Nord Stream 2 project advanced despite weak economics

Piotr Przybylo

GeoModes Consulting Ltd.

London

While it is too late to permanently halt construction of Nord Stream 2, it’s important to verify the nonfinancial reasons behind its construction. Political reasons are first. There is significant risk that to assure full operational capacity of Nord Stream 2, Russian-state Gazprom would continue decreasing the quantities of gas it sends to Western Europe through Ukraine and subsequently through its Yamal-Europe II pipeline through Poland. This will increase the dependency of these countries on Gazprom.

Any economic analysis of the Nord Stream 2 natural gas pipeline must consider the project’s actual cost. Recent data suggest that Nord Stream 2 capital investment will reach €9.5-10 billion ($10.3-10.8 billion). But the €9.5-10 billion is not the final construction cost of the project. Nord Stream 2 will not fulfil its function in isolation.

Without additional distribution gas pipelines on both the Russian and European sides, Nord Stream 2 will only be a pipe from nowhere to nowhere. This means that sufficient pipeline capacity needs to be built to supply Nord Stream 2 with 55 billion cu m/year (bcmy) from the gas fields in Western Siberia to the Baltic coast in Russia. Similarly, newly constructed pipelines will transport 55 bcmy of gas more than 800 km south from the Baltic shore in Germany to one of the biggest European gas hubs in Austria. Overall construction cost of Nord Stream 2 should include all additional necessary infrastructure to achieve this objective. The construction cost of the offshore pipeline is only a portion of the bigger project which aims to deliver Russian gas to southwest Europe.

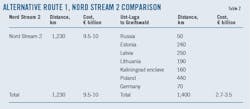

This article will focus on an economic analysis of initial investment in the Nord Stream project and a financial comparison with onshore alternatives. All three proposed alternatives would have been significantly cheaper to build, and the sum of the tariffs paid to transit countries equals tariffs paid using Nord Stream 2.

Investment

Nord Stream 2 was under construction and nearly 95% complete when US sanctions in December 2019 forced Allseas Group SA to stop pipelay offshore Denmark. The new pipeline will be an exact replica of Nord Stream 1 and have the same technical specifications. It will also run a similar route to Nord Stream 1. It starts at the Slavyanskaya compressor station near Ust-Luga port in Russia and continues along the bottom of the Baltic Sea to the Lubmin natural gas receiving station near the city of Greifswald, Germany. The length of the subsea pipeline is 1,230 km. Nord Stream 2 has two parallel lines, each with capacity of 27.5 bcmy. The aggregated design capacity of Nord Stream 1 and Nord Stream 2 is therefore 110 bcmy.

Russian gas must move from the place of production—Nadym Pur Taz and Yamal fields in Western Siberia, Russia—to consuming markets. Reaching the border of the EU through Nord Stream 2 is only the first leg of this journey. After that, gas has to be delivered to actual market areas. Nord Stream 1 aimed to reach consumers in northwest Europe including Germany (northern and southern), Benelux countries, and the UK. Gas transported by Nord Stream 2 is mainly aimed at two strategic locations in southeast Europe: the Rozvadov-Waidhaus station at the border between Germany and Czechia and the Baumgarten gas distribution hub in Austria, further delivering gas to Italy, Slovakia, Hungary, Slovenia, and Croatia.

Calculating the cost of the entire gas transit route and not just the offshore section of Nord Stream 2 allows assessment of the full cost of transport infrastructure from the place of origin to the destination. For example, in the case of Nord Stream 1 a pipeline supplying 55 bcmy also needed to be built in Russia spanning the 917 km from Gryazovets to Vyborg near the Baltic sea coast.

As the gas from Nord Stream 1 shipped to customers in Germany, Czechia, Benelux countries, and the UK, a minimum of three additional gas pipelines needed to be built in Germany. The construction of the NEL, OPAL, and Gazelle pipelines in Germany and Czechia cost about €2.4 billion. Together with the Gryazovets–Vyborg 1 pipeline (€4.5 billion), additional infrastructure apart from the actual cost of Nord Stream 1 cost nearly €7 billion. The cost of Nord Stream 1 offshore was estimated at €8.8 billion. Hence, the actual cost of new infrastructure needed to transport Russian gas from West Siberian fields to consumer markets in Western Europe via the offshore Nord Stream 1 route reached roughly €15.7 billion.

All the supporting gas lines that distribute gas from Nord Stream 1 already operate at full or near-full capacity. Delivering and distributing an additional 55 bcmy of Russian gas requires building new gas pipeline infrastructure on both sides of Nord Stream 2.

