US NATURAL GAS—Conclusion: Gulf, Southeast to see many new transport facilities by mid-2009

Between January 2008 and the end of second-quarter 2009, 29 pipeline and LNG terminal projects are scheduled to be completed in and around the Southeast US-Gulf Coast.

These projects represent pipeline capacity and LNG sendout additions totaling 25.4 bcfd. For purposes of this analysis, the projects are segmented into four groups:

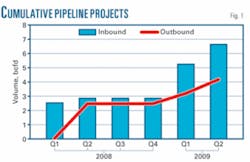

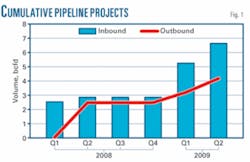

• Inbound projects bringing natural gas into the region. These seven projects are increasing capacity from major domestic producing regions into the Southeast-gulf. Fig. 1 shows inbound projects increasing deliverability into the region by 6.6 bcfd during this time.

• Outbound pipeline projects transporting natural gas through the region. These five projects (totaling 4.2 bcfd) either increase capacity west-to-east across the region or are designed to facilitate such movement by other pipelines (Fig. 1). Most of these projects are positioned to move gas out of the region, but downstream constraints on connecting pipelines will frustrate this intent until 2010 or later when debottlenecking projects start to relieve some of the downstream issues.

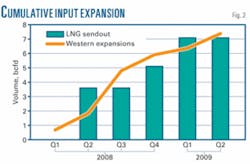

• New LNG terminals bringing supplies into the region. Four new gulf-region LNG terminals will increase LNG sendout capacity by 7.1 bcfd. Although it is unlikely these facilities will see more than a few nominal cargoes in the near term, the potential for additional internationally sourced supplies into the region is enormous.

• West-of-region expansions, feeder projects. During the 18-month timeframe of this analysis, 13 projects are scheduled to expand capacity out of the highest-growth producing regions by 7.4 bcfd (Fig. 2). These projects will bring either gas to inbound pipeline projects described above, relieve constraints out of producing areas, or achieve some combination of these objectives.

Figs. 1-2 show projects increasing inbound capacity and potential LNG deliveries into the Southeast-gulf far exceed incremental capacity to move gas across the region. Through the 18-month horizon of this analysis, it becomes apparent there is little synchronization between in-service dates of inbound and outbound projects. Net capacity additions to the region will come in successive waves, with an increment of inbound capacity coming online in one timeframe and a lesser increment of outbound capacity coming online at a later date.

The first article of this two-part series (OGJ, Apr. 28, 2008, p. 57) provided the background driving these expansions. This concluding article details capacity additions on a quarter-by-quarter basis, showing location of projects, size of capacity additions, and timeline of start-up dates. Each quarterly graphic builds on previous quarters to provide a sense of the magnitude of all projects as a group.

First-quarter 2008

Four projects entered service in the first few weeks of 2008. Three projects from Trunkline, NGPL, and Gulf South will increase capacity out of Texas and into the region by 2.5 bcfd. The Enbridge East Texas Pipeline project will feed into the Trunkline project as well as bringing incremental supply into South Texas from the Bossier Sands of East Texas. Fig. 3 shows these projects.

• Trunkline Field Zone-Henry lateral (625 MMcfd). Southern Union’s Trunkline system completed its 625,000-MMbtu expansion from South Texas to Henry Hub on Jan. 16. Known as the Trunkline Field Zone Expansion Project, the 58-mile pipeline (originally announced June 2006), expanded the line’s capacity to move gas from Jasper County, Tex., to Henry Hub.

• Gulf South ETX-to-MS pipeline (1.7 bcfd). Boardwalk’s 242-mile Gulf South East Texas to Mississippi expansion began service in the first week of January. This 1.7 bcfd expansion brings supplies from sources near Carthage, Tex., through Perryville, La., and then on to Harrisville, Miss.

