EIA: North American LNG export capacity could more than double by 2027

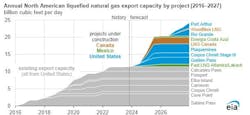

The US Energy Information Administration (EIA) expects North America’s LNG export capacity to increase to 24.3 bcfd by end-2027 from its current 11.4 bcfd.

Growth will be driven by commencement of LNG export terminals in Mexico and Canada and expansion of existing capacity in the US. By end-2027, EIA estimates LNG export capacity will grow by 1.1 bcfd in Mexico, 2.1 bcfd in Canada, and 9.7 bcfd in the US from a total of 10 new projects across the three countries.

Mexico

At present, developers are in the process of building three projects with a collective LNG export capacity of 1.1 bcfd in Mexico. These projects include Fast LNG Altamira offshore and onshore and Fast LNG Lakach, both on Mexico's east coast, and Sempra Energy's Energia Costa Azul on Mexico's west coast.

Fast LNG Altamira consists of three units, each with a capacity to liquefy up to 0.18 bcfd of natural gas. The first unit will be offshore, and the other two units will be installed onshore at the Altamira LNG regasification terminal. Natural gas from the US delivered via the Sur de Texas-Tuxpan pipeline will supply these units. Developers expect the first LNG exports from the offshore unit in December 2023 and LNG exports from the onshore units in 2025.

The Fast LNG Lakach unit, with a capacity of 0.18 bcfd, will be positioned offshore Veracruz, Mexico, at the nearby Lakach natural gas field. First LNG exports are expected in 2026.

The Energia Costa Azul LNG terminal lies at the site of the existing LNG regasification terminal in Baja California, western Mexico, which currently imports LNG. Export capacity for Phase 1, currently under construction, will be 0.4 bcfd, while the export capacity for the proposed Phase 2 is 1.6 bcfd. The export terminal will be supplied with natural gas from the US Permian basin.

Developers have put forth plans for additional LNG export projects for Mexico's west coast, including Saguaro Energia LNG, Salina Cruz FLNG, and Vista Pacifico LNG, collectively boasting an export capacity of over 2.7 bcfd. The projects aim to utilize cost-effective natural gas imported from the US to facilitate LNG exports to Asian markets. However, none of these proposed projects has reached a final investment decision.

Canada

Two LNG export projects with a combined capacity of 2.1 bcfd are under construction in British Columbia on Canada’s west coast. Developers have scheduled LNG Canada, with an export capacity of 1.8 bcfd, to begin service in 2025, and Woodfibre LNG, with an export capacity of 0.3 bcfd, to begin service in 2027. Both export terminals will be supplied with natural gas from western Canada. In addition, the Canada Energy Regulator (CER) has authorized an additional 18 LNG export projects with a combined capacity of 29 bcfd.

US

Five LNG export projects are currently under construction in the US with a combined 9.7 bcfd of LNG export capacity—Golden Pass, Plaquemines, Corpus Christi Stage III, Rio Grande, and Port Arthur. Developers expect LNG exports from Golden Pass LNG and Plaquemines LNG to start in 2024.