CASPIAN NATURAL GAS—1: Kazakh export plans affect regional producers, buyers

How Kazakhstan—the second largest oil and gas producer in the former Soviet Union after Russia—chooses to develop its gas resources and export infrastructure will affect both gas exports from other energy-producing countries of the FSU and European and Chinese plans for diversifying its natural gas supplies.

This first part of two articles examines the various land pipeline projects designed to export Kazakh supplies. The concluding article next week will look at the Trans-Caspian Gas Pipeline, competing proposals, and the legal status of the Caspian Sea.1

CAC Pipeline

The deterioration of the Central Asia-Center (CAC) gas pipeline network and projected increases in gas output from Turkmenistan, Uzbekistan, and Kazakhstan require expansion of the CAC to 100 billion cu m/year (about 3.5 tcf) from the current level of 54.8 billion cu m/year. CAC capacity before refurbishment started measured 47 billion cu m/year.

Bateman Engineering NV concluded a feasibility study in 2004 on the reconstruction and modernization of the Central Asia-Center gas pipeline network from 2004 to 2020. By 2012-15, seven stages of the CAC upgrade should be complete (capacities represent end-of-stage levels):

- Stage 1 (51.5 billion cu m/year), KazTransGaz reconstructs some sections and compressor stations along CAC-4 segment.

- Stage 2 (59.4 billion cu m/year), CAC-4 pipeline looping and new compression at Compressor Station (CS) Opornaya.

- Stage 3 (66.5-80 billion cu m/year), looping CAC-2 pipeline and building five new compressor stations.

- Stage 4 (86.3 billion cu m/year), modernizing remaining compressors along CAC-4.

- Stage 5 (92.5 billion cu m/year), new compression at CS Makat.

- Stage 6 (98 billion cu m/year), new compression at CS Opornaya, Beyneu, and Sai-Utes.

- Stage 7 (100.2 billion cu m/year), new pipeline construction within CAC.2

Kazakhstan intends to upgrade CAC on its own (via Kazmunaigaz’s subsidiary, KazTransGaz) so long as transit volumes of Turkmen and Uzbek gas do not exceed 60 billion cu m/year. KazTransGaz has already completed Stage 1 of the CAC modernization.

Kazakhstan may form a joint venture between KazTransGaz and Gazprom to increase CAC capacity beyond 60 billion cu m/year. The companies would be equally represented in the new consortium, which could also become operator of the expanded CAC sections. The new joint venture, however, would not control any of KazTransGaz’s existing assets, including the CAC gas pipeline network.

Preliminary estimates put costs of expanding CAC to 80 billion cu m/year at more than $2 billion. Increasing CAC throughput to 100 billion cu m/year will cost an additional $1.1-1.5 billion. These estimates are highly sensitive to steel prices and final costs will also depend on the subcontractors and suppliers selected.

Caspian Littoral

Russia, Turkmenistan, and Kazakhstan intend to build a new 1,700 km Caspian Littoral gas pipeline running from Turkmenistan (more than 500 km), along the eastern shore of the Caspian Sea into Kazakhstan (nearly 1,200 km), then parallel to the upgraded CAC-3 pipeline (Fig. 1).3 Initial cost estimates for this pipeline stand at $1 billion.

Caspian Littoral pipeline construction will occur in two stages. The initial stage (2009-10) will have capacity of 20 billion cu m/year, split evenly between Kazakhstan and Turkmenistan. Participants could increase capacity depending on availability of additional gas volumes.

Gazprom, Kazmunaigaz, and Turkmenneftegaz will build and operate the pipeline. Turkmenistan and Kazakhstan will be responsible for construction of pipeline sections within their territories. Russia will expand the CAC pipeline connection point at Alexandrov Gai to accommodate new gas volumes.

The Russian gas transport system’s ability downstream of the connection to receive additional volumes (40-50 billion cu m/year) of Central Asian gas by 2010-15 remains uncertain. The Russian Ministry of Economic Development says the existing Russian gas transport system is inadequate even for exporting larger volumes of domestically produced gas.

Valery Yazev, chairman of the Russian Natural Gas Association and chairman of the Energy, Transport, and Communications Committee of the State Duma, however, remains confident Russia will expand its gas transport system in time, suggesting a future 90 billion cu m/year limit for Central Asian gas supplies to and via Russia.4

Trans-Asian Pipeline

Kazakhstan and China reached agreement Aug. 18, 2007, to build and operate a new gas pipeline to China. An additional agreement followed in November 2007 between Kazmunaigaz and CNPC.

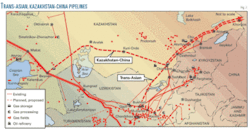

Provisional agreements envisioned a Trans-Asian Gas pipeline network consisting of two trunk lines. The first (running through Southern Kazakhstan) will be the Kazakh section of the Turkmenistan-China gas pipeline. This pipeline will rely on gas from Turkmenistan, while the second will deliver gas from western Kazakhstan to western China (Fig. 2).