• NGPL Louisiana Line expansion (200 MMcfd). The Kinder Morgan NGPL Louisiana Line Expansion consists of a 5-mile looping project increasing the system’s capacity from the gulf coast mainline to Henry Hub by 200,000 MMbtu/day. It also declares Compressor Station 304 as bidirectional to facilitate gas supplies flowing south along NGPL’s Gulf Coast system into the Louisiana line. Expansion finished in early February 2008.

• Enbridge East Texas pipeline (700 MMcfd). Completed in first-quarter 2008, Enbridge Energy Partners’ East Texas Pipeline expansion project consists of a 36-in. intrastate pipeline with a capacity of 700,000 MMbtu/day. This pipeline is a feeder project, designed to move East Texas production, primarily from the Bossier Sands, into the Trunkline project described earlier, as well as intrastate pipelines in the Houston Ship Channel-Beaumont area.

Second-quarter 2008

Regional expansions continue during second-quarter 2008 (Fig. 4). These include:

• Gulf South Southeast Expansion pipeline (1.272 bcfd). The second phase of Boardwalk’s Gulf South project, known as the Southeast Expansion, was scheduled to be in service April 2008. This pipeline project begins at the existing Gulf South pipeline terminus in Simpson County, Miss., and runs 112 miles to Transco Station 85 in West Butler, Ala.

The project will move gas from CenterPoint’s Perryville Hub to premium Southeast locations that can access eastern markets. In addition to the west-end CenterPoint connection and east-end Transco connection, the expansion will connect to Sonat, Destin, and Tennessee.

• Energy Transfer Maypearl-to-Malone pipeline (600 MMcfd). The Energy Transfer Maypearl-to-Malone expansion is designed to move supplies out of the Fort Worth basin to feed Carthage and South Texas, reaching as far as the Houston Ship Channel.

• Energy Transfer Cleburne-to-Tolar (600 MMcfd). The ETC Cleburne-to-Tolar expansion is designed to feed gas from the Fort Worth basin into the Maypearl-to-Malone expansion and other parts of the ETC system.

• Cheniere Sabine Pass, Creole pipeline (2.1 bcfd sendout). Phase I of Cheniere‘s Sabine Pass LNG facility in Cameron Parish, La., will be completed in second-quarter 2008. Phase I will have 10.1 bcf of LNG storage in three tanks, each with storage capacity of 160,000 cu m and a sendout rate of 2.1 bcfd.

First approval foresaw connection of the LNG terminal to four pipelines via Cheniere’s Sabine Pass Pipeline project. After approval of its Creole Trail LNG terminal only 18 miles to the east, however, Cheniere received FERC approval to merge Sabine Pass Pipeline with its proposed Creole Trail pipeline. This is a 153-mile, 42-in. line designed to move gas from the Sabine Pass terminal to NGPL, Transco, Tennessee, FGT, Bridgeline, TETCO, and Trunkline.

By the end of the quarter, a number of other projects will enter service (Fig. 5). These include:

• Freeport, Brazoria pipeline (1.5 bcfd sendout). Freeport LNG lies about 70 miles south of Houston on Quintana Island. The first phase of development will have sendout capacity of 1.5 bcfd. At start-up, ConocoPhillips will hold 500 MMcfd. On Sept. 30, 2009, ConocoPhillips’ capacity will increase to 1 bcfd. The Brazoria Interconnector pipeline transporting gas out of the Freeport terminal has 2.5 bcfd of capacity and is connected to Enterprise, TETCO, FGT, Channel, Kinder Morgan Tejas, Energy Transfer, and the Dow-Enterprise DT pipeline.

• CenterPoint’s C-P pipeline (316 MMcfd). The final expansion of CenterPoint’s Carthage-to-Perryville line is scheduled for April 2008. When the 316,000-MMbtu/day expansion is completed, the pipeline will deliver 1.5 bcfd from Carthage to Perryville into Columbia, Trunkline, Texas Gas, Tennessee, Sonat, and ANR. The Carthage-to-Perryville line receives gas primarily from Energy Transfer-HPL in the Carthage, Tex, area.