Expansion of the internal infrastructure in Russia necessary to launch Nord Stream 2 is ongoing and requires significant investment. The new gas pipeline from Gryazovets to Ust-Luga is being built along the existing Gryazovets–Vyborg pipeline route. The cost of the second line is estimated at €3.2 billion.

Gryazovets gas distribution hub in Russia is the point of divergence for many gas pipelines, including the Yamal-Europe pipeline. Up to Gryazovets, all onshore routes to Western Europe are aligned. All construction cost analysis therefore began in Gryazovets.

On the receiving side of Nord Stream 2 in Germany the new European Gas Pipeline Link (EUGAL) gas pipeline is under construction. The EUGAL pipeline to a large extent runs parallel to Ostsee Pipeline Connection Line (OPAL) to the Czechia-Germany border at Deutschneudorf-Brandov. Further south, gas will be transported through the already existing Gazelle pipeline in Czechia to an additional German network entry point at the Rozvadov-Waidhaus border connection. The cost of the 480-km long EUGAL is estimated at €3.1–4 billion. Construction of EUGAL’s second string was still underway as of March 2020.

After reaching the Deutschneudorf-Brandov border connector, the gas will be further distributed to the southeast through the existing gas infrastructure of Czechia (to Lanzhot) and Slovakia to the Baumgarten gas hub in Austria.

An even longer route is also planned. After reaching the Rozvadov-Waidhaus connector line at the Czechia-Germany border, gas can be transported through the Middle European Gas Connector (MEGAL) North and MEGAL South pipelines to Oberkappel at the Austrian border and then through the Westernport-Altona-Geelong (WAG) pipeline to the Baumgarten gas hub (see map).

The overall cost of supporting infrastructure built to transport gas through Nord Stream 2 Is about €6.3–7.2 billion which, together with the cost of the offshore line of Nord Stream 2 (€10 billion), equals €16.3–17.2 billion. This is the actual cost of the Nord Stream 2 project delivering gas to southwestern Europe.

Construction cost

The key determinants of pipeline construction costs are: diameter, operating pressure, number of compressor stations, distance, and terrain. Material (cost of steel) and labor costs are two of the most important considerations as they constitute about 70-80% of total construction cost. Other factors, including climate, the degree of competition among contracting companies, safety regulations, population density, rights of way, and differences in labor and tax laws cause construction costs to vary from one region to another. Surveying, engineering, supervision, administration, overheads, telecommunications equipment, freight, regulatory filing fees, interest, and contingencies are other costs that also need to be considered.

In the case of offshore Nord Stream 1 and 2, route preparation included removal of World War II-era naval mines and toxic materials including chemical waste, chemical munitions, and other items dumped in the Baltic Sea in the past decades. The cost of technical bases in Finland, Sweden, and Denmark was also taken into account in the final cost of the project.

Nord Stream 1 and 2, however, are also the first pipelines to move gas 1,200 km without intermediate compressor stations. Compressor stations (and their number along the route) increase construction cost as well as the operating cost of gas pipelines, increasing the cost of onshore alternatives.

The gas industry measures pipeline costs by currency unit per inch per km (e.g. €/in./km). Based on the recently built onshore gas pipelines in Europe (Northern European Natural Gas Line, NEL; OPAL; Gazelle) and gas pipelines under construction (Gas Interconnection Poland-Lithuania, GIPL; Gas Interconnection Poland-Slovakia, GIPS; EUGAL) that vary in length, diameter and transmission capacity, operating pressure, number of compression stations, and terrain, a ratio has been derived reflecting final construction cost of the projects.

The cost of onshore gas pipelines in Europe is €35,000-45,000/in./km. A 400-km, 48-in. OD onshore gas line would cost €480-770 million. For the sake of this estimation and based on all the factors that influence gas pipeline construction costs, only European projects were evaluated to try to reflect as closely as possible the proposed alternative pipeline prices which could be constructed under similar conditions.

While records from the last 20 years shows reduced construction costs for both onshore and offshore pipelines, offshore pipeline projects are still nearly twice the price of similar projects onshore (Table 1).

Cheaper alternatives

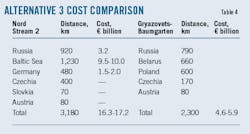

Studying three proposed alternative routes verifies construction cost sensitivity at various distances and with different destinations. The construction cost of the alternatives is compared with the construction cost of the route using Nord Stream 2.

For the purpose of this comparison, it was assumed that a newly built onshore gas pipeline would have equal capacity to Nord Stream 2 (55 bcmy) and be built with 56-in. OD pipe.

Nord Stream 2 together with Gryazovets-Ust-Luga (Russia) and EUGEL (Germany) require investment of €16.3-17.2 billion.

