Permian transmission pipelines wait for demand to catch up

The US exported 5.9 bcfd of natural gas to Mexico in March 2021, up almost 10% from a year earlier. A single-day export record of 7.1 bcf was set Apr. 14, with export volumes in April and May averaging about 6.1 bcfd, a 31% increase from the same period in 2020.1 Exports to Mexico were on track to average 6.7 bcfd in June, topping the 6.2-bcfd record set in May.

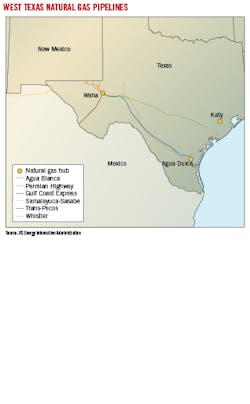

According to Mexico’s state Comision Federal de Electricidad the country has 24 gas supply contracts and 18 gas transportation contracts with US suppliers. Gas travels between the two countries through either of two western routes—one between the Permian basin’s Waha hub and Guadalajara, Mexico (Wahalajara); the other from Waha to Chihuahua and Sonora states—and an eastern route centered around the Agua Dulce hub in south Texas.

The 890-MMcfd southernmost portion of the Wahalajara system was completed in June 2020, connecting Villa de Reyes, Aguascalientes, and Guadalajara (VAG). The line, operated by Fermeca, began commercial shipments in October 2020. Wahalajara’s US portion, Energy Transfer Partners LP’s Trans-Pecos pipeline, crosses the border in Presidio, Tex., and had been underutilized before VAG’s opening, carrying just 10-15% of its 1.4-bcfd capacity.

Similar rates were in place for Energy Transfer’s 1.1-bcfd Comanche Trail pipeline, crossing the border in San Elizaro, Tex., where it feeds into Carso Energy’s 472-MMcfd Samalayuca-Sasabe pipeline. This line began commercial flows in late January 2021, delivering Waha gas to Chihuahua and Sonora and connecting with the Sasabe-Guaymas and San Isidro-Samalayuca pipelines, both also operated by Carso.

This initial boost in utilization, however, so far has been brought about via displacement of LNG imports to the Manzanillo terminal on Mexico’s west coast, not an uptick in the country’s demand for power generation, according to BTU Analytics. In 2019, Manzanillo imported about 357 MMcfd, falling to 209 MMcfd in 2020, and 0 in January 2021, the consulting company said, noting that, combined with similar trends earlier at Altamira terminal (coinciding with startup of the Sur de Texas-Tuxpan pipeline), future growth in US pipeline exports to Mexico will need to be driven by new demand rather than simply winning market share as the lower-priced alternative.2

Other gas projects

Focused on deliveries to the Gulf Coast, the Kinder Morgan Inc.-operated 430-mile Permian Highway pipeline (PHP) began operations in early January 2021, bringing 2.1 bcfd of additional natural gas capacity from Waha to Katy, Tex., with additional connections to Mexico.

WhiteWater Midstream LLC and MPLX LP’s Agua Blanca header expansion project, which entered service in late January, connects to nearly 20 Delaware basin natural gas processing sites, transporting 1.8 bcfd to the Waha hub. The project will also connect with the two companies’ Whistler pipeline, scheduled for third-quarter 2021 completion to move 2 bcfd of natural gas from the Permian basin to the Texas Gulf Coast.

In February 2021 WhiteWater bought Waha Gas Storage (WGS)—immediately adjacent to the Agua Blanca header system, to which it will be connected—from Enstor Gas LLC. When fully developed, WGS will store about 10 bcf of natural gas. It includes six underground salt caverns in Pecos County, Tex., and permits for five additional caverns. WhiteWater expects WGS to enter service mid-2022, injecting and withdrawing as much as 200 MMcfd. An initial open season was held for 2 bcf of capacity, with the rest to be developed as conditions warrant.

Summit Midstream Partners LLC applied to FERC in January 2021 for a permit to construct the 135-mile, 1.4 bcfd Double E pipeline from Eddy County, NM, to bring even more gas to Waha.

In December 2020, Tellurian withdrew its application to build the Permian Global Access pipeline in Texas and Louisiana, effectively canceling the project. The proposed 2-bcfd pipeline would have transported natural gas from the Permian basin to Tellurian’s proposed 27.6-million tonne/year Driftwood LNG plant in Gillis, La. Kinder Morgan, meanwhile, shelved its proposed 2-bcfd Permian Pass gas pipeline, with it unlikely to be reconsidered before mid-decade.

Even with these cancellations, the effects of the extra Permian gas takeaway capacity have been felt in the market. The discount for Waha natural gas to US-benchmark Henry Hub pricing in summer 2020 was more than $0.55/MMbtu. But as of Apr. 5, 2021, this had narrowed to $0.08/MMtbu, before widening back to $0.29/MMbtu as of June 25.3

Crude oil

Permian basin takeaway capacity for crude oil is even more plentiful than for natural gas. Consultants Wood Mackenzie forecast that utilization of Permian to Gulf Coast crude pipelines will drop to as low as 57% by fourth-quarter 2021. Rates in late 2019 had approached 90%. S&P Global Market Intelligence reported a predicted rebound to 80% by 2025.4

The last step in recent Permian crude transmission oversupply was the main segment of the ExxonMobil-led, 1.5-million b/d Wink-to-Webster (W2W) pipeline, which entered service last year (OGJ Online, Oct. 16, 2020), delivering crude to the Houston market, including Webster, Baytown, and Enterprise Products Parnters LP’s Crude Houston terminal (ECHO), with connectivity to Texas City and Beaumont.

One month earlier, Enterprise—ExxonMobil’s partner in W2W with MPLX LP, Plains All American Pipeline, Lotus Midtream, Delek US, and Rattler Midstream LP—had cancelled the 450,000 b/d ECHO 4 expansion of its own pipeline from the Permian.

“For midstream companies that made huge investments based on pre-Covid-19 production forecasts, low utilization now presents a challenge,” Wood Mackenzie noted even before W2W began operations. “Midstream infrastructure projects, many of which were financed with high levels of debt, will struggle to deliver projected returns.”5

Operators continue to feel uncertainty regarding returns given the political climate, potential restrictions tied to the energy transition, and continued pandemic-related variables. Once drilling and production accelerate, pipeline volumes will improve, but the rate and timing of this remains unclear.

References

- US Energy Information Administration, “New infrastructure increases takeaway capacity out of West Texas,” Natural Gas Weekly Update, June 3, 2021.

- McLean, C., “We Need More Power: LNG Displacement, Not Structural Growth, Drives Mexican Exports Increase,” BTU Analytics, June 2, 2021.

- Texas Alliance of Energy Producers, “Daily Market Information,” June 25, 2021.

- Passwaters, M., “Permian oil production could near record in 2021 with pipeline capacity to spare,” S&P Global Market Intelligence, Jan. 11, 2021.

- Beeker, A., “Lower 48 midstream not immune to oil price volatility,” Wood Mackenzie, June 3, 2020.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.