China is currently expanding its first West-East Gas Pipeline to 17 billion cu m/year. This 4,000-km pipeline carries gas from China’s Tarim basin in Lunnan, Xinjiang province, to Shanghai. China plans to build the second West-East Pipeline (6,500 km) from Xinjiang to Guangdong province, with a capacity of 30 billion cu m/year. The Turkmenistan-China and Kazakhstan-China pipelines will feed into China’s second West-East Gas Pipeline.

The Kazakh section of the Turkmenistan-China gas pipeline will run from the Uzbek-Kazakh border to the border between China and Kazakhstan via the Kazakh city of Chimkent, ending in Khorgos, in China’s Xinjiang Uygur Autonomous Region. The Kazakhstan-China pipeline is the part of the Turkmenistan-China gas pipeline project running from Turkmenistan (188 km) via Uzbekistan (530 km) through southern Kazakhstan (1,333 km) to western China.

The Turkmenistan-China trunk will consist of two parallel 1,067-mm OD pipelines and five compressor stations capable of transporting 30 billion cu m/year. Cost estimates in 2007 totaled more than $6.5 billion. CNPC will provide 100% financing for the pipeline and hopes to start building the Chinese section by 2010.

China has also taken a number of steps to secure gas volumes (from Turkmenistan) adequate to fill the 30 billion cu m/year pipeline and ensure safe transit through Uzbekistan and Kazakhstan.

CNPC and Turkmenistan’s state committee for oil and gas resources signed a production sharing agreement in July 2007 to develop estimated 1.3 trillion cu m gas reserves at Bagtyyarlyk on the right bank of Amu-Darya River in northeastern Lebap province, Turkmenistan.

Turkmenistan granted CNPC a license in August 2007 to develop new gas reserves at Bagtyyarlyk and supply 17 billion cu m/year of gas to China starting in 2009. Two older gas fields, Samandepe and Altyn Asyr, in Turkmenistan’s southeastern Mary province, will likely supply the remaining 13 billion cu m/year. Turkmenistan’s president, Gurbanguly Berdimuhamedov says the two fields will yield additional volumes of gas after new processing facilities are installed.5

Gas fields in the Mary province have traditionally been used to supply gas to Russia and Europe. Gazprom’s main resource base for these supplies, however, is Daulatabad-Sovetabad field and not Samandepe and Altyn Asyr fields, which will feed the pipeline to China.

Turkmenistan’s plan to connect Mary’s gas fields to a potential Turkmenistan-Afghanistan-Pakistan-India gas pipeline, however, could intensify international competition for Turkmen gas resources, despite the relatively recent discovery of the giant South Yolotan, Osman, and Yashlar fields.6

To ensure additional gas supplies from Central Asia, Beijing has continued to develop energy relations with Uzbekistan and Kazakhstan. China and Uzbekistan agreed in May 2007 to develop jointly Mingbulak field in the Fergana valley.

KazTransGaz and Trans-Asia Gas Pipeline Ltd. (owned by China National Oil and Gas Exploration and Development Corp., a subsidiary of CNPC) formed a joint venture in February 2008 to be sole operator of the Kazakh section of the Turkmenistan-China pipeline. Trans-Asia Gas Pipeline Ltd. formed similar joint ventures with relevant Uzbek and Turkmen gas companies to operate their respective sections of the gas pipeline.

Kazakhstan-China Pipeline

The Western Kazakhstan-Western China (Beyneu-Bozoy-Kyzylorda-Chimkent) gas pipeline will be 1,480 km long and have a 1,016-1,067-mm OD and a projected annual capacity of 10 billion cu m/year. This pipeline project, first initiated in 2005, has undergone a number of changes including its route and annual capacity.

Kazakhstan and China initially planned to build the pipeline along a central route—Atyrau (Makat-Aktobe (Zhanazhol)-Chelkar-Atasu-Dostyk-Alashankou—with a capacity of 30 billion cu m/year, projected to reach 40 billion cu m/year by 2015. The countries have since cut capacity to 10 billion cu m/year due to economics.

Complications and delays regarding development of Kazakhstan’s Caspian hydrocarbon resources (especially Kashagan) initially cut into forecasts regarding Kazakh gas output, affecting the planned pipeline’s capacity. A preliminary cost estimate of $3.84 billion recouped over 30 years also caused Chinese investors to pause, particularly in light of additional estimates that gas transported via this pipeline would cost almost three times as much as gas imported from Uzbekistan.

Two factors have likely driven the change from the central route to the current one: access to a larger number of gas resources and the need to deliver gas to southern Kazakhstan. Beyneu, part of the CAC network and close to Caspian hydrocarbon fields, provides a better starting point than Atyrau. Beyneu is also a connecting point to the Okarem-Beyneu gas pipeline (473 km), with access to the Caspian resources of Turkmenistan.

Petronas modernized the Beyneu pipeline, feeding into CAC-3 at a rate of 10 billion cu m/year.

