Pandemic slows Permian crude pipeline, offshore terminal projects

Four different terminal projects could add as much as 5.7 million b/d of crude export capacity on the Texas Gulf Coast by 2023. But the fate, or at least timeline, of some of these projects is uncertain in the wake of the COVID-19 pandemic’s effects on both global crude demand and US crude production. On Mar. 13, 2020, US crude exports were 4.38 million b/d, but by June 5 they had fallen more than 44%, to 2.44 million b/d, according to the US Energy Information Administration.

Sentinel Midstream LLC and Freepoint Commodities LLC’s proposed Texas GulfLink deepwater crude oil export terminal near Freeport, Tex., is designed to fully load very large crude carriers (VLCC). Texas GulfLink will include an onshore terminal with as much as 18 million bbl of storage (twelve 750,000-bbl tanks) near Jones Creek, Tex., an offshore 42-in. pipeline, and a manned platform 30 miles off the Gulf Coast in 100-ft of water on Outer Continental Shelf Galveston Area Lease Block 432.

The platform will connect to two single-point mooring (SPM) buoys for vessel loading and will include continuous port monitoring, custody transfer metering, and surge relief.

Projected export loading rates will be as much as 85,000 bbl/hr, with a nominal capacity of 1.2 million b/d over the course of a year. The offshore platform will have around-the-clock monitoring.

Texas GulfLink on May 30, 2019, applied for a deepwater port license to the US Maritime Administration (MARAD) and Coast Guard (USCG). On Nov. 8, 2019, MARAD suspended the regulatory timeline for the GulfLink port license application for submission of additional information and analyses determined necessary for the completion of the project’s environmental impact statement (EIS). The requested information was submitted and the suspension of the regulatory timeline removed Apr. 27, 2020.

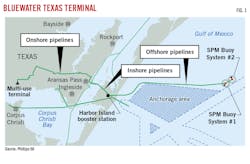

A 50-50 joint venture of Phillips 66 and Trafigura Group Pte. Ltd. is developing the Bluewater Texas Terminal (BWTX), a 1.56-million b/d offshore deepwater port project 21 nautical miles east of the entrance to the Port of Corpus Christi, Tex., in 90-ft water depths. Phillips 66 submitted its application to MARAD in mid-2019, but the agency suspended BWTX’s regulatory timeline on Nov. 7, allowing the project developers more time to submit information related to the project’s EIS.

BWTX, to be built by Phillips 66, includes two new 30-in. OD pipelines along 55 miles of onshore, inshore, and offshore routes, a booster station and control room at Harbor Island, and two SPMs capable of fully loading VLCC (Fig. 1).

Crude oil for BWTX will come from an onshore storage terminal located near Taft, Tex., which will connect to the Gray Oak pipeline, the future Red Oak pipeline, and other third-party pipelines.

The project is in the permitting stage and a final investment decision (FID) had been expected in 2020, pending approvals and customer volume commitments that support project economics. COVID-19, however, both has slowed the regulatory process and made project economics less certain, potentially pushing FID into early 2021.

MARAD is the lead permitting agency, but numerous other state and federal agencies, including the USCG and US Environmental Protection Agency (EPA), are also involved in the evaluation of the permit application and development of the final decision. BWTX could be online 18-24 months after receipt of regulatory approvals.

Trafigura withdrew a separate application to develop the Texas Gulf Terminals deepwater port near Padre Island National Seashore.

Enbridge described current US crude export infrastructure as inefficient in a June 2020 investor presentation, noting both the need to increase VLCC use to improve the economics of shipment to Asia and the Freeport-Houston area as being ideally situated for VLCC-focused export projects. The company included development of a VLCC-capable offshore terminal as part of organic growth plans despite current market headwinds and having earlier in 2020 withdrawn its MARAD permit application to build the Texas Crude Offshore Loading Terminal (COLT) with Oiltanking.

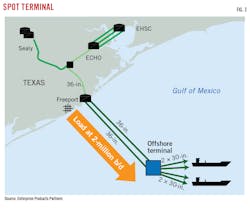

It had, however, decided in December 2019 to jointly develop the Sea Port Oil Terminal (SPOT) with Enterprise Products Partners (EPP) LP and continues to pursue that project. SPOT is planned for offshore Freeport, Tex., as COLT had been, and consists of onshore and offshore infrastructure, including a fixed platform 30 nautical miles offshore in 115 ft of water (Fig. 2).

