US LNG exports have reached new highs of about 12 bcfd of natural gas equivalent and are expected to grow to more than 13 bcfd by end 2022 as additional export capacity comes online. In 2024, US LNG peak export capacity will further increase to an estimated 16.3 bcfd.

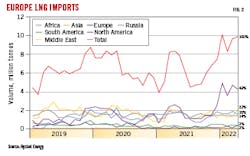

In the wake of Russia’s invasion of Ukraine, Europe has become the primary destination for US LNG exports, taking almost two thirds of the volumes leaving the country. US exports to Europe totaled about 23 million tonnes during the first 5 months of the year, and Rystad Energy predicts total US LNG exports will reach an all-time high of 85 million tonnes in 2022 despite the ongoing outage at Freeport LNG.1

US operators are keen capitalize on prevailing market conditions and to meet growing European demand. Updates on projects focused on doing so follow.

Venture Global

Venture Global LNG Inc.’s Calcasieu Pass LNG has commissioned the first six of nine two-train liquefaction blocks at its 10-million tonne/year (tpy) Calcasieu Pass LNG plant in Cameron Parish, La. In addition to its 18 0.6-million tpy liquefaction trains, the Calcasieu Pass plant includes an onsite natural gas-fired power plant, three pretreatment trains, two 203,500-cu m LNG storage tanks, and two berths capable of loading LNG vessels as large as 185,000 cu m.

FERC began granting commissioning authorization for Blocks 2-6 in November 2021 and issued its last authorization Mar. 30, 2022. With only three blocks left to authorize, and given the pace at which the terminal has received FERC approvals to commission, Calcasieu Pass—which loaded its first commissioning cargo in February—could reach full capacity by third-quarter 2022, according to the US Energy Information Administration (EIA). Venture Global loaded its first commissioning cargo from the plant earlier this year (OGJ Online, Feb. 7, 2022).

Calcasieu Pass receives its feedgas through Venture Global’s 24-mile, 42-in. OD TransCameron pipeline (1.9 bcfd), which has interconnections with TC Energy Corp.’s ANR pipeline, Enbridge Inc.’s TETCO pipeline, and EnLink Midstream Co.’s Bridgeline pipeline.

Venture Global took final investment decision (FID) on its second project, the 20-million tpy Plaquemines LNG plant, following closing of $13.2-billion in project financing for the project’s initial phase (upsized to 13.33 million tpy from 10 million tpy) and the 42-in. OD Gator Express pipeline.

The FID was the first taken in the US on an LNG plant since Venture Global’s Calcasieu Pass plant in August 2019. Plaquemines LNG is expected to enter service 2024-25.

Under construction in Plaquemines Parish, La. about 20 miles south of New Orleans, Plaquemines LNG has received all necessary permits, including FERC authorization and non-free trade agreement (FTA) export authorization from the US Department of Energy (DOE). Twenty-year sales agreements for 80% of the full export capacity have been signed (OGJ Online, Mar. 7, 2022).

Plaquemines LNG Phase 1 customers include Polish Oil & Gas Co. (PGNiG), China Petroleum & Chemical Corp. (Sinopec), China National Offshore Oil Corp. (CNOOC), Shell PLC, and Electricte de France SA (EDF). Phase two customers thus far are ExxonMobil Corp., Petroliam Nasional Berhad (Petronas), and New Fortress Energy Inc.

Sempra

Sempra Infrastructure in April 2022 entered into a heads of agreement (HOA) with affiliates of partners TotalEnergies SE, Mitsui & Co., and Japan LNG Investment LLC, a company jointly owned by Mitsubishi Corp. and Nippon Yusen Kabushiki Kaisha (NYK) Line, for development of the Cameron LNG Phase 2 liquefaction plant in Hackberry, La. Phase 2 will add a fourth train (6.75-million tpy) to the plant and debottleneck the three existing 4.5-million tpy trains, bringing total capacity to more than 20.25 million tpy.

The HOA allocates Sempra 50.2% of projected fourth-train production capacity and 25% of projected debottlenecking capacity under tolling agreements, with the remaining capacity allocated equally to existing Cameron LNG Phase 1 customers. Sempra plans to sell its LNG under long-term agreements before taking FID in 2023.

Sempra Infrastructure also awarded two front-end engineering design (FEED) contracts for Cameron LNG Phase 2, one to Bechtel Energy Inc. and one to a joint venture between JGC America Inc. and Zachry Industrial Inc. At the conclusion of the FEED process, Sempra expects to select one of the contractors for Phase 2 engineering, procurement, and construction (EPC).

Cameron LNG (Fig. 1) began commercial operations of Train 3 in 2020. FERC had approved a fifth train as well, but Sempra indicated it would not be developing it in June 2021, moving to a single 6.75-million tpy train from an earlier plan to build two 5-million tpy units.