- Ust-Luga (Russia)–Greifswald (Germany) through Russia, Estonia, Latvia, Lithuania, Kaliningrad exclave, Poland, and Germany (Fig. 1). This route resembles Nord Stream 2 but it is onshore. A similar route (Amber pipeline) was previously proposed by the Baltic states but was reconnected to Yamal–Europe.

This alternative is the shortest possible land option between Ust-Luga and Greifswald, about 1,400 km. Although the route is 170 km longer, its estimated construction cost would be €2.7-3.5 billion, roughly one-third the cost of Nord Stream 2 (Table 2).

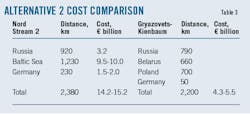

- Gryazovets (Russia)–Kienbaum (Germany) through Russia, Belarus, Poland, and Germany. This alternative closely follows the route of the Yamal-Europe pipeline. It would remove the need to build about 230 km of EUGAL pipeline from Greifswald to the Kienbaum-Mallnow gas connection (planned network coupling point of EUGAL).

Alternative 2’s route measures 2,200 km. Its estimated construction cost would be €4.3–5.5 billion, lowered by using the existing Yamal-Europe corridor. It is only 180 km shorter than the longest route using Nord Stream 2, yet again would cost about one-third as much (Table 3).

Tariffs

Apart from capital expenditure, operating costs including gas transit tariffs need to be considered. Tariff calculations are rarely easy to perform as the underlying information is often commercially confidential and varies significantly between countries.

The construction cost alternatives presented exclude the cost of transit tariffs, which was the most noted economic reason by Gazprom and German officials for building Nord Stream 1 and 2. Nord Stream’s higher operating pressure and resulting elimination of midstream compressor stations was also cited as a cost-reducing factor.

Tariff values for Eastern Europe come from the Energy Community Regulatory Board (ECRB), a tariff regulator for Poland, Belarus, the Baltic States, Czechia, Slovakia, Germany, and Ukraine. ECRB establishes cost-based tariffs which are non-discriminatory if they are applied equally to comparable network users and do not provide for cross-subsidization between them. This is not always the case, however, as Gazprom regularly appeals tariff calculations.

All tariffs presented here are the current averaged tariffs paid in each transit country with the current averaged amount of gas transported through a given gas pipeline. Certain discrepancies between the actual tariffs and those presented here still might occur. Consequently, tariffs for the three alternatives are hypothetical tariffs calculated using current averaged values in each transit country. Tariffs were calculated in €/100 km/1,000 standard cu m (scm).

In Poland, as per a contract from 2010 (binding until 2022), Russia is paying one of the lowest gas transit tariffs in Europe. The agreement between Gazprom and PGNiG (EuRoPol) from March 2010 established tariffs at €1.55/1,000 scm/100 km, less than tariffs in Belarus or Ukraine. In Belarus and Ukraine, Russia pays tariffs of €1.67 and €2.26 respectively.

In December 2015 the Ukrainian government set an even higher new transportation fee mechanism, with the tariffs based on entry-exit that would require payment of €3.40/1,000 scm/100 km. Gazprom, however, has refused to acknowledge the new tariffs.

Amber Grid, Lithuania’s state owner and operator of gas infrastructure, charges Russia for gas transit to Kaliningrad exclave at a rate of about €1.20/1,000 scm/100 km. The contract signed in January 2016 is binding until end-2025, with this range of tariffs fixed.

Gas tariffs in Latvia and Estonia are even lower, as the countries are not involved in the same levels of Russian gas transit as the others. For purposes of this comparison, prices for all Baltic countries were equalized at €1.20/1,000 scm/100 km.

On average, tariffs in most Eastern European countries are much lower than tariffs in Western Europe. The fee Russia usually pays to transit Eastern European countries averages €2.60/1,000 scm/100 km versus more than €3.50/1,000 scm/100 km in Western Europe.

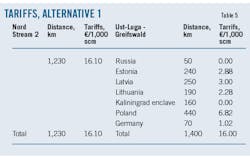

Tariffs for the three alternative pipelines breakdown like this:

- Ust-Luga (Russia)–Greifswald (Germany) through Russia, Estonia, Latvia, Lithuania, Kaliningrad exclave, Poland, and Germany. The difference between tariffs for these two routes is nominal (€0.10) and can be omitted (Table 5).

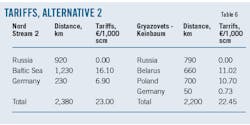

- Gryazovets (Russia)–Kienbaum (Germany) through Russia, Belarus, Poland, and Germany. The difference between tariffs for these two routes is again nominal (€0.55) and can be omitted (Table 6).

