US LNG EXPORT PROJECTS—1: Three-point system compares US LNG export projects

John E. Paisie

JEA Consulting Group

Toledo, Ohio

Evaluating potential US LNG export terminals on the basis of their development plan, financial health, and development timeline allows a sorting of the various projects by their likelihood of completion.

This first article of a two-part series provides a qualitative assessment of each of the proposed terminals on these bases to determine which are most likely to advance towards construction and commissioning. The second article will use a quantitative approach to compare the proposed terminals with generic LNG liquefaction projects of similar scale.

Development of high-volume shale natural gas in the US is poised to affect the global energy landscape dramatically. Increased US production could result in the country becoming a major exporter of LNG.

Depending on the extent of the exports, trade flow patterns could be altered and existing commercial arrangements disrupted. Increased unconventional domestic natural gas supplies will raise NGL production and could also shift US energy demand, both affecting future oil demand. Other countries with substantial unconventional gas resources could also apply the technological and operational lessons learned in the US to ramp up production rapidly.

Permitting

Fig. 1 shows proposed US LNG export terminals. One key obstacle facing these projects is the process companies must go through to obtain approval to build export terminals and export LNG.

A company must receive approval from the US Federal Energy Regulatory Commission to build an export terminal. FERC has exclusive authority to approve or deny an application for the siting, construction, expansion, or operation of onshore LNG terminals under the Natural Gas Act, as updated by the Energy Policy Act of 2005. FERC also monitors all construction and restoration to ensure compliance with federal, state, and local permits and regulations.

A company must first request FERC to undertake a prefiling environmental review. This process serves to prepare for compliance with the National Environmental Protection Act (NEPA) in preparing the environmental impact statement (EIS) or environmental assessment (EA) and can take up to 1 year to complete.

After the prefiling review begins, a company must prepare resource reports to submit to FERC with its formal application in so FERC can prepare an EIS or EA. This process can also take more than 1 year.

The EIS lays out the impacts and alternatives of proposed action, in this case the decision to approve or deny an LNG export project. During preparation of the EIS and EA, FERC will work with cooperating state and federal agencies to assess the environmental consequences of the plant. If the agency finds the plant will significantly affect the quality of the human environment, it will address those consequences with suggested mitigation strategies.

The report will also assess alternatives to the plant being approved. Provided that an owner of an LNG export plant is willing to work with FERC in mitigating the environmental consequences of a plant, it is likely that completing an EIS or EA will be followed by approval of a project.

After FERC authorization is obtained, a potential LNG export project must acquire a number of other state and federal permits. These include dispensations under the Clean Water Act, Coastal Zone Management Act, and Clean Air Act, as well as federal endangered species clearance from the Fish and Wildlife Service. Each state also has several permits, often ranging up to 30, that a company must obtain before construction can begin.

Cheniere Energy Inc. successfully completed approval processes for export capacity at its Sabine Pass plant in Louisiana. Approvals included a water quality certificate from Louisiana, a permit from the US Corps of Army Engineers for working in wetlands, state endangered species clearance from the Louisiana Department of Wildlife and Fisheries, an air emissions permit from the Louisiana Department of Environmental Quality, and a National Historic Preservation Act Clearance from the Louisiana Department of Culture.

These permits are similar to FERC approval in that they are not barriers to construction, provided the company complies with the guidelines necessary to obtain approval.

The permit currently restricting approval of all US LNG export terminals is the authorization-to-export permit from the Department of Energy. There are two types of permits needed from DOE regarding export of LNG: one to export to free-trade agreement (FTA) countries and one to export to non-FTA countries. The DOE considers several issues when deciding to issue this permit, including domestic need and public interest.

"Public interest" is not defined in the Natural Gas Act that grants DOE permitting power, leaving it a great deal of discretion in making this determination. If an applicant seeks permission to export natural gas to countries with which the US has a free-trade agreement in place the license is to be issued "without modification or delay" because such an application is considered to be "consistent with the public interest."1

If an applicant seeks permission to export natural gas to countries with which the US does not have an FTA, however, the DOE must make a public interest determination after first publicly providing notice of the filing.