• Columbia Gulf FGT Interconnect expansion (180 MMcfd). The NiSource-Columbia Gulf FGT Expansion Pipeline is small capacity but has large regional implications, expanding CGT’s existing facilities near Lafayette, La., by 180,000 MMbtu/day for total southward deliverability of 300,000 MMbtu/day. Columbia Gulf expects service beginning in June 2008.

• CenterPoint-Spectra Southeast Supply Header (1 bcfd). The 36 and 42-in.-OD Southeast Supply Header extends 270 miles from the Perryville hub to the Gulfstream Pipeline (50% owned by Spectra) near Mobile, Ala. SESH’s subscribed capacity totals 945 MMcfd. SESH sold an equity stake in the upstream 115 miles of the system to El Paso-Sonat, which has an expanded design capacity of 1.5 bcfd from Perryville to a connection with Sonat in Mississippi.

While the SESH system focuses on moving more gas into Florida, capacity constraints exist at the east end of the system not unlike those at Transco Stations 85 and 180, with 100% capacity already used on peak days. Any gas moving from Perryville into SESH will thus displace gas from traditional supply routes into Florida.

Third-quarter 2008

Third-quarter additions to regional capacity include (Fig. 6):

• Energy Transfer SE Bossier-HPL pipeline (900 MMcfd initially, growing to 1.3 bcfd by first quarter 2009). The 165-mile, 42-in. OD line will move more than 1 bcfd of natural gas from the heart of the Bossier play in East Texas southeast to a connection with the Houston Pipe Line system. The line will be part of the Katy Transportation and Storage system.

• Energy Transfer Cleburne-to-Carthage pipeline (500 MMcfd). The Cleburne-to-Carthage project will add about 90,000 hp on ETC’s Cleburne-to-Carthage pipeline, increasing natural gas deliverability at the Carthage hub to more than 2 bcfd.

• Energy Transfer Paris loop (350 MMcfd). The Paris loop consists of 145 miles of 36-in. OD pipeline running out of the Barnett shale to the northern most point of ETC’s Texoma pipeline. This pipeline will function as a header for the Midcontinent Express pipeline.

• Kinder Morgan Texas Goodrich pipeline (225 MMcfd). The 58-mile, 24-in. Kinder Morgan Goodrich pipeline will connect the Kinder Morgan Tejas system in Houston County (Station 7) to the Kinder Morgan Texas system in Polk County, Tex. CenterPoint has contracted a large portion of the initial project capacity.

• Energy Transfer Katy Pipeline expansion (400 MMcfd). This project will expand the 700 MMcfd ETC Katy Pipeline in Southeast Texas. The Katy Expansion will use 56 miles of 36-in. pipeline and 20,000 hp of compression to increase capacity to 1.1 bcfd.

• Energy Transfer Southern Shale pipeline (600 MMcfd). The Southern Shale natural gas pipeline consists of a 36-in. OD, 30-mile pipeline originating in southern Tarrant County, Tex., delivering Barnett shale production to ETC’s previously announced Maypearl-to-Malone pipeline expansion project.

First-quarter 2009

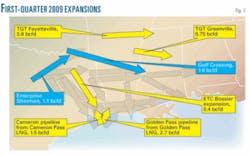

As 2009 begins, even larger expansions will enter service (Fig. 7). These include:

• Enterprise Sherman extension (1.1 bcfd). This 178-mile extension of the Enterprise intrastate system will deliver up to 1.1 bcfd from the Barnett shale area into Boardwalk’s Gulf Crossing project. Devon stands as the primary capacity holder in the system. Enterprise has the option to acquire up to a 49% interest in the Gulf Crossing project.

• Cameron LNG, Cameron pipeline (1.5 bcfd). Sempra’s Cameron LNG terminal in Hackberry, La. (on the Calcasieu channel in Cameron Parish), will have 1.5 bcfd of initial sendout capacity. The project includes the 35-mile Cameron Pipeline, delivering as much as 1.5 bcfd of natural gas to connections with Liberty Gas Storage, FGT, Tennessee Gas, Texas Eastern, and Transco Z3.