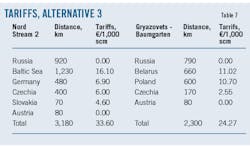

- Gryazovets (Russia)–Baumgarten (Austria) through Russia, Belarus, Poland, Czech Republic, and Austria. The tariff cost comparison between the original route using Nord Stream 2 and Alternative 3 shows that the latter would require less tariffs. The €9.33 of difference per 1000 scm between these routes equals more than €513 million/year given the 55 bcmy transported through Nord Stream 2. In the next 20 years for which Nord Stream 2 is expected to operate, this will equal to more than €10.2 billion of additional tariff costs.

The longer possible Nord Stream 2-centered route to Baumgarten through Gazelle, MEGAL North, MEGAL South, and WAG pipelines, increases the tariffs by another €1.30 to €34.90/1,000 scm as the final price for the entire route.

There is yet another alternative gas transit route to Baumgarten, Austria, which involves Ukrainian gas pipeline infrastructure. In December 2015 the Ukrainian government set the new transportation fee mechanism with the new tariffs based on entry-exit of €3.40/1,000 scm/100 km. From the Russian-Ukrainian border at Sudzha to Velke Kapusany at the border with Slovakia, Naftogaz charges €48.00/1,000 scm to travel 1,240 km, including fees, fuel gas for compressor stations, and taxes.

This price assumes the gas for the European market would flow through the most expensive Ukrainian route. But this does not need to be the case, as several routes through Ukraine’s pipeline system exist. Previous tariffs—as per a contract between Gazprom and Naftogaz concluded in January 2009—of €2.26/1,000 scm/100 km resulted in an overall cost of €28 for transit through Ukraine.

There is no difference in applicable tariff rates between Nord Stream 2 and the Ukrainian route under the old tariffs. With the application of new tariffs, however, the difference jumps to €14.56/1,000 scm over the whole route, or more ethan €800 million/year when moving 55 bcmy. This annual cost difference would accumulate to nearly €16 billion over the project’s 20-year operating life. If, however, Ukraine reduced its transit fee to the previous €28.00/1,000 scm, it would make no financial sense to use Nord Stream 2, assuming that no additional infrastructure investments would be needed in Ukraine and excluding issues regarding reliability and safety of the relatively aged Ukrainian pipelines, CO2 emissions, and the environmental impact of compressor stations.

Gazprom has already secured its gas transit through Slovakia and it will operate on ship-or-pay conditions until 2029. This means that transit fees on pre-Nord Stream 2 volumes will be paid irrespective of whether gas is transported or not, increasing the cost of transmission through Nord Stream 2.

True motives

Presented values for the transit tariffs are based on estimations as they are subject to exchange rate changes, tax changes, and different applied routes of transit. But there is still a striking lack of difference between the alternative routes and Nord Stream 2 in terms of tariffs, removing any financial justification for bypassing the Eastern European transit countries as the tariffs there are significantly lower than in Western European countries, at least for the time being. This excludes Ukraine’s new tariffs.

Cost results indicate that the Nord Stream 2 project is unprofitable and that there is no economic rationale for building it. The three main proposed onshore alternatives are cheaper to build and do not represent a substantial tariff difference. And that’s before considering the extensive costs of eventually decommissioning the subsea Nord Stream 2 pipeline.

To become independent of Russian supplies, all the bypassed countries should continue searching for alternative gas sources and routes, developing their own infrastructure, and investing in gas developments. More political pressure should be created—especially from Eastern Europe with a leading role for Poland—to preclude a situation where Germany and Austria distribute gas from Russia back to countries in Eastern Europe due to the lack of alternatives in Europe to Russian gas transported through Nord Stream 1 and 2. Should such a situation transpire, the status of Eastern countries like Poland, Ukraine, Belarus, and the Baltic states would drop from being transit countries involved in gas distribution to end-line clients buying expensive gas from an expensive pipeline distributed through a route bypassing their own states.

The author

Piotr Przybylo ([email protected]) is founder and chief executive officer of GeoModes, London, UK. Most recently he has been helping oil and gas businesses prepare for future challenges related to new technologies, digitalization, and talent pool uncertainties. Previously he worked for Maersk Oil in project planning and execution. He holds an MS (2006) in geology from Aarhus University, Denmark, an MS (2008) in exploration and production of oil and gas from Instituto Superior de la Energia, Repsol, Mostoles, Spain, and an MBA (2018) from Hult International Business School, Ashridge Executive Education, UK.