By end-2022, once new LNG liquefaction trains at Cheniere Energy Inc.’s Sabine Pass plant and Venture Global LNG Inc.’s Calcasieu Pass plant, both in Louisiana, are in full commercial service, the US will have the world’s largest LNG export capacity, according to the US Energy Information Administration (EIA).

Sabine Pass’s Train 6 will add up to 5 million tonnes/year (tpy) of peak capacity. It began producing LNG in late November 2021 and loaded its first cargo last month.

Venture Global’s new plant, in Calcasieu Pass, La., will have 18 liquefaction trains with a combined peak capacity of 10 million tpy. Commissioning activities started in November 2021. First production is expected before yearend. All liquefaction trains at the plant are expected to be operational by end 2022.

In October 2021, the US Federal Energy Regulatory Commission (FERC) approved requests to increase authorized LNG production at Cheniere’s Sabine Pass and Corpus Christi LNG plants by a combined 0.7 bcfd. The plants will achieve these increases by optimizing operations, including production uprates, and modifications to maintenance. Cheniere is also contemplating additional expansions at these plants.

Venture Global last month received FERC permission to start Block 2 commissioning at Calcasieu Pass. The plant’s 0.6-million tpy trains are arranged in two-train blocks. Block 1 received FERC commissioning approval in early November 2021.

Venture Global also applied with FERC to develop its fourth LNG plant in Louisiana, the 20-million tpy CP2 LNG. The new project would be built adjacent to Calcasieu Pass LNG (OGJ Online, Dec. 3, 2021).

The 48-in. OD, 87.5-mile CP Express pipeline, also being built by Venture Global, will provide natural gas to the plant from an interconnect in Jasper County, Tex. (OGJ Online, Feb. 2, 2021). Total cost of the project is expected to be more than $10 billion.

The company’s other two planned plants are the 20-million tpy Plaquemines LNG and 20-million tpy Delta LNG, both in Plaquemines Parish, La. Venture Global expects first production from Plaquemines LNG in 2024. Delta would be built in two 10-million tpy phases, supplied by the planned 42-in. OD, 283-mile Delta Express pipeline from interconnections near Alto, La.

The company plans to capture and sequester a total of 1-million tpy of carbon dioxide between the Calcasieu Pass, CP2, and Plaquemines plants (OGJ Online, May 27, 2021).

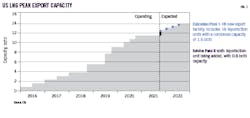

In total, by end-2022 EIA expects US nominal export capacity to increase to 11.4 bcfd (from 9.5 bcfd in November 2021), and peak capacity to increase to 13.9 bcfd (from 11.6 bcfd, see accompanying figure), exceeding capacities of 2020’s two largest LNG exporters, Australia and Qatar. In 2024, when construction on QatarEnergy (70%) and ExxonMobil Inc.’s (30%) Golden Pass LNG plant is completed and begins operations, US LNG peak export capacity will increase to an estimated 16.3 bcfd, according to EIA.

If Plaquemines LNG is developed on schedule this number would climb to 18.9 bcfd. Venture Global hopes to take final investment decision on the plant by early 2022.

Not all US projects are advancing, however. Pembina Pipeline Corp. halted its 7.8-million tpy Jordan Cove LNG liquefaction project in Coos Bay, Ore., requesting last month that FERC vacate permissions granted for the plant. Pembina had paused development in early 2021 citing difficulties obtaining permits from the State of Oregon (OGJ Online, Mar. 1, 2021).

FERC in March 2020 approved Jordan Cove and the associated 229-mile Pacific Connector natural gas pipeline. A series of lawsuits followed, with the US Appeals Court for the DC Circuit first denying a request that FERC approval be vacated pending resolution of the legal actions and then on Nov. 1, 2021, remanding the proceeding to FERC in part “to consider whether the imposition of a stay” of the certificate was “appropriate.”

Pembina, however, had still not obtained the necessary permits and authorizations from various Oregon agencies, nor been able to determine a timeline in which same might be forthcoming, and decided not to move forward with the project.

Jordan Cove LNG was initially proposed in 2007 but has faced resistance from environmental groups, property owners, and Indigenous communities ever since.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.