KazTransGaz and Petronas Carigali (Turkmenistan), an affiliate of Malaysia’s Petronas Carigali Overseas, signed a memorandum of understanding in June 2006 covering transportation of natural gas from Turkmenistan via Kazakhstan. Petronas is developing hydrocarbon fields in the Turkmen part of the Caspian having an estimated resource base of 1 trillion cu m and recoverable gas reserves as large as 545 billion cu m.

Petronas intends to produce 5 billion cu m of gas from these fields in 2009 and build an offshore gas terminal by 2010 feeding into the Okarem-Beyneu line at a rate of 10 billion cu m/year. Kazmunaigaz intends to buy Turkmen gas from Petronas and transport it to southern Kazakhstan and possibly China.

Bozoy, on the Aral Sea, sits as another strategic point on the proposed Western Kazakhstan-Western China pipeline. Uzbek Aral gas reserves measure 0.5-1 trillion cu m. Uzbekistan signed a production sharing agreement in August 2006 between its state natural gas holding company Uzbekneftegaz (Uzbekistan), Lukoil (Russia), Petronas (Malaysia), CNPC (China) and two Korean companies, KNOC and steel manufacturer POSCO. All companies have an equal share of 20% in the consortium, except for Korea’s 20% stake which is divided between KNOC (10.2%) and POSCO (9.8%).

CNPC and Petronas’s participation in the consortium could secure gas supplies from the Aral fields for the new pipeline, an idea also backed by Uzbekistan. Aral Sea gas production is scheduled to start by 2012, eventually reaching a peak of about 25 billion cu m/year. Kazakhstan’s own gas from fields in Aktobe province could also travel through the new pipeline. China’s main gas asset in Kazakhstan, Zhanazhol field, also lies in Aktobe province.

Running the pipeline through Kyzylorda could connect potential gas output from Kumkol hydrocarbon fields at Akshabulak to market. Russian Lukoil and CNPC are jointly developing these resources, with gas production reaching 119 million cu m in 2006. Lukoil and CNPC signed a strategic partnership agreement in September 2007 to bring gas to China from Kumkol.

Apart from potential exports to China, the pipeline will improve supplies to the central, eastern, and southern parts of Kazakhstan; particularly Kyzylorda, South Kazakhstan, Zhambyl, and Almaty provinces. Domestic consumption in this area will reach 6-7 billion cu m/year by 2015, 8.5 billion cu m/year by 2020, and as much as 10 billion cu m/year if a gas pipeline network is constructed in Almaty province. This plan will turn the main gas routes of central Kazakhstan into a unified system and provide the country with greater flexibility in supplying gas to different markets and making location swaps.

Kazakhstan will first connect the CAC and Bukhara-Ural gas trunklines. It will then, according to an agreement with Russia to send gas from Karachaganak to the Orenburg gas processing plant, build an interconnector pipeline between the Soyuz, Orenburg-Novopskov, and CAC trunk pipelines, supplying Caspian gas to the industrial and urban centers in the southern part of the country.

Kazakhstan views the pipeline to China as an energy security project, ensuring its domestic gas demand can be met without relying on imports. Prime Minister Karim Masimov says the government is examining three options for financing the project: full state financing; soliciting a loan to Kazmunaigaz, guaranteed by the state; and a state-private partnership.7

CNPC and Kazmunaigaz signed a preliminary agreement in early November 2008 covering construction of the Western Kazakhstan-Western China gas pipeline, with 5 billion cu m/year of gas to be sent to China and roughly 5 billion cu m/year for use in southern Kazakhstan.8

Previous agreements call for pipeline construction to begin in 2010 and be completed in two stages by 2015. Initial Kazakh gas exports to China will rely on gas produced by CNPC at Zhanazhol field.9

References

- This series is based in part on “Kazahkstan’s Gas: Export Markets and Export Routes,” Oxford Institute for Energy Studies, 2008.

- www.kmg.kz/.

- www.gazprom.com/eng/articles/article29535.shtml.

- Kirill, M., “Costs of Victory,” Kommersant, June 29, 2007.

- “Turkmenistan to start supplies of natural gas to China according to schedule,” Turkmenistan.ru, Sept. 19, 2008.

- “Turkmenistan Gas Production and Export: the next 10 years,” Oxford Institute for Energy Studies, 2009.

- Kazakhstan-Segodnya, Feb. 26, 2008.

- “Kazmunaigaz i CNPC dogovorilis’ sotrunichat’ po proektu stroitel’stva gazaprovoda Kazakhstan-Kitai,” Oil of Russia, Nov. 5, 2008.

- “Kazakhstan and China signed an agreement on the expansion of cooperation in the gas sector,” Xinhua News Agency, Nov. 2, 2008.

The author

Shamil Midkhatovich Yenikeyeff ([email protected]) is a research fellow at the Oxford Institute for Energy Studies and a senior associate member at the Russian and Eurasian Studies Centre, St. Antony’s College, University of Oxford. He holds a first-class degree with honors in law from Bashkir State University, Russia (1995), and an MA and PhD (2004) in politics from the University of Oxford.