The agency makes its determination with the understanding that "the market, not the government, should determine the price and other contract terms of exported natural gas."2 DOE determination considers a variety of issues, including the cumulative impacts of current and previously filed applications on the domestic need for natural gas, energy security, and impacts on the national gross domestic product, consumers, industry, balance of trade, and job creation.

The DOE currently has a moratorium on the issuance of all export licenses, even on those that it is supposed to issue "without modification or delay," stating that it is suspending the issuance of any new permits until a privately-commissioned study is released detailing the market impact of LNG exports.3 The study was originally to have been released in March of this year, but that deadline was extended until after the upcoming presidential election.4

Assessment

While permitting is critical, other issues also affect the probability of each export plant moving to completion and commissioning. JEA Consulting Group assessed each of the proposed plants from a qualitative and quantitative perspective.

The quantitative portion includes assessment of the financial robustness of the LNG export plants considering location (East Coast, Gulf Coast, and West Coast) and key sensitivities (capital requirements, natural gas prices, transportation costs, and exchange rates). The assessment also considers the influence of potential developments in the global oil and gas sector.

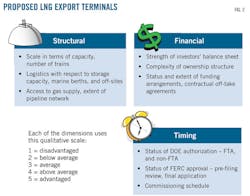

The qualitative portion of the assessment uses three major dimensions: structural, financial, and timing. The structural dimension considers the operational advantages and disadvantages associated with each of the plants. The financial dimension reflects the level of uncertainty associated with investors' ability to raise and invest the required funds. The timing dimension indicates the site or sites best positioned to capture the benefits of being earlier movers.

Fig. 2 provides further details of each dimension.

Structural assessment

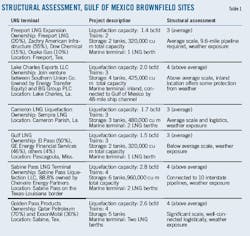

• Gulf of Mexico. Out of the existing terminals in the Gulf Coast region, the Sabine Pass and the Golden Pass have a slight structural advantage compared with Freeport LNG (Table 1).

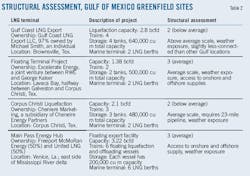

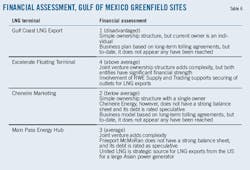

The brownfield locations (currently operated for LNG regasification and import) clearly have an advantage over greenfield locations: in-place logistics and equipment. With respect to the green-field locations, however, Excelerate Energy's proposed floating plant and the Main Pass Energy Hub have slight advantages over the other proposed greenfield sites because of their planned scale and access to both onshore and offshore supply (Table 2).

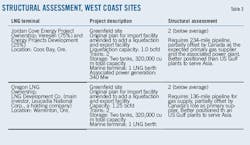

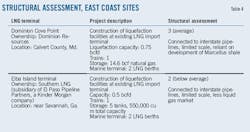

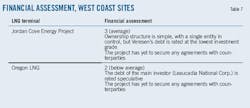

• West Coast. From a structural perspective, the Oregon LNG proposal has a slight advantage compared with the Jordan Cove Energy project, mainly because the associated pipeline project is less complicated. Both projects, however, are below average compared with other projects (Table 3).

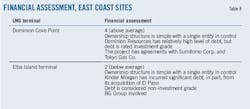

• East Coast. The Dominion Cove Point plant has structural advantages compared with the Elba Island LNG plant, mainly because of its more ready access to large supplies (Table 4).

Financial assessment

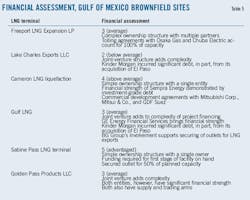

• Gulf of Mexico. Sabine Pass has a significant financial advantage among the already existing terminals in the region, with arrangements in place for funding and offtake associated with the its planned initial two trains. Cameron LNG also has an advantage (though to a lesser degree than Sabine Pass) stemming from its ownership structure and commercial arrangements (Table 5).