Also in April, Sempra received FERC approval of its request for an extension to build Port Arthur Pipeline LLC’s 2-bcfd Texas Connector and Louisiana Connector pipelines. The company now has until Mar. 31, 2023, to submit its implementation plan for the projects, both of which would supply natural gas to its planned 13.5-million tpy Port Arthur LNG plant in Port Arthur, Tex.

Sempra last year delayed FID on Port Arthur to 2022, saying it needed production from the plant to be fully contracted before making that decision (OGJ Online, May 7, 2021). Though still hopeful of reaching FID this year, the company has since acknowledged that it may not occur until early 2023.

In the past 2 months Sempra has reached offtake agreements with PGNiG (3 million tpy), RWE Supply & Trading GMBH (2.25 million tpy), and INEOS Energy Trading Ltd. (1.4 million tpy), to be drawn from a combination of the Cameron expansion and Port Arthur plant.

Glenfarne

Glenfarne Group LLC owns the 8.8-million tpy Magnolia LNG project in Lake Charles, La., and has a FERC deadline of Apr. 15, 2026, to put it in service. The same deadline applies to the 1.4-bcfd Lake Charles Expansion of the Kinder Morgan Louisiana Pipeline (KMLP), which will supply the plant.

Magnolia will include four 2.2-million tpy trains using patented optimized single-mixed refrigerant liquefaction technology. Magnolia LNG is already permitted to receive natural gas through the 2-bcfd KMLP.

DOE in April 2022 issued orders authorizing an additional 150 MMcfd of non-FTA exports by Magnolia, having granted permission for 1.08 bcfd in 2016.

Glenfarne also owns the 4-million tpy Texas LNG project, under development in Brownsville, Tex. In January 2022, it and Enbridge Inc. agreed to expand Enbridge’s Valley Crossing pipeline (VCP) to deliver 720 MMcfd of natural gas to Texas LNG for a term of at least 20 years.

Four months later Texas LNG executed an agreement with Technip Energies USA Inc. and Samsung Engineering Co. Ltd., committing the two companies to be responsible for all facets of the liquefaction plant’s delivery including engineering, construction coordination, start-up, and commissioning.

Cheniere, Corpus Christi Stage III

Cheniere Energy Inc in June made a positive FID on its 10-million tpy Corpus Christi Stage III liquefaction project and has issued full notice to proceed to Bechtel Energy Inc. to continue construction, which began earlier in the year (OGJ Online, Mar. 7, 2022).

The fully permitted project consists of up to seven midscale trains, each with an expected liquefaction capacity of about 1.49 million tpy, and will bring Corpus Christi LNG’s total capacity to 25 million tpy. The expansion is expected to enter service by end 2025.

ExxonMobil, Golden Pass LNG

DOE in April 2022 authorized an additional 350-MMcfd of natural gas exports from the 18-million tpy Golden Pass LNG plant under construction in Sabine Pass, Tex., to any country not prohibited by US law or policy. DOE in 2017 had issued a long-term non-FTA export order for the majority of the project’s capacity, 2.21 bcfd.

First exports from Golden Pass, jointly owned by ExxonMobil Corp. and Qatar Petroleum International Ltd., are expected in 2024.

Energy Transfer, Lake Charles LNG

Energy Transfer LP in June 2022 agreed to supply China Gas Holdings Ltd. subsidiary China Gas Hongda Energy Trading Co. Ltd. with 700,000 tpy of LNG from its planned 16.45-million tpy Lake Charles LNG plant in Calcasieu Parish, La., starting as soon as 2026 and continuing for 25 years. The LNG will be sold on a free-on-board, Henry Hub-indexed basis.

The sales-and-purchase agreement between the two companies will become effective once Energy Transfer takes FID on its plant, which it expects to do in 2022.

Energy Transfer has contracted 6 million tpy of Lake Charles LNG’s output. The company earlier this year requested a 3-year extension, to Dec. 16, 2028, to complete construction of the plant (OGJ Online, Feb. 4, 2022).

Tellurian, Driftwood LNG

Tellurian Inc. in March 2022 issued a limited notice to proceed to Bechtel Energy Inc. under its executed EPC contract to begin construction of Phase 1 of the 27.6-million tpy Driftwood LNG liquefaction plant in Calcasieu Parish, La. First LNG is expected in 2026.

Driftwood LNG will use twenty 1.38-million tpy trains developed in five 4-train blocks to reach its maximum planned capacity. Phase 1 (11 million tpy) includes the first two of these blocks, two (of three planned) 235,000-cu m storage tanks, and the first of three planned loading berths.

Baker Hughes will manufacture two of the natural gas turbines required for Phase 1.

