Market changes shape N. American gas spending needs

Investment requirements for natural gas infrastructure in North America will be amplified by market changes beyond the 33% consumption growth expected through 2020.

Consumption of gas not only will expand but also will occur in new locations and depend greatly on supply from new sources. The consequent flow changes raise needs for pipelines and storage facilities beyond what they would be if the expected market growth were geographically static.

Rerouting is central to the projection, in a study done for INGAA Foundation Inc., that investment needed for North American gas pipelines and storage will total $61 billion (2003 dollars) through 2020 (OGJ, Aug. 23, 2004, p. 54).

Conducted by Energy & Environmental Analysis Inc. (EEA), the study highlights strong future growth in gas demand for electric power generation and increasing reliance on production from frontier areas and imports of LNG.

In addition to highlighting the financial challenge, the study shows where construction of pipelines, storage facilities, LNG terminals, and other gas infrastructure needs to occur in the next decade and a half.

Gas for power

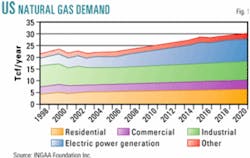

Projecting growth in US gas demand to 29.7 tcf in 2020 from 21.5 tcf in 2003, the study predicts electric power generation will account for 67% of the increase, followed by residential uses 14%, commercial and industrial 8% each, and other uses 3% (Fig. 1).

Because power generation peaks with cooling load in summer, growth in gas demand generally will be fastest in warm parts of the US with increasing population.

Of the 2003-20 gas demand increase, 28% will be in the Southeast and Florida, 27% in the Mountain states and West, 20% in the Northeast, 14% in the Gulf Coast, and 11% in the Midwest and Plains.

The combined shares of the US gas market claimed by the Southeast-Florida and Mountain-West regions will rise to 37% in 2020 from 33% in 2003 while those of the Gulf Coast and Midwest-Plains shrink to a combined 43% from 49%. The Northeast's share will remain at 18%, according to EEA.

Despite rising summertime use of gas for electric power generation, overall gas consumption will continue to peak in winter, when space heating dominates the market in most of the US.

By 2020, EEA says, peak winter demand will be 60% greater than peak summer demand, compared with 70% greater in a normal year now.

Because gas injection for storage claims much existing pipeline capacity during summer months, spare capacity won't be available to service the growing summertime needs for electric power generation.

"Therefore, incremental pipeline infrastructure will be needed to serve an increasing summer market," the study says.

Shifting supply

As geographic and seasonal patterns of demand shift, so will sources of supply.

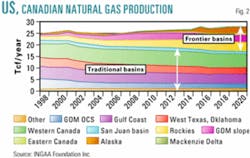

Production from what the INGAA study calls frontier basins will continue to capture a growing portion of total supply at the expense of traditional basins (Fig. 2). That means supply will come increasingly from the Rocky Mountains, Eastern Canada, Alaska, the Gulf of Mexico continental slope, and the Mackenzie Delta—areas underserved by pipelines or not served at all.

In 2003, the study says, frontier basins accounted for 20% of North American gas production totaling 24 tcf. Of the 26.7 tcf projected for 2020, the frontier-basin share will climb to 39%.

"Of course, to bring gas from the new supply regions, pipeline infrastructure will have to be built," the study notes.

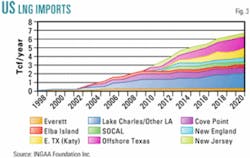

To supplement North American production, the INGAA study says LNG imports will have to leap from 475 bcf in 2003 to more than 6.6 tcf in 2020 (Fig. 3).

That growth will require construction of 10 terminals and expansion of the four existing facilities.

The study assumes construction of two terminals on the East Coast, seven on the Gulf Coast, and one on the West Coast.

Of the 2003-20 outlay the study projects for pipelines and storage, $19 billion is for maintenance, $18 billion for pipelines from the Mackenzie Delta and Alaska, and $24 billion for pipe- lines and storage projects elsewhere.

Capacity projections

EEA notes that new pipeline capacity will be needed from frontier basins and to accommodate growing imports of LNG.

During 2003-20, the US will need 4.6 bcfd of new pipeline capacity from western Canada. The study cites projections for 7 bcfd of gas entering British Columbia and Alberta from arctic fields but points out that its assessment of US requirements accounts for spare capacity available now, diminishing production from the Western Canadian Sedimentary Basin, and increased demand in western Canada, especially for production of oil sands.

The study also sees needs for 800 MMcfd of pipeline capacity from eastern Canada, 5.5 bcfd from the Rockies, and 8.4 bcfd from deep waters of the Gulf of Mexico.

Although gas flows will increase to the Midcontinent from the Rockies, no pipeline capacity expansion is projected there, on the corridor from Texas to the Northeast and Midwest, or along the eastern corridor.

There will, however, be projects to connect new supply basins and "numerous" pipeline projects to relieve local bottlenecks in market areas, EEA says.

Additional pipeline infrastructure will be needed to accommodate expected increases in LNG receiving capacity, which will exceed 11 bcfd. Pipeline requirements will increase even more if LNG terminals envisioned for the East Coast have to be built instead on the Gulf Coast because of permitting problems.

Mileage outlook

EEA projects installation of more than 45,000 miles of regional and interregional pipeline in North America through 2020 to meet gas demand growth. Of that, 10,000 will be replacement pipe and the rest new pipelines.

About 7,000 miles of the new pipeline will be for Alaskan and Mackenzie Delta gas destined for the US Lower 48.

Of the total mileage projected for installation through 2020, 66% of the pipe will have diameters less than 24 in., 18% will have diameters of 24-32 in., and 16% will be greater than 32 in.

EEA expects requirements for new compression associated with the pipeline installation to total 7.8 million hp. About three fourths of the new compression will be for new pipelines, half for the Alaskan and Mackenzie Delta projects. Replacement compression will account for 17% of the projected requirement and storage projects the remainder.