Excelerate's floating plant has a clear advantage compared with other newbuilds along the gulf because of the financial strength of its ownership and its ability to secure outlets for the LNG (Table 6).

• West Coast. The Jordan Cove Energy project has a slight financial advantage over the Oregon LNG project. As with the structural attributes, however, both projects are below average compared with other projects (Table 7).

• East Coast. Dominion Cove Point project's simple ownership structure and existing development agreements give it a financial advantage over other East Coast LNG-export proposals (Table 8).

Timing assessment

• Gulf of Mexico. Sabine Pass has a clear timing advantage over other projects already in place, having already secured required DOE and FERC permits. Freeport LNG also has an advantage (though smaller Sabine Pass) because of its progress in the permitting process (Table 9).

Excelerate's floating project has a slight advantage from a timing perspective among new projects, having secured the required DOE FTA permit (Table 10).

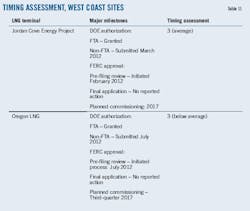

• West Coast. The Jordan Cove Energy project and the Oregon LNG project are essentially on par with each other from a timing perspective. The two projects are also on par with most of the other projects in terms of timing (Table 11).

• East Coast. Dominion Cove Point has a slight timing advantage compared with the other East Coast project (Table 12).

National perspective

Existing terminals are generally better positioned to build and commission liquefaction and export plants. Projects associated with the Gulf Coast also tend to be better positioned than projects in other regions.

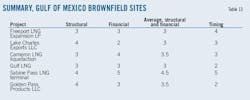

Table 13 illustrates the qualitative advantage enjoyed by Sabine Pass. Cameron LNG also has a slight advantage compared with the other projects. Table 14 shows the advantages of Excelerate's floating plant compared with other greenfield sites in the gulf region. The Jordan Cove Energy project has a slight advantage compared with the Oregon LNG project (Table 15). The quantitative assessment shows Dominion Cove Point having an advantage compared with Elba Island (Table 16).

Fig. 3 compares all proposed sites, plotting the average assessment for structural and financial attributes and an assessment of timing.

Sabine Pass's assessment is much higher than any other plant. Plants at the next level below Sabine Pass include Freeport LNG expansion, Cameron LNG liquefaction, and Excelerate's floating plant. Golden Pass scores relatively high in structural and financial terms but lags in terms of timing.

Borderline projects in terms of structure, finance, and timing include Lake Charles and Dominion Cove Point. Gulf LNG and the Main Pass Energy Hub are average in terms of structure and finance but lag in terms of timing. The remaining projects score below average in all areas and appear the least likely to come to fruition

References

1. National Gas Act Section 3(c), amended by Energy Policy Act of 1992, Section 201.

2. DOE Policy Guidelines at 6685.

3. "US Decision on LNG exports will not be "outsourced"—Energy Department," Reuters, http://Reuters.com/article/2012/11/14/usa-lng-doe (accessed Nov. 15, 2012).

4. "Natural Gas Import and Export Regulations," US Department of Energy, http://www.fossil.energy.gov/programs/gasregulations (accessed Oct. 17, 2012).

The author

John Paisie ([email protected]) is managing partner of JEA Consulting Group. Before joining JEA he was for 8 years a partner and member of the executive committee of PFC Energy, a consulting firm based in Washington, DC. Before joining PFC, Paisie worked with IBM Consulting Services (formerly PriceWaterhouseCoopers, PwC Consulting) and was an associate partner at the time of his departure. Before becoming a consultant he held management and technical positions in industry, starting his career as an engineer. Paisie holds an undergraduate engineering degree from the University of Toledo, Ohio, and an MBA from Purdue University, Lafayette, Ind. He is an energy risk professional, certified by the Global Association of Risk Professionals.