Freeport LNG

Freeport LNG Development LP in May 2022 requested a 26-month extension from FERC to place its 5.1-million tpy Train 4 in service. The request was made well in advance of the already established May 17, 2026, deadline, Freeport having recognized that the project’s 48-56 month construction timeline would prevent meeting that date.

The company also noted that its inability to meet the 2026 deadline was impeding efforts to structure project financing and reach FID. The requested new deadline is Aug. 1, 2028, with Freeport asking that FERC grant the extension by Sept. 15, 2022.

Construction of Train 4 has not yet begun, due in large part to delays stemming from the COVID-19 pandemic, Freeport LNG said. As these effects have waned, however, and LNG demand picked up, the company says it has begun actively marketing Train 4 capacity to potential off-takers, particularly in European markets, and is in negotiations with “several” potential customers. The company expects to take FID in first-quarter 2023.

Freeport LNG (Fig. 2) had originally selected KBR Inc. for Train 4’s EPC. KBR’s decision to exit the LNG EPC business, however, forced Freeport to begin a new EPC bidding process. The company expects to receive firm price and schedule proposals for Train 4 in early fourth-quarter 2022 and make a final award shortly thereafter.

Freeport LNG suffered an explosion and fire in early June 2022 and expects partial restart roughly 3 months after it begins making repairs and a return to full operations by the end of the year. There is no indication that the incident has affected expansion plans.

NextDecade, Rio Grande LNG

NextDecade Corp., in April 2022, requested a FERC extension to Nov. 22, 2028, to put its planned 27-million tpy Rio Grande LNG plant in Brownsville, Tex., into service. NextDecade ascribed the request to “unforeseeable developments in the global LNG market as a result of the COVID-19 pandemic.”

The move followed a January 2022 decision to delay FID on the plant’s 11-million tpy first phase to second-half 2022 from the first half of the year. The company, which has received FERC authorization for five 5.5-million tpy trains, had anticipated Phase 1 startup as early as 2026.

NextDecade has executed long-term sales agreements with Shell PLC (2 million tpy), ENN LNG (Singapore) Pte. Ltd. (1.5 million tpy), Engie SA (1.75 million tpy), and Guangdong Energy Group Natural Gas (1.5 million tpy), and has a lump-sum turnkey EPC contract in place with Bechtel Corp.

Delfin Midstream, Delfin LNG

Delfin Midstream Inc. in July 2022 finalized a binding LNG sales agreement with Vitol Inc., for supplies from the planned modular 13-million tpy Delfin Deepwater Port offshore Louisiana. Vitol also finalized an investment in the company. Under the Henry Hub-indexed agreement, Delfin will supply Vitol 500,000 tpy of LNG on an FOB basis for 15 years. Later that same month, the company asked FERC for a 1-year extenstion, to Sept. 28, 2023, to complete work on the onshore portion of the project.

The project will use 2-6 FLNG plants connected to onshore gas supplies via subsidiary-owned pipelines. Delfin LNG LLC, a 100% subsidiary of Delfin Midstream, owns the 42-in. OD UTOS pipeline which runs from Station 44 to the WC-167 platform. From WC 167 gas would travel south to the Delfin Deepwater Port site via the HIOS pipeline, for which Delfin has a long-term lease.

Avocet LNG LLC, another 100% subsidiary, own the Grand Chenier pipeline system to the east of WC-167. Avocet LNG may be permitted and developed as a stand-alone deepwater port project or as an additional feedgas supply route to the Delfin project, according to the company.

As a modular project, requiring only 2-2.5 million tpy of long-term contracts to begin construction, Delfin expects to take FID on the port’s first FLNG plant by end-2022.

The company has completed FEED with Samsung Heavy Industries and Black & Veatch, which it says put it on pace to begin operations in 2026.

Alaska Gasline, Alaska LNG

Alaska Gasline Development Corp. (AGDC) is seeking feed gas suppliers for the 20-million tpy plant it is developing in Nikiski, Alas. Gov. Mike Dunleavy, meanwhile, has been talking with Japan-based potential customers regarding the plant’s output.

AGDC expects FID by early 2024 to meet a targeted 2027 startup date.

Kinder Morgan, Gulf LNG

Kinder Morgan Inc.’s Gulf LNG 10-million tpy liquefaction plant is a brownfield project at the site of the company’s regasification terminal in Pascagoula, Miss. As announced in 2015, Phase 1 would consist of a single 5-million tpy liquefaction train, production from which would be stored in the terminal’s two existing 160,000-cu m LNG storage tanks, Phase 2 would add a second 5-million tpy train.

FERC has approved the plant. The terminal, however, has a contract customer paying for regasification capacity. Kinder Morgan says it has been working with that customer regarding opportunites to advance the liquefaction plant.

References

- Luo, Z.Q., “Europe looks to coal as Russia curbs gas supplies while first LNG deal is signed between US and Germany,” Rystad Energy Market Notes, June 22, 2022.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.