An extension or expansion of the pipeline could include other interconnections with ANR, Columbia Gulf, and Sempra’s proposed Port Arthur Pipeline. Eni SPA holds a 20-year contract for 600 MMcf/d (40%) of the terminal’s sendout capacity and Suez-Tractebel has a 20-year agreement for up to 33% of sendout capacity.

• Boardwalk’s Gulf Crossing pipeline (1.6 bcfd). Gulf Crossing is Boardwalk’s 355-mile, 42-in. OD interstate pipeline beginning near Sherman, Tex., and terminating near Tallulah, La. Boardwalk designed this pipeline to move Barnett shale, Bossier sand, and Woodford shale gas to the Perryville area.

This project will increase capacity into Perryville without a corresponding increase in capacity out of Perryville. Boardwalk’s Gulf South subsidiary is also constructing a 17-mile parallel line called the Mississippi Loop crossing Hinds, Copiah, and Simpson counties.

• Texas Gas Fayetteville lateral (800 MMcfd, increasing to 1.1 bcfd). This Boardwalk project consists of about 165 miles of up to 42-in. OD pipeline with an initial capacity of 800 MMcfd. The addition of up to 14,000 hp of compression will increase capacity to 1.1 bcfd. The proposed route of the pipeline begins in Conway County, Ark., and extends through Faulkner, Cleburne, White, Woodruff, St. Francis, Lee, and Phillips counties in Arkansas, crossing the Mississippi river near Helena, Ark., before interconnecting with Texas Gas in Coahoma County, Miss. Injecting 1.1 bcfd into the Texas Gas system at this point will improve capacity out of the Fayetteville shale.

• Texas Gas Greenville lateral (750 MMcfd). The 95-mile Greenville lateral will move up to 750 MMcfd from the Texas Gas compressor station at Greenville, Miss., to an interconnect with Boardwalk Pipelines’s subsidiary, Gulf South Pipeline Co., in Attala County, Miss.

• Golden Pass LNG, Golden Pass pipeline (2.7 bcfd). Golden Pass LNG is a joint venture among Qatar Petroleum, ExxonMobil, and ConocoPhillips. The facility is 10 miles south of Port Arthur and 2 miles northwest of Sabine Pass, Tex., along the Sabine-Neches waterway. Sendout capacity can average 2 bcfd and peak at 2.7 bcfd.

The terminal is connected to 11 regional pipeline systems via a new 2.5 bcfd, 75-mile pipeline. An additional 2-mile, 24-in. diameter pipeline will move gas to ExxonMobil’s Beaumont refinery. Qatar Petroleum has committed 15.6 million tons/year (2 bcfd) of LNG to the facility for 25 years.

Second-quarter 2009

Projects entering service during second-quarter 2009 include:

• MarkWest Arkoma Connector (500 MMcfd). The 30-in. MarkWest Arkoma Connector pipeline will extend about 50 miles from an interconnect with MarkWest’s gathering system in the Woodford shale in southeastern Oklahoma to an interconnect with the Midcontinent Express pipeline in Bennington, Okla. MarkWest has a one-time right to acquire 10% of MEP after construction is complete.

• Kinder Morgan Midcontinent ExpressCarthage-to-Perryville (1.4 bcfd). The Midcontinent Express pipeline project is a joint venture among Kinder Morgan Energy Partners and Energy Transfer Partners designed to move gas from the Barnett shale, Woodford shale, Fayetteville shale, Anadarko basin, Arkoma basin, and Bossier Sands through Perryville and ultimately to Transco Station 85.

The project will have an initial capacity of 1.4 bcfd, connecting to NGPL, Energy Transfer, Columbia Gulf, and Transco. Midcontinent Express brings 1.4 bcfd into Perryville but moves only 1 bcfd out to Station 85 (Fig. 8). This mismatch increases pressure on overall regional capacity.