total SA (20%), CNPC, and the Chinese state-run Silk Road Fund (9.9%).

Arctic LNG 2

Novatek is building another LNG plant—Arctic LNG 2—in Russia’s north, east of Yamal LNG on the west coast of the Gydan peninsula in the shallow waters of the Gulf of Ob. Arctic LNG 2 will boost Novatek’s production of LNG to more than 34 million tpy.

Construction began this year. Plans call for three 6.6-million tpy trains: Train 1 completed in 2022, Train 2 in 2023, and Train 3 in 2025.

This project will be less capital intensive ($10 billion vs. Yamal’s $20 billion), using liquefaction technology licensed from Linde Engineering and a gravity-based structure (GBS) installed by Saipem on the seabed.

The trains will rest on three standalone, ice-resistant platforms stationed near shore. LNG and gas condensate will be shipped directly from the platforms, which will be equipped with storage tanks. Natural gas will come from nearby Salmanovskoye and Geofizicheskoye fields, and possibly Gydanskoye, East Tambey, and North Ob fields. Arctic LNG’s front-end engineering and design is to be complete by late 2018 and a final investment decision taken before end 2019.

Novatek signed a memorandum of understanding with Saudi Aramco in February 2018, the parties agreeing to collaborate internationally on natural gas projects, including LNG supplies, development of LNG markets, gas exploration and production projects, and research and technology development.

In May 2018, Novatek and Total signed an agreement for the French company to buy 10% of Arctic LNG, with plans to close the deal first-quarter 2019. Novatek also is in talks with both CNPC and the Silk Road Fund regarding potential participation in the project.

Other projects

Gazprom, meanwhile, is building the Baltic LNG and Vladivostok LNG plants and Rosneft and Alltech Group the Pechora LNG plant with combined expected capacity by 2023 of 27.6-33.8 million tpy. All told, announced Russian LNG projects would produce as much as 118.75 million tpy, the bulk of which would be exported (Table 1).

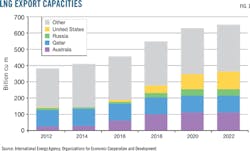

Analysts predict substantial growth both in LNG export capacities and LNG trade (Fig. 1). A fleet of 25 LNG carriers owned mostly (in whole or in part) by Sovcomflot is used by Russia to export its LNG (Table 2).

Dynagas Holding, the sponsor of Dynagas LNG Partners, has entered into long-term time charter agreements for five Arc7 and four Arc4 carriers for Yamal LNG. Dynagas will build five 172,000-cu m ARC7 LNG carriers at Daewoo Shipbuilding & Marine Engineering shipyard in South Korea which will serve the Novatek-operated Yamal project under long-term time charters. The vessels will be capable of breaking 2.1 m of ice in both forward and reverse directions. Four of Dynagas’s existing Arc4 LNG carriers will join the shipping fleet to support Yamal deliveries committed to Asian buyers from 2019 onwards and will be time-chartered for 15 years each.

Both Rosneft and Sovcomflot have placed orders for several ice-class vessels at Zvezda shipyard on Russia’s east coast. The yard is heavily supported by the federal authorities.

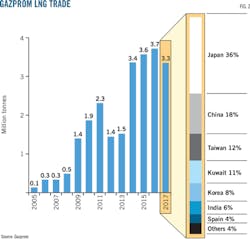

Gazprom is Russia’s sole LNG exporter, buying 2.9 million tpy from Yamal LNG to ship to international markets. Since 2005 exports of LNG by Gazprom (or Russia) have grown to more than 3 million tpy from a mere 0.1 million tpy, with deliveries to Japan, China, Taiwan, Kuwait, South Korea, India, Spain, and Pakistan to mention only major buyers (Fig. 2).

Gazprom has a 20-year agreement with GAIL to deliver 2.5 million tpy to India and an 8-year sales and purchase contract to supply 1.2 million tpy to a floating regasification terminal off Cameroon owned by Perenco. LNG from Gazprom already supplies Kuwait, Thailand, and the UAE.

Early in 2018, Gazpom-affiliate Gazexport predicted that by 2025 Gazprom would provide around 6% the world’s LNG exports. Russia’s historic share of the global LNG trade has so far peaked at 1.5% in 2015 (Table 3).

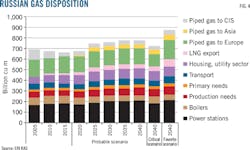

According to Russian and Japanese analysts, the Russian Far East’s (Sakhalin and Vladivostok) LNG projects are competitive compared with other major LNG schemes worldwide (Fig. 4).

Sakhalin-2

The Sakhalin-2 LNG plant, commissioned in 2009, was the first of its kind in Russia. It is in Prigorodnoye on the coast of Aniva Bay, 13 km (8.1 miles) east of Korsakov. Construction of the LNG plant was carried out by OAO Nipigazpererabotka (Nipigaz) and the KhimEnergo consortium, together with Japanese companies Chiyoda Corp. and Toyo Engineering Corp. The plant was designed to prevent major loss of containment in the event of an earthquake and to ensure the structural integrity of critical elements such as emergency shut-down valves and the control room.

Sakhalin-2 LNG includes:

• Two double-walled 100,000-cu m (3.5-MMcf) LNG storage tanks.

• An 805-m (2,641-ft) jetty.

• Two 4.8-million tpy LNG trains.

• Two 1,600-cu m gross capacity refrigerant storage spheres, for propane and ethane.

• Five 129-Mw gas-turbine driven generators.

The jetty is fitted with four arms: two loading arms, one dual-purpose arm, and one vapor return arm. Its upper deck includes a road bed and electric cables. The lower deck is used for the LNG pipeline, communication lines, and a footpath. The water depth at the tail of the jetty is 14 m.

The jetty serves LNG tankers with capacities between 18.000 and 145.000 cu m. Loading takes 6-16 hr, depending on vessel capacity.

Sakhalin Energy Investment Co. Ltd. (SEIC) is considering adding another train to the site using Royal Dutch Shell’s double-mixed refrigerant process (DMR), developed for use in cold climates such as Sakhalin.

Growth

Moscow-based Energy Research Institute of the Russian Academy of Sciences (ERI RAS) predicted in 2016 that by 2040 Russia’s natural gas consumption would grow by 30 bcm/year (14 million tpy) to 80 bcm/year in its favorable scenario (Fig. 5), while the same institute foresaw in 2014 that by 2040 Russian LNG plants would be producing 80-120 bcm/year (Fig. 6).

According to BP’s 2018 Energy Outlook, by 2040 Russia’s LNG exports should reach 5 bcfd (almost 52 bcm/year or nearly 24 million tpy) (Fig. 7).

The author

Eugene M. Khartukov ([email protected]) teaches world oil and energy markets research at the Moscow State University for International Relations (MGIMO), Ministry of Foreign Affairs. Since 1984, Khartukov has led the Moscow-based World Energy Analysis & Forecasting Group, advising and consulting on oil and gas economics and policies and energy pricing to various Soviet-Russian ministries, international agencies, foreign governments, private oil and gas companies, consulting firms and financial institutions, and the administrations of Soviet-Russian leaders Mikhail Gorbachev, Boris Yeltsin, and Vladimir Putin. Since 1995 he has served as vice president (for Eurasia) of Petro-Logistics Ltd., Switzerland, becoming general director of the (International) Center for Petroleum Business Studies, Moscow, and professor of marketing, management and commerce at MGIMO the next year. Khartukov earned his PhD (1980), doctor of sciences (1993), and professor certification (1994) at MGIMO.