SPOT would load VLCCs at 85,000 bbl/hr or as much as 2 million b/d. SPOT’s MARAD application is under review, but the agency stopped the clock on its process in June 2020, potentially pushing completion to 2023 from 2022.

The proposed Plaquemines Liquids Terminal (PLT) is a Tallgrass Energy LP-led joint development project with Drexel Hamilton Infrastructure Partners LP and in concert with the Plaquemines Port & Harbor Terminal District, a Louisiana state agency.

PLT is a liquid export terminal to be sited on 200 acres along the Mississippi River in Plaquemines Parish, La. The terminal is being permitted for up to 20 million bbl storage. It will be able to fully load and unload post-Panamax (~1-million bbl) vessels at its deepwater dock.

Louisiana’s Department of Natural Resources and Department of Environmental Quality in February 2020 postponed a public hearing to discuss potential conflicts between PLT and the state’s Coastal Master Plan.

In addition to these four projects, Energy Transfer LP plans to build an offshore crude terminal near its existing Nederland, Tex., terminal and supplied by its pipeline network. Deliveries could be sourced from the Permian basin, Bakken shale, or storage in Cushing, Okla. The company is in talks with potential shippers and expects the terminal to enter service late-2022 or early 2023.

Crude pipelines

Three large Permian-to-Gulf Coast crude pipelines are also under construction, Wink-to-Webster, M2E4, and Red Oak. Each has been somewhat delayed by the pandemic’s effects, but the developers of all still plan to complete them between now and end-2021.

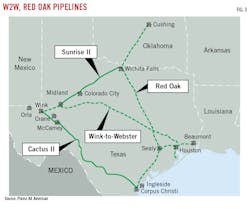

The 1.5-million b/d Wink-to-Webster (W2W) pipeline is a joint venture among ExxonMobil, Plains All American (PAA) Pipeline LP, EPP, Lotus Midstream LLC, MPLX LP, Delek US Holdings LP, and Rattler Midstream LP, carrying crude oil and condensate from the Permian basin to the Texas gulf coast. The 650-mile pipeline will have origin points in Wink, Tex., and Midland, Tex., delivering to multiple sites near Houston including Webster and Baytown, with connectivity to Texas City and Beaumont (Fig. 3). PAA has ordered long-lead materials for the project, including 36-in. OD pipe, awarded several construction contracts, and is advancing development activities.

EPP merged its 450,000-b/d Midland-to-Enterprise Crude Houston (ECHO) M2E3 expansion into W2W in exchange for a 29% share of the project. The W2W joint venture expects construction to be completed during 2021.

EPP expects its M2E4 expansion to add another 450,000 b/d to M2E by second-half 2021. M2E4 is further expandable to 540,000 b/d and M2E2 could convert back to NGL service, giving the complete M2E system capacity-flexibility between 1.3- and 1.8-million bbl depending on market demand.

Enterprise had expected M2E4 to enter service first-half 2021 but pushed this back to the second half of the year due to capital spending adjustments in the wake of the COVID-19 pandemic.

M2E interconnects to the 1.3-million b/d Rancho II pipeline in Sealy, Tex., to complete shipment to the ECHO terminal. In addition to the M2E pipeline additions, EPP is building a combined 2.4 million bbl of storage at Midland and ECHO.

PAA is also 50% of a joint venture with Phillips 66 to develop the Red Oak pipeline, bringing 450,000 b/d of Permian crude to the Texas Gulf Coast via the 24-in. OD Sunrise II pipeline and Wichita Falls, Tex. The 650-mile Red Oak line includes 30-in. OD pipe from Cushing to Wichita Falls and Wichita Falls to Sealy, Tex., 20-in. OD pipe from Sealy to Houston and Beaumont, Tex., and another 30-in. OD leg from Sealy to Corpus Christi-Ingleside, Tex (Fig. 3).

The companies expected to place Red Oak in service first-half 2021 but in first-quarter 2020 deferred the project as part of capital spending cuts (OGJ Online, Mar. 24, 2020).

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.